Germany Bottled Water Market

Germany Bottled Water Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Still, Carbonated, Flavored, and Mineral), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Direct Sales, On-Trade, and Others), and Germany Bottled Water Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Germany Bottled Water Market Size Insights Forecasts to 2035

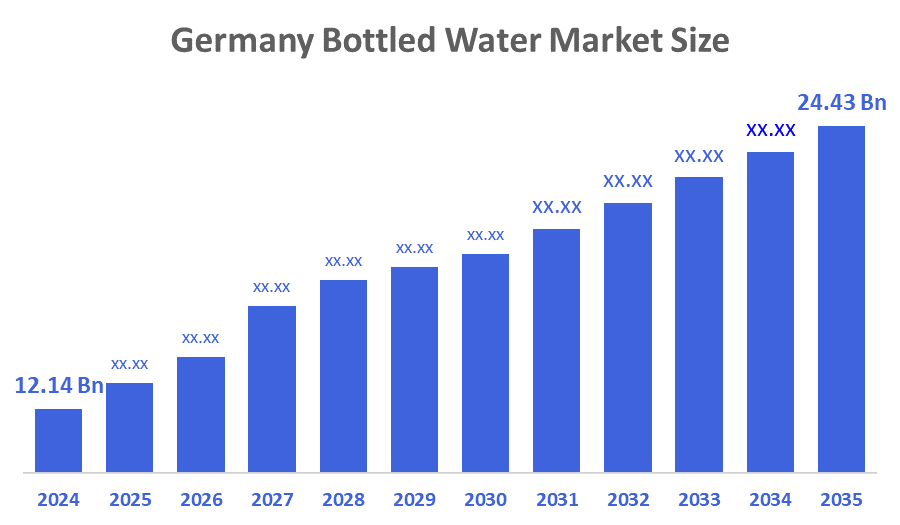

- The Market Size was estimated at USD 12.14 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.56% from 2025 to 2035

- The Germany Bottled Water Market Size is Expected to Reach USD 24.43 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Germany Bottled Water Market Size is anticipated to Reach USD 24.43 Billion by 2035, Growing at a CAGR of 6.56% from 2025 to 2035. The market is driven by strong health consciousness, stringent water quality regulations, and a societal preference for mineral and carbonated water. Due to its simplicity and purity, German consumers favor bottled water over sweetened beverages.

Market Overview

In Germany, the bottled water market encapsulates the production, marketing, distribution, and consumption of packaged, drinkable water throughout Germany, and encompasses many different types of water that are bottled after they have been purified, whether they come from a natural spring, a well, or even municipal source. Further exciting opportunity is the growing consumer focus on sustainability. Brands that invest in biodegradable materials, recycled plastics, or reusable solutions can obtain a competitive advantage as environmental concerns fuel the demand for eco-friendly packaging. Additionally, promoting sustainability narratives, cutting transportation emissions, and sourcing water locally appeal to consumers who care about the environment. In parallel, the accessibility of bottled water products has increased due to the quick development of e-commerce platforms. Brands can reach a larger audience through online sales channels, especially for niche and high-end products. Companies may capitalize on the convenience-driven tastes of contemporary consumers and propel the growth of the German bottled water market by maximizing their online presence and guaranteeing flawless delivery experiences.

Report Coverage

This research report categorizes the market for the Germany bottled water market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany bottled water market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany bottled water market.

Driving Factors

German consumers are now more willing to spend money on high-end bottled water products as a result of the country's economic growth and growing disposable incomes. Because it appeals to people who prefer effervescent options over still water, sparkling water continues to dominate the market. Private-label products, on the other hand, are becoming more popular because they provide affordable substitutes without sacrificing quality. The market is also characterized by innovation and premiumization, as companies launch limited-edition goods, functional beverages, and flavored waters to appeal to discriminating consumers. These patterns demonstrate how the German market for bottled water has changed dynamically.

Restraining Factors

The market for bottled water is extremely competitive, which creates additional difficulties. Private-label brands are becoming more well-known by providing affordable substitutes. As a result of the increased competition, well-known brands are being forced to stand out through premium products and innovation. Pressures on production and operations are also exacerbated by economic factors like inflation and growing raw material costs. The market for high-end bottled water products is impacted by consumers' tendency to choose less expensive options or cut back on discretionary spending during economic downturns.

Market Segmentation

The Germany bottled water market share is classified into product type and distribution channel.

- The carbonated segment dominated the market in 2024, approximately 25.5% and is projected to grow at a substantial CAGR during the forecast period.

The Germany bottled water market is segmented by product type into still, carbonated, flavored, and mineral. Among these, the carbonated segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to sparkling hydration is strongly preferred in culture and is thought to have digestive benefits. Widespread availability in grocery stores, eateries, and vending machines, as well as brand-led advancements in packaging and carbonation levels, all contribute to growth.

- The supermarkets and hypermarkets segment dominated the market in 2024, approximately 74% and is projected to grow at a substantial CAGR during the forecast period.

The Germany bottled water market is segmented by distribution channel into supermarkets and hypermarkets, convenience stores, direct sales, on-trade, and others. Among these, the supermarkets and hypermarkets segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. Driven by their large retail presence, high customer traffic, and capacity to provide a variety of bottled water formats, including flavored, premium mineral, and still and carbonated varieties. Strong brand alliances, promotional pricing, and bulk packaging options that appeal to both individual and family consumers are advantages of these outlets.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany bottled water market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Gerolsteiner Brunnen GmbH & Co. KG

- Hassia Mineralquellen GmbH & Co. KG

- Adelholzener Alpenquellen GmbH

- Rhodius Mineralquellen und Getränke GmbH & Co. KG

- Staatl. Fachingen Heil- und Mineralbrunnen GmbH

- Vilsa-Brunnen Otto Rodekohr GmbH

- Others

Recent Developments:

- In August 2024, Refresco Deutschland, a major independent beverage bottler for private-label brands in Germany, had declared that it had finalized an agreement with Vivaris GmbH & Co. KG, a subsidiary of Berentzen-Gruppe AG, to acquire the Grüneberg site in Brandenburg. 'Märkisch Kristall' and 'Grüneberg Quelle' were mineral water brands that Refresco had purchased together with the site. Different beverages and lemonades were being manufactured in Grüneberg. Moreover, Refresco and Vivaris had reached an understanding to maintain the production of the Vivaris brand Mio Mio under a contract bottling arrangement.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Germany Bottled Water Market based on the below-mentioned segments:

Germany Bottled Water Market, By Product Type

- Still

- Carbonated

- Flavored

- Mineral

Germany Bottled Water Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Direct Sales

- On-Trade

- Others

FAQ’s

Q: What is the Germany bottled water market size?

A: Germany Bottled Water Market is expected to grow from USD 12.14 billion in 2024 to USD 24.43 billion by 2035, growing at a CAGR of 6.56% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: The demand for flavored and functional water, growing health consciousness, growing preference for safe and convenient hydration, and growing retail and on-the-go consumption channels throughout German cities are some of the major growth drivers.

Q: What factors restrain the Germany bottled water market?

A: Growing consumer preference for reusable bottles and environmentally friendly hydration options, regulatory pressures on packaging sustainability, fierce competition from tap water, and growing environmental concerns about plastic waste are some of the main obstacles.

Q: Who are the key players in the Germany bottled water market?

A: Gerolsteiner Brunnen GmbH & Co. KG, Hassia Mineralquellen GmbH & Co. KG, Adelholzener Alpenquellen GmbH, Rhodius Mineralquellen und Getränke GmbH & Co. KG, Staatl. Fachingen Heil- und Mineralbrunnen GmbH, Vilsa-Brunnen Otto Rodekohr GmbH, Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 185 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |