Global Froth Flotation Chemicals Market

Global Froth Flotation Chemicals Market Size, Share, and COVID-19 Impact Analysis, By Product (Collectors, Frothers, Modifiers, Other Product), By End Use (Mining, Pulp & Paper, Industrial Waste & Sewage Treatment, Other End Uses), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035.

Report Overview

Table of Contents

Froth Flotation Chemicals Market Summary

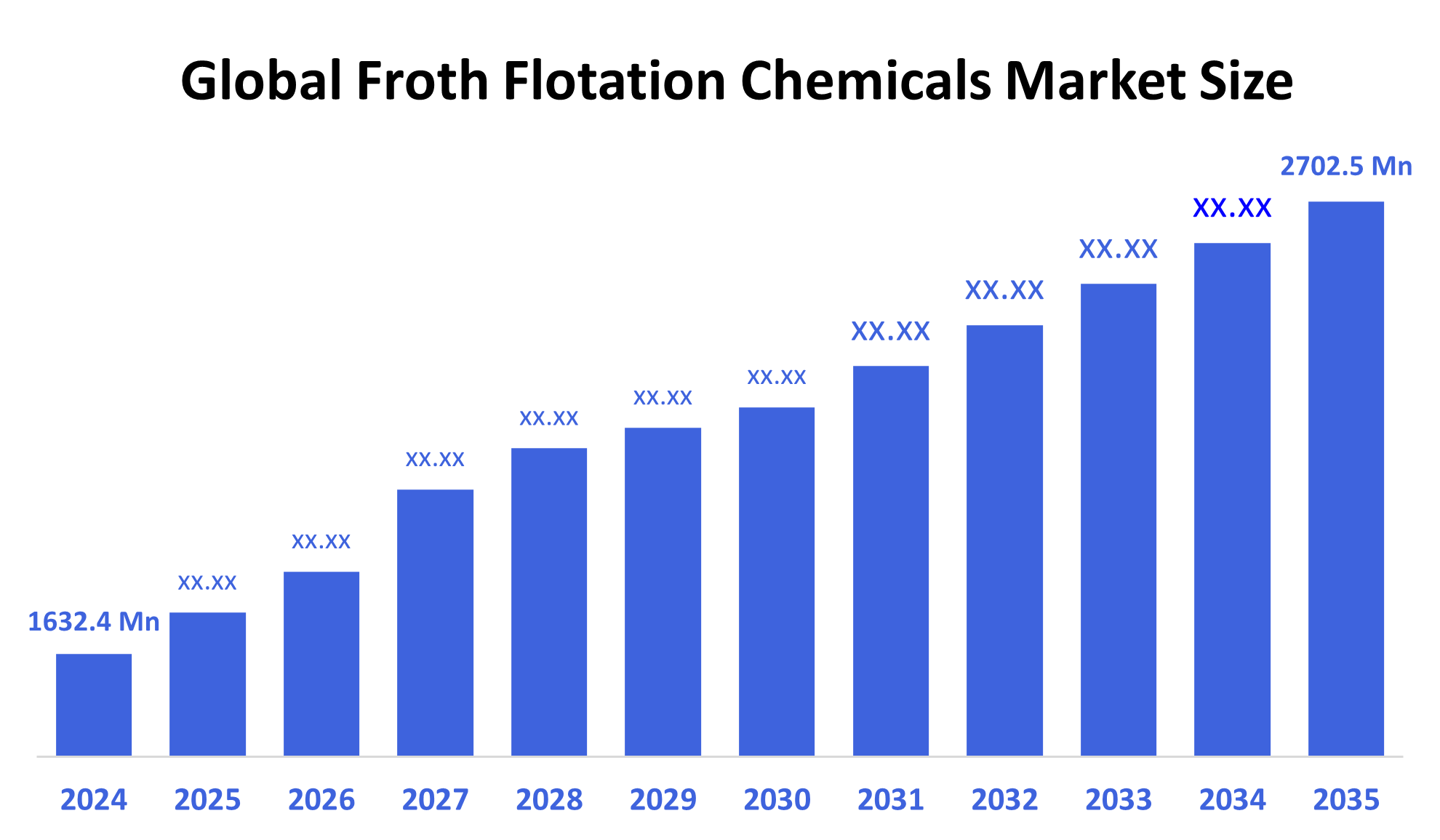

The Global Froth Flotation Chemicals Market Size Was Estimated at USD 1632.4 Million in 2024, and is Projected to Reach USD 2702.5 Million by 2035, Growing at a CAGR of 4.69% from 2025 to 2035. The market for froth flotation chemicals is expanding because of the growing demand for effective mineral separation processes in emerging economies, the mining industry, increased metal extraction activities, technological advancements, water treatment applications, and the expansion of industrial infrastructure.

Key Regional and Segment-Wise Insights

- In 2024, Asia Pacific held the biggest revenue share of 51.7%, dominating the market for froth flotation chemicals.

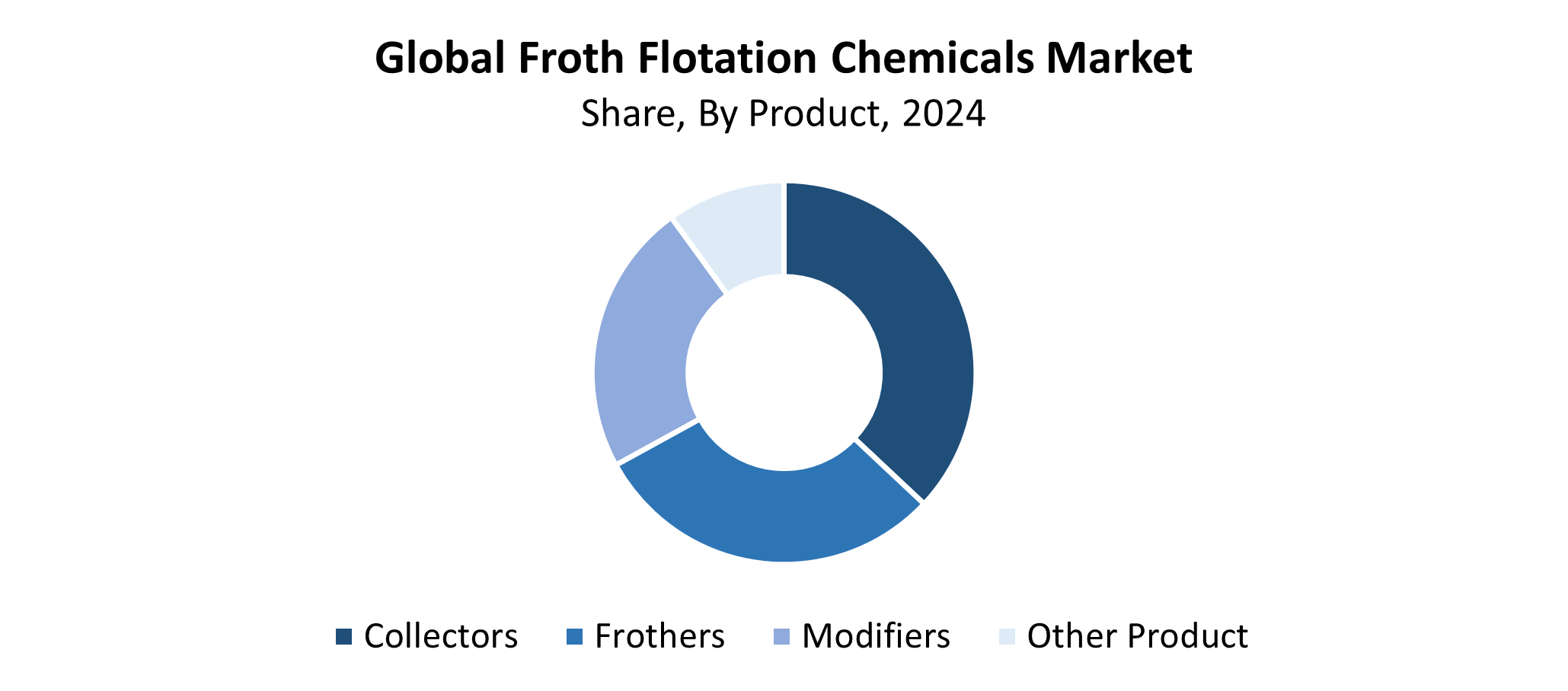

- With a 37.5% market share, the collectors segment led the froth flotation chemicals market by product.

- In 2024, the mining segment held 39.4% revenue share, dominating the market by end-use.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1632.4 Million

- 2035 Projected Market Size: USD 2702.5 Million

- CAGR (2025-2035): 4.69%

- Asia Pacific: Largest market in 2024

The froth flotation chemicals market represents the industrial sector that manufactures and distributes reagents used in froth flotation for mineral ore processing. The essential substances for mineral separation efficiency include depressants alongside activators, dispersants, collectors, and frothers. The rising market demand stems from the industrial requirement for metals, including copper and lead, as well as zinc and rare earth elements found in electronics and automotive, and construction sectors. The rising demand for flotation chemicals stems from both declining quality of ore deposits and expanding mining operations in developing regions, which drives the necessity for improved mineral beneficiation techniques.

The froth flotation chemicals market continues to develop because of new technological advancements. The mineral separation process uses sustainable solutions through environmentally friendly reagents, along with enhanced process automation, which leads to better efficiency. Various regions across the world have started programs to support environmentally friendly mining operations through flotation technology development. The mining industry will benefit from rising research funding and government regulations that target innovation during the next years, primarily in North America and Europe, and the Asia-Pacific regions, thus expanding market potential.

Product Insights

The collectors segment held the largest market share of 37.5% in 2024 and dominated the froth flotation chemicals market. Collectors function as essential chemicals that bind to valuable minerals to make them hydrophobic so they can be separated from gangue by air bubbles during flotation. The main reason behind their widespread adoption stems from their superior ability to boost mineral recovery, especially when processing copper, lead, and zinc sulfide ores. The growing requirement for base metals across electronics, automotive, and infrastructure sectors has driven the increased adoption of collectors. The market leadership of froth flotation chemicals for collectors continues to grow due to new developments in selective and environmentally friendly collector formulations.

The frothers segment in the froth flotation chemicals market is anticipated to experience the fastest CAGR throughout the forecast period. Frothers play a vital role in flotation cells because they stabilize air bubbles so the flotation process can separate hydrophilic from hydrophobic particles effectively. The creation of a stable froth layer through frothers leads to improved process efficiency and enhanced mineral recovery rates. The expanding requirement for advanced frothing agents stems from the rising demand for high-purity materials in sectors such as electronics, renewable energy, and construction. Research and development efforts continue to enhance the adoption of environmentally friendly and biodegradable frothing agents.

End Use Insights

The mining segment held the largest revenue share of the froth flotation chemicals market and dominated the market with 39.4% market share in 2024. Froth flotation represents a vital extraction technique in mining operations that separates valuable minerals from ore with low concentrations when processing lead, copper, gold, and zinc metals. The worldwide demand for metals has surged because of fast industrialization and urban growth, along with automotive and electronic industry expansion, which has driven mining operations to expand significantly. The demand for efficient flotation chemicals increases because mining operations pursue more complex ore deposits and face declining grade values. The dominant market position of the mining segment continues to grow because mining operations increasingly depend on flotation methods for mineral beneficiation.

During the forecast period, the pulp and paper segment of the froth flotation chemicals market is anticipated to grow at the fastest CAGR. The pulp and paper sector demonstrates increasing adoption of froth flotation processes to enhance fiber retrieval operations and improve recycled paper deinking and paper quality outcomes. The rising demand for recycled paper products needs effective flotation chemicals, which become essential because of the increasing sustainability and circular economy principles. The production of recycled and environmentally friendly paper has sped up because of both stricter environmental regulations and rising deforestation awareness. The segment's rapid development will be supported by both the unfolding market patterns and the creation of specialized chemical solutions for deinking processes during the next few years.

Regional Insights

In 2024, Asia Pacific held the largest revenue share of 51.7% and dominated the froth flotation chemicals market worldwide. The region maintains its market leadership because of its massive mining operations which include large mineral deposits in Australia China and India along with their extensive iron ore and coal and copper resources. The rising need for efficient mineral processing techniques because of industrial and urban development and metal demand from electronic automotive and construction sectors has driven the increased use of flotation chemicals. The market leadership of this region was strengthened by investments in mining operations abroad as well as government support programs and innovations in mineral processing technologies. The industry leadership of Asia Pacific stems from its expanding pulp and paper sector as well as its vital chemical industry presence.

Europe Froth Flotation Chemicals Market Trends

The European market for froth flotation chemicals grows steadily because mining operations seek eco-friendly methods and advanced mineral processing solutions. Major mining operations exist in Poland alongside Russia and Germany, which serve as key markets. The region's focus on environmental standards supports the use of biodegradable and environmentally friendly flotation chemicals. The pulp and paper industry utilizes froth flotation for fiber recovery and deinking, which drives market expansion. The combined investment in research and development, along with technological improvements in flotation procedures, enhances operational efficiency and reduces environmental damage. Europe stands as a leading global market participant because of its strict regulatory framework combined with sustainable practices and major chemical manufacturing facilities.

North America Froth Flotation Chemicals Market Trends

The North American froth flotation chemicals market experiences significant growth because of rising mining operations, mainly in both the United States and Canada. Several industries, including construction, automotive, and renewable energy, require basic and precious metals, which leads to rising demand for efficient mineral processing solutions in the region. The market receives two main driving factors from the increasing utilization of environmentally friendly flotation chemicals and evolving mining technological solutions. The North American pulp and paper industry uses flotation chemicals more frequently to execute recycling and deinking procedures. The market growth receives support through government funding of research and development activities and programs for sustainable resource management. The area achieves better capabilities to meet growing industrial needs through its major chemical producers.

Key Froth Flotation Chemicals Companies:

The following are the leading companies in the froth flotation chemicals market. These companies collectively hold the largest market share and dictate industry trends.

- BASF

- Ecolab

- Nouryon

- Clariant

- Chevron Phillips Chemical Company LLC.

- Solvay

- Kemira

- NASACO

- Arkema

- Solvay

- Dow

- Quadra Groups.

- Others

Recent Developments

- In April 2025, Leading North American distributor of ingredients and chemicals, Quadra, announced that it has acquired Bell Chem, a Florida-based supplier with a reputation for working with a variety of industries, including water treatment. By making this calculated step, Quadra expands its market reach and capabilities in two crucial areas for environmental management and mineral processing: water treatment and froth flotation chemicals. The purchase supports Quadra's ongoing expansion and puts the combined company in a position to provide more effective, customized solutions in both domestic and foreign markets, due to Bell Chem's robust logistics network, warehousing capacity, and specialized product lines, which include sanitation solutions for the food and beverage industry.

- In October 2023, to support the quick expansion of its mining solutions portfolio, BASF introduced two new flotation reagent brands: Luproset for modifiers and Luprofroth for frothers. By enhancing the current Lupromin collector range, these brands establish BASF as a mining industry solutions provider. Sulfidic frothers from the Luprofroth line are made to maximize process efficiency, froth stability, and bubble behavior while improving environmental safety. In the meantime, to enhance mineral recovery and minimize reagent usage, the Luproset range incorporates sophisticated modifiers such as gold activators. Supported by BASF's extensive worldwide reach and robust backward integration, this strategic initiative demonstrates the company's dedication to sustainable mining methods and innovation.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the froth flotation chemicals market based on the below-mentioned segments:

Global Froth Flotation Chemicals Market, By Product

- Collectors

- Frothers

- Modifiers

- Other Product

Global Froth Flotation Chemicals Market, By End Use

- Mining

- Pulp and Paper

- Industrial Waste and Sewage Treatment

- Other End Uses

Global Froth Flotation Chemicals Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |