France Sun Care Cosmetics Market

France Sun Care Cosmetics Market Size, Share, and COVID-19 Impact Analysis, By Product (Tinted Moisturizers, SPF Foundation, SPF BB Creams, SPF Primers, SPF Sunscreen, and Others), By Type (Conventional and Organic), By Distribution Channel (Hypermarkets & Supermarkets, Specialty Stores, E-Commerce, and Others), and France Sun Care Cosmetics Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Sun Care Cosmetics Market Size Insights Forecasts to 2035

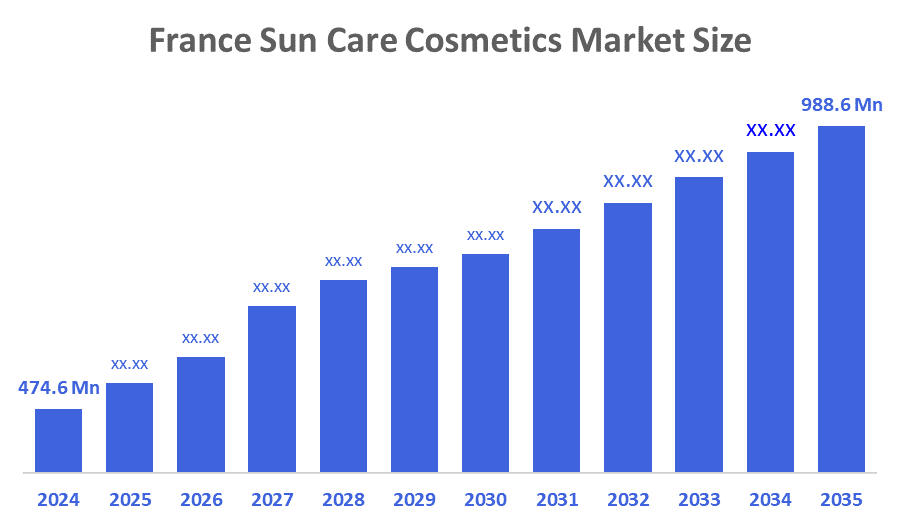

- The France Sun Care Cosmetics Market Size Was Estimated at USD 474.6 Million in 2024.

- The France Sun Care Cosmetics Market Size is Expected to Grow at a CAGR of Around 6.9% from 2024 to 2035.

- The France Sun Care Cosmetics Market Size is Expected to Reach USD 988.6 Million By 2035.

According to a Research Report Published by Decisions Advisors & Consulting, The France Sun Care Cosmetics Market Size is projected to Reach USD 988.6 Million by 2035, Growing at a CAGR of 6.9% from 2025 to 2035. The France sun care cosmetics market is driven by consumers who are becoming increasingly aware of how UV rays affect their body and well-being. This has led to a higher demand for high-quality natural products as well as an increase in interest in being outside, going to the beach, etc. The growing interest in wellness and health, combined with concerns regarding sunburns, skin damage due to long-term UV exposure, and other skin problems associated with aging, has all contributed to this increase in interest.

Market Overview

The France sun care cosmetics market is a segment of the broader beauty and personal care market that develops and sells products to protect skin from sun damage through various means. Cosmetic manufacturers in France produce UV (ultraviolet radiation) protection products. The primary categories of sun care cosmetics include products that provide UVA and UVB protection through a variety of formats, such as lotions, creams, sprays, and tinted moisturizers. Historically, cosmetic manufacturers used chemical and inorganic compounds to develop traditional sun care products. Today, the sun care cosmetics industry also includes a growing selection of new, organic, and mineral-based products. The purpose of sun care products is to help reduce the negative effects on health and appearance that occur from the sun's rays, such as sunburns, premature skin aging, the formation of age spots, skin cancer, etc.

France skin cancer cases are increasing significantly therefore, the need for daily sun protection has increased dramatically, along with the demand for sun care products. France reports between 141,200 to 243,500 cases of skin cancer each year. About 83% of melanomas are associated with solar Ultraviolet (UV) radiation therefore, a large percentage of these cases could have been prevented if adequate sun protection had been used. In 2015, over 10,000 cases of melanoma were reported in France adults due to exposure to UV radiation, thereby continuing to be a serious public health crisis. The continued increase in the incidence of skin cancer, most of which is preventable, needs to encourage consumers to seek more effective and affordable sun care products; thereby causing the continued growth of the sun care cosmetics industry in France.

Report Coverage

This research report categorizes the market for the France sun care cosmetics market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France sun care cosmetics market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France sun care cosmetics market.

Driving Factors

The France sun care cosmetics market is primarily driven by growing awareness within society of the damaging effects of ultraviolet rays on the skin and an increasing demand for people to use sun protection every day as part of their usual skincare routine As a result, consumers are searching for cosmetics and products that provide several different uses, such as being both a moisturizer and foundation, and providing both a cosmetic benefit (SPF) as well as UV protection. This trend is indicative of a larger trend in France for sustainability and dermo-cosmetics, and therefore, the demand for clean, natural, mineral, and eco-friendly products will continue to increase. Continued innovation in Cosmetics will continue to create lighter, less greasy, and cosmetically appealing textures that will encourage consumers to use them daily, and increased distribution opportunities through multiple retail outlets, including hypermarkets, pharmacies, and rapidly growing opportunities via E-commerce.

Restraining Factors

The France sun care cosmetics market faces several restraining factors that slow its growth. seasonal demand, with the strong summer peak sale significantly declining during winter months, limits the revenue stability of the industry throughout the year. Consumers' concerns regarding the chemical UV filters regarding skin sensitivity issues, potential health concerns, and possible environmental issues create doubt among customers, particularly with individuals who are conscientious of the environment and have sensitive skin. In addition, the high price of premium or mineral-based sunscreen products generally deters price-sensitive customers from purchasing these products.

Market Segmentation

The France sun care cosmetics market share is categorized by product, type, and distribution channel.

- The SPF sunscreen segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France sun care cosmetics market is segmented by product into tinted moisturizers, SPF foundation, SPF BB creams, SPF primers, SPF sunscreen, and others. Among these, the SPF sunscreen segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The SPF sunscreen segmental growth is due to increased concern about the damage that UV rays can contribute to your skin, including aging and cancers, which has caused dermatologists and government agencies to stress the need to apply sunscreen every day. As a result of this awareness, consumers have been searching for sunscreens with high SPF levels that provide broad-spectrum protection and a non-greasy feel when applied to their skin.

- The conventional segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The France sun care cosmetics market is segmented by type into conventional and organic. Among these, the conventional segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The conventional segmental growth is due to France consumers showing strong consumer confidence in established product brands, with the formulation of clinically evaluated products. For many consumers in France, proven effectiveness and dermatological safety are the most important factors when using products on their skin, especially for people with sensitive skin. Seasonal increases during holiday and summer periods support ongoing sales of traditional sunscreens, while easy access to conventional sun care products through retail and pharmacy outlets creates ongoing consumer loyalty to these brands.

- The hypermarkets & supermarkets held the largest share in 2024 and are anticipated to grow at a significant CAGR during the forecast period.

The France sun care cosmetics market is segmented by distribution channel into hypermarkets & supermarkets, specialty stores, e-commerce, and others. Among these, the hypermarkets & supermarkets segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The hypermarkets & supermarkets segmental growth is due to their wide product availability, competitive pricing, and strong consumer trust in established retail chains. These stores offer convenient access to a broad assortment of sun care products, ranging from mass-market to premium brands, allowing consumers to compare options in one place. In addition, the high foot traffic in these outlets ensures greater visibility for sun care products, supporting both brand exposure and higher sales volumes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France sun care cosmetics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- L’Oreal S.A.

- Pierre Fabre Laboratories

- Beiersdorf AG

- NAOS INC

- Clarins

- LVMH

- Groupe rocher

- Sisley

- Laboratoires SVR

- PATYKA

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2025, La Roche-Posay expanded its Anthelios summer range with a new lightweight SPF 50+ fluid formulated to deliver high UV protection while simultaneously addressing dark spots. The innovation is powered by Melasyl, a patented, dermatologically tested ingredient developed over 18 years, designed to help prevent excess pigmentation by regulating melanin production. This launch reinforces the brand’s focus on advanced dermo-cosmetic solutions that combine effective sun defense with targeted skin-tone correction.

- In March 2021, Pierre Fabre Laboratories launched TRIASORB, an organic, non-nano sun filter integrated into the Eau Thermale Avene Intense Protect 50+ sunscreen. It offers ultra-broad protection (UVB, UVA, and blue light) while being non-toxic to coral, phytoplankton, and zooplankton.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the France Sun Care Cosmetics Market based on the below-mentioned segments:

France Sun Care Cosmetics Market, By Product

- Tinted Moisturizers

- SPF Foundation

- SPF BB Creams

- SPF Primers

- SPF Sunscreen

- Others

France Sun Care Cosmetics Market, By Type

- Conventional

- Organic

France Sun Care Cosmetics Market, By Distribution Channel

- Hypermarkets & Supermarkets

- Specialty Stores

- E-Commerce

- Others

Frequently Asked Questions (FAQ)

- What is the CAGR of the France sun care cosmetics market?

The France sun care cosmetics market size is expected to grow at a CAGR of around 6.9% from 2024 to 2035.

- What is the France sun care cosmetics market size in 2024?

The France sun care cosmetics market size was estimated at USD 474.6 million in 2024.

- What is the projected market size of the France sun care cosmetics market by 2035?

The France sun care cosmetics market size is expected to reach USD 988.6 million by 2035.

- What are the key growth drivers of the France sun care cosmetics market?

Rising awareness of UV damage is encouraging daily sun protection in France and boosting demand for multifunctional, clean, and eco-friendly sun care products. Continued innovation in lighter textures and wider availability across retail and e-commerce channels is further driving market growth.

- Which distribution channel segment held the largest market share in 2024?

The hypermarkets & supermarkets segment held the largest market share in 2024.

- Which product segment accounted for the largest market share in 2024?

The SPF sunscreen segment accounted for the largest market share in 2024.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 170 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |