Global Fruit & Vegetable Juice Market

Global Fruit & Vegetable Juice Market Size, Share, and COVID-19 Impact Analysis, By Product (Fruit Juices, Fruit & Vegetable Blend, Vegetable Juices), By Distribution Channel (Supermarkets/ Hypermarkets, Convenience Stores, Online, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035.

Report Overview

Table of Contents

Fruit & Vegetable Juice Market Summary

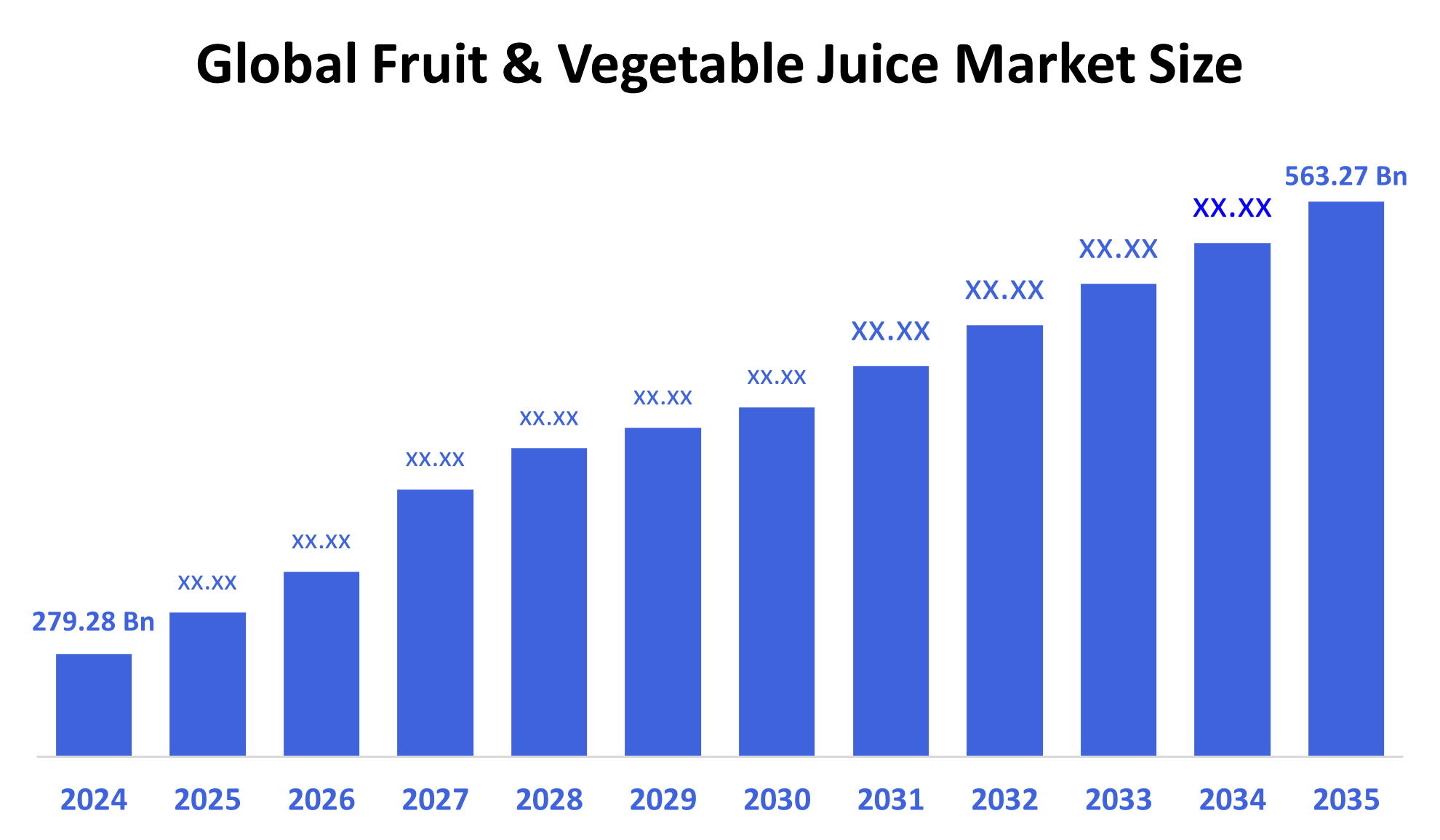

The Global Fruit And Vegetable Juice Market Size Was Valued at USD 279.28 Billion in 2024 and is Expected to Reach USD 563.27 Billion by 2035, Growing at a CAGR of 6.59% from 2025 to 2035. The market for fruit and vegetable juice is booming as a result of increased health consciousness, expanding vegan and plant-based trends, convenience food driven by busy lives, growing demand for natural and functional beverages, and advancements in cold-pressed juice technology, tastes, and packaging.

Key Regional and Segment-Wise Insights

- With 35.7% revenue share, the worldwide fruit and vegetable juice market is dominated by the North America region in 2024.

- With a 42.6% market share, the fruit juices segment led the market based on product.

- The supermarkets and hypermarkets segment dominated the market by distribution channel, holding a 35.2% share in 2024.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 279.28 Billion

- 2035 Projected Market Size: USD 563.27 Billion

- CAGR (2025-2035): 6.59%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The market for fruit and vegetable juices consists of drinks that have their natural fruit and vegetable juices extracted from them; these beverages serve as both convenient options and flavorful, nutritious choices for consumers. The principal drivers behind market growth include consumer interest in natural and organic offerings, together with increased health awareness and the rising popularity of functional beverages that support digestion and boost energy and immunity. The industry has experienced growth because of people's busy schedules and their increasing need for ready-made portable beverages. The global market growth has resulted from increased consumer preference for juice products instead of carbonated or dairy-based drinks due to the growing trend of plant-based diets and vegan lifestyles.

The fruit and vegetable juice industry faces significant changes because of technological advancements. Food appeal improves through the use of aseptic packaging and high-pressure processing (HPP) and cold-pressing technologies, which extend shelf life while preserving flavor and nutrition. Producers utilize modern filtration techniques together with extraction methods to produce higher-quality and purer juice products. Multiple governments support healthier beverage options through public education programs and taxation of sugary drinks, and mandatory product labeling. National health initiatives across Europe and North America support natural low-sugar juice consumption, which drives both market growth and product development.

Product Insights

The fruit juices segment held the largest revenue share of 42.6% and dominated the global fruit and vegetable juice market in 2024. The main factor driving this domination is the high demand from consumers for savory, hydrating, and nourishing beverages. Fruit juices, including orange, apple, mango, and mixed fruit, are well-liked by people of all ages because they naturally contain sweetness and vitamins and have perceived health benefits. The market growth stems from customers seeking convenient, ready-to-drink beverages along with the increased availability of organic and sugar-free options. Health-conscious consumers are attracted to continuing product evolutions that focus on immunity and energy benefits through fortified and functional fruit beverages. These factors collectively maintain the segment's position as the dominant force in the worldwide market.

During the forecast period, the vegetable juice segment is expected to grow at a significant CAGR because consumers are becoming more aware of the health benefits of vegetable drinks. The increasing awareness about fruit juice sugar content is leading health-conscious consumers to select tomato, carrot, beetroot, and mixed vegetable juices, which contain low sugar levels and high nutritional value. The vitamin and mineral antioxidant content of these juices helps people maintain better immunity, digestive functions, and heart health. The growing trend of detox drinks alongside functional beverages continues to drive market demand, especially among people living in cities and fitness enthusiasts. Manufacturers are testing new production approaches by combining cold-pressed extraction with organic ingredients and vegetable and herb blends to enhance both flavor and nutritional value. The industry experiences growth across both advanced economies and developing nations because of these developments.

Distribution Channel Insights

The supermarket and hypermarket segment held the largest market share of 35.2% in 2024 and dominated the fruit and vegetable juice market. These retail formats' extensive product selection, alluring in-store promotions, and convenience of use are the main reasons for their dominance. Customers choose supermarkets and hypermarkets because these stores let them purchase everything they need in one visit, while checking product brands, prices, and nutrition labels. These stores dedicate substantial shelf space to health and wellness products like cold-pressed and organic juices because they want to match evolving consumer preferences. The segment maintains its world market supremacy through strategic partnerships that juice manufacturers establish with major retail chains to ensure continuous product availability and market visibility.

The online segment of the fruit and vegetable juice market is expected to grow at the fastest CAGR throughout the forecast period because of increasing internet penetration and smartphone usage, together with convenient home delivery services. The convenience of e-commerce platforms enables customers to view product comparisons while accessing extensive product ranges and exclusive brands that traditional stores lack, thus leading consumers to purchase juices online. Online shopping continues to gain popularity as the COVID-19 pandemic accelerated this trend. Online merchants attract regular customers through their discount programs and subscription services. The growth of online sales receives additional support from juice manufacturers investing in digital marketing, together with their partnerships with meal delivery platforms, thus making this distribution channel a key industry growth factor.

Regional Insights

North America held the largest revenue share of 35.7% and dominated the worldwide fruit and vegetable juice market during 2024. This leadership exists because of consumers who understand health benefits, combined with increased interest in natural and organic drinks and the wide range of available juice products. The region achieves strong market penetration because of its modern retail network, which includes supermarkets and hypermarkets, and a rapidly developing online market. The demand for functional and fortified juices with additional health benefits, such as immune support and digestive health, continues to rise among North American consumers. The advancement of processing technology through high-pressure and cold-pressed processing methods has resulted in better product quality, which drives increasing consumer interest. The government programs that promote healthy eating habits contribute to the market dominance of this region.

Europe Fruit and Vegetable Juice Market Trends

The European market for fruit and vegetable juice experiences significant growth because consumers in this region increasingly prioritize health products and seek natural, organic, and functional beverages. European consumers choose fresh and cold-pressed fruit and vegetable juices because they want nutrient-dense solutions with low sugar content. The market receives its strongest acceptance in Germany, France, and the United Kingdom because of their well-established retail networks and consumer preference for products that have ethical and sustainable sourcing. Manufacturers face pressure to create healthier juice combinations because of government regulations about sugar quantity and product labeling. The market experiences growth because more consumers choose products with clean labels and plant-based diets. The region continues to expand because modern technology enhances juice extraction and preservation methods, which improve product quality and shelf life.

Asia Pacific Fruit and Vegetable Juice Market Trends

The Asia Pacific fruit and vegetable juice market is expected to grow at the fastest CAGR throughout the forecasted period because of urbanization progress and increasing disposable income, together with rising health awareness among consumers. The demand for convenient, wholesome, natural beverage options is growing in China, India, Japan, and Australia. The rising middle class, together with changing lifestyles, leads to a growing requirement for ready-to-drink fruit and vegetable juices. The market expands because consumers want functional and fortified juices that boost their immunity and overall health. The growing investments in e-commerce platforms and modern retail infrastructure enable better product accessibility and availability. Asia Pacific stands as a major worldwide growth market because producers focus on developing innovative flavors together with packaging solutions that meet diverse consumer needs.

Key Fruit And Vegetable Juice Companies:

The following are the leading companies in the fruit & vegetable juice market. These companies collectively hold the largest market share and dictate industry trends.

- The Coca?Cola Company

- The Kraft Heinz Company

- Lakewood Organic Juices

- PepsiCo

- Keurig Dr Pepper Inc.

- Fresh Del Monte

- Ocean Spray

- Bolthouse Farms, Inc.

- Welch's

- Dole Packaged Foods, LLC

- Others

Recent Developments

- In July 2025, in the United States, PIM Brands launched Welch's Juicefuls Fusions. This dual-flavor fruit snack, which comes in Watermelon & Lemon, Green Apple & Peach, and Blueberry & Raspberry varieties, has a chewy fruit outside and a contrasting juicy interior. It was naturally colored, devoid of gluten and peanuts, and fortified with vitamins A, C, and E.

- In December 2024, Ocean Spray Cranberries (USA) and Dyla Brands collaborated to introduce a line of powdered drink mixes with no added sugar. Using actual cranberry juice powder, the portfolio's White Cran × Strawberry, Cran × Grape, and White Cran × Peach varieties provided 100% daily vitamin C in handy on-the-go stick packs.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the fruit & vegetable juice market based on the below-mentioned segments:

Global Fruit & Vegetable Juice Market, By Product

- Fruit Juices

- Fruit & Vegetable Blend

- Vegetable Juices

Global Fruit & Vegetable Juice Market, By Distribution Channel

- Supermarkets/ Hypermarkets

- Convenience Stores

- Online

- Others

Global Fruit & Vegetable Juice Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 230 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |