France Wound Care Management Devices Market

France Wound Care Management Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Wound Care and Wound Closure), By Wound Type (Chronic Wounds and Acute Wounds), By Mode of Purchase (Institutional Procurement and Retail / OTC Channel), End User (Hospitals & Specialty Wound Clinics, Long-term Care Facilities, Home-Healthcare Settings, and Others), and France Wound Care Management Devices Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Wound Care Management Devices Market Size Insights Forecasts to 2035

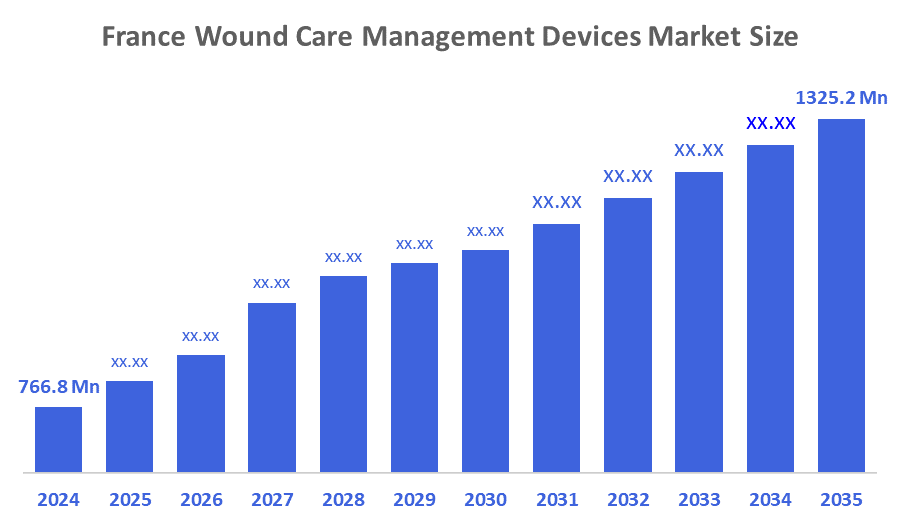

- The France Wound Care Management Devices Market Size Was Estimated at USD 766.8 Million in 2024.

- The France Wound Care Management Devices Market Size is Expected to Grow at a CAGR of Around 5.1% from 2024 to 2035.

- The France Wound Care Management Devices Market Size is Expected to Reach USD 1325.2 Million By 2035.

According to a Research Report Published by Decisions Advisors & Consulting, The France Wound Care Management Devices Market Size is projected to Reach USD 1325.2 Million by 2035, growing at a CAGR of 5.1% from 2025 to 2035. The France wound care management devices market is driven by the rising prevalence of chronic wounds such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers, along with an aging population that is more prone to slow-healing injuries. Growing cases of diabetes and obesity, advances in advanced wound care technologies. Strong government focus on improving healthcare infrastructure, expanding home-care services, and higher healthcare spending further boost demand for modern wound care devices in France.

Market Overview

The France market for wound care management devices includes medical products and their uses to monitor, treat, and provide support during the healing of acute and chronic wounds. Examples of this type of medical device include negative pressure wound therapy (NPWT), advanced wound dressings, wound closures, infection-control products, and tools to relieve pressure.

The key to the growth of the France market for wound care management devices is a heightening number of chronic injuries resulting from a rapidly increasing number of people who are diabetic and an older population requiring prolonged and enhanced treatment for their chronic injuries. As indicated in the January 2021 Journal of Diabetes, 6-7% of all patients in primary care had an open wound of some form, a substantial number of which eventually became chronic, and the increasing demand for new and effective means of treating these injuries continues to increase.

With the advent and acceptance of new and advanced technology such as smart dressings, NPWT, and AI-based wound monitoring systems, there are many opportunities within the marketplace. Additionally, the France government is currently striving to establish tele-wound care within the community, and by creating a supportive reimbursement program for NPWT, the government is encouraging the increased use of innovative wound care products. At the same time, there are many pressures placed on the France healthcare system via the cost of delivering healthcare.

Report Coverage

This research report categorizes the market for the France wound care management devices market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France wound care management devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France wound care management devices market.

Driving Factors

The France wound care management devices market is driven by several key factors. The increasing number of chronic wounds, especially those caused by diabetes, obesity, and vascular disease, is generating high demand for new and improved advanced wound care devices. France's ageing population is also driving growth, as the elderly population is more vulnerable to developing pressure ulcers and experiences delays in healing time for their wounds. The rapid rise of new technological advancements in wound care, such as negative pressure wound therapy, new antimicrobial dressings, and high-tech tools to monitor wounds, has produced increased patient outcomes through improved healing processes. With the strong emphasis of the government on digital health and the drive towards reducing hospital stays and overall health care costs, the rising trend toward new and improved technology will play a large role in increasing the number of efficient, technology-based wound care devices in France.

Restraining Factors

The France wound care management devices market faces several restraining factors. High costs of advanced wound care products, such as NPWT systems and smart dressings, limit adoption, especially in smaller clinics and home-care settings. Strict regulatory requirements and reimbursement complexities can slow market entry and delay patient access to innovative devices. Limited awareness and training among healthcare professionals regarding the latest wound care technologies also hinder widespread use. Supply chain issues, particularly for specialized components, and the risk of infections or improper device use further restrict market growth.

Market Segmentation

The France wound care management devices market share is categorized by product, wound type, mode of purchase, and end user.

- The wound care segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The France wound care management devices market is segmented by product into wound care and wound closure. Among these, the wound care segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The wound care segmental dominance is due to the high prevalence of chronic wounds such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers, which require ongoing management with advanced dressings and therapeutic devices. The growing elderly population, combined with rising diabetes rates, has increased demand for long-term wound treatment products. Additionally, advancements in technologies like antimicrobial dressings, foam dressings, hydrocolloids, and negative pressure wound therapy have made wound care solutions more effective, further driving their widespread use in hospitals, clinics, and home-care settings across France.

- The chronic wounds segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France wound care management devices market is segmented by wound type into chronic wounds and acute wounds. Among these, the chronic wounds segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The chronic wounds segmental growth is due to the high and growing prevalence of long-lasting conditions such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers, which require continuous and advanced wound management. Rising rates of diabetes and obesity, along with an expanding elderly population prone to slow-healing wounds, further increased the demand for specialized devices like advanced dressings, negative pressure wound therapy, and infection-control products.

- The institutional procurement segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France wound care management devices market is segmented by mode of purchase into institutional procurement and retail / OTC channel. Among these, the institutional procurement segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The institutional procurement segmental growth is due to the high demand from hospitals, clinics, and long-term care facilities, which handle the majority of chronic and acute wound cases. Large-scale institutions prefer bulk purchases of advanced wound care devices, such as negative pressure wound therapy systems, specialized dressings, and wound closure products, to ensure consistent supply and cost efficiency.

- The hospitals & specialty wound clinics held the largest share in 2024 and are anticipated to grow at a significant CAGR during the forecast period.

The France wound care management devices market is segmented by end user into hospitals & specialty wound clinics, long-term care facilities, home-healthcare settings, and others. Among these, the hospitals & specialty wound clinics segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The hospitals & specialty wound clinics segmental growth is due to the high concentration of acute and complex wound cases treated in these settings. Hospitals and specialized clinics have access to advanced wound care technologies such as negative pressure wound therapy, antimicrobial and hydrocolloid dressings, and sophisticated wound closure devices, making them the primary users of these products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France wound care management devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ConvaTec Group PLC

- Medtronic PLC

- Smith & Nephew plc

- Solventum

- Coloplast

- Sechrist Industries, Inc.

- Acelity

- Cardinal Health Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2025, Convatec confirmed an initial France launch of ConvaNiox, a nitric-oxide antimicrobial therapy for diabetic foot ulcers, ahead of full rollout in 2026.

- In June 2025, In Situ showcased an advanced 3D bio-dressing, a technology designed for chronic wounds and severe burns. This innovative dressing uses 3D printing with a hydrogel scaffold and nanoparticles to create a customized, bioactive matrix. It promotes healing by creating a moist environment, acting as a barrier to pathogens, and providing mechanical support for cell infiltration and proliferation.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the France Wound Care Management Devices Market based on the below-mentioned segments:

France Wound Care Management Devices Market, By Product

- Wound Care

- Wound Closure

France Wound Care Management Devices Market, By Wound Type

- Chronic Wounds

- Acute Wounds

France Wound Care Management Devices Market, By Mode of Purchase

- Institutional Procurement

- Retail / OTC Channel

France Wound Care Management Devices Market, By End User

- Hospitals & Specialty Wound Clinics

- Long-term Care Facilities

- Home-Healthcare Settings

- Others

Frequently Asked Questions (FAQ)

- What is the CAGR of the France wound care management devices market?

The France wound care management devices market size is expected to grow at a CAGR of around 5.1% from 2024 to 2035.

- What is the France wound care management devices market size in 2024?

The France wound care management devices market size was estimated at USD 766.8 million in 2024.

- What is the projected market size of the France wound care management devices market by 2035?

The France wound care management devices market size is expected to reach USD 1325.2 million by 2035.

- What are the key growth drivers of the France wound care management devices market?

The increasing parental awareness of infant health, growing adoption of certified organic and clean-label personal-care products, combined with rising incidences of infant skin conditions. Supportive regulations in France.

- Which product segment dominated the market share in 2024?

The wound care segment dominated the market share in 2024.

- Which mode of purchase segment accounted for the largest market share in 2024?

The Institutional Procurement segment accounted for the largest market share in 2024.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 160 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |