France Rum Market

France Rum Market Size, Share, and COVID-19 Impact Analysis, By Product (Dark & Golden Rum, White Rum, Flavored & Spiced Rum, and Others), By Distribution Channel (Off-Trade and On-Trade), and France Rum Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Rum Market Size Insights Forecasts to 2035

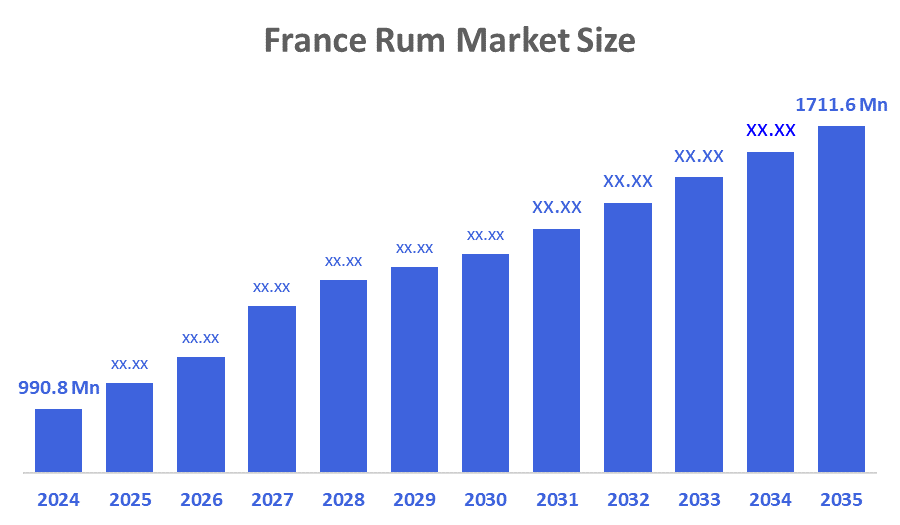

- The France Rum Market Size Was Estimated at USD 990.8 Million in 2024.

- The France Rum Market Size is Expected to Grow at a CAGR of Around 5.1% from 2024 to 2035.

- The France Rum Market Size is Expected to Reach USD 1711.6 Million By 2035.

According to a Research Report Published by Decisions Advisors & Consulting, The France Rum Market Size is projected to Reach USD 1711.6 Million by 2035, Growing at a CAGR of 5.1% from 2025 to 2035. The France rum market is driven by a strong cultural connection to the France Caribbean islands like Martinique, the rising popularity of rum-based cocktails, a growing demand for premium and craft rums, and an increase in sustainable and innovative products. The convenience of at-home consumption and e-commerce has also boosted sales, particularly for the off-trade sector.

Market Overview

The France rum market refers to the production, distribution, and consumption of rum and rum-based beverages within France. Rum and rum-based alcoholic beverages are produced in or imported into France. There are many types of rum, including white, black, aged, spiced, and premium rums, that can be purchased at retail outlets (supermarkets, liquor shops, online) or on-trade (bars, cafes, restaurants). Domestically bottled products and a large volume of imported rums from France's overseas territories and rum-producing countries located in the Caribbean and other regions make up this market. The France rum market represents the economic activity that takes place, consumer demand trends, and the competitive environment in relation to rum, which continues to be a major distilled spirit in France.

The popularity of rum cocktails, especially amongst the younger audiences and urban consumers, is rapidly increasing. This has been particularly driven by the Mojito, launching a surge of rums into cocktail menus both in bars and restaurants and at home. Light rums and flavored rums can be easily adapted into mixed drinks, creating new users of rum. Brands like Havana Club are taking advantage of this trend by including the cocktail culture in their advertising to promote rum in bars across France, while also capitalizing on the specific consumer group who is seeking eco-friendly and premium products.

The markets for rum in France continue to grow, as the double listing of on-trade and off-trade distributors, such as bars, restaurants, supermarkets, specialty liquor retailers, and eCommerce channels, offer additional convenience and accessibility to the consumer base. sustainability and innovation are the two major factors driving the growth of rum in France, with many companies adopting "green" initiatives, consumer record keeping, and offering organic, limited-release rums that are designed for the ever-changing preferences of the consumer base. The growth of the rum industry in France continues to be supported by the growing global recognition and demand for France rum, thereby encouraging improvement in the overall quality of domestic production going forward to 2030.

Report Coverage

This research report categorizes the market for the France rum market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France rum market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France rum market.

Driving Factors

The growth of the France rum market is driven by several key factors. The emergence of cocktail culture in a generation of urbanites has generated more consumers interested in rum cocktails than before. Bars and restaurants are key venues for introducing new consumers to rum cocktails, speaking to an increase in the demand for rum cocktails. Additionally, there is significant evidence that consumers are turning to more premium, artisanal, and terroir-based brands of rum. Furthermore, France is historically associated with rum-producing countries' cultures, and the consumer experience of connections found in heritage and provenance is part of an increased consumer interest in rum products. Trends regarding premiumization, artisanal experiences, and sustainable craft or limited-edition rum products continue to support increased consumer demand.

Restraining factors

The France rum market is restrained by high taxes, and stringent government regulations on rum imports from foreign countries create additional costs and markups on retail prices. Meanwhile, changing consumer tastes towards low-alcohol products and premium-priced products, economic downturns impacting many consumers, and strong competition from other alcoholic products further limit demand. Smaller volume producers of rum face many challenges, including difficulty accessing markets, distribution challenges, and limited brand recognition; thus, expanding their product will be extremely difficult for them.

Market Segmentation

The France rum market share is categorized by product and distribution channel.

- The dark & golden rum segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France rum market is segmented by product into dark & golden rum, white rum, flavored & spiced rum, and others. Among these, the dark & golden rum segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The dark & golden rum segmental growth is due to a higher value placed on these two types of rum as a result of their more premium reputation and greater depth of flavor than other types of rum. There are many classic cocktails that use either dark or gold rum as an ingredient, which means that there is a wide variety to choose from and use either at home, at bars or restaurants, etc. Plus, growing consumer interest in aged and artisanal spirits will continue to foster the growth of this segment of rum.

- The off-trade segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France rum market is segmented by distribution channel into off-trade and on-trade. Among these, the off-trade segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. The off-trade segmental growth is due to the convenience and accessibility of purchasing rum from supermarkets, hypermarkets, and online stores. Consumers increasingly prefer buying alcohol for home consumption, driven by changing lifestyles and the growth of e-commerce. Competitive pricing, promotional offers, and wide product availability in off-trade channels also attract more buyers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France rum market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bacardi Limited

- Davide Campari-Milano N.V.

- Demerara Distillers Ltd. (DDL)

- Diageo Plc

- LT Group Inc.

- Nova Scotia Spirit Co.

- Pernod Ricard SA

- Dictador Europe Sp. z o.o.

- William Grant & Sons Ltd.

- Mohan Meakin Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Angostura launched its limited-edition Tribute Distiller’s Cut in select European markets, honoring Master Distiller John Georges’ 40-year legacy. The blend, featuring a 25-year-old rum, offers smoky, vanilla, and dried fruit notes. To celebrate, Angostura held exclusive European events with tastings, masterclasses, and interactive sessions for rum connoisseurs.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the France Rum Market based on the below-mentioned segments:

France Rum Market, By Product

- Dark & Golden Rum

- White Rum

- Flavored & Spiced Rum

- Others

France Rum Market, By Distribution Channel

- Off-Trade

- On-Trade

Frequently Asked Questions (FAQ)

- What is the CAGR of the France rum market?

The France rum market size is expected to grow at a CAGR of around 5.1% from 2024 to 2035.

- What is the France rum market size in 2024?

The France rum market size was estimated at USD 990.8 million in 2024.

- What is the projected market size of the France rum market by 2035?

The France rum market size is expected to reach USD 1711.6 million by 2035.

- What are the key growth drivers of the France rum market?

The rising popularity of rum-based cocktails, a growing demand for premium and craft rums, and an increase in sustainable and innovative products. The convenience of at-home consumption and e-commerce have also boosted sales, particularly for the off-trade sector.

- Which distribution channel segment dominated the market share in 2024?

The off-trade segment dominated the market share in 2024.

- Which product segment accounted for the largest market share in 2024?

The dark & golden rum segment accounted for the largest market share in 2024.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 165 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |