France Self-Monitoring Blood Glucose Devices Market

France Self-Monitoring Blood Glucose Devices Market Size, Share, and COVID-19 Impact Analysis, By Component (Glucometer Devices, Test Strips, Lancets, and Others), By Application (Type 1 Diabetes, Type 2 Diabetes, Gestational Diabetes, and Others), By Distribution Channel (Retail Pharmacies, Online Sales, Diabetes Clinics & Centers, Home care, and Others), and France Self-Monitoring Blood Glucose Devices Market Size Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Self-Monitoring Blood Glucose Devices Market Size Insights Forecasts to 2035

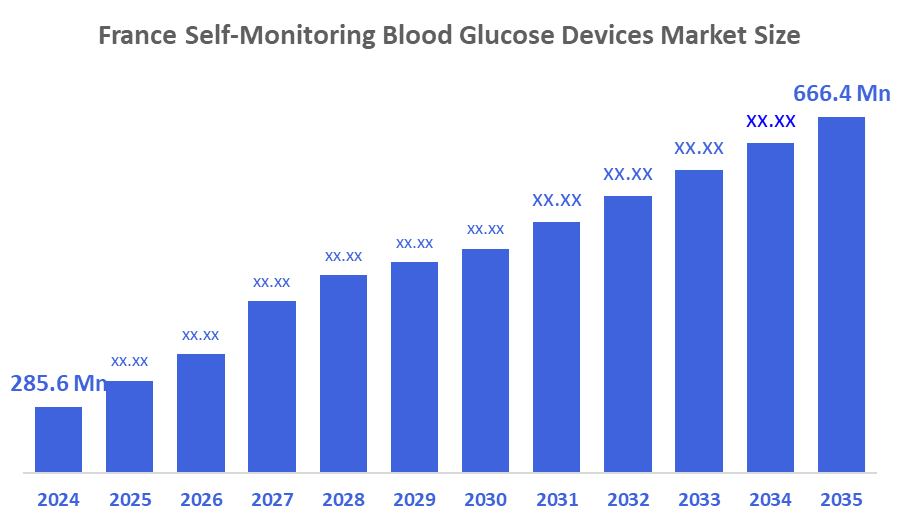

- The France Self-Monitoring Blood Glucose Devices Market Size Was Estimated at USD 285.6 Million in 2024.

- The France Self-Monitoring Blood Glucose Devices Market Size is Expected to Grow at a CAGR of Around 8.01% from 2025 to 2035.

- The France Self-Monitoring Blood Glucose Devices Market Size is Expected to Reach USD 666.4 Million by 2035.

According to a Research Report Published by Decisions Advisors & Consulting, the France Self-Monitoring Blood Glucose Devices Market Size is Anticipated to Reach USD 666.4 Million by 2035, growing at a CAGR of 8.01% from 2025 to 2035. The France self-monitoring blood glucose devices market is driven by rising diabetes cases, an aging population, strong government reimbursement, and growing health awareness. New and easy-to-use technologies, along with the shift toward home and remote care, also make these devices more popular and widely used.

Market Overview

The France self-monitoring blood glucose devices Market refers to the segment of the medical device industry in France that includes products used by people with diabetes to regularly measure and track their blood sugar levels at home or on the go. This market covers blood glucose meters, test strips, lancets, and connected digital tools that help patients manage their condition, support treatment decisions, and improve overall diabetes control.

The France self-monitoring blood glucose devices market is supported by strong recent conditions, including rising diabetes prevalence, widespread adoption of home monitoring, and favorable reimbursement policies that make glucose meters, test strips, and related tools accessible to most patients. France has a significant and growing burden of diabetes, which highlights the importance of self-monitoring blood glucose devices in the country. About 4.1 million adults in France were living with diabetes in 2024, and this number has risen sharply over the past two decades as prevalence increased from around 1.7 million in 2000 to over 4 million today, driven primarily by lifestyle changes, aging, and rising obesity levels. Diabetes affects roughly 6-8% of the population, with type 2 diabetes accounting for the vast majority of cases. A large part of the population is at risk or already managing diabetes, and many require regular blood glucose testing to control their condition and prevent serious complications. Early detection remains an issue, with a portion of people living with undiagnosed diabetes, underscoring the need for accessible glucose monitoring.

The France healthcare system continues to expand coverage for both traditional SMBG and advanced options like connected meters and continuous glucose monitoring devices, reflecting a growing national focus on chronic disease management. Government initiatives such as France’s broader digital health and innovation programs, including France 2030, support research and development in medical technologies, encouraging the creation of smarter, connected monitoring solutions. These trends, along with the push for preventive care, the rising aging population, and increased health awareness, highlight the continuing importance and growth potential of the self-monitoring blood glucose devices market in France.

Report Coverage

This research report categorizes the market for the France self-monitoring blood glucose devices market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France self-monitoring blood glucose devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France self-monitoring blood glucose devices market.

Driving Factors

The France self-monitoring blood glucose devices market is driven by the rising number of people living with diabetes, an aging population that faces a higher risk of Type 2 diabetes, and strong government reimbursement policies that make glucose monitoring tools affordable and widely accessible. Increased health awareness, the need for effective daily diabetes management, and the shift toward home-based and remote care further support demand. In addition, ongoing technological advancements such as connected meters, smartphone integration, and more accurate, user-friendly devices continue to strengthen market growth and encourage broader adoption across the country.

Restraining Factors

The France self-monitoring blood glucose devices market faces several restraining factors. High costs of advanced devices and test strips can limit adoption among some patient groups despite reimbursement. Patient non-compliance, improper use, or lack of awareness about regular monitoring also reduces market growth. Additionally, the rising popularity of continuous glucose monitoring (CGM) systems may shift demand away from traditional SMBG devices, and stringent regulatory requirements can slow the introduction of new products.

Market Segmentation

The France self-monitoring blood glucose devices market share is categorized by component, application, and distribution channel.

- The test strips segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France self-monitoring blood glucose devices market is segmented by component into glucometer devices, test strips, lancets, and others. Among these, the test strips segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The test strips segment's growth is driven by their high consumption rate, as patients require multiple strips daily for regular monitoring. Increasing diabetes prevalence and the emphasis on accurate and frequent glucose testing further boost demand. Additionally, widespread insurance reimbursement for test strips and the growing adoption of both traditional and connected glucometers contribute to the segment’s continued expansion.

- The type 2 diabetes segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France self-monitoring blood glucose devices market is segmented by application into type 1 diabetes, type 2 diabetes, gestational diabetes, and others. Among these, the type 2 diabetes segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The type 2 diabetes segmental growth is driven by the rising prevalence of type 2 diabetes among adults, largely due to sedentary lifestyles, obesity, and an aging population. Increased awareness about the importance of regular blood glucose monitoring for effective disease management. The need for long-term self-management and prevention of complications also contributes to the sustained growth of this segment.

- The retail pharmacies segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France self-monitoring blood glucose devices market is segmented by distribution channel into retail pharmacies, online sales, diabetes clinics & centers, home care, and others. Among these, the retail pharmacies segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The retail pharmacies segmental growth is driven by easy accessibility and wide availability of glucose meters, test strips, and lancets. Strong pharmacy networks across urban and rural areas, the presence of trained pharmacy staff who can provide guidance on device usage and diabetes management, further support the segment’s continued growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France self-monitoring blood glucose devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Roche Diabetes Care

- Abbott Laboratories

- Ascensia Diabetes Care

- Sanofi

- LifeScan Inc.

- ARKRAY Inc.

- Bionime Corporation

- Menarini

- VivaChek

- Rossmax International Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2022, Roche launched the Cobas Pulse, a point-of-care blood glucose monitor with advanced features for hospital professionals. An industry-first professional blood glucose management solution with mobile digital health capabilities to improve patient care

- In January 2023, LifeScan reported that a study of over 144,000 patients showed improved glucose control using a Bluetooth-connected blood glucose meter with a mobile diabetes app, highlighting the effectiveness of digital monitoring tools.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the France Self-Monitoring Blood Glucose Devices Market based on the below-mentioned segments:

France Self-Monitoring Blood Glucose Devices Market, By Component

- Glucometer Devices

- Test Strips

- Lancets

- Others

France Self-Monitoring Blood Glucose Devices Market, By Application

- Type 1 Diabetes

- Type 2 Diabetes

- Gestational Diabetes

- Others

France Self-Monitoring Blood Glucose Devices Market, By Distribution Channel

- Retail Pharmacies

- Online Sales

- Diabetes Clinics & Centers

- Home care

- Others

Frequently Asked Questions (FAQ)

- What is the France self-monitoring blood glucose devices market size in 2024?

The France self-monitoring blood glucose devices market size was estimated at USD 285.6 million in 2024.

- What is the projected market size of the France self-monitoring blood glucose devices market by 2035?

The France self-monitoring blood glucose devices market size is expected to reach USD 666.4 million by 2035.

- What is the CAGR of the France self-monitoring blood glucose devices market?

The France self-monitoring blood glucose devices market size is expected to grow at a CAGR of around 8.01% from 2024 to 2035.

- What are the key growth drivers of the France self-monitoring blood glucose devices market?

Rising diabetes cases, an aging population, and growing health awareness. New and easy-to-use technologies, along with the shift toward home and remote care.

- Which distribution channel segment dominated the market in 2024?

The retail pharmacies segment dominated the market in 2024.

- Which component segment accounted for the largest market share in 2024?

The test strips segment accounted for the largest market share in 2024.

- What segments are covered in the France self-monitoring blood glucose devices market report?

The France self-monitoring blood glucose devices market is segmented on the basis of component, application, and distribution channel.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |