France Soy Protein Market

France Soy Protein Market Size, Share, and COVID-19 Impact Analysis, By Form (Concentrates, Isolates, Textured/Hydrolyzed, and Others), By End User (Animal Feed, Personal Care & Cosmetics, Food & Beverages, Supplements, and Others), and France Soy Protein Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Soy Protein Market Insights Forecasts to 2035

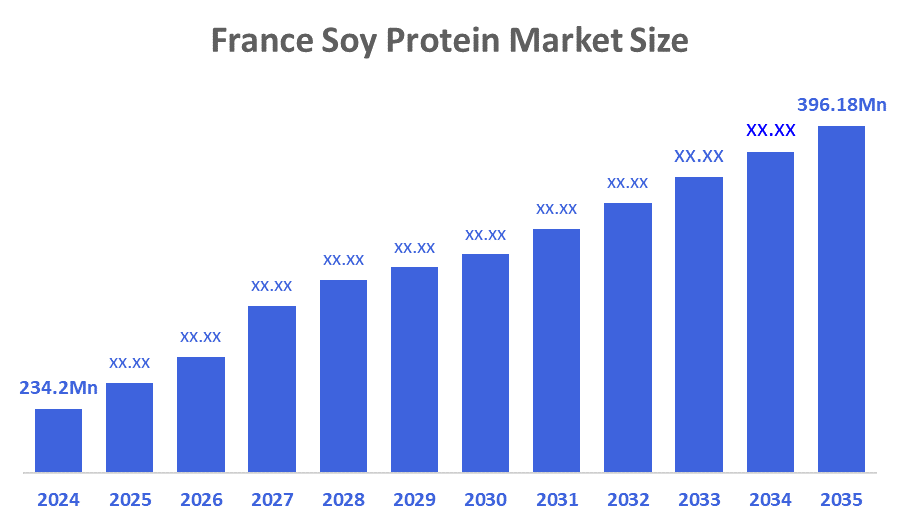

- The France Soy Protein Market Size Was Estimated at USD 234.2 Million in 2024.

- The France Soy Protein Market Size is Expected to Grow at a CAGR of Around 4.9% from 2025 to 2035.

- The France Soy Protein Market Size is Expected to Reach USD 396.18 Million by 2035.

According To a Research Report Published By Decisions Advisors & Consulting, The France Soy Protein Market Size Is Anticipated To Reach USD 396.18 Million By 2035, Growing At a CAGR Of 4.9% From 2025 To 2035. The France soy protein market is driven by increasing consumer awareness of health and wellness, rising demand for plant-based and protein-rich diets, and the growing popularity of vegan and vegetarian lifestyles. The market is also supported by the food industry’s expansion in bakery, dairy alternatives, meat substitutes, and nutritional supplements.

Market Overview

The France soy protein market refers to the industry involved in the production, processing, and distribution of soy-derived protein products used across food, beverage, and nutraceutical applications. Soy protein is a plant-based protein extracted from soybeans and is valued for its high nutritional content, including essential amino acids, and its versatility in various formulations. The market includes soy protein isolates, concentrates, and textured soy protein, which are used in meat alternatives, dairy substitutes, protein supplements, bakery products, and beverages. Growing consumer interest in plant-based diets, health and wellness, and sustainable food sources drives the adoption and expansion of the soy protein market in France.

The France soy protein market is expanding rapidly due to rising consumer interest in health, nutrition, and sustainable diets, with around 25% of the population now consuming plant-based protein products weekly. Shifts toward vegetarian, vegan, and flexitarian diets, combined with decreasing meat consumption, have increased demand for soy protein in meat alternatives, dairy substitutes, bakery products, beverages, sports nutrition, and functional foods. Government initiatives aimed at reducing import dependence and promoting domestic protein-crop cultivation, including funding for research and innovation, support the development of local soy protein production and supply chains. The focus on non-GMO, traceable, and environmentally friendly soy aligns with both consumer preferences and national sustainability goals. Additionally, rising awareness of dietary deficiencies and the need for balanced, protein-rich diets further drives adoption, creating strong opportunities for soy protein in France across food, beverage, and nutraceutical applications.

Report Coverage

This research report categorizes the market for the France soy protein market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France soy protein market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France soy protein market.

Driving Factors

The France soy protein market is driven by rising consumer awareness of health, nutrition, and plant-based diets, boosting demand for meat and dairy alternatives, bakery, beverages, and functional foods. Government initiatives promoting domestic protein-crop cultivation and reducing import reliance support local production. Technological advancements improving taste, texture, and functional properties enhance product versatility. Sustainability concerns and demand for non-GMO, traceable, and eco-friendly protein sources further reinforce market adoption across food, beverage, and nutraceutical sectors.

Restraining Factors

The France soy protein market faces several restraining factors that could limit growth. High production and processing costs for quality soy protein products. Dependence on imported raw soy and price fluctuations in global soybean markets may affect supply stability and profitability. Consumer resistance to plant-based alternatives due to taste, texture, or cultural dietary preferences can slow acceptance. Additionally, competition from other plant proteins, such as pea, wheat, and rice proteins, poses challenges for market share expansion in food, beverage, and nutraceutical applications.

Market Segmentation

The France soy protein market share is categorized by form and end user.

- The concentrates segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France soy protein market is segmented by form into concentrates, isolates, textured/hydrolyzed, and others. Among these, the concentrates segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The concentrates segment's growth is driven by its high protein content, cost-effectiveness, and versatility in a wide range of applications, including meat alternatives, bakery products, beverages, and nutritional supplements. Its functional properties, such as emulsification, gelling, and water-binding capacity, make it ideal for food formulation and processing. Additionally, increasing demand for plant-based protein sources in vegetarian, vegan, and flexitarian diets further supports the expansion of the soy protein concentrates segment in France.

- The food & beverages segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France soy protein market is segmented by end user type into animal feed, personal care & cosmetics, food & beverages, supplements, and others. Among these, the food & beverages segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The food & beverage segmental growth is driven by increasing consumer demand for plant-based and protein-enriched products, including meat alternatives, dairy substitutes, bakery items, snacks, and beverages. Rising health consciousness and dietary shifts toward vegetarian, vegan, and flexitarian lifestyles have further boosted the adoption of soy protein in this sector. Additionally, technological advancements in soy protein processing, which enhance taste, texture, solubility, and functional properties, support the segment’s strong growth in France.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France soy protein market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DuPont de Nemours, Inc.

- Cargill, Incorporated

- Archer Daniels Midland Company (ADM)

- Soja Austria GmbH

- Tofutti Brands, Inc.

- Bunge Limited

- Marubeni Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, DuPont de Nemours, Inc. announced the expansion of its plant-based protein portfolio in France, introducing a new soy protein isolate product to meet the growing demand for vegan and allergen-free ingredients in the European marketplace.

- In March 2024, Cargill, Incorporated, announced plans to increase soy protein concentrate production capacity in France, with a focus on meeting the growing demand for sustainable and plant-based protein sources in the food and beverage industry.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the France Soy Protein Market based on the below-mentioned segments:

France Soy Protein Market, By Form

- Concentrates

- Isolates

- Textured/Hydrolyzed

- Others

France Soy Protein Market, By End User

- Animal Feed

- Personal Care & Cosmetics

- Food & Beverages

- Supplements

- Others

Frequently Asked Questions (FAQ)

- What is the CAGR of the France soy protein market?

The France soy protein market size is expected to grow at a CAGR of around 4.9% from 2024 to 2035.

- What is the France soy protein market size in 2024?

The France soy protein market size was estimated at USD 234.2 million in 2024.

- What is the projected market size of the France soy protein market by 2035?

The France soy protein market size is expected to reach USD 396.18 million by 2035.

- What are the key growth drivers of the France soy protein market?

Increasing consumer awareness of health and wellness, rising demand for plant-based and protein-rich diets, and the growing popularity of vegan and vegetarian lifestyles.

- Which end-user segment dominated the market in 2024?

The food & beverages segment dominated the market in 2024.

- Which form segment accounted for the largest market share in 2024?

The concentrates segment accounted for the largest market share in 2024.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Regional |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |