France Sealants Market

France Sealants Market Size, Share, and COVID-19 Impact Analysis, By Resin (Acrylic, Epoxy, Polyurethane, Silicone, and Others), By End User Industry (Aerospace, Automotive, Building & Construction, Healthcare, and Others), and France Sealants Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Sealants Market Insights Forecasts to 2035

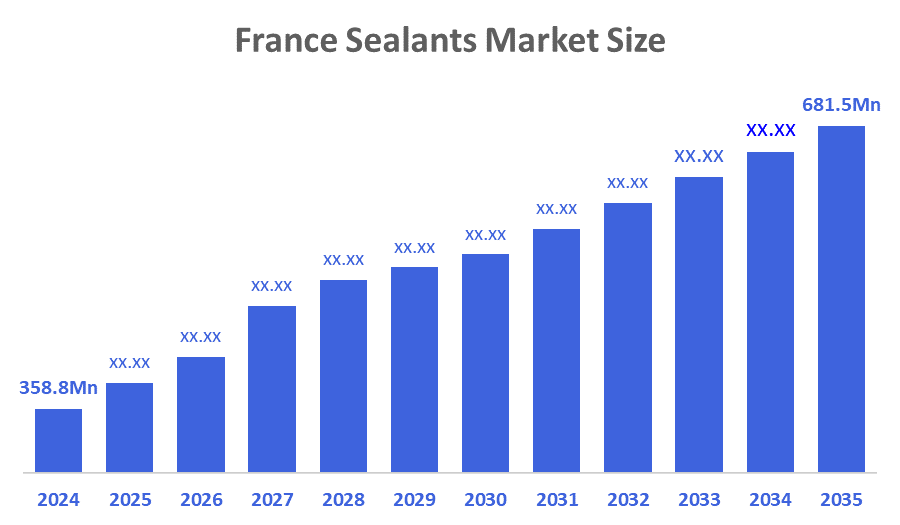

- The France Sealants Market Size Was Estimated at USD 358.8 Million in 2024.

- The France Sealants Market Size is Expected to Grow at a CAGR of Around 6.01% from 2025 to 2035.

- The France Sealants Market Size is Expected to Reach USD 681.5 Million by 2035.

According To a Research Report Published By Decisions Advisors & Consulting, The France Sealants Market Size Is Anticipated To Reach USD 681.5 Million By 2035, Growing At a CAGR of 6.01% From 2025 to 2035. The France sealants market is driven by strong demand from the construction and automotive sectors and ongoing infrastructure development. Growth is fueled by energy-efficient building initiatives, the adoption of advanced and sustainable sealant technologies, and a rising focus on durability, insulation, and safety.

Market Overview

The France sealants market refers to the industry involved in the production, distribution, and application of sealant materials used to fill gaps, joints, and cavities in various substrates to prevent leakage, provide insulation, enhance durability, and ensure structural integrity. Sealants are widely used in construction, automotive, aerospace, and industrial applications for purposes such as waterproofing, bonding, vibration damping, and thermal or acoustic insulation. The market encompasses different types of sealants, including silicone, polyurethane, acrylic, and hybrid formulations, catering to both commercial and residential needs.

The France sealants market is witnessing strong growth due to a combination of increasing demand, strategic importance, and favorable adoption conditions across multiple sectors. The need for sealants arises from their critical role in filling gaps, joints, and cavities in buildings, vehicles, and industrial equipment, ensuring waterproofing, thermal and acoustic insulation, vibration damping, and overall structural integrity. Rapid urbanization, large-scale residential and commercial construction projects, and infrastructure development have significantly increased the demand for high-performance sealants. The importance of the market is further underscored by its contribution to energy efficiency, sustainability, and safety. Modern construction projects in France increasingly emphasize low energy consumption, durability, and environmental compliance, necessitating advanced sealant solutions, including low-VOC and eco-friendly formulations. Sealants also enhance the lifespan of structures, protect against moisture, chemicals, and temperature fluctuations, and improve occupant comfort through thermal and acoustic insulation.

The conditions for the adoption of sealants in France are highly favorable. Government initiatives such as France 2030, which promotes energy-efficient and green building practices, provide incentives for the use of advanced sealants. Growing investments in infrastructure, increasing awareness about building safety and durability, and the modernization of industrial and automotive applications further drive market adoption. Technological advancements in sealant formulations such as silicone, polyurethane, acrylic, and hybrid products enable versatile applications across diverse sectors. The automotive industry, particularly the rise of electric vehicles and industrial machinery, also contributes to demand for high-performance sealants for waterproofing, thermal management, and vibration control.

Report Coverage

This research report categorizes the market for the France sealants market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France sealants market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France sealants market.

Driving Factors

The France sealants market is driven by strong demand from construction and automotive sectors, where sealants are essential for waterproofing, insulation, vibration damping, and structural integrity. Growth is further supported by government initiatives promoting energy-efficient and sustainable buildings, as well as stricter regulations on low-VOC and eco-friendly materials. Technological advancements in high-performance sealants, including silicone, polyurethane, acrylic, and hybrid formulations, enhance durability, chemical resistance, and versatility across applications. Additionally, expanding industrial uses in machinery, pipelines, and equipment manufacturing contribute to market growth.

Restraining Factors

The France sealants market faces restraints from the high cost of advanced and eco-friendly formulations, which can limit adoption in smaller projects. Regulatory compliance and certification requirements increase complexity, while fluctuating raw material prices affect production costs. Limited technical expertise in some sectors and competition from alternative bonding and insulation materials further challenge market growth.

Market Segmentation

The France sealants market share is categorized by resin and end-user industry.

- The silicone segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France sealants market is segmented by resin into acrylic, epoxy, polyurethane, silicone, and others. Among these, the silicone segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The silicone segment's growth is driven by its excellent durability, flexibility, and resistance to extreme temperatures, moisture, and chemicals, making it ideal for construction, automotive, and industrial applications. Its superior adhesion, long service life, and low maintenance requirements further boost demand. Additionally, increasing use of silicone sealants in energy-efficient and sustainable building projects, as well as their compatibility with modern eco-friendly and low-VOC formulations, supports the segment’s strong growth in the France sealants market.

- The building & construction segment held the largest market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France sealants market is segmented by end-user industry into aerospace, automotive, building & construction, healthcare, and others. Among these, the building & construction segment held the largest market share in 2024 and is projected to grow at a substantial CAGR during the forecast period. The building & construction segmental growth is due to rising residential, commercial, and infrastructure development across France, which drives demand for sealants in joints, gaps, and cavities to ensure waterproofing, insulation, and structural integrity. Additionally, increasing focus on energy-efficient and sustainable buildings, along with stricter building codes and environmental regulations, has boosted the adoption of advanced sealant technologies, including silicone, polyurethane, and hybrid formulations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France sealants market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Arkema Group

- CERMIX

- Dow

- Henkel AG & Co. KGaA

- ISPO Group

- MAPEI S.p.A.

- RPM International Inc.

- Sika AG

- Soudal Holding N.V.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2025, Wacker Chemie AG unveiled ELASTOSIL eco 7770 P, a new resource-saving silicone sealant optimized for natural stone applications. It features low emission classification, high mold/mildew resistance, and adhesion without primer.

- In June 2025, TYPAR launched TYPAR Liquid Flashing, a gun-grade elastomeric sealant offering superior air and water sealing. Designed for residential and commercial applications, it ensures primer-free bonding, durability, and mildew resistance, and integrates seamlessly into the TYPAR Weather Protection System.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the France Sealants Market based on the below-mentioned segments:

France Sealants Market, By Resin

- Acrylic

- Epoxy

- Polyurethane

- Silicone

- Others

France Sealants Market, By End User Industry

- Aerospace

- Automotive

- Building & Construction

- Healthcare

- Others

Frequently Asked Questions (FAQ)

- What is the CAGR of the France sealants market?

The France sealants market size is expected to grow at a CAGR of around 6.01% from 2024 to 2035.

- What is the France sealants market size in 2024?

The France sealants market size was estimated at USD 358.8 million in 2024.

- What is the projected market size of the France sealants market by 2035?

The France sealants market size is expected to reach USD 681.5 million by 2035.

- What are the key growth drivers of the France sealants market?

Strong demand from the construction and automotive sectors and ongoing infrastructure development. The adoption of advanced and sustainable sealant technologies and a focus on durability, insulation, and safety.

- Which end-user industry segment held the largest market share in 2024?

The building & construction segment held the largest market share in 2024.

- Which resin segment accounted for the largest market share in 2024?

The silicone accounted for the largest market share in 2024.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Regional |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |