Global Gel Documentation Systems Market

Global Gel Documentation Systems Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Source of Light (UV, LED, and Laser), By Detection Technology (Fluorescence, Chemiluminescence, and Colorimetric), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Gel Documentation Systems Market Summary, Size & Emerging Trends

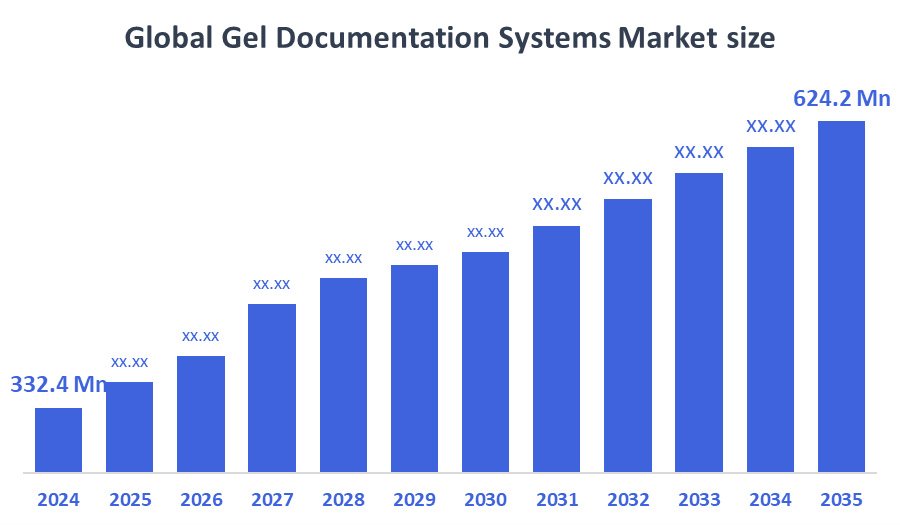

According to Decision Advisor, The Global Gel Documentation Systems Market Size is Expected to Grow from USD 332.4 Million in 2024 to USD 624.2 Million by 2035, at a CAGR of 5.9% during the forecast period 2025-2035. The market is witnessing consistent growth driven by increasing demand for molecular biology research, advances in imaging technologies, and a shift towards safer and more energy-efficient light sources such as LEDs.

Key Market Insights

- North America is expected to account for the largest share in the gel documentation systems market during the forecast period.

- In terms of source of light, the LED segment is expected to dominate in terms of revenue during the forecast period.

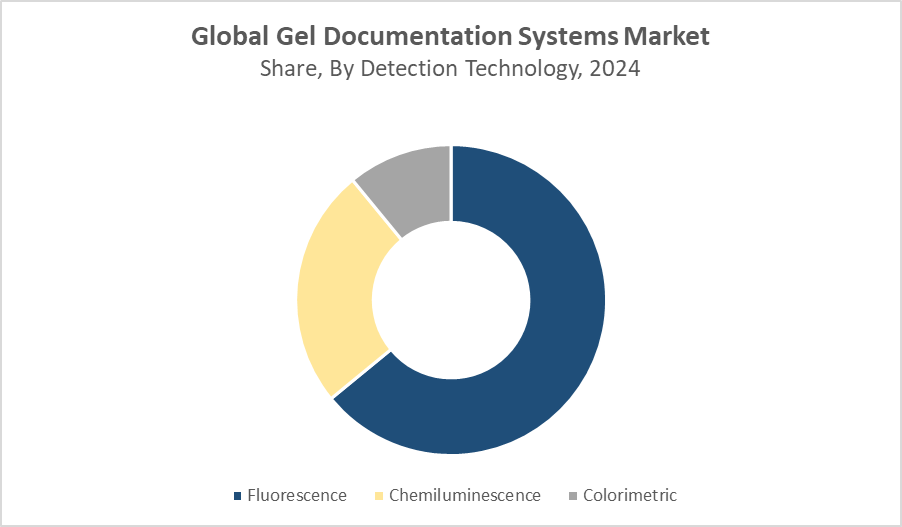

- In terms of detection technology, the fluorescence segment accounted for the largest revenue share in the global gel documentation systems market during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 332.4 Million

- 2035 Projected Market Size: USD 624.2 Million

- CAGR (2025-2035): 5.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Gel Documentation Systems Market

The gel documentation systems market revolves around laboratory equipment designed to image and analyze nucleic acid and protein gels following electrophoresis. These systems use advanced light sources and detection technologies to capture high-resolution images of DNA, RNA, and proteins stained with various dyes. The integration of software and hardware enhances the accuracy and reproducibility of results, which is essential in molecular biology, genetics, drug development, and diagnostic applications. Rising investments in life sciences research, increased focus on healthcare diagnostics, and demand for efficient and safe imaging systems are fueling the growth of this market. The shift from UV-based to LED-based systems and the incorporation of chemiluminescence and fluorescence detection are defining future trends in product development and adoption.

Gel Documentation Systems Market Trends

- Growing adoption of LED light sources due to energy efficiency, safety, and longevity.

- Increasing preference for fluorescence and chemiluminescence technologies owing to their high sensitivity and enhanced imaging capabilities.

- Integration of automation and software for image analysis, quantification, and data storage is becoming standard.

- Development of compact and portable gel documentation systems for academic and small-scale laboratories.

- Product innovation focusing on multi-modal detection systems to meet diverse research needs.

Gel Documentation Systems Market Dynamics

Driving Factors: Rising demand for molecular biology and diagnostic research

Key growth factors for the gel documentation systems market include increasing applications in genetic analysis, proteomics, and diagnostics. Rising investments in biotech and pharmaceutical R&D are accelerating the demand for high-performance imaging systems. The transition towards safer, more energy-efficient light sources, especially LED, and advancements in detection technologies such as fluorescence and chemiluminescence, are enhancing system capabilities. Additionally, the growth of diagnostic testing and academic research worldwide is further supporting market expansion.

Restrain Factors: High cost and presence of alternative technologies

Restraints in the gel documentation systems market include the high cost of advanced systems, particularly those equipped with chemiluminescence and fluorescence capabilities. Regulatory compliance, especially concerning UV light usage, and the need for skilled personnel can also challenge adoption in developing regions. Furthermore, emerging imaging and real-time detection alternatives may offer competition in certain applications.

Opportunity: Increasing demand from emerging markets and automation trends

The market presents significant opportunities, particularly in emerging economies investing in life sciences infrastructure. Growing awareness of molecular diagnostics and academic research funding supports broader adoption. Automation, software integration, and the push for eco-friendly laboratory environments are enabling next-generation gel documentation systems. Demand for multi-functionality, compact size, and cloud-based data access also opens avenues for innovation and product differentiation.

Challenges: Regulatory constraints and limited technical expertise

Challenges include navigating stringent regulatory requirements related to UV exposure and safe handling of chemical stains. Limited access to advanced systems and trained personnel in lower-income regions can hinder adoption. Additionally, price sensitivity among small-scale laboratories and academic institutions may slow uptake of high-end systems. The need for standardized protocols and consistent image quality across devices further adds to market complexity.

Global Gel Documentation Systems Market Ecosystem Analysis

The global gel documentation systems market ecosystem consists of light source and sensor component suppliers, system manufacturers, and end-users in academic, pharmaceutical, biotechnology, and diagnostic sectors. Manufacturers focus on improving detection sensitivity, image quality, and system versatility while ensuring compliance with safety regulations. The ecosystem benefits from increasing collaborations between software developers and hardware manufacturers to create fully integrated imaging platforms. As demand grows for safer and more sustainable lab practices, the market is witnessing a shift toward LED-based systems and enhanced detection solutions that align with global laboratory standards.

Global Gel Documentation Systems Market, By Source of Light

What factors enabled the LED segment to lead the global gel documentation systems market in 2024?

The LED segment dominated the global gel documentation systems market in 2024 primarily due to its superior energy efficiency, longer lifespan, and enhanced illumination quality, which improved the accuracy and clarity of gel imaging. Additionally, LED technology's lower operational costs and reduced maintenance requirements made it more cost-effective compared to traditional lighting systems. These factors, combined with increasing demand for advanced and reliable gel documentation systems in research and clinical laboratories, enabled the LED segment to capture approximately 52% of the market revenue, securing its position as the leading choice during the forecast period.

Why did the UV segment continue to hold around 35% market share despite a declining trend in 2024?

The UV segment maintained a notable market share of around 35% in 2024 due to its well-established presence and compatibility with specific applications that require UV light for sensitive gel imaging. Many laboratories continue to rely on UV technology because of its proven effectiveness in detecting certain dyes and nucleic acids that respond well to UV illumination. Furthermore, existing investments in UV-based equipment and the segment’s ability to deliver consistent results helped sustain its competitiveness. Although newer technologies like LEDs are gaining ground, the UV segment’s unique advantages and continued relevance in specialized workflows allowed it to retain a significant portion of the market.

Global Gel Documentation Systems Market, By Detection Technology

How did the fluorescence technology gain a competitive edge in the gel documentation systems market in 2024?

The fluorescence segment accounted for the largest revenue share of approximately 48% in the global gel documentation systems market during the forecast period due to its high sensitivity and specificity in detecting a wide range of biomolecules. Fluorescence technology offers enhanced imaging capabilities with greater accuracy and faster detection compared to traditional methods. Additionally, the ability to use multiple fluorescent dyes simultaneously allows for multiplexing, making it highly valuable in advanced research and clinical applications. These advantages, combined with growing demand for precise and reliable gel imaging solutions, enabled the fluorescence segment to secure a dominant position in the market.

What made the chemiluminescence segment the fastest-growing segment in the gel documentation systems market?

The chemiluminescence segment is expected to register the highest growth rate with a projected CAGR during the forecast period due to its exceptional sensitivity and ability to produce high-contrast images with minimal background noise. This technology enables the detection of low-abundance biomolecules, making it highly valuable in advanced molecular biology and clinical diagnostics. Additionally, improvements in chemiluminescence reagents and detection systems have enhanced its reliability and ease of use, attracting increased adoption. Growing demand for precise and rapid analytical techniques in research and healthcare has driven the chemiluminescence segment's rapid expansion and market growth.

Asia-Pacific is expected to hold the largest share of the gel documentation systems market during the forecast period, accounting for approximately 36% of global market revenue.

This leadership is driven by rapid advancements in molecular biology research, substantial government funding for academic and clinical projects, and significant expansion of biopharmaceutical manufacturing in key countries like China, India, and South Korea. Additionally, rising demand for diagnostic testing, along with increasing awareness of laboratory safety and automation technologies, further propels market growth across the region.

India is witnessing accelerated growth in the gel documentation systems market, with a projected CAGR of around 9.2% during the forecast period.

This strong momentum is fueled by the rapid expansion of biotechnology parks that provide advanced infrastructure and facilities for research and development. Moreover, India’s growing focus on life sciences research, particularly in genomics, proteomics, and molecular diagnostics, is driving demand for sophisticated imaging technologies like gel documentation systems.

North America, the gel documentation systems market is expected to experience steady growth, capturing approximately 34% of the global market share during the forecast period.

This growth is largely attributed to the region’s well-established research infrastructure, which includes world-class universities, government research organizations, and private R&D centers. The strong presence of the diagnostic sector, which continuously demands high-precision imaging and detection technologies, also contributes significantly to market expansion.

The United States leads the North American market,

driven by a dense concentration of research institutions, university laboratories, and biotechnology companies focused on cutting-edge life sciences research. Increasing investment in proteomics, genomics, and gene expression studies heightens demand for gel documentation systems capable of delivering high sensitivity and resolution. Advanced applications like protein quantification and DNA/RNA analysis benefit from improved detection technologies, encouraging laboratories to upgrade existing systems or acquire new platforms.

WORLDWIDE TOP KEY PLAYERS IN THE GEL DOCUMENTATION SYSTEMS MARKET INCLUDE

- Bio-Rad Laboratories

- Thermo Fisher Scientific

- GE Healthcare

- LI-COR Biosciences

- Azure Biosystems

- Vilber Lourmat

- Cleaver Scientific

- ATTO Corporation

- Syngene

- Analytik Jena AG

- Gel Company

- VWR International

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the gel documentation systems market based on the below-mentioned segments:

Global Gel Documentation Systems Market, By Source of Light

- UV

- LED

- Laser

Global Gel Documentation Systems Market, By Detection Technology

- Fluorescence

- Chemiluminescence

- Colorimetric

Global Gel Documentation Systems Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: What is the market size of the Global Gel Documentation Systems Market in 2024?

A: The market size was USD 332.4 million in 2024.

Q: What is the projected market size by 2035?

A: It is expected to reach USD 624.2 million by 2035.

Q: What is the forecasted CAGR for the Gel Documentation Systems Market from 2025 to 2035?

A: The market is expected to grow at a CAGR of 5.9% during the period 2025-2035.

Q: Which region holds the largest market share in gel documentation systems?

A: North America is expected to account for the largest share during the forecast period.

Q: Which region is the fastest growing in the gel documentation systems market?

A: Asia Pacific is the fastest-growing market.

Q: What light source segment dominated the market in 2024?

A: The LED segment dominated with approximately 52% revenue share due to energy efficiency, longer lifespan, and better illumination.

Q: Why does the UV light source segment still hold around 35% market share?

A: Because of its established presence, effectiveness with specific dyes, and compatibility with sensitive gel imaging despite declining trend.

Q: Which detection technology accounted for the largest revenue share in 2024?

A: Fluorescence technology held approximately 48% revenue share due to its high sensitivity and multiplexing capabilities.

Q: Which detection technology segment is growing the fastest?

A: Chemiluminescence is the fastest-growing segment owing to its high sensitivity and superior image contrast.

Q: What are the key drivers of growth in the gel documentation systems market?

A: Increasing molecular biology research, advances in imaging technologies, adoption of energy-efficient LED light sources, and rising demand in diagnostics and biotech sectors.

Q: What are the major restraints limiting market growth?

A: High cost of advanced systems, regulatory compliance challenges, need for skilled personnel, and competition from alternative imaging technologies.

Q: What opportunities exist in the market?

A: Growth in emerging markets, automation and software integration trends, demand for compact and multi-modal detection systems, and eco-friendly lab practices.

Q: What challenges are faced by manufacturers?

A: Regulatory constraints related to UV exposure, limited technical expertise in developing regions, price sensitivity of small labs, and the need for standardized imaging protocols.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 231 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |