Global Gas Turbine Market

Global Gas Turbine Market Size, Share, and COVID-19 Impact Analysis, By Capacity (<=200 MW, >200 MW), By Technology (Combined Cycle, Open Cycle), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Gas Turbine Market Summary

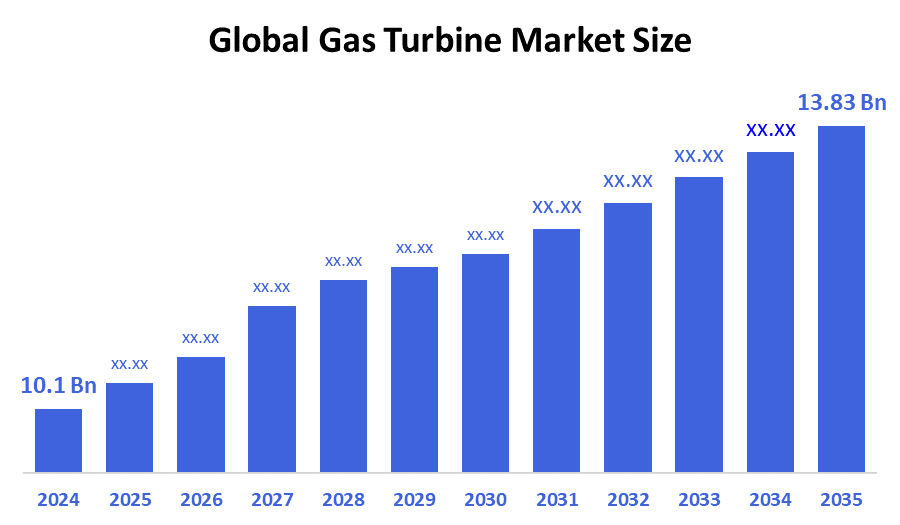

The Global Gas Turbine Market Size Was Estimated at USD 10.1 Billion in 2024 and is Projected to Reach USD 13.83 Billion by 2035, Growing at a CAGR of 2.9% from 2025 to 2035. The market for gas turbines is expanding as a result of rising global energy demand brought on by urbanization and industrialization, as well as the switch from coal to cleaner, more efficient natural gas power generation, particularly with the popularity of combined cycle plants.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific held the largest revenue share of over 21.5% and dominated the market globally.

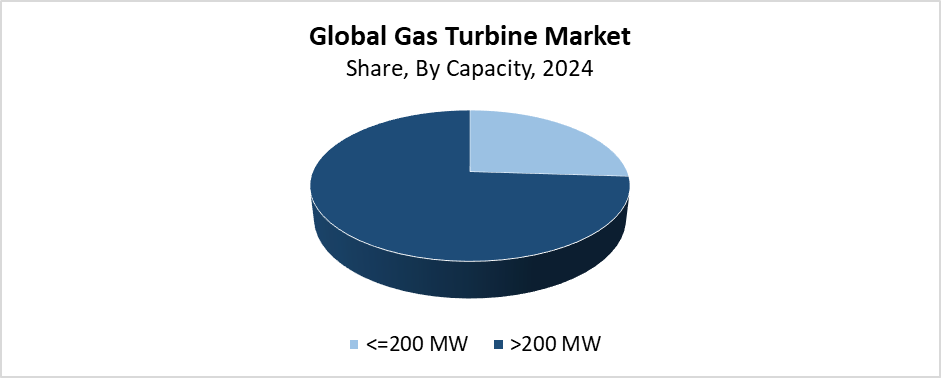

- In 2024, the >200 MW segment had the highest market share by capacity, accounting for 74.52%.

- In 2024, the combined cycle segment had the biggest market share by technology, accounting for 86.24%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 10.1 Billion

- 2035 Projected Market Size: USD 13.83 Billion

- CAGR (2025-2035): 2.9%

- Asia Pacific: Largest market in 2024

The worldwide gas turbine market includes the manufacturing process, distribution network, and usage of power generation devices that convert natural gas and other fuels into mechanical power and electrical energy. The oil and gas sector, together with power plants, aviation, and industrial operations, extensively uses gas turbines because they deliver high efficiency, reliable operation, and fast startup capabilities. The worldwide expansion of the market results mainly from increasing investments in power infrastructure and higher energy needs, as well as the move toward cleaner energy sources. The market growth depends heavily on the rising demand for flexible power solutions in developing countries, together with urbanization and industrial expansion. The use of gas turbines becomes more popular through their capability to link with renewable power systems as well as their functionality to stabilize electrical grids.

Current technological advancements have a major impact on the gas turbine market dynamics. Digital monitoring systems and ceramic composite materials, along with high-efficiency combined cycle gas turbines (CCGT), enable performance advancements and emission reductions. Governments from all over the world encourage the use of cleaner energy technology through their implementation of incentives, rules and research and development funding. The implementation of decarbonization and energy transition support programs has led to the deployment of advanced gas turbines, which fulfill environmental targets while enhancing overall energy efficiency, particularly in industrialized areas.

Capacity Insights

The >200 MW capacity segment held the largest revenue share of 74.52% in 2024 while leading the gas turbine market. High-capacity gas turbines dominate the market primarily because industries use them extensively in large power plants and industrial applications that need continuous and substantial energy output. These turbines deliver the best solution for the global demand of clean, reliable power because they provide superior efficiency alongside fuel versatility and reduced emissions compared to smaller units. The ability of >200 MW turbines to connect with combined cycle systems enables power providers to favor these models for their enhanced total plant efficiency. Large investments in major power infrastructure projects across developing nations continue to drive demand for high-capacity gas turbines, which maintains this segment's dominant position in the market.

Throughout the forecast period, the ≤200 MW capacity segment of the gas turbine market is anticipated to grow at the fastest CAGR. The demand for small-scale power production solutions, along with flexibility and effectiveness in commercial buildings and industrial settings, and decentralized energy systems, drives this market expansion. The market experiences growth because microgrids and combined heat and power (CHP) systems require gas turbines with capacities equal to or less than 200 MW. The benefits of these turbines include straightforward installation and reduced initial costs, together with fuel adaptability, which makes them suitable for emerging markets and regions with growing energy demands yet deficient infrastructure. The worldwide expansion of this market segment receives additional momentum from governmental encouragement of distributed generation along with sustainable energy initiatives.

Technology Insights

The combined cycle segment dominated the gas turbine market with the largest revenue share of 86.24% in 2024. The power generation optimization capability of combined cycle gas turbines through their gas and steam turbine combination (CCGT) delivers high efficiency and low emission benefits, which makes them dominant in the market. Power facilities that aim to achieve maximum fuel usage efficiency alongside environmental compliance standards choose combined cycle technology. Utilities alongside industrial organizations select CCGT systems because they deliver reliable, large-scale power production alongside improved thermal efficiency. The worldwide demand for cleaner and more efficient energy solutions has established combined cycle gas turbines as the leading segment in the market.

During the forecast period, the Open Cycle segment of the Gas Turbine market is anticipated to grow at the fastest CAGR. The demand for flexible, quick-start power production solutions, primarily in peaking power plants and emergency backup systems, drives this market expansion. Open cycle gas turbines (OCGT) offer advantages over combined cycle systems through their straightforward design, along with lower initial costs and faster startup procedures. The particular attributes of these turbines make them an excellent solution for handling unpredictable energy input from solar and wind sources. Open-cycle turbine adoption benefits from the increasing financial support directed toward remote power generation facilities as well as distributed power systems. The open cycle section will transform as the energy sector advances toward adaptable and responsive grid operations.

Regional Insights

The Asia Pacific Gas Turbine market led the global market by generating the largest revenue share of 36.32% in 2024. The main factors behind this market dominance include fast urban development alongside industrial growth, coupled with increasing power requirements in China, India, Japan, and South Korea. The region's expanding power generation facilities, along with investments in both traditional and renewable energy systems, have pushed gas turbine adoption to new heights. The adoption of cleaner and more efficient gas turbine technology receives support from government initiatives that modernize energy grid systems while reducing carbon emissions. The world-leading position of Asia Pacific as a gas turbine market remains supported by rising industrial demand from manufacturing, transportation, and oil and gas sectors.

North America Gas Turbine Market Trends

The North American gas turbine sector experiences significant growth because the US and Canada demand trustworthy power generation solutions. Modern power infrastructure updates and environmentally friendly energy technology integration have driven the rising popularity of advanced gas turbine systems across this region. The growing interest in carbon emission reduction across North America has driven the rising adoption of High-efficiency combined cycle gas turbines (CCGT) and low-emission technology. The growing industrial base and expanding urban areas, together with the oil and gas industry, create multiple demands for gas turbines across various sectors. The industry experiences growth because government programs and rules push clean energy solutions, while digital monitoring and predictive maintenance technologies advance.

Europe Gas Turbine Market Trends

The gas turbine market in Europe continues to grow steadily because the continent focuses strongly on reducing carbon emissions and shifting toward renewable energy. Advanced combined cycle gas turbines (CCGT), along with low-emission technologies, gain traction because power generation needs adaptability and effectiveness to support renewable energy integration. European countries direct major funds toward upgrading their power infrastructure and expanding natural gas capacity because it serves as a cleaner alternative to coal power. Environmental regulations and government programs that promote clean energy options serve as the main drivers for the fast adoption of high-efficiency gas turbines. Rising industrial activities, together with the need for reliable backup power systems during renewable energy fluctuations, drive market growth. The European gas turbine market experiences constant growth because of ongoing advancements in digital technology and turbine performance optimization.

Key Gas Turbine Companies:

The following are the leading companies in the gas turbine market. These companies collectively hold the largest market share and dictate industry trends.

- Ansaldo Energia

- Siemens Energy

- Kawasaki Heavy Industries, Ltd.

- Bharat Heavy Electricals Ltd. (BHEL)

- Mitsubishi Power, Ltd.

- General Electric (GE)

- MAN Energy Solutions

- Centrax Gas Turbines

- OPRA Turbines

- Solar Turbines Inc.

- Others

Recent Developments

- In February 2025, Siemens Energy declared that its gas turbine production facilities in Houston, Texas, would be expanded. Advanced, high-efficiency gas turbines designed for combined cycle and peaking power applications will be produced more frequently at the new site. As utilities shift to greener energy mixes, this calculated action helps meet the growing need for flexible and low-emission power generation alternatives. Additionally, it is anticipated that the development will boost domestic manufacturing capabilities in the gas turbine industry in the United States and generate about 400 skilled jobs.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the gas turbine market based on the below-mentioned segments:

Global Gas Turbine Market, By Capacity

- <=200 MW

- >200 MW

Global Gas Turbine Market, By Technology

- Combined Cycle

- Open Cycle

Global Gas Turbine Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |