Global Gas Insulated Transformer Market

Global Gas Insulated Transformer Market Size, Share, and COVID-19 Impact Analysis, By Voltage (Medium Voltage, High Voltage, Extra High Voltage), By Installation (Indoor, Outdoor), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Gas Insulated Transformer Market Summary

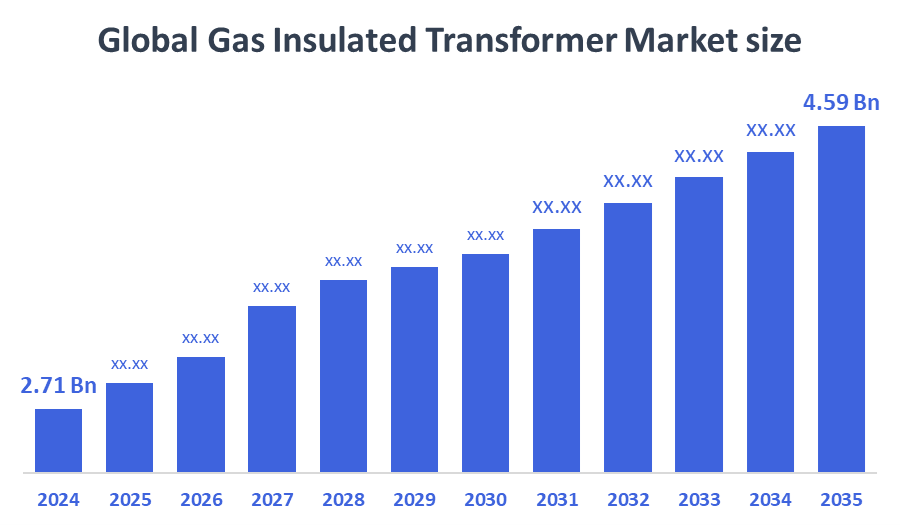

The Global Gas-Insulated Transformer Market Size Was Estimated at USD 2.71 Billion in 2024 and is Projected to Reach USD 4.59 Billion by 2035, Growing at a CAGR of 4.91% from 2025 to 2035. Increased expenditures in renewable energy, substation space limits, improved safety features, the need for low-maintenance, environmentally friendly electrical infrastructure, and the growing demand for compact, dependable power solutions in urban areas are all driving growth in the gas-insulated transformer market.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific region held the largest revenue share of 39.25%, dominating the global industry.

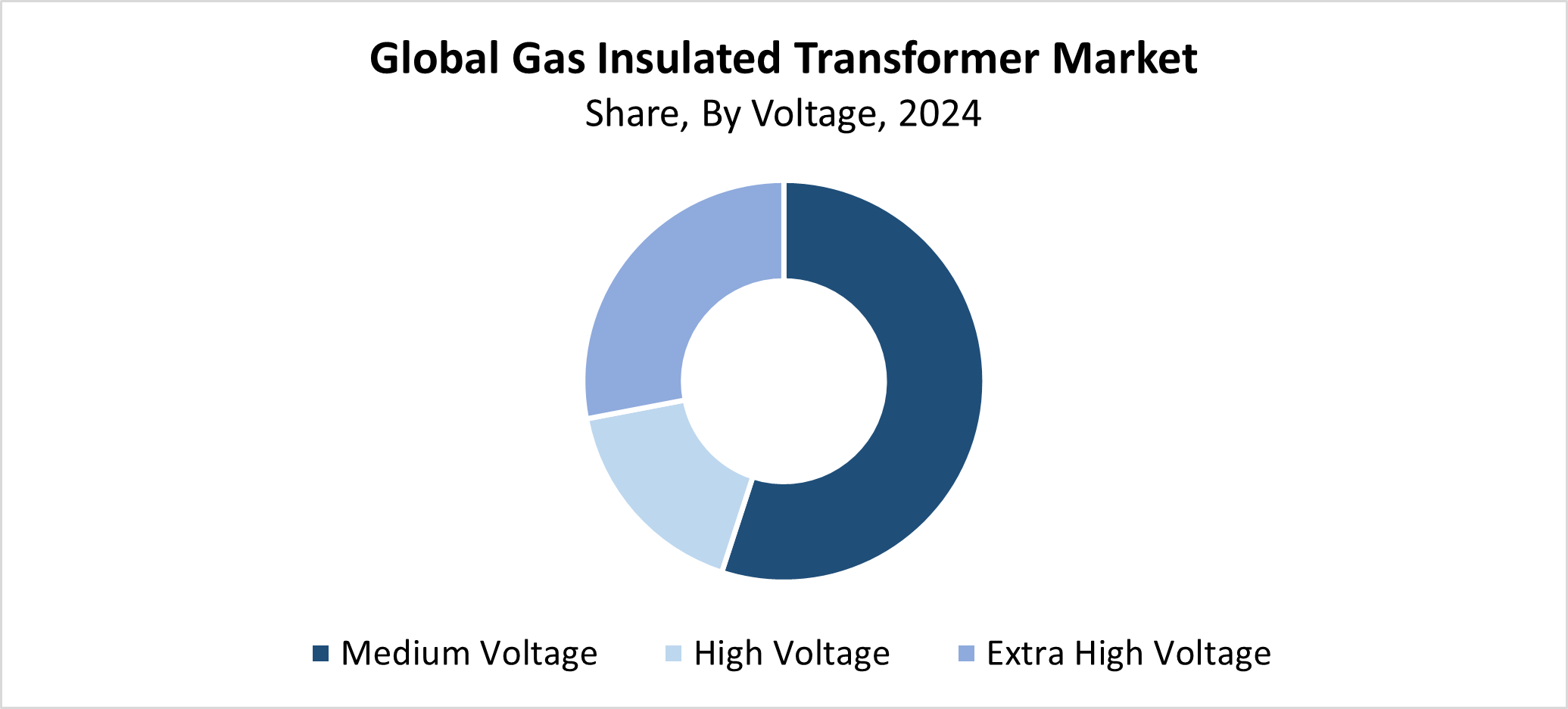

- In 2024, the medium voltage segment had the largest revenue share of 55.3% and led the market by voltage.

- In 2024, the indoor segment held the largest market share and led the market by installation.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 2.71 Billion

- 2035 Projected Market Size: USD 4.59 Billion

- CAGR (2025-2035): 4.91%

- Asia Pacific: Largest market in 2024

Gas-insulated transformers (GITs) market operates with gas insulation and cooling systems which utilize SF? (sulfur hexafluoride) as their standard choice instead of conventional oil. These transformers demonstrate high efficiency together with compact design while providing environmental safety for restricted spaces, so they suit offshore installations and subterranean substations, along with densely populated urban areas. The market growth is primarily driven by increasing energy requirements, along with space-saving technology demands and expanding renewable energy infrastructure investments. The modernization of aging power systems, along with increased urbanization and industrialization, drives the demand for low-maintenance electrical equipment, including gas-insulated transformers. The widespread use of these transformers in critical applications stems from their ability to withstand harsh weather conditions and their lower risk of causing fires.

The latest technological advancements enhance gas-insulated transformers through increased safety features and better performance, together with improved operational efficiency. The development of SF?-free or low-emission insulating gases represents an advancement that tackles greenhouse gas emission problems. Real-time monitoring systems, together with IoT-enabled smart transformer technologies, are gaining widespread adoption in the market. The government pushes utilities and industry to adopt advanced transformer systems through its initiatives to modernize energy infrastructure and maintain reliable grid performance while advancing sustainable power. The GIT market expansion receives its primary support from worldwide grid modernization project financing, together with regulatory frameworks and incentive programs.

Voltage Insights

The medium voltage segment led the gas-insulated transformer market during 2024 with the largest revenue share of 55.3%. The widespread application of medium voltage transformers in utility, commercial, and industrial power distribution systems explains this segment's market dominance. The combination of compact dimensions and high reliability, along with minimal maintenance requirements, makes medium voltage gas-insulated transformers suitable for urban substations and limited space environments. The expanding industrial sectors, together with urban areas experiencing rapid development, require stable power supply systems that drive the growth of this market segment. The leading position of the market continues to strengthen because medium voltage GITs serve as preferred choices for utilities and businesses across the globe due to their ability to handle tough environmental conditions and enhanced safety features.

During the forecast period, the extra high voltage (EHV) segment within gas gas-insulated transformer market is anticipated to grow at the fastest CAGR. Long-distance power transmission demands reliability and efficiency, which drives this growth because national grids need to connect renewable energy sources such as solar and wind. The modern power infrastructure depends on EHV transformers because these units reduce transmission losses while allowing high-capacity electrical transmission. The development of new insulation materials together with compact transformer designs has led to improved performance and safety features for EHV gas-insulated transformers. The implementation of government programs, along with financial investments to update aging transmission systems and expand worldwide power networks, supports EHV transformer adoption, which results in substantial market growth.

Installation Insights

The indoor segment held the largest market share in 2024 and led the gas-insulated transformer market. Urban substations, commercial buildings, and industrial sites with space limitations select indoor gas-insulated transformers because they provide compact dimensions and enhanced safety features. These transformers deliver steady and reliable operation because they shield against environmental elements, which include dust and moisture, as well as severe weather conditions. The rising popularity of indoor installations stems from the increasing urbanization, together with the requirement for underground power distribution networks. The design of indoor transformers enables simpler monitoring and repair operations, and they need less maintenance than other transformer types. The indoor segment continues to dominate the gas-insulated transformer market because densely populated areas require compact and safe electrical infrastructure solutions.

During the forecast period, the outdoor segment of gas-insulated transformers is anticipated to experience substantial growth in the market. The market expansion exists because of growing requirements for transformers that provide reliable service in harsh environmental conditions such as dust exposure, high temperature, and rain. The outdoor gas-insulated transformers suit locations where indoor installation proves difficult, including remote sites, industrial facilities, and renewable energy installations such as wind and solar power farms. The protective coatings and weather-resistant materials used in these transformers have advanced through technological progress, which leads to better durability and functionality. The worldwide growth of the outdoor segment stems from increasing government initiatives and financial support for electricity infrastructure modernization and expansion in both rural and urban territories.

Regional Insights

The North American gas-insulated transformer market represented 19.7% of the worldwide revenue share in 2024 while maintaining its strong market position. The region maintains its strong market position because it dedicates regular investments to modernizing power systems and expanding renewable power projects. Modern cities, along with commercial, industrial, and residential power needs, are pushing demand toward small, reliable, low-maintenance transformers. North America's focus on renewable power sources and smart grids increases the usage of gas-insulated transformers. The strict environmental and safety standards in place push organizations to adopt more efficient transformer technologies that minimize environmental impact. The North American gas-insulated transformer market holds a major portion of the global market share because of its advanced research and development programs and its major manufacturing facilities.

Europe Gas Insulated Transformer Market Trends

The European market for gas-insulated transformers represented a substantial revenue share of the worldwide market in 2024 because of major investments in energy infrastructure renovation and renewable energy integration. Modern transformer solutions, which are compact and environmentally friendly, are receiving increasing popularity throughout European countries because of strict regulations regarding safety and energy efficiency, together with emission standards. The increasing need for space-efficient electrical equipment and urban development initiatives has led to higher demand for gas-insulated transformers within underground and interior substations in the region. Industry development is propelled by government initiatives that focus on modernizing energy grids alongside promoting clean energy systems. Important industry players, together with ongoing technical advances, have helped Europe achieve its leading position in the worldwide gas-insulated transformer market.

Asia Pacific Gas Insulated Transformer Market Trends

The Asia Pacific gas-insulated transformer market held the largest revenue share of 39.25% in 2024 and led the market globally. The region leads because of rapid industrialization and urbanization alongside significant power infrastructure investments in China, India, Japan, and South Korea. Gas-insulated transformers are gaining popularity in the region because they provide compact solutions to handle rising electrical demand while addressing limited space in densely populated urban areas. The market experiences growth because governmental initiatives focus on modernizing power grid systems alongside expanding renewable energy development. The region maintains its leadership position in the global market because of supportive policies, together with growing environmental awareness and major manufacturing and supply operations. Technological advancements, along with increased private-public investment, continue to drive growth.

Key Gas Insulated Transformer Companies:

The following are the leading companies in the gas insulated transformer market. These companies collectively hold the largest market share and dictate industry trends.

- MEIDENSHA CORPORATION

- HYOSUNG HEAVY INDUSTRIES

- Hitachi Energy Ltd.

- ARTECHE

- NISSIN ELECTRIC Co., Ltd.

- TAKAOKA TOKO CO., LTD.

- Toshiba International Corporation

- Fortune Electric Co., Ltd.

- Mitsubishi Electric Corporation

- Siemens Energy

- Transpower Engineering Ltd.

- GE Grid Solutions, LLC

- Others

Recent Developments

- In May 2025, Hitachi Energy unveiled the first SF6-free 550 kV Gas Insulated Switchgear (GIS) in history, which will be delivered to the State Grid Corporation of China's Central China Branch (SGCC). This program is essential to China's ambition to become carbon neutral by 2060 and represents a major step forward in lowering carbon emissions in the electrical grid. By using a sustainable gas combination, the EconiQ GIS removes SF6 emissions without sacrificing the reliable operation and small size of conventional solutions. This suggests a transition toward the use of eco-friendly and sustainable gases within this sector.

- In July 2024, Kansai Transmission and Distribution, Inc. placed an order with Mitsubishi Electric for their recently created 84kV dry air-insulated switchgear. This product is noteworthy because it doesn't include greenhouse gases and substitutes vacuum interrupters and synthetic dry air for sulfur hexafluoride (SF?). Delivery of the equipment is anticipated by March 2026. The introduction of SF?-free switchgear by Mitsubishi Electric represents a significant shift in the GIT market toward greener alternatives. The business's innovation positions it as a pioneer in this change, which may influence industry norms and inspire other producers to develop similar technologies. This action is in line with the general market trend of incorporating sustainable practices, which is expected to drive innovation and growth in the GIT industry.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the gas-insulated transformer market based on the below-mentioned segments:

Global Gas Insulated Transformer Market, By Voltage

- Medium Voltage

- High Voltage

- Extra High Voltage

Global Gas Insulated Transformer Market, By Installation

- Indoor

- Outdoor

Global Gas Insulated Transformer Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |