Global Gas Processing Market

Global Gas Processing Market Size, Share, and COVID-19 Impact Analysis, By Type (Dry Gas, Natural Gas Liquid (NGL), and Others), By Application (Acid Gas Removal, Dehydration, and Others), By Industry Vertical (Metallurgy, Healthcare, Chemical, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Global Gas Processing Market Size Insights Forecasts to 2035

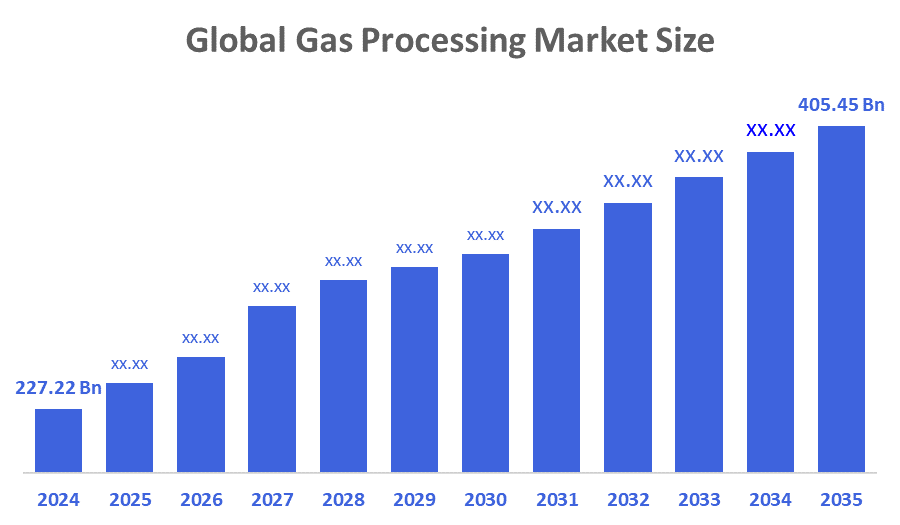

- The Global Gas Processing Market Size Was Estimated at USD 227.22 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.38% from 2025 to 2035

- The Worldwide Gas Processing Market Size is Expected to Reach USD 405.45 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global Gas Processing Market Size is expected to Grow from USD 227.22 Billion in 2024 to USD 405.45 Billion by 2035, at a CAGR of 5.38% during the forecast period 2025-2035. The growing investments in oil and gas upstream operations are driving an increase in natural gas output, which is expected to propel the expansion of the worldwide gas processing market throughout the forecast period. New technologies are driving the growth of the global gas processing market by lowering the cost of gas processing activities.

Market Overview

The global gas processing market refers to the industry that converts raw gas extracted from oil and gas wells into usable products by separating hydrocarbons and removing impurities such as water, carbon dioxide, hydrogen sulfide, and other contaminants. Gas processing treatment is a process that uses cleaning agents to remove undesirable gases from freshwater, natural gas, and the air in order to improve gas quality and prevent pollution. This technique is very effective in clearing the fuel system of hazardous carbon and varnish accumulation. Gas processing is a collection of industrial processes that produce pipeline-quality dry natural gas by removing contaminants, impurities, and higher molecular mass hydrocarbons from raw natural gas. Gas is first processed at the wellhead. The composition of raw natural gas extracted from producing wells depends on the kind, depth, and location of the subsurface deposit as well as the local geology. Oil and natural gas are often found in the same reservoir.

In December 2025, Ghana is fast-tracking its energy independence by launching a new gas processing plant (GPP II), which will expand domestic gas processing capacity, reduce reliance on imported liquid fuels, and strengthen the country’s energy security. Jinapor cited 6 billion (US$527 million) in payments made under the Cash Waterfall Mechanism (CWM) in 2024 as evidence that capital flows automatically when there is efficiency and improvement.

In December 2025, Uniper and Vermilion extended their gas supply partnership in Germany with a new two-year agreement. Vermilion will sell all of its German natural gas production to Uniper, reinforcing energy security and portfolio diversification.

Report Coverage

This research report categorises the gas processing market based on various segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the gas processing market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the gas processing market.

Driving Factors

The market is being driven by a rising demand for natural gas. Natural gas is in great demand because of its plentiful supply, versatility, and environmentally friendly combustion. The rise in natural gas utilisation within the transportation industry has led to a surge in global natural gas consumption. Moreover, to enhance the technical and financial viability of gas processing operations, many cutting-edge technologies which boost the market growth. These innovative technologies aim to minimise energy consumption, leading to considerable cost savings for gas processing firms. Gas treatment methods, utilised in gas processing plants and refineries to remove acid gases such as hydrogen sulfide and carbon dioxide, are also applied in various conventional scenarios, which creates new market opportunities. In recent times, several companies have launched advanced gas treatment technologies that enable swift processing and boost market expansion.

In June 2025, ADNOC Gas announced that it had taken the Final Investment Decision (FID) and awarded $5 billion in contracts for the first phase of its Rich Gas Development (RGD) Project, marking the largest capital investment in the company’s history.

Restraining Factors

The market for gas processing is restrained by a number of problems, chief among them being high capital costs, regulatory obstacles, and environmental concerns. Despite growing demand for natural gas worldwide, the use of alternative energy sources, issues with gas processing operations, and fluctuations in oil and gas prices are all expected to hinder the growth of the market.

Market Segmentation

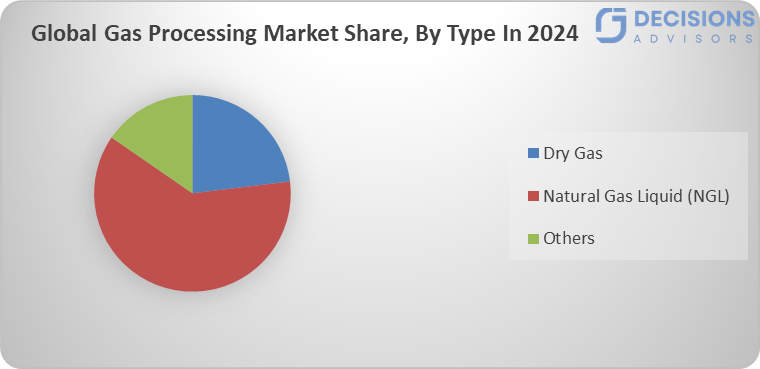

The gas processing market share is classified into type, application, and industry vertical.

- The natural gas liquid (NGL) segment accounted for the largest share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

Based on the type, the gas processing market is segmented into dry gas, natural gas liquid (NGL), and others. Among these, the natural gas liquid (NGL) segment accounted for the largest share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This is due to the quick rise in natural gas production, growing NGL adoption programs, and growing natural gas demand. The technique of pressure-assisted stripping (PAS) advances. The usage of natural gas is growing because it emits fewer greenhouse gases when burned than other fossil fuels. Consequently, as natural gas output rises due to increased investments and upstream oil and gas operations, there is a greater need for gas processing, which is fueling the market's growth.

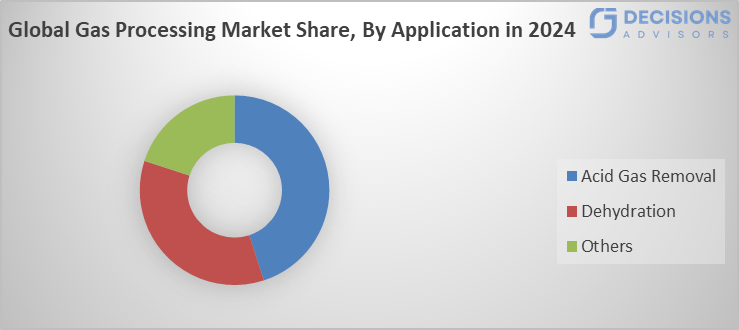

- The acid gas removal segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR over the forecast period.

Based on the application, the gas processing market is differentiated into acid gas removal, dehydration, and others. Among these, the acid gas removal segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR over the forecast period. This is due to the growing demand for natural gas as a greener energy source and the various businesses' improved adherence to environmental rules. The process of removing carbon dioxide (CO2) and hydrogen sulfide (H2S) from vapour streams is known as acid gas removal. A crucial part of Integrated Gasification Combined Cycle (IGCC) power plants is acid gas removal (AGR) units for eliminating acid gases like carbon dioxide and hydrogen sulfide. Most gas processing facilities have an acid gas removal stage.

- The chemical segment accounted for a significant share in 2024 and is anticipated to grow at a rapid pace during the forecast period.

Based on the industry vertical, the gas processing market is classified into metallurgy, healthcare, chemical, and others. Among these, the chemical segment accounted for a significant share in 2024 and is anticipated to grow at a rapid pace during the forecast period. Ethane, propane, and butane are examples of natural gas liquids (NGLs) that are essential feedstocks for petrochemicals.

Most processed gas is used by the chemical industry to make plastics, fertilisers, solvents, and other industrial chemicals.

Regional Segment Analysis of the Gas Processing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the gas processing market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the gas processing market over the predicted timeframe. This is due to the expanding use of natural gas and its increased acceptance in transportation, petrochemicals, power plants, fertiliser plants, and other sectors, particularly in developing countries like China and India. Additionally, the gas processing industry's activities will become more technically and financially viable as a result of the development of various novel processes. By reducing energy usage, these methods will help the gas processing sector minimise expenses and achieve significant cost reductions.

Tokyo Gas announced that it will direct more than half of its overseas investments to the United States over the next three years, according to CEO Shinichi Sasayama (December 2025).

India’s Petroleum Ministry declared at the Energy Technology Meet in Hyderabad that India is poised to become a global refining and energy hub, with ambitious plans to expand refining capacity and integrate clean energy initiatives.

North America is expected to grow at a rapid CAGR in the gas processing market during the forecast period. This is because of the growing need for natural gas in this region's countries, particularly in the United States and Canada. In 2021, the US consumed around 30.66 trillion cubic feet (Tcf) of natural gas, or 31.73 quadrillion British thermal units (quads), or 32% of the nation's total energy consumption. In addition to producing electricity, natural gas is utilised in the electric power industry to generate valuable thermal output. In 2021, electricity generation accounted for about 37% of the natural gas used in the US.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the gas processing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BP

- Chevron

- China National Petroleum

- ConocoPhillips

- Eni

- Exxon Mobil

- Gazprom

- PetroChina Company Limited

- PJSC Gazprom

- Public Joint Stock Company Gazprom

- Royal Dutch Shell

- Saudi Arabian Oil Co.

- Statoil

- Total

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2025, Baker Hughes and Hunt Oil Company announced a joint framework agreement to redevelop mature oil and gas fields worldwide, combining Baker Hughes’ technology expertise with Hunt’s upstream operational experience. This partnership is indicative of a larger trend in the industry: redeveloping mature assets is turning into a key component of international energy strategy.

- In November 2025, Eni, through its joint venture Azule Energy (with bp), inaugurated the New Gas Consortium (NGC) gas treatment plant in Soyo, northern Angola. This marks Angola’s first non-associated gas development, a milestone for the country’s energy diversification.

- In August 2025, Enterprise Products Partners L.P. announced that it will acquire Occidental’s natural gas gathering affiliate in the Midland Basin for $580 million, while also entering into a long-term natural gas processing agreement and unveiling plans for a new Midland Basin gas processing plant.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the gas processing market based on the below-mentioned segments:

Global Gas Processing Market, By Type

- Dry Gas

- Natural Gas Liquid (NGL)

- Others

Global Gas Processing Market, By Application

- Acid Gas Removal

- Dehydration

- Others

Global Gas Processing Market, By Industry Vertical

- Metallurgy

- Healthcare

- Chemical

- Others

Global Gas Processing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the projected size and growth rate of the global gas processing market?

The market was valued at USD 227.22 billion in 2024 and is expected to reach USD 405.45 billion by 2035, growing at a CAGR of 5.38% from 2025 to 2035.

- What drives the growth of the global gas processing market?

Rising demand for natural gas due to its abundant supply, versatility, and lower emissions fuels growth. Investments in upstream oil and gas operations boost natural gas production, while new technologies reduce processing costs and improve efficiency.

- What are the main restraining factors for the market?

High capital costs, regulatory hurdles, environmental concerns, competition from alternative energy sources, operational challenges, and oil/gas price volatility hinder expansion.

- Which application segment leads the market?

Acid gas removal held the highest revenue share in 2024 and is projected to grow at a significant CAGR, driven by demand for cleaner natural gas and stricter environmental regulations.

- What industry vertical dominates and why?

The chemical segment held a significant share in 2024 and is set for rapid growth. Natural gas liquids (NGLs) like ethane, propane, and butane serve as key feedstocks for petrochemicals, plastics, fertilisers, and other chemicals.

- Which region holds the largest market share?

Asia-Pacific is expected to dominate due to rising natural gas use in transportation, petrochemicals, power, and fertilisers in countries like China and India, supported by innovative, cost-reducing technologies.

- Which region is expected to grow the fastest?

North America, led by high natural gas demand in the US and Canada for power generation and other uses (e.g., the US consumed 30.66 Tcf in 2021, with 37% for electricity).

- Who are the key players in the gas processing market?

Major companies include BP, Chevron, China National Petroleum, ConocoPhillips, Eni, Exxon Mobil, Gazprom, PetroChina, Royal Dutch Shell, Saudi Arabian Oil Co., Statoil, Total, and others.

- What are some recent developments in the market?

December 2025: Ghana launches GPP II plant for energy independence; Uniper-Vermilion extend German gas deal.

- What does the gas processing market overview entail?

It involves converting raw natural gas from wells into pipeline-quality dry gas by removing impurities like water, CO2, H2S, and heavy hydrocarbons. Processing starts at the wellhead and varies by reservoir geology.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Type

- Market Attractiveness Analysis By Application

- Market Attractiveness Analysis By Industry Vertical

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Growing investment and high demand for natural gas

- Restraints

- Initial costs, regulatory obstacles, and environmental concerns

- Opportunities

- Expand technical and financial stability

- Challenges

- High utilisation of the alternative process

- Global Gas Processing Market Analysis and Projection, By Type

- Segment Overview

- Dry Gas

- Natural Gas Liquid (NGL)

- Others

- Global Gas Processing Market Analysis and Projection, By Application

- Segment Overview

- Acid Gas Removal

- Dehydration

- Others

- Global Gas Processing Market Analysis and Projection, By Industry Vertical

- Segment Overview

- Metallurgy

- Healthcare

- Chemical

- Others

- Global Gas Processing Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Gas Processing Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Gas Processing Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Coverage Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- BP

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Chevron

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- China National Petroleum

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- ConocoPhillips

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Eni

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Exxon Mobil

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Gazprom

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- PetroChina Company Limited

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- PJSC Gazprom

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Public Joint Stock Company Gazprom

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Royal Dutch Shell

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Saudi Arabian Oil Co.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Statoil

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Total

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Others

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- BP

List of Table

- Global Gas Processing Market, By Type, 2024-2035(USD Billion)

- Global Dry Gas, Gas Processing Market, By Region, 2024-2035(USD Billion)

- Global Natural Gas Liquid (NGL), Gas Processing Market, By Region, 2024-2035(USD Billion)

- Global Others, Gas Processing Market, By Region, 2024-2035(USD Billion)

- Global Gas Processing Market, By Application, 2024-2035(USD Billion)

- Global Acid Gas Removal, Gas Processing Market, By Region, 2024-2035(USD Billion)

- Global Dehydration, Gas Processing Market, By Region, 2024-2035(USD Billion)

- Global Others, Gas Processing Market, By Region, 2024-2035(USD Billion)

- Global Gas Processing Market, By Industry Vertical, 2024-2035(USD Billion)

- Global Metallurgy, Gas Processing Market, By Region, 2024-2035(USD Billion)

- Global Healthcare, Gas Processing Market, By Region, 2024-2035(USD Billion)

- Global Chemical, Gas Processing Market, By Region, 2024-2035(USD Billion)

- Global Others, Gas Processing Market, By Region, 2024-2035(USD Billion)

- North America Gas Processing Market, By Type, 2024-2035(USD Billion)

- North America Gas Processing Market, By Application, 2024-2035(USD Billion)

- North America Gas Processing Market, By Industry Vertical, 2024-2035(USD Billion)

- U.S. Gas Processing Market, By Type, 2024-2035(USD Billion)

- U.S. Gas Processing Market, By Application, 2024-2035(USD Billion)

- U.S. Gas Processing Market, By Industry Vertical, 2024-2035(USD Billion)

- Canada Gas Processing Market, By Type, 2024-2035(USD Billion)

- Canada Gas Processing Market, By Application, 2024-2035(USD Billion)

- Canada Gas Processing Market, By Industry Vertical, 2024-2035(USD Billion)

- Mexico Gas Processing Market, By Type, 2024-2035(USD Billion)

- Mexico Gas Processing Market, By Application, 2024-2035(USD Billion)

- Mexico Gas Processing Market, By Industry Vertical, 2024-2035(USD Billion)

- Europe Gas Processing Market, By Type, 2024-2035(USD Billion)

- Europe Gas Processing Market, By Application, 2024-2035(USD Billion)

- Europe Gas Processing Market, By Industry Vertical, 2024-2035(USD Billion)

- Germany Gas Processing Market, By Type, 2024-2035(USD Billion)

- Germany Gas Processing Market, By Application, 2024-2035(USD Billion)

- Germany Gas Processing Market, By Industry Vertical, 2024-2035(USD Billion)

- France Gas Processing Market, By Type, 2024-2035(USD Billion)

- France Gas Processing Market, By Application, 2024-2035(USD Billion)

- France Gas Processing Market, By Industry Vertical, 2024-2035(USD Billion)

- U.K. Gas Processing Market, By Type, 2024-2035(USD Billion)

- U.K. Gas Processing Market, By Application, 2024-2035(USD Billion)

- U.K. Gas Processing Market, By Industry Vertical, 2024-2035(USD Billion)

- Italy Gas Processing Market, By Type, 2024-2035(USD Billion)

- Italy Gas Processing Market, By Application, 2024-2035(USD Billion)

- Italy Gas Processing Market, By Industry Vertical, 2024-2035(USD Billion)

- Spain Gas Processing Market, By Type, 2024-2035(USD Billion)

- Spain Gas Processing Market, By Application, 2024-2035(USD Billion)

- Spain Gas Processing Market, By Industry Vertical, 2024-2035(USD Billion)

- Asia Pacific Gas Processing Market, By Type, 2024-2035(USD Billion)

- Asia Pacific Gas Processing Market, By Application, 2024-2035(USD Billion)

- Asia Pacific Gas Processing Market, By Industry Vertical, 2024-2035(USD Billion)

- Japan Gas Processing Market, By Type, 2024-2035(USD Billion)

- Japan Gas Processing Market, By Application, 2024-2035(USD Billion)

- Japan Gas Processing Market, By Industry Vertical, 2024-2035(USD Billion)

- China Gas Processing Market, By Type, 2024-2035(USD Billion)

- China Gas Processing Market, By Application, 2024-2035(USD Billion)

- China Gas Processing Market, By Industry Vertical, 2024-2035(USD Billion)

- India Gas Processing Market, By Type, 2024-2035(USD Billion)

- India Gas Processing Market, By Application, 2024-2035(USD Billion)

- India Gas Processing Market, By Industry Vertical, 2024-2035(USD Billion)

- South America Gas Processing Market, By Type, 2024-2035(USD Billion)

- South America Gas Processing Market, By Application, 2024-2035(USD Billion)

- South America Gas Processing Market, By Industry Vertical, 2024-2035(USD Billion)

- Brazil Gas Processing Market, By Type, 2024-2035(USD Billion)

- Brazil Gas Processing Market, By Application, 2024-2035(USD Billion)

- Brazil Gas Processing Market, By Industry Vertical, 2024-2035(USD Billion)

- The Middle East and Africa Gas Processing Market, By Type, 2024-2035(USD Billion)

- The Middle East and Africa Gas Processing Market, By Application, 2024-2035(USD Billion)

- The Middle East and Africa Gas Processing Market, By Industry Vertical, 2024-2035(USD Billion)

- UAE Gas Processing Market, By Type, 2024-2035(USD Billion)

- UAE Gas Processing Market, By Application, 2024-2035(USD Billion)

- UAE Gas Processing Market, By Industry Vertical, 2024-2035(USD Billion)

- South Africa Gas Processing Market, By Type, 2024-2035(USD Billion)

- South Africa Gas Processing Market, By Application, 2024-2035(USD Billion)

- South Africa Gas Processing Market, By Industry Vertical, 2024-2035(USD Billion)

List of Figures

- Global Gas Processing Market Segmentation

- Gas Processing Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top investment pocket in the Gas Processing Market

- Top Winning Strategies, 2024-2035

- Top Winning Strategies, By Development, 2024-2035(%)

- Top Winning Strategies, By Company, 2024-2035

- Moderate Bargaining power of Buyers

- Moderate Bargaining power of Suppliers

- Moderate Bargaining power of New Entrants

- Low threat of Substitution

- High Competitive Rivalry

- Top Player Positioning, 2024

- Market Share Analysis, 2024

- Restraint and Drivers: Gas Processing Market

- Gas Processing Market Segmentation, By Type

- Gas Processing Market For Dry Gas, By Region, 2024-2035 ($ Billion)

- Gas Processing Market For Natural Gas Liquid (NGL), By Region, 2024-2035 ($ Billion)

- Gas Processing Market For Others, By Region, 2024-2035 ($ Billion)

- Gas Processing Market Segmentation, By Application

- Gas Processing Market For Acid Gas Removal, By Region, 2024-2035 ($ Billion)

- Gas Processing Market For Dehydration, By Region, 2024-2035 ($ Billion)

- Gas Processing Market For Others, By Region, 2024-2035 ($ Billion)

- Gas Processing Market Segmentation, By Industry Vertical

- Gas Processing Market For Metallurgy, By Region, 2024-2035 ($ Billion)

- Gas Processing Market For Healthcare, By Region, 2024-2035 ($ Billion)

- Gas Processing Market For Chemical, By Region, 2024-2035 ($ Billion)

- Gas Processing Market For Others, By Region, 2024-2035 ($ Billion)

- BP: Net Sales, 2024-2035 ($ Billion)

- BP: Revenue Share, By Segment, 2024 (%)

- BP: Revenue Share, By Region, 2024 (%)

- Chevron: Net Sales, 2024-2035 ($ Billion)

- Chevron: Revenue Share, By Segment, 2024 (%)

- Chevron: Revenue Share, By Region, 2024 (%)

- China National Petroleum: Net Sales, 2024-2035 ($ Billion)

- China National Petroleum: Revenue Share, By Segment, 2024 (%)

- China National Petroleum: Revenue Share, By Region, 2024 (%)

- ConocoPhillips: Net Sales, 2024-2035 ($ Billion)

- ConocoPhillips: Revenue Share, By Segment, 2024 (%)

- ConocoPhillips: Revenue Share, By Region, 2024 (%)

- Eni: Net Sales, 2024-2035 ($ Billion)

- Eni: Revenue Share, By Segment, 2024 (%)

- Eni: Revenue Share, By Region, 2024 (%)

- Exxon Mobil: Net Sales, 2024-2035 ($ Billion)

- Exxon Mobil: Revenue Share, By Segment, 2024 (%)

- Exxon Mobil: Revenue Share, By Region, 2024 (%)

- Gazprom: Net Sales, 2024-2035 ($ Billion)

- Gazprom: Revenue Share, By Segment, 2024 (%)

- Gazprom: Revenue Share, By Region, 2024 (%)

- PetroChina Company Limited: Net Sales, 2024-2035 ($ Billion)

- PetroChina Company Limited: Revenue Share, By Segment, 2024 (%)

- PetroChina Company Limited: Revenue Share, By Region, 2024 (%)

- PJSC Gazprom.: Net Sales, 2024-2035 ($ Billion)

- PJSC Gazprom.: Revenue Share, By Segment, 2024 (%)

- PJSC Gazprom.: Revenue Share, By Region, 2024 (%)

- Public Joint Stock Company Gazprom: Net Sales, 2024-2035 ($ Billion)

- Public Joint Stock Company Gazprom: Revenue Share, By Segment, 2024 (%)

- Public Joint Stock Company Gazprom: Revenue Share, By Region, 2024 (%)

- Royal Dutch Shell: Net Sales, 2024-2035 ($ Billion)

- Royal Dutch Shell: Revenue Share, By Segment, 2024 (%)

- Royal Dutch Shell: Revenue Share, By Region, 2024 (%)

- Saudi Arabian Oil Co.: Net Sales, 2024-2035 ($ Billion)

- Saudi Arabian Oil Co.: Revenue Share, By Segment, 2024 (%)

- Saudi Arabian Oil Co.: Revenue Share, By Region, 2024 (%)

- Statoil: Net Sales, 2024-2035 ($ Billion)

- Statoil: Revenue Share, By Segment, 2024 (%)

- Statoil: Revenue Share, By Region, 2024 (%)

- Total: Net Sales, 2024-2035 ($ Billion)

- Total: Revenue Share, By Segment, 2024 (%)

- Total: Revenue Share, By Region, 2024 (%)

- Others: Net Sales, 2024-2035 ($ Billion)

- Others: Revenue Share, By Segment, 2024 (%)

- Others: Revenue Share, By Region, 2024 (%)

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 182 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |