Global Generator Sets Market

Global Generator Sets Market Size, Share, and COVID-19 Impact Analysis,†By Type (Low Power, Medium Power, High Power), By Fuel Type (Diesel, Gas), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 ? 2035

Report Overview

Table of Contents

Generator Sets Market Summary

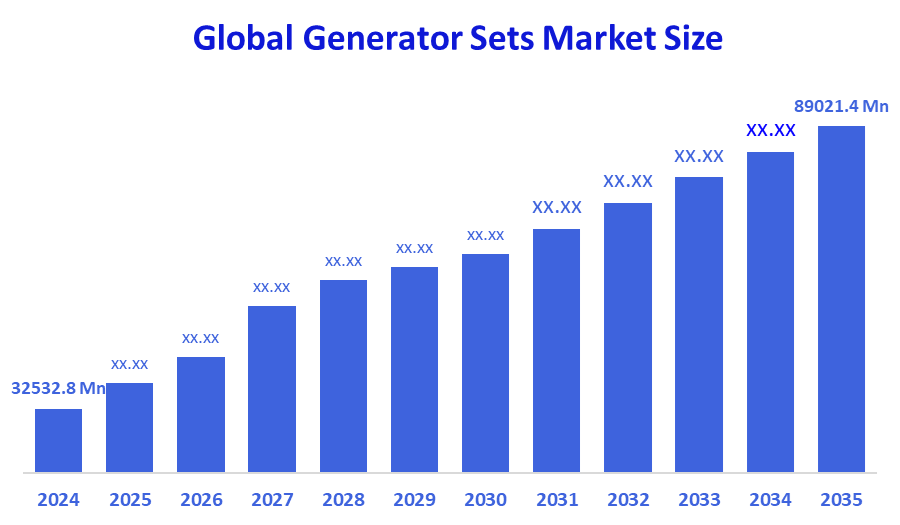

The Global Generator Sets Market Size Was Estimated at USD 32532.8 Million in 2024 and is Projected to Reach USD 89021.4 Million by 2035, Growing at a CAGR of 9.58% from 2025 to 2035. The market for generator sets is expanding as a result of growing demand for dependable backup power, expanding infrastructure, frequent power outages, fast industrialization, and expanding applications in distant, residential, and commercial locations. Hybrid solutions and technological developments also help the market grow.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific held the largest revenue share of over 36.5% and dominated the market globally.

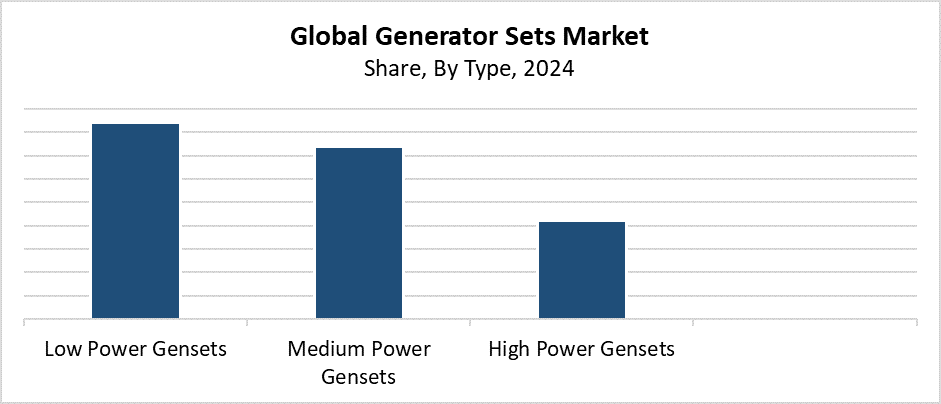

- In 2024, the low-power generator segment had the highest market share and led the market by type, accounting for 42.5%.

- In 2024, the diesel segment had the biggest market share and led the market by fuel type, accounting for 66.3%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 32532.8 Million

- 2035 Projected Market Size: USD 89021.4 Million

- CAGR (2025-2035): 9.58%

- Asia Pacific: Largest market in 2024

The generator sets market exists as a dedicated sector for developing and distributing engine-powered generators that supply electrical power in locations without utility grid access and in situations of power failure. Generator sets operate as essential power sources in both commercial and industrial facilities, as well as residential buildings. The market continues to grow at a steady pace because of fast urban development, combined with more regular power interruptions, along with rising demand for continuous electricity in data centers, medical institutions, construction sites, and remote areas. The worldwide growth of generator sets receives additional momentum from cellular network expansion and major infrastructure investments in developing countries, together with increasing power requirements in areas lacking grid access.

Technological developments are creating major changes in the generator set market. Generator sets now operate with higher efficiency and reduced environmental impact through hybrid systems, as well as renewable energy integration and improved fuel efficiency, and decreased emission levels. The market demand for automated and remotely monitored generator sets continues to grow steadily. The implementation of government programs that focus on disaster preparedness and rural electrification, and infrastructure development serves to advance generator set usage. Certain market regions experience sustainable growth because policies support the adoption of biofuels and natural gas, which stimulate product development.

Type Insights

The low power generator segment held the largest revenue share of 42.5% and dominated the global generator sets market in 2024. Low-power generators lead the market because they meet the demand for small, economical power systems in both residential and commercial settings. The main reason low-power generators serve as backup power sources during blackouts is their frequent use in developing regions that have unstable grid systems. The combination of low cost and portability, along with simple installation, makes these generators ideal for use in homes and small workplaces as well as retail locations and rural settings. The rising demand for emergency power solutions, together with increasing weather-related incidents, has driven up sales of low-power generator sets. The widespread adoption of these generators benefits from continuous developments in their noise reduction capabilities and fuel efficiency improvements.

The medium power generator segment is expected to grow significantly during the projected period because of rising requirements from industrial operations of moderate scale, along with commercial real estate and construction projects, and healthcare facilities. These generators deliver an optimal combination of power generation with operational efficiency to fulfill requirements for consistent power delivery. The typical power capacity of these generators falls between 100 kVA and 500 kVA. The growth of telecom networks, together with data centers and urban infrastructure projects, drives the rising demand for medium power gensets. The market appeal of these generators grows because of advancements in hybrid systems, together with improved fuel efficiency and emission control technology. Government initiatives to boost industrial growth, together with increased understanding of energy reliability, support the positive market prospects of this segment.

Fuel Type Insights

The diesel segment leads the generator sets market with the largest revenue share of 66.3% in 2024. The high efficiency, along with reliability and standby and prime power capability, make diesel generators the most chosen option for numerous industries. The extensive usage of these generators spans across construction sites and business buildings, industrial operations, as well as isolated locations with limited grid connection. The low starting expenses, along with a mature fuel delivery network, help sustain their market dominance. The market demand for diesel generators remains stable because technological advancements in engine design lead to enhanced fuel efficiency along with reduced emission output despite rising environmental awareness. The capacity of diesel gensets to operate under heavy load conditions for extended periods makes them an ideal solution for immediate power requirements.

The gas segment will experience substantial CAGR growth during the forecasted period because of worldwide shifts toward environmentally friendly energy alternatives. Generator sets that run on natural gas, along with biogas and LPG, produce fewer emissions than diesel generators, which makes them more appealing in areas with strict environmental rules. The cost of using gas generators decreases in regions that have sufficient gas availability, together with stable fuel market prices. Gas generator adoption continues to rise in commercial buildings, as well as healthcare facilities and industrial applications, which drives this market expansion. The performance of gas generators improves through technological advancements in gas engines, as well as better efficiency levels and their ability to connect with renewable energy systems. The increase in government support for clean energy use drives the market demand for gas-powered generators.

Regional Insights

During the forecast period, the North American generator sets market will experience substantial growth because commercial, residential, and industrial sectors need reliable backup power. The growth of gensets in the area is driven by increasing energy demands and deteriorating grid infrastructure alongside recurring weather-based power interruptions. The requirement for standby and prime power solutions continues to escalate because data centers, along with medical facilities and building developments, are increasing in number. The adoption of gas-powered generators receives support from the movement towards sustainable energy systems. Modern technological developments, including hybrid systems and remote monitoring solutions, have enhanced operational efficiency. The North American generator set market will grow because of government funding that supports emergency preparedness initiatives as well as infrastructure development projects.

Asia Pacific Generator Sets Market Trends

The Asia Pacific generator sets market dominated globally with the largest revenue share of 36.5% in 2024. Industrialization, together with urbanization and expanding infrastructure projects throughout China, India, Indonesia, and Vietnam, drives this market to lead. The increasing use of generator sets as backup power and prime power solutions results from frequent power failures and unstable grid systems in remote locations and growing energy requirements. The expanding manufacturing and telecom, and construction sectors drive the rising demand for generator sets in this region. The market growth receives support from increasing residential and commercial real estate investments, as well as rural electrification programs initiated by governments. The region maintains its leading position because of its numerous large corporations and cost-effective manufacturing capabilities.

Europe Generator Sets Market Trends

The European market for generator sets will experience significant growth because of rising demand for reliable power backup during increasing energy uncertainties and unstable grid conditions. The increasing implementation of generator sets across data centers along with commercial buildings and healthcare facilities, and industrial plants drives market growth. The transition to gas-powered and hybrid generator sets receives a boost from stricter pollution rules, which align with European environmental objectives. The occurrence of natural disasters and extreme weather events has led to an increased demand for emergency power solutions. Technological developments, including improved fuel efficiency alongside intelligent monitoring systems, are making modern gensets more attractive to consumers. The market growth in this region receives support from government programs that focus on infrastructure development, together with energy security initiatives.

Key Generator Sets Companies:

The following are the leading companies in the generator sets market. These companies collectively hold the largest market share and dictate industry trends.

- Atlas Copco AB

- Wartsila Corporation

- Kohler Co.

- Caterpillar Inc.

- Mitsubishi Heavy Industries Ltd

- MTU Onsite Energy

- General Electric

- Doosan Corporation

- Cummins Inc.

- Cooper Corporation

- Honda Siel Power Products Ltd.

- Others

Recent Developments

- In April 2024, Rolls-Royce announced a partnership with ASCO and Landmark to create cutting-edge CO2 recovery power generation systems. By using carbon capture technology, this collaboration seeks to increase generator sets' efficiency and lower greenhouse gas emissions. The project's main purpose is to develop environmentally friendly power generation systems that support international climate goals. Through this partnership, which aims to offer ecologically friendly alternatives in the power generation industry, Rolls-Royce highlights its dedication to promoting cleaner energy solutions.

- In April 2024, Cummins Power Generation unveiled the C2750D6E and C3000D6EB, two new generator sets. These QSK78-powered units have outputs of 2750kW and 3000kW and are intended for critical applications like data centers and medical institutions. The new generator sets maximize space with a smaller footprint, while offering strong load-handling capabilities and quick start performance.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the generator sets market based on the below-mentioned segments:

Global Generator Sets Market, By Type

- Low Power Gensets

- Medium Power Gensets

- High Power Gensets

Global Generator Sets Market, By Fuel Type

- Diesel

- Gas

Global Generator Sets Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |