France Ultrasound Devices Market

France Ultrasound Devices Market Size, Share, and COVID-19 Impact Analysis, By Application (Anesthesiology, Cardiology, Gynecology/Obstetrics, Musculoskeletal, Radiology, Critical Care, Urology, Vascular, and Others), By Technology (2D Ultrasound Imaging, 3D & 4D Ultrasound Imaging, Doppler Imaging, High-Intensity Focused Ultrasound, and Others), By Portability (Stationary Systems, Portable Cart-Based Systems, Handheld/Pocket Devices, and Others), By End User (Hospitals, Diagnostic Centers, Ambulatory Surgical Centers, and Others), and France Ultrasound Devices Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Ultrasound Devices Market Size Insights Forecasts to 2035

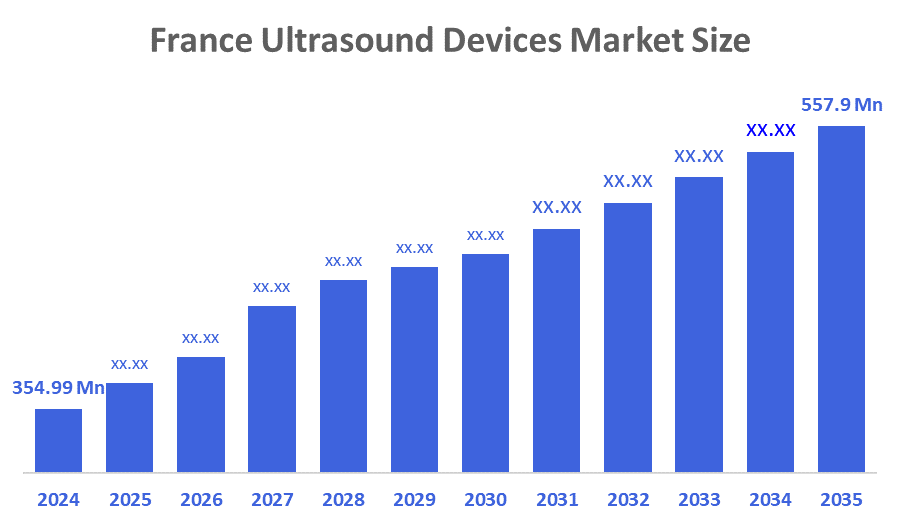

- The France Ultrasound Devices Market Size Was Estimated at USD 354.99 Million in 2024.

- The France Ultrasound Devices Market Size is Expected to Grow at a CAGR of Around 4.2% from 2024 to 2035.

- The France Ultrasound Devices Market Size is Expected to Reach USD 557.9 Million by 2035.

According to a Research Report Published by Decisions Advisors & Consulting, The France Ultrasound Devices Market Size is projected to Reach USD 557.9 Million by 2035, Growing at a CAGR of 4.2% from 2025 to 2035. The France ultrasound devices market is driven by the rising prevalence of chronic diseases, an aging population, and increasing demand for non-invasive diagnostic procedures. Technological advancements, such as portable, 3D/4D, and Doppler ultrasound devices, have expanded applications across cardiology, obstetrics, and musculoskeletal imaging.

Market Overview

The France ultrasound devices market refers to the market for medical imaging equipment that uses ultrasonic waves to create real-time visual representations of the inside of the body. These devices are widely used in diagnostic applications across various medical specialties, including obstetrics, cardiology, musculoskeletal, and emergency medicine. Ultrasound devices in France include systems for diagnostic imaging, portable devices, 3D/4D imaging, Doppler ultrasound, and point-of-care systems.

The France ultrasound devices market is expected to experience strong growth driven by the rising need for advanced, accurate, and accessible diagnostic imaging across hospitals, clinics, and point-of-care environments. The market includes the rapid adoption of portable and handheld ultrasound systems, increasing integration of artificial intelligence for automated image analysis, and the expansion of tele-ultrasound to support remote diagnostics. The French government continues to invest heavily in health innovation through initiatives such as the France 2030 plan, which allocates funding for the development of advanced medical technologies, including imaging devices. Additional support comes from national digital health programs, grants for med-tech startups, and public-private research infrastructures that foster collaboration between industry and academic institutions. Together, these factors create a favorable environment for innovation, market expansion, and improved ultrasound accessibility across the country.

Report Coverage

This research report categorizes the market for the France ultrasound devices market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France ultrasound devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France ultrasound devices market.

Driving Factors

The France ultrasound devices market is driven by several factors, including the increasing prevalence of chronic and age-related diseases, which boosts the need for accurate and non-invasive diagnostic imaging. Growing demand for radiation-free procedures, along with advances such as 3D/4D imaging, Doppler technologies, and AI-enhanced systems. The adoption of portable and handheld ultrasound devices is rising rapidly, supporting point-of-care diagnostics in emergency and outpatient settings. Strong government support through initiatives like the France 2030 Plan, combined with ongoing healthcare infrastructure modernization, also plays a significant role in accelerating market growth.

Restraining Factors

The France ultrasound devices market faces several restraining factors, including stringent and frequently evolving EU regulatory requirements, which increase compliance costs and extend product approval timelines. High acquisition and maintenance costs for advanced ultrasound systems also pose financial challenges for smaller healthcare facilities. Additionally, the market is hindered by a shortage of trained sonographers, limiting the effective use of ultrasound equipment in some regions. Together, these factors create barriers to widespread adoption despite growing demand for diagnostic imaging.

Market Segmentation

The France ultrasound devices market share is categorized by application, technology, portability, and end user.

- The radiology segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France ultrasound devices market is segmented by application into anesthesiology, cardiology, gynecology/obstetrics, musculoskeletal, radiology, critical care, urology, vascular, and others. Among these, the radiology segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The radiology segmental growth is due to the high demand for diagnostic imaging across a wide range of conditions, including organ abnormalities, tumors, and internal injuries. Ultrasound is widely preferred in radiology because it is noninvasive, radiation-free, and suitable for repeated monitoring, making it ideal for both acute and chronic disease management. Technological advancements, such as high-resolution imaging, 3D/4D ultrasound, and portable devices, have further expanded its applications and improved diagnostic accuracy.

- The 3D & 4D ultrasound imaging segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France ultrasound devices market is segmented by technology into 2D ultrasound imaging, 3D & 4D ultrasound imaging, Doppler imaging, high-intensity focused ultrasound, and others. Among these, the 3D & 4D ultrasound imaging segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The 3D & 4D ultrasound imaging segmental growth is due to the increasing demand for advanced imaging techniques that provide more detailed and accurate visualization of anatomical structures. These technologies offer real-time, high-resolution images, which enhance diagnostic accuracy in fields such as obstetrics, gynecology, cardiology, and radiology. The growing preference for noninvasive and patient-friendly imaging methods, coupled with rising investments in technologically advanced ultrasound systems by hospitals and diagnostic centers, further fueled the adoption of 3D and 4D ultrasound.

- The stationary systems segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France ultrasound devices market is segmented by portability into stationary systems, portable cart-based systems, handheld/pocket devices, and others. Among these, the stationary systems accounted for the largest market share in 2024 and are expected to grow at a significant CAGR during the forecast period.

The stationary system’s segmental growth is due to its superior imaging capabilities, higher processing power, and ability to support advanced applications across multiple specialties such as radiology, cardiology, and obstetrics. Hospitals and diagnostic centers prefer stationary systems for comprehensive and high-resolution image features. Additionally, the integration of advanced technologies, including 3D/4D imaging and Doppler capabilities, is more feasible in stationary systems, making them essential for complex diagnostic procedures.

- The hospitals segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The France ultrasound devices market is segmented by end user into hospitals, diagnostic centers, ambulatory surgical centers, and others. Among these, the hospitals segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The hospital’s segmental growth is due to the high patient volumes and the wide range of diagnostic and therapeutic applications performed in hospital settings. Hospitals require advanced ultrasound systems for specialties such as radiology, cardiology, obstetrics/gynecology, and critical care, which drives demand for both stationary and portable devices. Additionally, hospitals have the infrastructure and budget to invest in technologically advanced ultrasound equipment, including 3D/4D imaging and Doppler systems, to ensure accurate and comprehensive diagnostics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France ultrasound devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Canon Medical Systems Corporation

- Fujifilm Holdings Corporation

- GE Healthcare

- Siemens Healthineers AG

- Koninklijke Philips N.V.

- Samsung BioLogics

- Konica Minolta Inc

- Mindray Medical International

- Esaote

- GE HealthCare Technologies Inc Common Stock

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2025, GE HealthCare and NVIDIA announced a collaboration to develop autonomous X-ray and ultrasound systems using the Isaac for Healthcare platform, aiming to automate tasks traditionally performed by technicians and address healthcare workforce shortages.

- In March 2025, Boston Scientific announced an agreement to acquire SoniVie Ltd. for approximately USD 360 million, gaining access to the TIVUS Intravascular Ultrasound System for renal denervation therapy to treat hypertension

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decisons Advisors has segmented the France Ultrasound Devices Market based on the below-mentioned segments:

France Ultrasound Devices Market, By Application

- Anesthesiology

- Cardiology

- Gynecology/Obstetrics

- Musculoskeletal

- Radiology

- Critical Care

- Urology

- Vascular

- Others

France Ultrasound Devices Market, By Technology

- 2D Ultrasound Imaging

- 3D & 4D Ultrasound Imaging

- Doppler Imaging

- High-Intensity Focused Ultrasound

- Others

France Ultrasound Devices Market, By Portability

- Stationary Systems

- Portable Cart-Based Systems

- Handheld/Pocket Devices

- Others

France Ultrasound Devices Market, By End User

- Hospitals

- Diagnostic Centers

- Ambulatory Surgical Centers

- Others

Frequently Asked Questions (FAQ)

- What is the CAGR of the France ultrasound devices market?

The France ultrasound devices market size is expected to grow at a CAGR of around 4.2% from 2024 to 2035.

- What is the France ultrasound devices market size in 2024?

The France ultrasound devices market size was estimated at USD 354.99 million in 2024.

- What is the projected market size of the France ultrasound devices market by 2035?

The France ultrasound devices market size is expected to reach USD 557.9 million by 2035.

- What are the key growth drivers of the France ultrasound devices market?

increasing prevalence of chronic and age-related diseases, government initiatives promoting advanced diagnostic technologies, and technological advancements. Expanded use in both hospital and outpatient settings.

- Which application segment held the largest share in 2024?

The radiology segment held the largest market share in 2024.

- Which technology segment dominated the market in 2024?

The 3D & 4D ultrasound imaging segment dominated in 2024.

- Which government initiative supports market growth?

The France 2030 Plan supports innovation and funding for advanced medical technologies

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 267 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |