Global Gastrointestinal Diagnostics Market

Global Gastrointestinal Diagnostics Market Size, Share, and COVID-19 Impact Analysis, By Test Type (Endoscopy, Blood Test, H. Pylori Test, Calprotectin Test, Immunoglobulin A Test, and Others), By Technology (ELISA, PCR, Microbiology, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Global Gastrointestinal Diagnostics Market Size Insights Forecasts to 2035

- The Global Gastrointestinal Diagnostics Market Size Was Estimated at USD 5.15 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.35% from 2025 to 2035

- The Worldwide Gastrointestinal Diagnostics Market Size is Expected to Reach USD 8.23 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global Gastrointestinal Diagnostics Market Size was worth around USD 5.15 Billion in 2024 and is predicted to Grow to around USD 8.23 Billion by 2035 with a compound annual growth rate (CAGR) of 4.35% from 2025 to 2035. The continued development of diagnostic technologies, the rising incidence of gastrointestinal illnesses, the increasing use of non-invasive diagnostic methods, and rising healthcare costs are all contributing factors to the market's strong expansion. The market has been influenced by factors such as the rising frequency of stomach infections and malignancies, as well as the growing demand for point-of-care (POC) diagnostics for gastrointestinal ailments.

Market Overview

The worldwide market for technology, tests, and services used to identify, track, and treat gastrointestinal conditions, such as infections, malignancies, inflammatory bowel disease (IBD), and gastroesophageal reflux disease (GERD), is known as the gastrointestinal (GI) diagnostics market. Endoscopy, blood, stool, imaging, and molecular diagnostics are all included. The range of medical treatments, tests, and methods used to identify and assess conditions and illnesses affecting the gastrointestinal (GI) tract, which includes the stomach, intestines, oesophagus, liver, gallbladder, and pancreas. Additionally, the speed, sensitivity, and accuracy of GI diagnostic tests have significantly increased because of advancements in diagnostic technologies. Endoscopic ultrasound (EUS), capsule endoscopy, virtual colonoscopy, and molecular diagnostics are examples of innovations that have improved patient outcomes by enabling physicians to identify and diagnose GI disorders at an earlier stage.

Recently, Geneoscopy received $105 million in Series C funding to improve gastrointestinal diagnostics, especially for tests for inflammatory bowel disease and colorectal cancer. The promotion of Bio-Rad Laboratories' FDA-approved ColoSense stool-based screening test is aided by this funding.

EQT Life Sciences has led a USD 44 million Series B financing round in Cyted Health, a gastrointestinal (GI) molecular diagnostics company, to accelerate its expansion into the United States. The round was co-led by Advent Life Sciences and the British Business Bank, with continued support from Morningside and BGF, and includes a strategic partnership with HCA Healthcare.

Report Coverage

This research report categorises the gastrointestinal diagnostics market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the gastrointestinal diagnostics market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the gastrointestinal diagnostics market.

Driving Factors

The GI diagnostics market is experiencing an array of significant trends that are influencing its growth and development. This includes the ongoing advancements in diagnostic technologies, the increasing demand for non-invasive diagnostic approaches, and the growing emphasis on early detection and screening programs. Moreover, the surging demand for integrated artificial intelligence in healthcare and machine learning, among other factors that is driving the industry growth. Non-invasive tests, such as stool-based tests for colorectal cancer diagnostics, breath tests for Helicobacter pylori infection, and serum biomarker assays for various GI disorders. Some GI problems, such as IBS and colorectal cancer, are influenced by genetic factors. Research indicates that inherited gene mutations and gene-gene interactions are frequently associated with specific GI malignancies and illnesses. Further, such initiatives for gastrointestinal genetic testing are being supported by both public and private entities.

Restraining Factors

The market for gastrointestinal diagnostics is constrained by a number of problems, such as the high cost of cutting-edge technology, restricted accessibility in areas with limited resources, regulatory obstacles, and patient resistance to intrusive procedures.

Market Segmentation

The gastrointestinal diagnostics market share is classified into test type and technology.

- The endoscopy segment accounted for the largest share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

Based on the test type, the gastrointestinal diagnostics market is divided into endoscopy, blood test, H. pylori test, calprotectin test, immunoglobulin A test, and others. Among these, the endoscopy segment accounted for the largest share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. The endoscopy market is expanding due in large part to technological improvements, medical professionals' preference for endoscopy, and the increased need for non-invasive procedures. Additionally, the launch of cutting-edge, highly precise devices is anticipated to accelerate market growth.

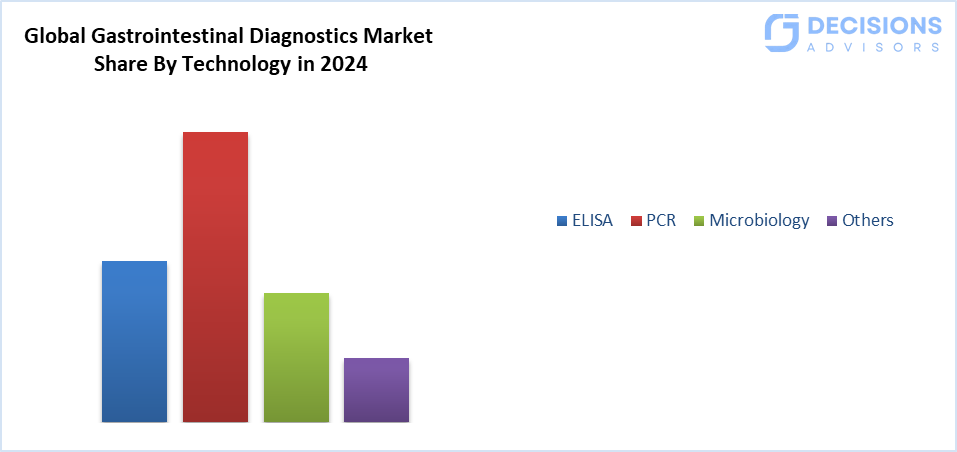

- The PCR segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the technology, the gastrointestinal diagnostics market is segmented into ELISA, PCR, microbiology, and others. Among these, the PCR segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This segment growth is driven by its detect infections with high sensitivity and specificity, even in situations where conventional diagnostic techniques are insufficient, PCR can detect a variety of stomach illnesses. Faster diagnosis and more focused therapy are made possible by its quick and precise results, which lower complications and enhance patient outcomes.

Regional Segment Analysis of the Gastrointestinal Diagnostics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the gastrointestinal diagnostics market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the gastrointestinal diagnostics market over the predicted timeframe. The expanding access to cutting-edge diagnostic technologies, enhancing healthcare infrastructure, and raising awareness of preventative healthcare are all driving market growth. The market for gastrointestinal diagnostics in China is expected to grow over the course of the forecast period due to government measures to enhance healthcare infrastructure and access, as well as growing awareness of gastrointestinal health. The accuracy and efficiency of diagnostics are being improved by technological developments, such as the creation of novel diagnostic instruments and non-invasive testing techniques. Preventive care is prioritised in Japan's healthcare system, which encourages more attention to early detection and routine screening initiatives.

In July 2025, Chinese researchers unveiled a groundbreaking AI system, called GRAPE, that can detect early-stage stomach cancer using standard CT scans. This innovation, developed by Zhejiang Cancer Hospital in collaboration with Alibaba’s DAMO Academy, is expected to revolutionise cancer diagnostics worldwide.

North America is expected to grow at a rapid CAGR in the gastrointestinal diagnostics market during the forecast period. The high frequency of gastrointestinal illnesses, growing awareness of these conditions, and a strong healthcare infrastructure, it is anticipated that regional demand. Furthermore, the regional market is expected to grow even more due to the existence of significant companies and their strategic activities. Another important component of regional growth is the introduction of innovative products in the region. The prevalence of gastrointestinal illnesses, including colorectal cancer and various infections, is driving demand for sophisticated diagnostic solutions, which highlights the market of the U.S. gastrointestinal diagnostics market is expected to develop significantly over the forecast period. Additionally, patients and healthcare professionals are more conscious of early diagnosis and treatment.

In October 2025, the FDA granted clearance to Hologic’s Panther Fusion Gastrointestinal (GI) Bacterial and Expanded Bacterial Assays, enabling faster and more accurate detection of infectious gastroenteritis pathogens. These assays also received CE marking in the EU, expanding their global reach.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the gastrointestinal diagnostics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott Laboratories

- Beckman Coulter, Inc.

- bioMérieux

- Bio-Rad Laboratories, Inc.

- DiaSorin S.p.A

- EKF Diagnostics Holdings plc

- F. Hoffmann-La Roche Ltd

- Fujifilm Holdings Corporation

- Meridian Bioscience

- QIAGEN N.V.

- R-Biopharm AG

- Siemens Healthineers AG

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2025, OMED Health officially launched its new Personalised Health Plans to address functional gastrointestinal (GI) conditions, combining breath-based diagnostics with tailored treatments and clinician-led care pathways.

- In June 2024, MP Biomedicals launched a new line of advanced gastrointestinal disease diagnostic kits, expanding its portfolio of rapid in vitro diagnostic tests for infectious diseases. These kits are designed to deliver fast and accurate detection of key gastrointestinal pathogens, thereby improving early diagnosis and patient outcomes.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the gastrointestinal diagnostics market based on the below-mentioned segments:

Global Gastrointestinal Diagnostics Market, By Test Type

- Endoscopy

- Blood Test

- H. Pylori Test

- Calprotectin Test

- Immunoglobulin A Test

- Others

Global Gastrointestinal Diagnostics Market, By Technology

- ELISA

- PCR

- Microbiology

- Others

Global Gastrointestinal Diagnostics Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the current size of the global gastrointestinal diagnostics market?

The market was valued at USD 5.15 billion in 2024.

- What is the projected market size by 2035?

It is expected to reach USD 8.23 billion by 2035.

- What is the CAGR for the forecast period?

The market is projected to grow at a CAGR of 4.35% from 2025 to 2035.

- Which test type holds the largest market share?

Endoscopy accounted for the largest share in 2024 and is expected to grow substantially.

- Which technology segment dominated in 2024?

PCR dominated the market and is anticipated to grow at a significant CAGR.

- Which region is expected to grow the fastest?

North America is expected to grow at the fastest CAGR during the forecast period.

- What are the main drivers of market growth?

Key drivers include advancements in diagnostic technologies, rising GI illnesses, demand for non-invasive tests, and early detection programs.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Test Type

- Market Attractiveness Analysis By Technology

- Market Attractiveness Analysis By Region

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Growing prevalence of gastrointestinal diseases, the heightened adoption of non-invasive diagnostic techniques

- Restraints

- High cost of cutting-edge technology, restricted accessibility

- Opportunities

- Endoscopic ultrasound (EUS), virtual colonoscopy, and molecular diagnostics are examples of advancements that have enhanced patient outcomes

- Challenges

- Regulatory obstacles and patient resistance to intrusive procedures

- Global Gastrointestinal Diagnostics Market Analysis and Projection, By Test Type

- Segment Overview

- Endoscopy

- Blood Test

- H. Pylori Test

- Calprotectin Test

- Immunoglobulin A Test

- Others

- Global Gastrointestinal Diagnostics Market Analysis and Projection, By Technology

- Segment Overview

- ELISA

- PCR

- Microbiology

- Others

- Global Gastrointestinal Diagnostics Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Gastrointestinal Diagnostics Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Gastrointestinal Diagnostics Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Coverage Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Abbott Laboratories

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Beckman Coulter, Inc

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- bioMérieux

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Bio-Rad Laboratories

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- DiaSorin S.p.A

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- EKF Diagnostics Holdings plc

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- F. Hoffmann-La Roche Ltd

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Fujifilm Holdings Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Meridian Bioscience

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- QIAGEN N.V

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- R-Biopharm AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Siemens Healthineers AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Sysmex Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Thermo Fisher Scientific Inc

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Others

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Abbott Laboratories

List of Table

- Global Gastrointestinal Diagnostics Market, By Test Type, 2024-2035(USD Billion)

- Global Endoscopy, Gastrointestinal Diagnostics Market, By Region, 2024-2035(USD Billion)

- Global Blood Test, Gastrointestinal Diagnostics Market, By Region, 2024-2035(USD Billion)

- Global H. Pylori Test, Gastrointestinal Diagnostics Market, By Region, 2024-2035(USD Billion)

- Global Calprotectin Test, Gastrointestinal Diagnostics Market, By Region, 2024-2035(USD Billion)

- Global Immunoglobulin A Test, Gastrointestinal Diagnostics Market, By Region, 2024-2035(USD Billion)

- Global Others, Gastrointestinal Diagnostics Market, By Region, 2024-2035(USD Billion)

- Global Gastrointestinal Diagnostics Market, By Technology, 2024-2035(USD Billion)

- Global ELISA, Gastrointestinal Diagnostics Market, By Region, 2024-2035(USD Billion)

- Global PCR, Gastrointestinal Diagnostics Market, By Region, 2024-2035(USD Billion)

- Global Microbiology, Gastrointestinal Diagnostics Market, By Region, 2024-2035(USD Billion)

- Global Others, Gastrointestinal Diagnostics Market, By Region, 2024-2035(USD Billion)

- North America Gastrointestinal Diagnostics Market, By Test Type, 2024-2035(USD Billion)

- North America Gastrointestinal Diagnostics Market, By Technology, 2024-2035(USD Billion)

- U.S. Gastrointestinal Diagnostics Market, By Test Type, 2024-2035(USD Billion)

- U.S. Gastrointestinal Diagnostics Market, By Technology, 2024-2035(USD Billion)

- Canada Gastrointestinal Diagnostics Market, By Test Type, 2024-2035(USD Billion)

- Canada Gastrointestinal Diagnostics Market, By Technology, 2024-2035(USD Billion)

- Mexico Gastrointestinal Diagnostics Market, By Test Type, 2024-2035(USD Billion)

- Mexico Gastrointestinal Diagnostics Market, By Technology, 2024-2035(USD Billion)

- Europe Gastrointestinal Diagnostics Market, By Test Type, 2024-2035(USD Billion)

- Europe Gastrointestinal Diagnostics Market, By Technology, 2024-2035(USD Billion)

- Germany Gastrointestinal Diagnostics Market, By Test Type, 2024-2035(USD Billion)

- Germany Gastrointestinal Diagnostics Market, By Technology, 2024-2035(USD Billion)

- France Gastrointestinal Diagnostics Market, By Test Type, 2024-2035(USD Billion)

- France Gastrointestinal Diagnostics Market, By Technology, 2024-2035(USD Billion)

- U.K. Gastrointestinal Diagnostics Market, By Test Type, 2024-2035(USD Billion)

- U.K. Gastrointestinal Diagnostics Market, By Technology, 2024-2035(USD Billion)

- Italy Gastrointestinal Diagnostics Market, By Test Type, 2024-2035(USD Billion)

- Italy Gastrointestinal Diagnostics Market, By Technology, 2024-2035(USD Billion)

- Spain Gastrointestinal Diagnostics Market, By Test Type, 2024-2035(USD Billion)

- Spain Gastrointestinal Diagnostics Market, By Technology, 2024-2035(USD Billion)

- Asia Pacific Gastrointestinal Diagnostics Market, By Test Type, 2024-2035(USD Billion)

- Asia Pacific Gastrointestinal Diagnostics Market, By Technology, 2024-2035(USD Billion)

- Japan Gastrointestinal Diagnostics Market, By Test Type, 2024-2035(USD Billion)

- Japan Gastrointestinal Diagnostics Market, By Technology, 2024-2035(USD Billion)

- China Gastrointestinal Diagnostics Market, By Test Type, 2024-2035(USD Billion)

- China Gastrointestinal Diagnostics Market, By Technology, 2024-2035(USD Billion)

- India Gastrointestinal Diagnostics Market, By Test Type, 2024-2035(USD Billion)

- India Gastrointestinal Diagnostics Market, By Technology, 2024-2035(USD Billion)

- South America Gastrointestinal Diagnostics Market, By Test Type, 2024-2035(USD Billion)

- South America Gastrointestinal Diagnostics Market, By Technology, 2024-2035(USD Billion)

- Brazil Gastrointestinal Diagnostics Market, By Test Type, 2024-2035(USD Billion)

- Brazil Gastrointestinal Diagnostics Market, By Technology, 2024-2035(USD Billion)

- The Middle East and Africa Gastrointestinal Diagnostics Market, By Test Type, 2024-2035(USD Billion)

- The Middle East and Africa Gastrointestinal Diagnostics Market, By Technology, 2024-2035(USD Billion)

- UAE Gastrointestinal Diagnostics Market, By Test Type, 2024-2035(USD Billion)

- UAE Gastrointestinal Diagnostics Market, By Technology, 2024-2035(USD Billion)

- South Africa Gastrointestinal Diagnostics Market, By Test Type, 2024-2035(USD Billion)

- South Africa Gastrointestinal Diagnostics Market, By Technology, 2024-2035(USD Billion)

List of Figures

- Global Gastrointestinal Diagnostics Market Segmentation

- Gastrointestinal Diagnostics Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top investment pocket in the Gastrointestinal Diagnostics Market

- Top Winning Strategies, 2024-2035

- Top Winning Strategies, By Development, 2024-2035(%)

- Top Winning Strategies, By Company, 2024-2035

- Moderate Bargaining power of Buyers

- Moderate Bargaining power of Suppliers

- Moderate Bargaining power of New Entrants

- Low threat of Substitution

- High Competitive Rivalry

- Top Player Positioning, 2024

- Market Share Analysis, 2024

- Restraint and Drivers: Gastrointestinal Diagnostics Market

- Gastrointestinal Diagnostics Market Segmentation, By Test Type

- Gastrointestinal Diagnostics Market For Endoscopy, By Region, 2024-2035 ($ Billion)

- Gastrointestinal Diagnostics Market For Blood Test, By Region, 2024-2035 ($ Billion)

- Gastrointestinal Diagnostics Market For H. Pylori Test, By Region, 2024-2035 ($ Billion)

- Gastrointestinal Diagnostics Market For Calprotectin Test, By Region, 2024-2035 ($ Billion)

- Gastrointestinal Diagnostics Market For Immunoglobulin A Test, By Region, 2024-2035 ($ Billion)

- Gastrointestinal Diagnostics Market For Others, By Region, 2024-2035 ($ Billion)

- Gastrointestinal Diagnostics Market Segmentation, By Technology

- Gastrointestinal Diagnostics Market For ELISA, By Region, 2024-2035 ($ Billion)

- Gastrointestinal Diagnostics Market For PCR, By Region, 2024-2035 ($ Billion)

- Gastrointestinal Diagnostics Market For Microbiology, By Region, 2024-2035 ($ Billion)

- Gastrointestinal Diagnostics Market For Others, By Region, 2024-2035 ($ Billion)

- Abbott Laboratories: Net Sales, 2024-2035 ($ Billion)

- Abbott Laboratories: Revenue Share, By Segment, 2024 (%)

- Abbott Laboratories: Revenue Share, By Region, 2024 (%)

- Beckman Coulter, Inc: Net Sales, 2024-2035 ($ Billion)

- Beckman Coulter, Inc: Revenue Share, By Segment, 2024 (%)

- Beckman Coulter, Inc: Revenue Share, By Region, 2024 (%)

- bioMérieux: Net Sales, 2024-2035 ($ Billion)

- bioMérieux: Revenue Share, By Segment, 2024 (%)

- bioMérieux: Revenue Share, By Region, 2024 (%)

- Bio-Rad Laboratories: Net Sales, 2024-2035 ($ Billion)

- Bio-Rad Laboratories: Revenue Share, By Segment, 2024 (%)

- Bio-Rad Laboratories: Revenue Share, By Region, 2024 (%)

- DiaSorin S.p.A: Net Sales, 2024-2035 ($ Billion)

- DiaSorin S.p.A: Revenue Share, By Segment, 2024 (%)

- DiaSorin S.p.A: Revenue Share, By Region, 2024 (%)

- EKF Diagnostics Holdings plc: Net Sales, 2024-2035 ($ Billion)

- EKF Diagnostics Holdings plc: Revenue Share, By Segment, 2024 (%)

- EKF Diagnostics Holdings plc: Revenue Share, By Region, 2024 (%)

- F. Hoffmann-La Roche Ltd: Net Sales, 2024-2035 ($ Billion)

- F. Hoffmann-La Roche Ltd: Revenue Share, By Segment, 2024 (%)

- F. Hoffmann-La Roche Ltd: Revenue Share, By Region, 2024 (%)

- Fujifilm Holdings Corporation: Net Sales, 2024-2035 ($ Billion)

- Fujifilm Holdings Corporation: Revenue Share, By Segment, 2024 (%)

- Fujifilm Holdings Corporation: Revenue Share, By Region, 2024 (%)

- Meridian Bioscience.: Net Sales, 2024-2035 ($ Billion)

- Meridian Bioscience.: Revenue Share, By Segment, 2024 (%)

- Meridian Bioscience.: Revenue Share, By Region, 2024 (%)

- QIAGEN N.V: Net Sales, 2024-2035 ($ Billion)

- QIAGEN N.V: Revenue Share, By Segment, 2024 (%)

- QIAGEN N.V: Revenue Share, By Region, 2024 (%)

- R-Biopharm AG: Net Sales, 2024-2035 ($ Billion)

- R-Biopharm AG: Revenue Share, By Segment, 2024 (%)

- R-Biopharm AG: Revenue Share, By Region, 2024 (%)

- Siemens Healthineers AG: Net Sales, 2024-2035 ($ Billion)

- Siemens Healthineers AG: Revenue Share, By Segment, 2024 (%)

- Siemens Healthineers AG: Revenue Share, By Region, 2024 (%)

- Sysmex Corporation: Net Sales, 2024-2035 ($ Billion)

- Sysmex Corporation: Revenue Share, By Segment, 2024 (%)

- Sysmex Corporation: Revenue Share, By Region, 2024 (%)

- Thermo Fisher Scientific Inc: Net Sales, 2024-2035 ($ Billion)

- Thermo Fisher Scientific Inc: Revenue Share, By Segment, 2024 (%)

- Thermo Fisher Scientific Inc: Revenue Share, By Region, 2024 (%)

- Others: Net Sales, 2024-2035 ($ Billion)

- Others: Revenue Share, By Segment, 2024 (%)

- Others: Revenue Share, By Region, 2024 (%)

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 293 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |