Germany Biopharmaceutical Manufacturing Market

Germany Biopharmaceutical Manufacturing Market Size, Share, and COVID-19 Impact Analysis, By Cell Culture (Mammalian Cell Culture and Microbial Cell Culture), By Class (Monoclonal Antibodies, Recombinant Proteins, Interferon, Granulocyte Colony-Stimulating Factor (G-CSF), Erythropoietin, Recombinant Human Insulin, Vaccines, and Human Growth Hormones (HGH)), and Germany Biopharmaceutical Manufacturing Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Germany Biopharmaceutical Manufacturing Market Insights Forecasts to 2035

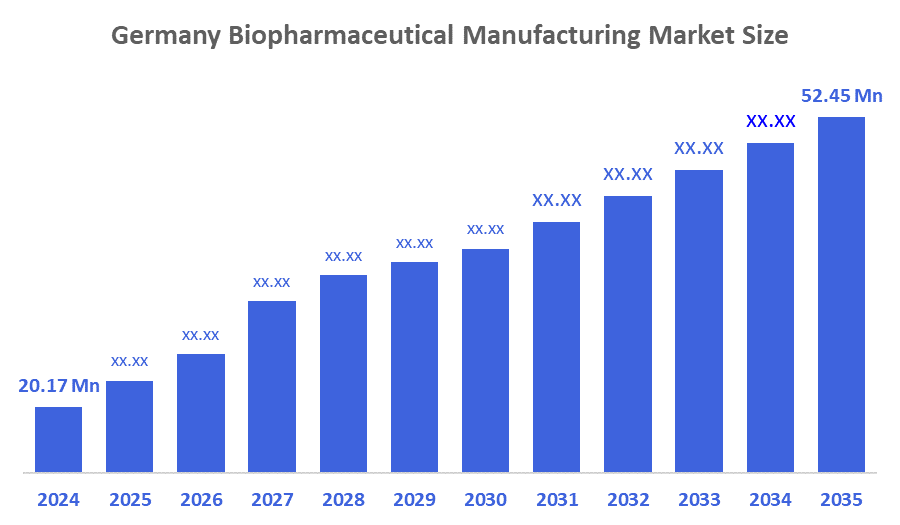

- The Germany Biopharmaceutical Manufacturing Market Size was estimated at USD 20.17 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.08% from 2025 to 2035

- The Germany Biopharmaceutical Manufacturing Market Size is Expected to Reach USD 52.45 Billion by 2035

According To a Research Report Published By Decisions Advisors & Consulting, the Germany Biopharmaceutical Manufacturing Market Size is Anticipated To Reach USD 52.45 Billion By 2035, Growing At a CAGR of 9.08% From 2025 to 2035.The strong R&D investments, a robust healthcare system, and high demand for innovative drugs, generics, and biosimilars, driven by an aging population, government regulations, and technological advancements, with key players expanding manufacturing and digital health solutions is augmenting the Germany pharmaceutical market share.

Market Overview

The organized industry in Germany devoted to the creation and mass manufacturing of pharmaceuticals derived from biological sources is known as the Germany Biopharmaceutical Manufacturing Market. Additionally, one of the main elements providing a positive market outlook is Germany's growing biotech ecosystem. A well-established network of academic institutions, research facilities, and innovation hubs is encouraging industry players to work together, fostering an innovative culture and rapid advancement. These businesses are able to introduce new biopharmaceuticals to the market due to the increased emphasis on providing biotech startups with a variety of funding programs and incubators. The collaboration between academia and industry is also facilitating cutting-edge research leading to useful applications, which is improving the development of new treatments. Furthermore, the existence of specialized talent in the life sciences ensures that businesses can successfully negotiate difficult obstacles in drug development and production, supporting the expansion of the German pharmaceutical market.

Report Coverage

This research report categorizes the market for the Germany biopharmaceutical manufacturing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany biopharmaceutical manufacturing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany biopharmaceutical manufacturing market.

Driving Factors

The main driving forces behind Germany's biopharmaceutical manufacturing sector are its location as Europe’s largest pharmaceutical location, skilled labour and academic-industry collaboration that drives innovation within Germany. The presence of major global companies such as Bayer, Merck KGaA, Boehringer Ingelheim and BioNTech creates competition and expedites technology transfer. The rise in partnerships with contract manufacturing organizations (CMOs) and the use of continuous and disposable manufacturing technologies also enhance scalability and cost reduction.

Restraining Factors

The biopharmaceutical manufacturing markets within Germany have a second set of constraints caused by their fragmented structure, with many smaller and mid-sized businesses that are unable to compete with larger multinational firms, which creates a pricing challenge and reduces economies of scale. The time it takes to get new products approved and put through the EU regulatory process is typically very long, delaying the product launch time.

Market Segmentation

The Germany biopharmaceutical manufacturing market share is classified into cell culture and class.

- The mammalian cell culture segment dominated the market in 2024, approximately 62% and is projected to grow at a substantial CAGR during the forecast period.

The Germany biopharmaceutical manufacturing market is segmented by cell culture into mammalian cell culture and microbial cell culture. Among these, the mammalian cell culture segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to the growing need for sophisticated biologics like recombinant proteins, monoclonal antibodies, and cutting-edge treatments that need mammalian systems for precise post-translational modifications and protein folding. Strong R&D investments by German pharmaceutical leaders like Boehringer Ingelheim, Merck KGaA, and BioNTech, coupled with supportive government initiatives and EU regulatory frameworks, further accelerate adoption.

- The monoclonal antibodies segment dominated the market in 2024, approximately 62% and is projected to grow at a substantial CAGR during the forecast period.

The Germany biopharmaceutical manufacturing market is segmented by class into monoclonal antibodies, recombinant proteins, interferon, granulocyte colony-stimulating factor (G-CSF), erythropoietin, recombinant human insulin, vaccines, human growth hormones (HGH). Among these, the monoclonal antibodies segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to rising demand for targeted therapies in oncology, autoimmune, and infectious diseases. Germany’s strong biopharmaceutical R&D ecosystem, supported by leading players such as Boehringer Ingelheim, Merck KGaA, and BioNTech, continues to advance antibody engineering, including bispecific antibodies and antibody-drug conjugates. Adoption is further accelerated by favorable regulatory frameworks and rising healthcare spending, while technological advancements in bioprocessing and cell culture improve production efficiency. The expansion of biosimilars and the rising incidence of chronic illnesses both support the monoclonal antibody market's steady growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany biopharmaceutical manufacturing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bayer AG

- Boehringer Ingelheim GmbH

- Merck KGaA

- BioNTech SE

- CureVac AG

- Evotec SE

- Rentschler Biopharma SE

- Leukocare AG

- Others

Recent Developments:

- In August 2024, Sanofi invested €1.3 Billion (USD 1.36 Billion) to expand its insulin production facility in Frankfurt, Germany, with the new site covered 36,000 m² and was set to become operational by 2029, with support from the German government and the Hesse state government, subject to European Union (EU) approval.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Germany Biopharmaceutical Manufacturing Market based on the below-mentioned segments:

Germany Biopharmaceutical Manufacturing Market, By Cell Culture

- Mammalian Cell Culture

- Microbial Cell Culture

Germany Biopharmaceutical Manufacturing Market, By Class

- Monoclonal Antibodies

- Recombinant Proteins

- Interferon

- Granulocyte Colony-Stimulating Factor (G-CSF)

- Erythropoietin

- Recombinant Human Insulin

- Vaccines

- Human Growth Hormones (HGH)

FAQ’s

Q: What is the Germany biopharmaceutical manufacturing market size?

A: Germany Biopharmaceutical Manufacturing Market is expected to grow from USD 20.17 billion in 2024 to USD 52.45 billion by 2035, growing at a CAGR of 9.08% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: The Germany biopharmaceutical manufacturing market is driven by strong R&D investments, advanced healthcare infrastructure, rising demand for biologics and biosimilars, aging population, supportive government regulations, and technological innovations enhancing production efficiency.

Q: What factors restrain the Germany biopharmaceutical manufacturing market?

A: The high production costs, complicated regulations, a lack of skilled labor, supply chain vulnerabilities, and fierce international competition limit the scalability and profitability of domestic manufacturers in Germany's biopharmaceutical manufacturing market.

Q: Who are the key players in the Germany biopharmaceutical manufacturing market?

A: Bayer AG, Boehringer Ingelheim GmbH, Merck KGaA, BioNTech SE, CureVac AG, Evotec SE, Rentschler Biopharma SE, Leukocare AG, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |