France Short-wave Infrared Cameras & Sensors Market

France Short-wave Infrared Cameras & Sensors Market Size, Share, and COVID-19 Impact Analysis, By Technology (Cooled SWIR Cameras/Sensors and Uncooled SWIR Cameras/Sensors), By Product (SWIR Cameras and SWIR FPAs), By Application (Defense & Military, Industrial, Security & Surveillance, Healthcare & Research, Automotive, Agriculture & Food, and Others), and France Short-wave Infrared Cameras & Sensors Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Short-wave Infrared Cameras & Sensors Market Insights Forecasts to 2035

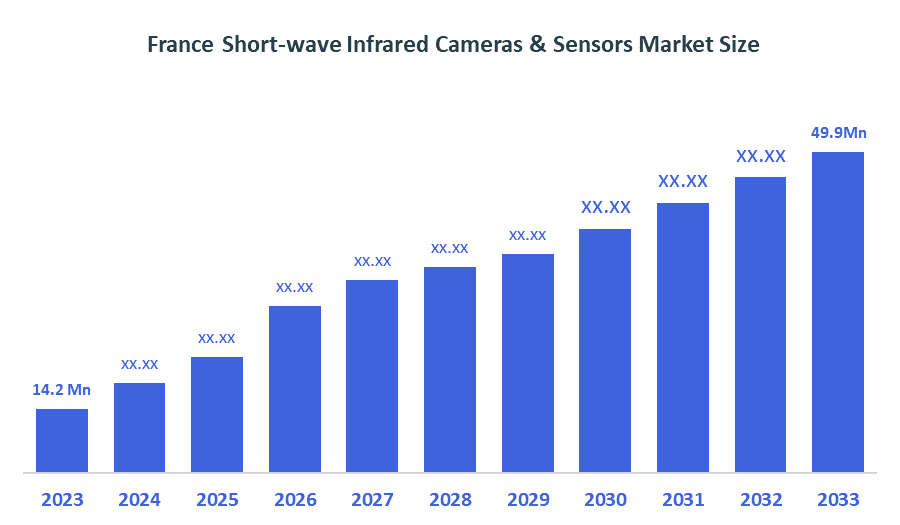

- The France Short-wave Infrared Cameras & Sensors Market Size Was Estimated at USD 14.2 Million in 2024.

- The France Short-wave Infrared Cameras & Sensors Market Size is Expected to Grow at a CAGR of Around 12.1% from 2025 to 2035.

- The France Short-wave Infrared Cameras & Sensors Market Size is Expected to Reach USD 49.9 million by 2035.

According to a Research Report Published by Decision Advisior & Consulting, the France Short-wave Infrared Cameras & Sensors Market size is anticipated to reach USD 49.9 million by 2035, growing at a CAGR of 12.1% from 2025 to 2035. The France short-wave infrared cameras & sensors market is driven by increasing demand from the defense sector for surveillance and target detection, coupled with the growing adoption of short-wave infrared technology in industrial applications for quality control, inspection, and automation. The market also benefits from advanced research and development, especially in precision agriculture and environmental monitoring.

Market Overview

The France short-wave infrared cameras & sensors market refers to the commercial ecosystem for short-wave infrared imaging technologies, devices, and components within France. Short-wave infrared cameras and sensors detect light in the short-wave infrared spectrum (typically 0.9–1.7 µm), beyond the visible range, enabling imaging in low-light, high-contrast, or obscured conditions. These systems are used across diverse applications, including industrial inspection, surveillance and security, automotive and driver-assistance systems, scientific research, defense, and medical imaging. The market encompasses cameras, sensors, modules, and related software supplied to industries, research institutions, and government organizations. It is evaluated in terms of revenue, growth potential, technology adoption, product type, application areas, and end-user segments, reflecting the demand for SWIR imaging solutions to enhance visual detection, monitoring, and analysis in various high-precision and specialized applications in France.

The adoption of short-wave infrared (SWIR) cameras and sensors in France is supported by the country’s growing focus on defense, security, industrial automation, and research applications, driven by population health, safety, and technological needs. France has a population of approximately 68 million, with rising urbanization and industrial activities increasing demand for advanced surveillance, border security, and industrial inspection. The prevalence of industrial and research sectors employing high-precision monitoring and quality control creates significant opportunities for SWIR technology. Moreover, France invests heavily in defense modernization and scientific research, with SWIR sensors being critical for military reconnaissance, healthcare imaging, and advanced R&D, emphasizing the technology’s strategic importance in enhancing safety, efficiency, and innovation across multiple sectors.

Report Coverage

This research report categorizes the market for the France short-wave infrared cameras & sensors market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France short-wave infrared cameras & sensors market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France short-wave infrared cameras & sensors market.

Driving Factors

The France short-wave infrared cameras & sensors market is driven by growing industrial automation and quality control needs, where SWIR technology enables real-time inspection in food processing, pharmaceuticals, electronics, and semiconductor manufacturing. Rising demand for advanced surveillance and security systems, capable of operating in low-light, fog, or smoke conditions, further supports market growth. Technological advancements in sensor sensitivity, resolution, and miniaturization, along with integration with AI and machine vision, are accelerating adoption. Additionally, increasing use in research, scientific imaging, medical diagnostics, and automotive applications, including driver-assistance and autonomous systems, creates new opportunities. Government investments in defense, security, and high-tech research also promote the deployment of SWIR imaging technologies across France.

Restraining Factors

The France short-wave infrared cameras & sensors market face restraints due to the high cost of SWIR cameras and sensors, which limits adoption among small and medium enterprises. Complex integration requirements with existing industrial or security systems can also hinder deployment. Limited awareness of SWIR technology benefits in certain sectors and the availability of alternative imaging solutions, such as visible or near-infrared cameras, further slows market growth. Additionally, challenges related to maintenance, calibration, and specialized technical expertise required for operating and interpreting SWIR systems restrict widespread adoption across industries.

Market Segmentation

The France short-wave infrared cameras & sensors market share is categorized by technology, product, and application.

- The cooled SWIR cameras/sensors segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France short-wave infrared cameras & sensors market is segmented by technology into cooled SWIR cameras/sensors and uncooled SWIR cameras/sensors. Among these, the cooled SWIR cameras/sensors segment accounted for the largest market share in 2014 and is expected to grow at a significant CAGR during the forecast period. The cooled SWIR cameras’/sensors’ segmental growth is due to their higher sensitivity, lower noise levels, and superior image quality compared to uncooled systems, making them ideal for high-precision applications in defense, surveillance, industrial inspection, and scientific research. Their ability to operate effectively in low-light and long-range imaging scenarios further drives adoption. Increasing demand in sectors requiring accurate and reliable imaging, such as aerospace, security, and quality control, contributes to the segment’s strong growth in France.

- The SWIR camera segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France short-wave infrared cameras & sensors market is segmented by product into SWIR cameras and SWIR FPAs. Among these, the SWIR camera segment dominated the market in 2024 and is projected to grow at a significant CAGR during the forecast period. The SWIR cameras’ segmental growth is due to their wide range of applications across industrial, defense, automotive, and research sectors, where real-time imaging and high-resolution detection are critical. The increasing demand for machine vision, quality inspection, and surveillance solutions in France drives adoption. Additionally, advancements in camera performance, miniaturization, and integration with AI and image-processing software enhance their usability and efficiency

- The defense & military segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France short-wave infrared cameras & sensors market is segmented by application into defense & military, industrial, security & surveillance, healthcare & research, automotive, agriculture & food, and others. Among these, the defense & military segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The defense & military segmental growth is driven by the increasing adoption of SWIR cameras and sensors for surveillance, target detection, and reconnaissance in low-light and challenging environmental conditions. Rising defense modernization programs, border security initiatives, and tactical operations in France further boost demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France short-wave infrared cameras & sensors market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bitflow

- Active Silicon

- TriEye

- Raptor Photonics

- Princeton Infrared Technologies

- New Imaging Technologies SA

- Allied Vision

- Lynred

- Teledyne Technologies In

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2025, Xenics partnered with the German Aerospace Center to supply its Bobcat short-wave infrared sensor for NASA’s VERITAS and ESA’s EnVision missions to Venus, enabling high-resolution imaging and detailed surface mapping for planetary exploration

- In January 2025, Lynred introduced the Eyesential SW, a cost-effective shortwave infrared (SWIR) sensor for machine vision. This sensor delivers high resolution and rapid frame rates to improve industrial automation.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decision Advisior has segmented the France Short-Wave Infrared Cameras & Sensors Market based on the below-mentioned segments:

France Short-Wave Infrared Cameras & Sensors Market, By Technology

- Cooled SWIR Cameras/Sensors

- Uncooled SWIR Cameras/Sensors

France Short-Wave Infrared Cameras & Sensors Market, By Product

- SWIR Cameras

- SWIR FPAs

France Short-Wave Infrared Cameras & Sensors Market, By Application

- Defense & Military

- Industrial

- Security & Surveillance

- Healthcare & Research

- Automotive

- Agriculture & Food

- Others

Frequently Asked Questions (FAQ)

- What is the CAGR of the France short-wave infrared cameras & sensors market?

The France short-wave infrared cameras & sensors market size is expected to grow at a CAGR of around 12.1% from 2024 to 2035.

- What is the France short-wave infrared cameras & sensors market size in 2024?

The France short-wave infrared cameras & sensors market size was estimated at USD 14.2 million in 2024.

- What is the projected market size of the France short-wave infrared cameras & sensors market by 2035?

The France short-wave infrared cameras & sensors market size is expected to reach USD 49.9 million by 2035.

- What are the key growth drivers of the France short-wave infrared cameras & sensors market?

Increasing demand from the defense sector for surveillance and target detection, coupled with the growing adoption of short-wave infrared technology. The market also benefits from advanced research and development, especially in precision agriculture and environmental monitoring

- Which product segment dominated the market in 2024?

The SWIR cameras segment held the largest market share in 2024.

- Which technology segment accounted for the largest market share in 2024?

The cooled SWIR cameras/sensors segment accounted for the largest market share in 2024.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 150 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |