Global Gemstones Market

Global Gemstones Market Size, Share, and COVID-19 Impact Analysis, By Type (Diamond, Ruby, Sapphire, Emerald, Others), By Sales Channel (Online, Offline), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Gemstones Market Summary

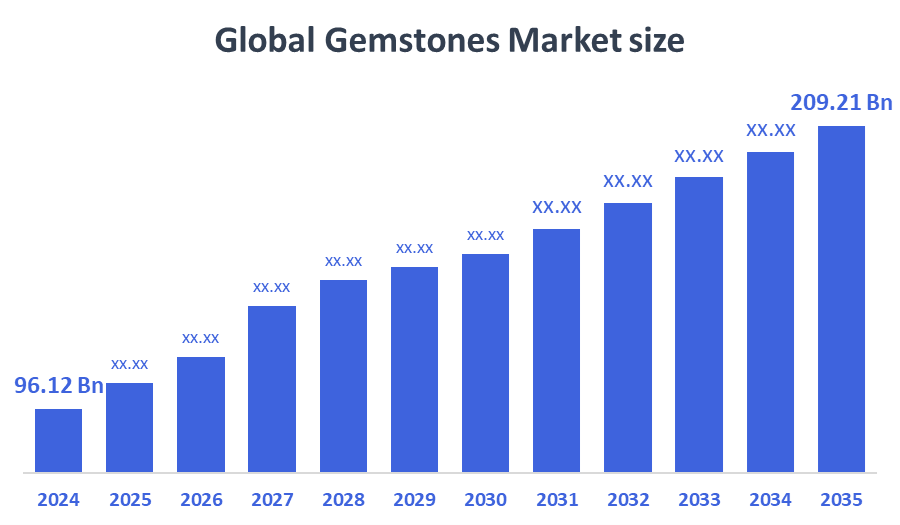

The Global Gemstones Market Size Was Estimated at USD 96.12 Billion in 2024 and is Projected to Reach USD 209.21 Billion by 2035, Growing at a CAGR of 7.33% from 2025 to 2035. Rising consumer demand for upscale and personalized jewelry, rising disposable incomes, growing e-commerce platforms, fashion trends, cultural significance, and growing knowledge of the metaphysical qualities of gemstones, as well as developments in gemstone cutting and certification, are all contributing factors to the growth of the gemstones market.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific held the largest revenue share of over 45.8% and dominated the market globally.

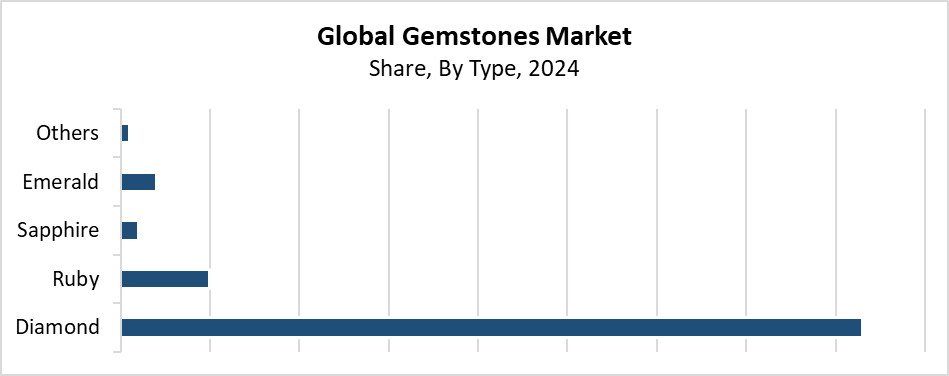

- In 2024, the diamond segment had the highest market share by type, accounting for 83.5%.

- In 2024, the online segment had the biggest market share by sales channel.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 96.12 Billion

- 2035 Projected Market Size: USD 209.21 Billion

- CAGR (2025-2035): 7.33%

- Asia Pacific: Largest market in 2024

The worldwide gemstones market encompasses the commercial distribution and practical usage of precious and semi-precious stones, including diamonds, rubies, sapphires, and emeralds, which are commonly utilized in jewelry, fashion, and luxury products. The minerals obtain their value from their rare qualities, strong nature, and aesthetic appeal, regardless of whether they grow naturally or through laboratory methods. Market growth occurs because people have more money to spend on luxury goods and personalized jewelry, and the cultural importance of gemstones as symbols of engagement and wedding, and gift traditions continues to rise. The market demand received additional support because of the growing popularity of online jewelry stores and rising brand recognition among young customers. Emerging countries such as China and India play a vital role in the market because they have large populations who are deeply connected with gemstones.

Precision cutting, 3D printing, and computer-aided design (CAD) are examples of technological developments in gemstone processing that are revolutionizing jewelry production and enhancing the quality and personalization of gemstones. Additionally, the popularity of lab-grown gemstones draws in eco-aware customers by providing more sustainable and reasonably priced alternatives. Responsible mining methods are being encouraged by government programs that support ethical sourcing and open supply chains, including the Kimberley Process for diamonds. In order to promote local gemstone processing companies, especially in Africa and Southeast Asia, a number of nations are also investing in infrastructure and skill development. This increases market competitiveness and international trade.

Type Insights

With the biggest revenue share of 83.5% in 2024, the diamonds segment led the worldwide gemstones market. The reason for this largest market share is that diamonds have long been the most sought-after gemstone due to their use in expensive jewelry, especially wedding and engagement rings. Strong consumer demand, brand familiarity, and the long-standing belief that diamonds are permanent and luxurious emblems all contribute to the segment's growth. Furthermore, improvements in the manufacturing of synthetic diamonds have increased market accessibility, attracting customers who are concerned about the environment as well as their budget. The diamond segment's impressive performance indicates its ongoing significance in the worldwide gemstone industry, surpassing other varieties including sapphires, rubies, and emeralds in terms of demand and value.

Over the course of the projection period, the ruby segment is expected to grow at the fastest CAGR. The growing demand for colored gemstones by consumers and the growing use of rubies in both conventional and modern jewelry designs are the main drivers of this increase. Rubies are becoming more popular among younger consumers looking for distinctive alternatives to conventional diamonds because of their vivid red color and associations with passion, riches, and protection. High-quality rubies are becoming more and more valuable due to their restricted supply and rarity. Growing retail presence, particularly in emerging regions, increased knowledge of the provenance and authenticity of gemstones, is also anticipated to support the expansion of the ruby segment throughout the course of the projected period.

Sales Channel Insights

The online segment dominated the gemstones market, with the largest revenue share in 2024. The growing popularity of online shopping among consumers, which provides ease, a wider range of products, and affordable prices, is the main driver of this growth. Features like virtual try-ons, high-resolution product photos, and personalization choices have improved consumer experiences on brand-owned websites and e-commerce platforms. Gemstone shops now have a wider audience, particularly among younger, tech-savvy consumers, thanks to the growth of digital marketing, influencer relationships, and social media promotions. Furthermore, consumers' confidence in buying expensive goods online has increased due to safe payment gateways, clear return policies, and authenticity certification, which has cemented the online segment's leadership in the worldwide gemstones market in 2024.

Over the course of the forecast period, the offline segment of the gemstones market is expected to grow at a significant CAGR. For high-value commodities like jewels, where trust, tactile sensation, and physical examination are important factors, many buyers still prefer in-person transactions despite the rise in internet purchasing. One of the main drivers of offline growth is the individualized customer attention, instant product availability, and professional advice that brick-and-mortar retailers provide. Increased foot traffic is also a result of the growth of specialist jewelry shops, premium retail establishments, and showroom experiences in growing economies. Exclusive collections and in-store customizing services are two more advantages that make offline channels a popular option for high-end clients and contribute to their continued growth.

Regional Insights

North America's gemstone market is expanding significantly due to growing consumer demand for upscale and personalized jewelry. The main drivers of this growth include rising disposable income, shifting fashion preferences, and rising knowledge about lab-grown and ethically produced gemstones. Unique, premium gemstones, such as colored stones like rubies, sapphires, and emeralds, are becoming increasingly popular among consumers in the United States and Canada. Leading jewelry manufacturers have strong branding and marketing strategies, and the area also benefits from a well-established retail infrastructure, both online and offline. North America is already a prominent player in the global gemstone market thanks to the rising demand for sustainable, conflict-free stones and the popularity of gemstone engagement rings.

Asia Pacific Gemstones Market Trends

Asia Pacific held the largest revenue share of 45.8% in 2024, dominating the worldwide gemstone market. The significant cultural and traditional significance of gemstones in nations like Thailand, China, and India, where they are frequently utilized in religious ceremonies, weddings, and festivals, is what drives this domination. The demand for both precious and semi-precious stones is being further fueled by the region's vast population, burgeoning middle class, and rising disposable incomes. In addition, the Asia Pacific is a significant center for the cutting, polishing, and trading of gemstones, especially in Bangkok and Jaipur. The region's dominant market position is also a result of growing retail networks, rising branded jewelry usage, and government assistance for the gem and jewelry sector.

Europe Gemstones Market Trends

The market for gemstones in Europe is growing at a significant CAGR due to rising demand for sustainable and upscale jewelry. Growing environmental and social consciousness is reflected in consumers' choice for lab-grown and ethically sourced gemstones in major markets, including the UK, Germany, France, and Italy. The market for colorful gemstones like sapphires, emeralds, and rubies has increased due to European consumers' preference for distinctive, artisanal designs and vintage-inspired pieces. The area benefits from a thriving fashion industry, a rich cultural legacy surrounding fine jewelry, and a significant presence of luxury jewelry businesses. Further boosting consumer confidence are developments in transparency, traceability, and gemstone certification. Market expansion is also being aided by the growth of e-commerce and customized shopping experiences.

Key Gemstones Companies:

The following are the leading companies in the global gemstones market. These companies collectively hold the largest market share and dictate industry trends.

- Anglo American plc

- Rio Tinto Group

- Debswana Diamond Company (Pty) Limited

- Blue Nile, Inc.

- Kiran Gems Private Limited

- Gem Diamonds Limited

- PJSC ALROSA

- Chow Tai Fook Jewellery Group Limited

- Gemfields Group Limited

- Tiffany & Co.

- Others

Recent Development

- In September 2025, at a significant launch event in Mysore, Malabar Gold & Diamonds revealed the "Vyana" Gemstone Collection, which was attended by corporate officials and notable visitors. Crafted in both 18kt and 22kt gold, the new range combines a variety of vivid gemstones with diamond-like brilliance to create lightweight, flowing designs that are ideal for modern Indian women who manage to balance tradition and modern lifestyles.

- In August 2025, Columbia Gem House unveiled a new line of untreated, traceable sapphires and rubies that come from the Winza region and nearby central Tanzanian mining locations. Authentic rubies, fuchsia, padparadscha, brilliant pinks, and deep purples were among the vivid gemstones that were released with this launch. Many of the stones had unique bicolor effects and two-tone zoning.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the gemstones market based on the below-mentioned segments:

Global Gemstones Market, By Type

- Diamond

- Ruby

- Sapphire

- Emerald

- Others

Global Gemstones Market, By Sales Channel

- Online

- Offline

Global Gemstones Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |