Germany Cement Market

Germany Cement Market Size, Share, and COVID-19 Impact Analysis, By Type (Blended, Portland, and Others), By End-Use (Residential, Commercial, and Infrastructure), and Germany Cement Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

Germany Cement Market Insights Forecasts to 2035

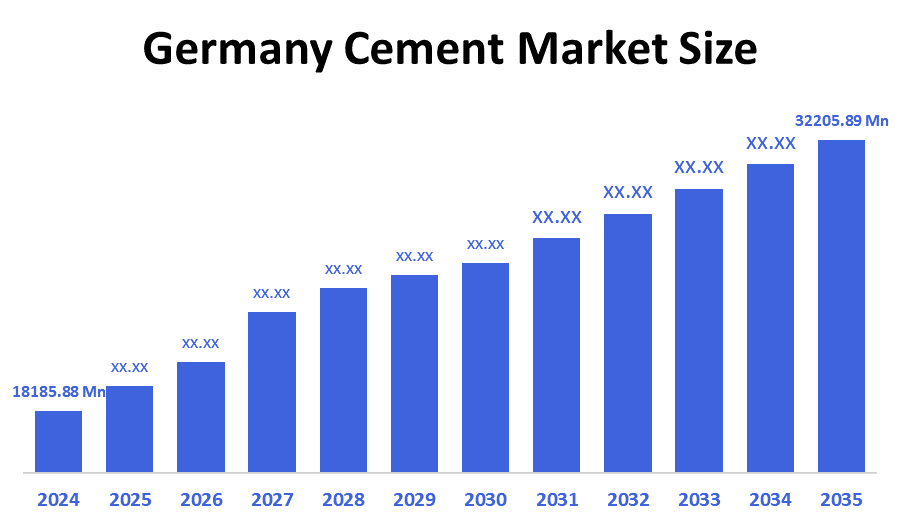

- The Germany Cement Market Size was estimated at USD 18185.88 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.33% from 2025 to 2035

- The Germany Cement Market Size is Expected to Reach USD 32205.89 Million by 2035

According to a research report published by decision advisor & Consulting, the Germany Cement Market is anticipated to reach USD 32205.89 million by 2035, growing at a CAGR of 5.33% from 2025 to 2035. Strict energy-efficiency laws encouraging sustainable cement use in the residential and commercial sectors are driving the market.

Market Overview

Germany's cement market pertains to the manufacturing, distribution, and consumption of cement materials utilized in a variety of construction and infrastructure initiatives throughout the country. The cement market consists of a variety of cement types and technologies in accordance with national sustainability targets, regulations, and efforts to modernize industry. Additionally, customized concrete formulations that meet energy-efficient design requirements are needed for smart city frameworks that emphasize sustainable mobility hubs and mixed-use commercial centers. In response, cement manufacturers have made research investments and worked with regulatory agencies to create product variations that comply with Germany's Ecodesign Directive. In order to meet Germany's climate targets, local production facilities are also incorporating carbon capture methods and updating kiln operations. In a competitive European framework, the combination of strict environmental regulations and market-driven sustainability demands is strengthening cement's role in energy-optimized construction and directly bolstering the growth of the German cement market.

Report Coverage

This research report categorizes the market for the Germany cement market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany cement market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany cement market.

Driving Factors

Germany's solid industrial foundation along with a transition to more sustainable manufacturing techniques is driving interest in specialty cement solutions. In 2023, total construction investment in Germany amounted to €486 billion, a significant proportion of which was invested in residential construction (61%). Construction employment rose to 2.65 million (+0.5% year-on-year). Upgrades to factories, warehouses, and production plants increasingly feature energy-efficient designs and sustainable construction standards including DGNB (German Sustainable Building Council) certification standards. Cement is used to produce durable flooring, corrosion-resistant industrial pavements, and heavy-duty pavements for logistics centers, especially in the Rhineland, North Rhine-Westphalia, and Bavaria. At the same time, Germany's renewable energy transition Energiewende centers on building out wind farms, solar facilities, and energy storage facilities. All of which will require large amounts of cement for foundations, turbine bases, and other supplementary facilities. Cement formulations with lower embodied carbon content are now being specified in contracts to meet corporate decarbonization strategies.

Restraining Factors

The market for cement in Germany is constrained by strict environmental laws, high production and energy costs, and mounting pressure to lower carbon emissions. Operating efficiency is further challenged by the slow adoption of digital technologies and the limited availability of substitute raw materials. Long-term investment and scalability in the industry are also hampered by regulatory delays in approving low-carbon cement formulations and shifting demand from the construction sector, particularly in residential projects.

Market Segmentation

The Germany cement market share is classified into type and end-use.

- The blended segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany cement market is segmented by type into blended, Portland, and others. Among these, the blended segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to industry-wide initiatives to lower CO2 emissions, stricter environmental regulations, and growing demand for low-carbon building materials. Additional cementitious materials like fly ash, slag, and limestone are incorporated into blended cement to reduce the amount of clinker and improve sustainability. Its growth is also aided by government subsidies, green building certifications, and the growing use of circular construction techniques.

- The infrastructure segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany cement market is segmented by end-use into residential, commercial, and infrastructure. Among these, the infrastructure segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This growth is driven by ongoing public spending on energy transition initiatives, transportation, and climate-resilient urban planning. The demand for cement is being driven by significant projects like the modernization of highways, the growth of the rail network, and the construction of renewable energy infrastructure, such as wind and hydrogen facilities. Long-term growth in this market is further supported by the government's pledge to upgrade aging infrastructure and decarbonize construction, which is consistent with a rise in the use of low-carbon cement solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany cement market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Heidelberg Materials

- Holcim Germany

- Master Builders Solutions

- Others

Recent Developments:

- In December 2024, Fluor Corporation had secured a Front-end Engineering and Design (FEED) contract from Heidelberg Materials for integrating an industrial-scale carbon capture and storage (CCS) system at its Geseke cement production facility in Germany. The GeZero project had aimed to capture 700,000 tons of CO? annually, with construction scheduled to begin in 2026 and commissioning expected three years later. This initiative had marked a significant step in decarbonizing Germany’s cement industry, directly impacting future sustainability goals and long-term cement market dynamics.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. decision advisor has segmented the Germany Cement Market based on the below-mentioned segments:

Germany Cement Market, By Type

- Blended

- Portland

- Others

Germany Cement Market, By End-Use

- Residential

- Commercial

- Infrastructure

FAQ’s

Q: What is the Germany cement market size?

A: Germany Cement Market is expected to grow from USD 18185.88 million in 2024 to USD 32205.89 million by 2035, growing at a CAGR of 5.33% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: The modernization of infrastructure, the need for low-carbon building materials, government sustainability regulations, urban redevelopment initiatives, and industry investments in carbon-neutral cement production technologies and digital process optimization are the main factors propelling the cement market in Germany.

Q: What factors restrain the Germany cement market?

A: The market for cement in Germany is constrained by strict environmental laws, high energy expenses, pressure to reduce carbon emissions, a lack of substitute raw materials, and a sluggish adoption of digital technologies in conventional production methods.

Q: Who are the key players in the Germany cement market?

A: Heidelberg Materials, Holcim Germany, Master Builders Solutions, Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 185 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |