Germany Bancassurance Market

Germany Bancassurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Life Bancassurance and Non-Life Bancassurance), By Distribution Channel (Banks and Insurance Companies), and Germany Bancassurance Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

Germany Bancassurance Market Insights Forecasts to 2035

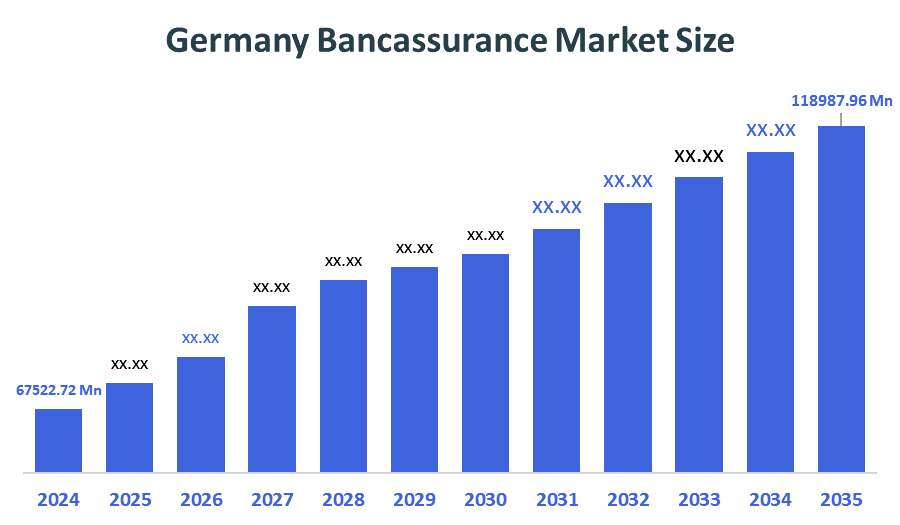

- The Germany Bancassurance Market Size was estimated at USD 67522.72 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.29% from 2025 to 2035

- The Germany Bancassurance Market Size is Expected to Reach USD 118987.96 Million by 2035

According to a research report published by Spherical Insights & Consulting, the Germany Bancassurance Market is anticipated to reach USD 118987.96 million by 2035, growing at a CAGR of 5.29% from 2025 to 2035. The German government's strong banking system, changing pension demands, and a well-balanced mix of digital and advisory-based distribution are the main factors driving the market. The need for retirement-focused products has increased due to pension reforms and an aging population, and omnichannel distribution guarantees convenience and individualized advice.

Market Overview

The German bancassurance market is the integrated distribution model in which banks work in conjunction with insurance companies to provide insurance products through banks. The bancassurance business model allows banks to capitalize on their existing customer base and trust by leveraging the bank’s foundations and infrastructure to facilitate the sale of life and non-life insurance policies. Additionally, developments in the Germany bancassurance market are focused on digital platforms, AI-driven advisory tools, and embedded insurance to simplify customer onboarding and customize product offerings. The industry has opportunities through the expansion of hybrid distribution models, open banking frameworks, and the ability to embed insurance into mobile banking applications for more customer engagement. With enhancements in data analytics and the adoption of cloud-based ecosystems, banks and insurers are able to create new revenue opportunities, optimize cross-selling, and respond to consumer demand in evolving retirement, health, and life protection needs.

Report Coverage

This research report categorizes the market for the Germany bancassurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany bancassurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany bancassurance market.

Driving Factors

The strong banking system, growing demand for integrated financial and insurance solutions, and an aging population looking for retirement and life insurance products are the main factors propelling the German bancassurance market. By using hybrid advisory models, digital transformation in the banking and insurance industries has improved customer engagement, and market penetration is further increased by regulatory support for long-term savings and financial inclusion. Effective cross-selling, increased product accessibility, and the reinforcement of bancassurance as a crucial distribution channel are made possible by strategic alliances between banks and insurers.

Restraining Factors

Increasing consumer preference for independent financial advisory channels, strict regulatory frameworks that restrict product bundling and cross-selling flexibility, and growing competition from digital-only insurance platforms are some of the factors that are limiting the German bancassurance market. Additionally, dwindling foot traffic in physical branches limits opportunities for in-person insurance sales, and legacy IT systems and data privacy concerns impede smooth integration between banks and insurers.

Market Segmentation

The Germany bancassurance market share is classified into type and distribution channel.

- The life bancassurance segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany bancassurance market is segmented by type into life bancassurance and non-Life bancassurance. Among these, the life bancassurance segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment is driven by an aging population, changing pension systems, and an increase in the demand for life insurance and retirement planning products. By providing reliable distribution channels, banks allow insurers to offer packaged financial solutions to a wide range of clients. The accessibility and engagement of products are further improved by regulatory support for long-term savings instruments and growing digitalization of advisory services. The effectiveness of cross-selling is being strengthened by strategic alliances between banks and insurers, which is propelling the steady growth of life insurance products via bancassurance platforms.

- The banks segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany bancassurance market is segmented by distribution channel into banks and insurance companies. Among these, the banks segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their large clientele, solid reputation, and capacity to provide integrated advisory channels for bundled financial and insurance products. While strategic alliances with insurers increase product diversity and cross-selling effectiveness, digital platform and data analytics advancements improve tailored insurance offerings. Banks' position as major insurance distributors is further reinforced by regulatory support for financial inclusion and the move toward hybrid distribution models, which will guarantee steady growth over the course of the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany bancassurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Allianz SE

- Deutsche Bank AG

- DZ Bank AG

- Commerzbank AG

- Sparkassen-Finanzgruppe

- Others

Recent Developments:

- In July 2025, Round2 Capital had invested a EUR 7-figure amount in Friendsurance, a Berlin-based InsurTech company, to support the growth of its digital bancassurance platform. The platform connected banks, insurers, and customers, enabled seamless digital sales of insurance products, and provided new revenue streams for banks. Friendsurance, a leader in the DACH region, aimed to expand its partnerships with key financial institutions and continued driving the digital transformation of bancassurance services.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany Bancassurance Market based on the below-mentioned segments:

Germany Bancassurance Market, By Type

- Life Bancassurance

- Non-Life Bancassurance

Germany Bancassurance Market, By Distribution Channel

- Banks

- Insurance Companies

FAQ’s

Q: What is the Germany bancassurance market size?

A: Germany Bancassurance Market is expected to grow from USD 67522.72 million in 2024 to USD 118987.96 million by 2035, growing at a CAGR of 5.29% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Important growth factors for the bancassurance market in Germany include the strong banking system, changing pension demands, aging demographics, hybrid advisory-digital channel distribution models, and increased requirement for investment and life insurance products with a retirement focus.

Q: What factors restrain the Germany bancassurance market?

A: Restrictions in the German bancassurance market are regulatory uncertainties, limited cross-selling effectiveness, digital disruptions, privacy issues regarding customer information, and reduced engagement in branch-based, independent financial advisory channels.

Q: Who are the key players in the Germany bancassurance market?

A: Allianz SE, Deutsche Bank AG, DZ Bank AG, Commerzbank AG, Sparkassen-Finanzgruppe, Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 172 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |