France Urinary Tract Infection Testing Market

France Urinary Tract Infection Testing Market Size, Share, and COVID-19 Impact Analysis, By Type (Urethritis, Cystitis, Pyelonephritis, and Others), By End User (General Practitioners (GPs), Urologists, Urogynecologists, Hospital Laboratories, Reference Laboratories, and Others), and France Urinary Tract Infection Testing Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Urinary Tract Infection Testing Market Insights Forecasts to 2035

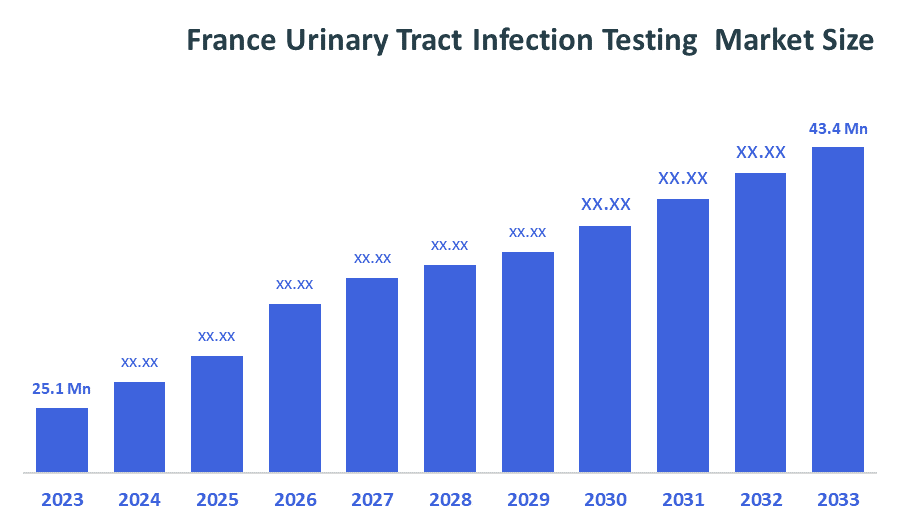

- The France Urinary Tract Infection Testing Market Size Was Estimated at USD 25.1 Million in 2024.

- The France Urinary Tract Infection Testing Market Size is Expected to Grow at a CAGR of Around 5.1% from 2025 to 2035.

- The France Urinary Tract Infection Testing Market Size is Expected to Reach USD 43.4 million by 2035.

According to a Research Report Published by Decision Advisior & Consulting, the France Urinary Tract Infection Testing Market size is anticipated to reach USD 43.4 million by 2035, growing at a CAGR of 5.1% from 2025 to 2035. The France urinary tract infection testing market is driven by the rising incidence of UTIs, advancements in diagnostic technology like point-of-care and rapid tests, and an aging population susceptible to infection. Increased awareness, the need for prompt diagnosis, and a focus on antibiotic stewardship also play significant roles in driving market demand for more efficient testing solutions.

Market Overview

The France urinary tract infection testing market refers to the entire France diagnostic UTI testing market, which includes all types of diagnostic tests and associated tools used to detect and track urinary tract infections throughout the country. The France urinary tract infection testing market includes many different types of diagnostic tests and tools for determining if an individual is suffering from a flagrant infection of urinary tract. Examples of UTI testing in France include urinalysis, urine cultures, susceptibility testing, rapid dipstick tests, immunoassays, PCR-based methods, and home-testing kits. The France urinary tract infection testing market has grown because of the high levels of UTI prevalence, increased educational awareness of diagnosing urinary tract infections early on, the need to monitor the emergence of antimicrobial resistance, and the screening of women, older adults, and diabetics who are at greater risk.

The adoption of urinary tract infection diagnostic testing in France is influenced by the nation's demographic profile and the epidemiology of UTIs. Approximately 68 million people reside in France, and UTIs rank among the top three most frequently reported bacterial infections, primarily affecting females, older adults, and those with diabetes or urinary catheters. Research shows that approximately 10 to 15 percent of women each year experience a UTI in France. Furthermore, a higher number of individuals with recurrent UTIs increases both visits to the physician and hospitalization. Concern about increased levels of antimicrobial resistance also reaffirms the need for rapid and accurate UTI diagnostic testing to help guide appropriate treatment decisions. All of these elements demonstrate the value of the France urinary tract infection testing sector for improving patient outcomes, decreasing UTI-related complications, and enhancing the ability to effectively manage UTIs in both the clinical and home environments.

Report Coverage

This research report categorizes the market for the France urinary tract infection testing market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France urinary tract infection testing market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France urinary tract infection testing market.

Driving Factors

The France urinary tract infection testing market is driven by the high prevalence of UTIs, urinary tract infections are widespread, with women, the elderly, and diabetic patients suffering from a higher rate of UTI than average. In addition to their worries about too-long resistance, clinicians also want fast and reliable diagnostic results, which drives the growth of the French urinary tract infection testing market. Also, the advancements in technology (like immunoassays and rapid dipstick tests) and increased investment in medical care by the country’s elderly population are helping to drive demand for reliable, fast results both within France's hospitals and throughout many types of clinics (including private clinics) and homes.

Restraining Factors

The market for urinary tract testing in France is constrained by the cost of many of the advanced diagnostic tests available, including molecular PCR-based assays, which may make them difficult to adopt by smaller clinics or at-home care settings. Certain areas of the country have limited access to rapid diagnostic solutions and so which affects their growth rates. In addition, some of the tests available may provide results that are falsely positive or negative. With the alternative empirical treatment approaches now being available, the immediate need for formal diagnostics has decreased.

Market Segmentation

The France urinary tract infection testing market share is categorized by type and end user.

- The cystitis segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France urinary tract infection testing market is segmented by type into urethritis, cystitis, pyelonephritis, and others. Among these, the cystitis segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The cystitis segmental growth is due to its high prevalence among women, who experience cystitis far more frequently than other forms of UTI, making it the most commonly diagnosed urinary infection in France. Increased recurrence rates, greater demand for rapid and accurate diagnostic testing, and rising awareness of early treatment further drive testing volume. Additionally, factors such as aging populations, higher incidence of comorbidities like diabetes, and widespread use of urinary catheters contribute to more frequent cases of cystitis, supporting the segment’s strong growth within the France UTI testing market.

- The hospital laboratories segment held the largest market share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France urinary tract infection testing market is segmented by end user into general practitioners (GPs), urologists, urogynecologists, hospital laboratories, reference laboratories, and others. Among these, the hospital laboratories held the largest market share in 2024 and are projected to grow at a significant CAGR during the forecast period. The hospital laboratories’ segmental growth is due to their high testing capacity, advanced diagnostic infrastructure, and ability to perform comprehensive UTI analyses, including urine culture, susceptibility testing, and molecular diagnostics. Hospitals manage a large volume of UTI cases, particularly among elderly patients, inpatients, and individuals with recurrent or complicated infections, which increases the need for accurate and rapid testing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France urinary tract infection testing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Qiagen NV

- Bio-Rad Laboratories Inc

- Roche Holding AG

- Danaher Corp

- Siemens Healthineers AG ADR

- Thermo Fisher Scientific Inc

- BioMerieux SA

- T2 Biosystems Inc

- Accelerate Diagnostics Inc

- Randox

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, PreAnalytiX, a joint venture between QIAGEN and BD, launched the PAXgene Urine Liquid Biopsy Set, enabling non-invasive urine sample collection and immediate stabilization of cell-free DNA. This innovative solution includes a collection cup and a nucleic acid stabilizing tube, advancing liquid biopsy capabilities.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decision Advisior has segmented the France Urinary Tract Infection Testing Market based on the below-mentioned segments:

France Urinary Tract Infection Testing Market, By Type

- Urethritis

- Cystitis

- Pyelonephritis

- Others

France Urinary Tract Infection Testing Market, By End User

- General Practitioners (GPs)

- Urologists

- Urogynecologists

- Hospital Laboratories

- Reference Laboratories

- Others

Frequently Asked Questions (FAQ)

- What is the CAGR of the France urinary tract infection testing market?

The France urinary tract infection testing market size is expected to grow at a CAGR of around 5.1% from 2024 to 2035.

- What is the France urinary tract infection testing market size in 2024?

The France urinary tract infection testing market size was estimated at USD 25.1 million in 2024.

- What is the projected market size of the France urinary tract infection testing market by 2035?

The France urinary tract infection testing market size is expected to reach USD 43.4 million by 2035.

- What are the key growth drivers of the France urinary tract infection testing market?

Rising incidence of UTIs, advancements in diagnostic technology, and an aging population susceptible to infection. Increased awareness, the need for prompt diagnosis, and a focus on antibiotic stewardship also play significant roles in driving market demand for more efficient testing solutions.

- Which end-user segment held the largest market share in 2024?

The hospital laboratories segment held the largest market share in 2024.

- Which type of segment accounted for the largest market share in 2024?

The cystitis segment accounted for the largest market share in 2024.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 167 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |