Germany Commercial Insurance Market

Germany Commercial Insurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, and Others), By Enterprise Size (Large Enterprises and Small and Medium-sized Enterprises), and Germany Commercial Insurance Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Germany Commercial Insurance Market Size Insights Forecasts to 2035

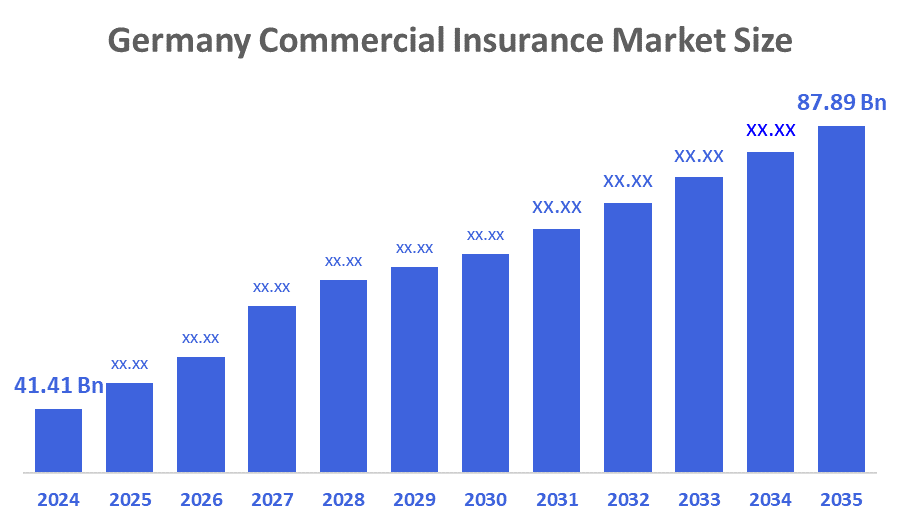

- The Germany Commercial Insurance Market Size was estimated at USD 41.41 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.08% from 2025 to 2035

- The Germany Commercial Insurance Market Size is Expected to Reach USD 87.89 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Germany Commercial Insurance Market Size is anticipated to Reach USD 3589.4 Million by 2035, Growing at a CAGR of 7.08% from 2025 to 2035. The market is growing as a result of strategic acquisitions and rising adoption of cutting-edge technology.

Market Overview

The commercial insurance market in Germany is the system of insurance products and services to protect businesses operating in Germany against financial loss from operational risks, legal liability, property damage, employee-related exposures, or other unexpected events. It consists of a broad spectrum of coverage solutions tailored for companies of all types and sizes throughout all industries, provided by both traditional insurers and brokers, as well as increasingly by digital platforms. Additionally, the modernization of IT is more and more becoming a key driver of efficiency and innovation in the German commercial insurance market. In the response to evolving company needs, high technology helps improve both the operational process and product offerings. VPV Versicherungen launched its first commercial insurance products utilizing Faktor Zehn technology in June 2025, marking a significant moment in the modernization of its IT infrastructure. By combining Faktor Zehn policy management and claims handling technology, VPV was able to release contents, business interruption, and liability coverage to improve flexibility and responsiveness in its commercial insurance business. This development also contributed directly to the growth of the German commercial insurance market, while at the same time allowing VPV to provide more tailored and scalable solutions to its clients and improve operational efficiency.

Report Coverage

This research report categorizes the market for the Germany commercial insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany commercial insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany commercial insurance market.

Driving Factors

The growing need for specialized risk solutions across industries, particularly in response to growing cyber threats, climate-related risks, and regulatory compliance requirements, is propelling Germany's commercial insurance market. Product innovation and distribution efficiency have increased due to the nation's robust industrial base, growing SME sector, and increasing digitalization of insurance services. Customer engagement and operational agility have also been improved by the rise of InsurTechs and digital-first platforms, and companies are being prompted to adopt more extensive and sustainable insurance portfolios by cross-border workforce trends and ESG regulations.

Restraining Factors

The high level of market fragmentation in Germany's commercial insurance market, which makes distribution and customer acquisition more difficult because there are more than 46,000 brokers, is one of the market's limiting factors. Insurers also face difficulties with regulatory complexity and compliance costs, particularly when modifying their products to comply with changing EU regulations. Permeation and scalability are further hampered by traditional brokers' low digital adoption and SMEs' low awareness.

Market Segmentation

The Germany commercial insurance market share is classified into type and enterprise size.

- The commercial property insurance segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany commercial insurance market is segmented by type into liability insurance, commercial motor insurance, commercial property insurance, marine insurance, and others. Among these, the commercial property insurance segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to growing demand from the real estate, logistics, and industrial sectors all of which are growing as a result of infrastructure modernization and digitization. Increasing climate-related risks and regulatory pressures are driving businesses to seek comprehensive coverage for physical assets, which further supports growth.

- The large enterprises segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany commercial insurance market is segmented by enterprise size into large enterprises and small and medium-sized enterprises. Among these, the large enterprises segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Driven by their broad operational reach, intricate risk profiles, and increased insurance penetration across various business sectors. Growing demand for specialized coverage in areas like property protection, global liability, and cyber risk, particularly among multinational corporations and industrial players, is another factor driving growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany commercial insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Allianz SE

- Munich Re

- Talanx AG

- HDI Global SE

- ERGO Group AG

- AXA Konzern AG

- Debeka Group

- Others

Recent Developments:

- In June 2025, Feather had launched a digital-first business insurance product targeting companies with expat employees across Europe. The service, which covered health, life, pension, and liability insurance, aimed to address inefficiencies in commercial insurance for international staff and enhanced the market by offering tailored coverage for cross-border workforces.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Germany Commercial Insurance Market based on the below-mentioned segments:

Germany Commercial Insurance Market, By Type

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

Germany Commercial Insurance Market, By Enterprise Size

- Large Enterprises

- Small and Medium-sized Enterprises

FAQ’s

Q: What is the Germany commercial insurance market size?

A: Germany Commercial Insurance Market is expected to grow from USD 41.41 billion in 2024 to USD 87.89 billion by 2035, growing at a CAGR of 7.08% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: The demand for customized coverage across the manufacturing, construction, and real estate sectors, as well as regulatory changes, growing risk awareness, and the consolidation of private equity-backed brokerages, are some of the major growth drivers.

Q: What factors restrain the Germany commercial insurance market?

A: Primary restraints are market fragmentation, lack of digital maturity on broker's part, regulatory complexity and pricing competition. Restraints inhibit scalability, operational efficiency, and therefore the build-up for customer acquisition and retention.

Q: Who are the key players in the Germany commercial insurance market?

A: Allianz SE, Munich Re,Talanx AG, HDI Global SE, ERGO Group AG, AXA Konzern AG, Debeka Group, Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 212 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |