Global Genomics Data Analysis Market

Global Genomics Data Analysis Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Service (Data Preprocessing and Quality Control, Variant Calling and Annotation, Gene Expression Analysis, and Data Interpretation and Reporting), By Technology (Next-Generation Sequencing (NGS), Microarray, PCR, and CRISPR-based Analysis), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Genomics Data Analysis Market Summary, Size & Emerging Trends

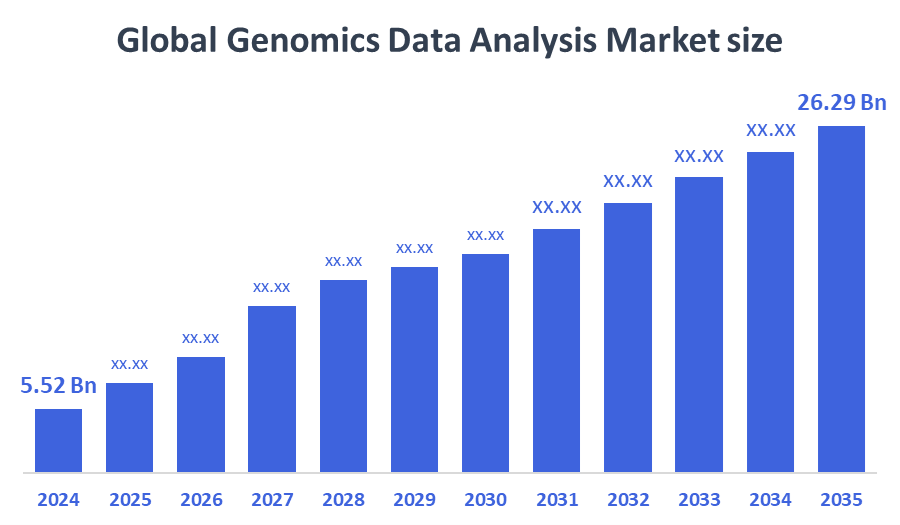

According to Decision Advisor, The Global Genomics Data Analysis Market Size is Expected to Grow from USD 5.52 Billion in 2024 to USD 26.29 Billion by 2035, at a CAGR of 15.25% during the forecast period 2025-2035. The rising adoption of next-generation sequencing technologies and increasing demand for precision medicine and personalized therapies are key factors driving market growth.

Key Market Insights

- North America holds the largest share in the genomics data analysis market due to advanced healthcare infrastructure and extensive R&D activities.

- Among services, the variant calling and annotation segment dominates in terms of revenue share, owing to its critical role in identifying genetic variants linked to diseases.

- Next-generation sequencing (NGS) technology leads the market in terms of adoption and revenue contribution, driven by its high throughput and accuracy.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 5.52 Billion

- 2035 Projected Market Size: USD 26.29 Billion

- CAGR (2025-2035): 15.25%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Genomics Data Analysis Market

The genomics data analysis market revolves around the interpretation and management of complex biological data generated from high-throughput sequencing and other genomic technologies. These analyses facilitate understanding of genetic variations, gene expression, and molecular mechanisms underpinning diseases, thereby enabling the development of targeted therapies and diagnostics. The market growth is propelled by advancements in bioinformatics tools, increased funding in genomics research, and rising applications in oncology, rare diseases, and agricultural genomics. Government initiatives promoting precision medicine and data sharing platforms are further accelerating market expansion. Increasing collaborations between technology providers, research institutes, and healthcare organizations enhance innovation and service delivery in genomics data analysis.

Genomics Data Analysis Market Trends

- Integration of artificial intelligence and machine learning in genomics data interpretation to improve accuracy and reduce analysis time.

- Growing demand for cloud-based data storage and analysis platforms to handle large-scale genomics datasets securely and efficiently.

- Increasing use of CRISPR-based technologies for gene editing and analysis, opening new avenues for research and therapeutic development.

Genomics Data Analysis Market Dynamics

Driving Factors: Widespread adoption of next-generation sequencing (NGS) technologies

The key growth drivers include the widespread adoption of next-generation sequencing (NGS) technologies across clinical and research settings, which generate vast amounts of data requiring sophisticated analysis. Rising prevalence of genetic disorders and cancer increases the demand for genomics-based diagnostics and personalized medicine. Additionally, increasing investments by pharmaceutical and biotechnology companies in genomic research fuel the demand for advanced data analysis services. The growing focus on data accuracy and quality control, coupled with regulatory support for genomics research, further stimulates market expansion.

Restrain Factors: Data privacy concerns and regulatory complexities

High costs associated with genomic data analysis platforms and bioinformatics tools limit accessibility, especially in developing regions. Data privacy concerns and regulatory complexities around genomic data sharing can also slow adoption rates. Furthermore, the shortage of skilled bioinformaticians and data scientists hinders efficient data interpretation, creating bottlenecks in the analysis pipeline. Variability in data standards and formats across different platforms poses challenges for data integration and interoperability.

Opportunity: Technological advancements in AI-powered bioinformatics

Technological advancements in AI-powered bioinformatics and cloud computing offer significant opportunities to improve genomics data analysis efficiency and scalability. The expansion of genomics applications into fields like agriculture, microbiomics, and infectious disease surveillance opens new market segments. Emerging economies with growing healthcare infrastructure and genomics research capabilities provide untapped markets. Additionally, partnerships between genomics service providers and pharmaceutical companies to develop novel therapeutics present lucrative growth prospects.

Challenges: Regulatory hurdles related to data protection

Challenges include managing the exponential growth of genomics data requiring robust storage and processing infrastructure. Regulatory hurdles related to data protection, ethical concerns, and compliance with international standards complicate global market operations. Intense competition among service providers necessitates continuous innovation and investment in cutting-edge technologies. The rapid pace of technological change demands ongoing training and skill development for workforce readiness.

Global Genomics Data Analysis Market Ecosystem Analysis

The global genomics data analysis market ecosystem includes sequencing technology providers, bioinformatics software developers, research institutions, CROs, regulatory bodies, and end-users like pharma and diagnostics companies. Raw data from NGS and PCR platforms is processed using AI-powered tools for variant analysis and interpretation. Cloud infrastructure supports storage and scalability, while collaborations drive innovation. Regulatory compliance, skilled workforce, and data privacy are essential for smooth operations. The ecosystem’s growth is fueled by rising demand for precision medicine and personalized healthcare solutions.

Global Genomics Data Analysis Market, By Service

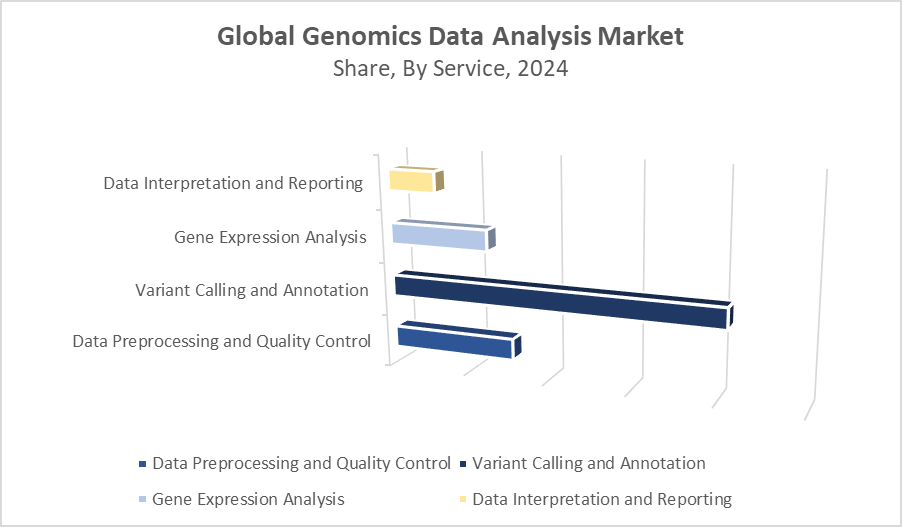

What factors enabled the variant calling and annotation segment to dominate the genomics data analysis market in 2024?

The variant calling and annotation segment dominated the genomics data analysis market in 2024 by holding the largest revenue share of approximately 40%, driven by the critical role it plays in identifying and interpreting genetic variations. The segment's dominance is fueled by increasing demand for precision medicine, where accurate detection of variants is essential for diagnosis, treatment planning, and drug development. Advances in sequencing technologies and bioinformatics tools have improved the speed and accuracy of variant analysis, making this segment highly valuable.

Why did the data preprocessing and quality control segment secure around 30% of the market share in 2024?

The data preprocessing and quality control segment held a significant market share of around 30% in 2024 due to its vital role in ensuring the accuracy and reliability of genomics data analysis. Effective preprocessing and stringent quality control are crucial for eliminating errors and biases from raw sequencing data, which directly impacts the success of downstream analyses. The segment benefited from increasing adoption of high-throughput sequencing technologies, which generate large volumes of data requiring robust quality checks. Additionally, advancements in automated and scalable preprocessing tools enhanced data handling efficiency, making this segment indispensable and helping it maintain a strong market presence during the forecast period.

Global Genomics Data Analysis Market, By Technology

How did the next-generation sequencing (NGS) segment gain a competitive edge in the genomics data analysis market in 2024?

The next-generation sequencing (NGS) segment led the genomics data analysis market in 2024, capturing the largest revenue share of about 50%. This leadership was driven by NGS’s ability to generate vast amounts of high-quality genomic data rapidly and cost-effectively, fueling a surge in genomics research and clinical applications. The technology's high throughput and scalability enable comprehensive analysis of genetic variations, supporting precision medicine and personalized healthcare initiatives. Continuous advancements in NGS platforms, along with decreasing sequencing costs, made it highly accessible and favored among researchers and healthcare providers.

What made the microarray segment a key contributor to market revenue in 2024?

The microarray segment held a substantial share of around 25% in the genomics data analysis market in 2024 due to its established utility in gene expression profiling and genotyping applications. Its relatively lower cost compared to some sequencing technologies, along with ease of use and reliable performance, made it a preferred choice for many researchers and clinical laboratories. The segment benefited from continuous improvements in microarray platforms, enabling higher throughput and better accuracy. Additionally, Microarrays remain valuable for specific applications where targeted analysis is sufficient, helping the segment maintain a significant and stable market presence during the forecast period.

North America holds the largest share of the genomics data analysis market,

largely due to the concentration of major industry players and cutting-edge research institutions. The region benefits from well-established healthcare infrastructure and extensive government and private funding dedicated to genomics and personalized medicine. Supportive regulatory frameworks streamline the approval process for new technologies, encouraging innovation and faster market entry. Additionally, the presence of leading pharmaceutical and biotechnology companies in the U.S. and Canada drives strong demand for advanced genomics data analysis services, particularly for drug discovery and precision healthcare.

Europe is the second-largest market,

supported by increasing genomics research activities and significant government investments in healthcare innovation. Countries such as Germany, the UK, and France have launched several initiatives to promote precision medicine and integrate genomics into clinical practice. Collaborative research programs across the European Union further enhance data sharing and technology development. Regulatory bodies in Europe also focus on establishing guidelines for genomic testing and data privacy, which helps build trust and adoption among healthcare providers. The growing emphasis on early disease diagnosis and personalized treatment fuels steady demand for genomics data analysis in this region.

Asia Pacific is the fastest-growing region in the genomics data analysis market,

driven by rapid industrialization, urbanization, and improving healthcare infrastructure. Increasing government funding and private investments in biotechnology and genomics research contribute significantly to market expansion. Countries like China, India, Japan, and South Korea are adopting advanced sequencing technologies and bioinformatics tools to address rising incidences of chronic diseases and genetic disorders. The growing middle-class population and rising awareness of personalized medicine also boost demand for genomics solutions.

WORLDWIDE TOP KEY PLAYERS IN THE GENOMICS DATA ANALYSIS MARKET INCLUDE

- Illumina, Inc.

- Thermo Fisher Scientific Inc.

- QIAGEN N.V.

- Agilent Technologies, Inc.

- BGI Group

- F. Hoffmann-La Roche AG

- PerkinElmer, Inc.

- Bio-Rad Laboratories, Inc.

- Pacific Biosciences of California, Inc.

- Qlucore AB

- Others

Product Launches in Genomics Data Analysis Market

- In September 2023, Illumina, a global leader in genomics technology, launched an AI-driven data analysis platform designed to significantly improve the accuracy of variant detection in genomic data. This innovative platform leverages advanced artificial intelligence algorithms to streamline genomic workflows, reducing analysis time and minimizing errors. By enhancing the precision of genetic mutation identification, the platform supports faster diagnostics and more effective personalized treatment strategies.

Market Segment

This study forecasts revenue at global, regional, and counkthiktry levels from 2020 to 2035. Decision Advisor has segmented the genomics data analysis market based on the below-mentioned segments:

Global Genomics Data Analysis Market, By Service

- Data Preprocessing and Quality Control

- Variant Calling and Annotation

- Gene Expression Analysis

- Data Interpretation and Reporting

Global Genomics Data Analysis Market, By Technology

- Next-Generation Sequencing (NGS)

- Microarray

- PCR

- CRISPR-based Analysis

Global Genomics Data Analysis Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q. What factors enabled the variant calling and annotation segment to dominate the market in 2024?

It held ~40% share due to its key role in detecting genetic variations for precision medicine, supported by advanced bioinformatics tools.

Q. Why did data preprocessing and quality control secure around 30% market share in 2024?

Its importance in ensuring accurate and reliable data, along with automated preprocessing tools, drove its significant share.

Q. How did next-generation sequencing (NGS) lead the market in 2024?

NGS accounted for ~50% share due to high throughput, accuracy, reduced costs, and wide adoption in research and clinical use.

Q. Why is the microarray segment important in genomics data analysis?

Microarrays offer cost-effective, reliable gene expression and genotyping solutions, maintaining ~25% market share.

Q. Which region held the largest share in the genomics data analysis market in 2024?

North America led the market, driven by advanced healthcare infrastructure, extensive R&D, and strong regulatory support.

Q. What is driving the fastest growth in the genomics data analysis market regionally?

Asia Pacific is the fastest-growing region due to rising investments, improving healthcare infrastructure, and increasing genomics research.

Q. What are the main challenges restraining market growth?

High costs, data privacy concerns, regulatory complexities, and shortage of skilled bioinformaticians limit growth.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |