Germany Compact Road Sweeper Market

Germany Compact Road Sweeper Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Mechanical Sweepers, Vacuum Sweepers), By Fuel Type (Diesel, Electric), By Application (Municipal, Industrial, Commercial) And Germany Compact Road Sweeper Market Insights, Industry Trend, Forecast To 2035

Report Overview

Table of Contents

Germany Compact Road Sweeper Market Size Insights Forecasts to 2035

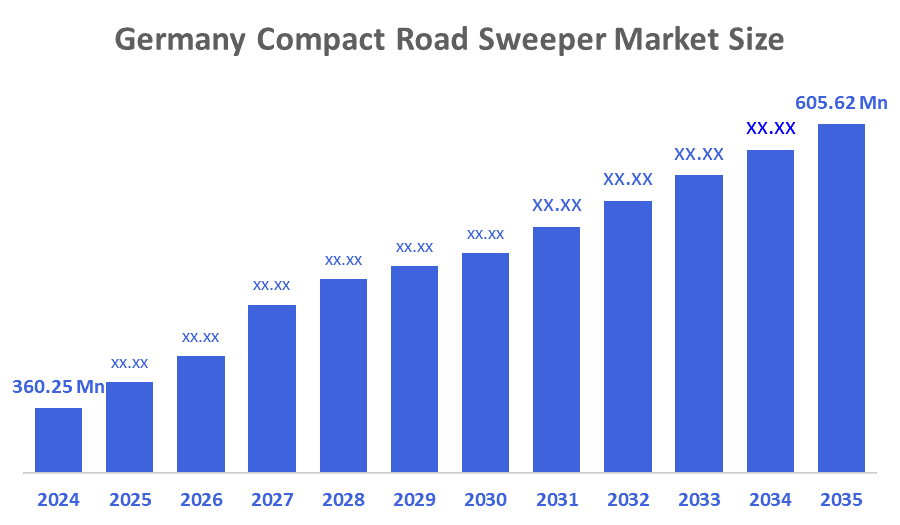

- Germany Compact Road Sweeper Market Size Was Estimated at USD 360.25 Million in 2024.

- The Market Size is Expected to Grow at a CAGR of Around 4.84% from 2025 to 2035.

- Germany Compact Road Sweeper Market Size is Expected to Reach USD 605.62 Million by 2035.

According to a Research Report Published by Decisions Advisors & Consulting, The Germany Compact Road Sweeper Market Size is anticipated to Reach USD 605.62 Million by 2035, Growing at a CAGR of 4.84% from 2025 to 2035. The market is driven by rising urbanization, stringent environmental regulations, increased municipal spending on smart city infrastructure, and growing adoption of electric sweepers.

Market Overview

Compact road sweepers refer to the vehicles that are specially designed to remove dust, debris, and waste from different areas such as streets, sidewalks, parking areas, and public spaces and thus keep them clean. These vehicles are necessary for local authorities, industrial areas, and commercial places, in particular, they are very useful in narrow streets of the city where larger vehicles are not able to move. Their operations can be on city streets, pedestrian areas, parks, and parking spaces. Germany is very instrumental in the entire Europe’s compact road sweeper market. The country was able to make an export of 509,392 units worth 285.83 million USD to the world in 2024. Imports in 2023 amounted to 274.77 million USD, mainly from China, Czech Republic, and Poland. This is an indication of Germany’s powerful production base as well as the use of sophisticated technology in the country.

Some of the technological innovations are electrification of drivetrains, hybrid drivetrains, robotized route planning, and the use of the advanced dust filtration component, all of which enhance the result of the work and minimize the unfriendly effect on nature. The government subsidies of fleet modernization such as the Saarbrücken 2025 electrically driven street-sweeper purchase and urban clean air programs aligned with EU PM10/PM2.5 directives, are some indications that the future is bright for this sector. The continuous investment in environmentally friendly fleets, smart city cleaning solutions, and adherence to environmental regulations will, most probably, increase the market potential until 2035.

Report Coverage

This research report categorizes the market for the Germany compact road sweeper market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany compact road sweeper market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany compact road sweeper market.

Driving Factors

The demand for the cleaner streets and the effective waste management of the urban areas has been the main reason for the growth of the Germany compact road sweeper market. The rising urban population and the increased municipal expenditure on the modern cleaning fleets have, together, been the main factors of the demand's growth. Urban areas have been choosing environmentally friendly, quiet machines with features such as automatic dust collection and intelligent route optimisation. The implementation of public programs on sustainability and the tightening of environmental regulations has been some of the other factors encouraging the use of the modern compact road cleaners.

Restraining Factors

The expensive initial and maintenance costs of advanced compact sweepers act as a major deterrent to the adoption of these tools by small municipalities. The limited knowledge of off-the-grid cleaning solutions coupled with the budget constraints have significantly slowed down the pace of fleet upgrades. In addition to the aforesaid challenges, difficulties in conforming to complex regulations and the need for operational training also discourage users.

Market Segmentation

The Germany compact road sweeper market share is categorized by product type, fuel type, and application.

- The mechanical Sweepers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany compact road sweeper market is segmented by product type into mechanical sweepers and vacuum sweepers. Among these, the mechanical sweepers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Mechanical sweepers are becoming more popular because of their long life, low maintenance costs, and ability to be used in narrow streets and heavily trafficked urban areas. Cities use them in frequent cleaning schedules as they provide stable results and have less downtime, thus they are a cost-efficient solution for small and medium city fleets.

- The diesel segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany compact road sweeper market is segmented by fuel type into diesel and electric. Among these, the diesel segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Diesel-powered sweepers lead the market mainly because they offer more power and longer working hours, thus large area cleaning can be done without the need for frequent refuelling. Their long-term reliability and easy servicing make them the best choice for municipalities that are in charge of large street networks and are looking for operational efficiency and cost control.

- The municipal segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany compact road sweeper market is segmented by application into municipal, industrial, and commercial. Among these, the municipal segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Local governments are choosing to buy more and more compact sweepers to be able to maintain the cleanliness of the city and meet the environmental regulations. The implementation of smart city projects, the need of frequent street cleaning, and the allocation of municipal budgets for modern fleets are the main factors that drive the demand for efficient and compact sweeping solutions that can be found all over Germany.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within The Germany compact road sweeper market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bucher Municipal

- Aebi Schmidt Group

- Kärcher Municipal

- FAUN Umwelttechnik

- Hako GmbH

- Johnston Sweepers

- Boschung Group

- Dulevo International

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

• In November 2025, ZKE (Central Municipal Waste Management Company), Saarbrücken released a public tender for the supply of an electrically powered small street sweeper with four-wheel steering for municipal street cleaning in Germany. The acquisition is part of a fleet modernization program for urban cleaning with low-emission vehicles to improve sustainability and operational efficiency.

• In October 2025, the City of Waiblingen Infrastructure Department raised a public tender for a 5 m³ compact street sweeper to support municipal road cleaning. The tender is a local government initiative to renew the urban sanitation equipment and enhance street hygiene. It also serves as a signal of continuing investment in public fleet renewal and municipal service efficiency.

Market Segment

This study forecasts revenue at the Germany, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Germany Compact Road Sweeper Market based on the following segments:

Germany Compact Road Sweeper Market, By Product Type

- Mechanical Sweepers

- Vacuum Sweepers

Germany Compact Road Sweeper Market, By Fuel Type

- Diesel

- Electric

Germany Compact Road Sweeper Market, By Application

- Municipal

- Industrial

- Commercial

FAQ’s

Q. What is the projected market size & growth rate of the Germany compact road sweeper market?

A. The Germany compact road sweeper market is expected to grow from USD 360.25 million in 2024 to USD 605.62 million by 2035, at a CAGR of 4.84% from 2025 to 2035.

Q. What are the key driving factors for the Germany compact road sweeper market?

A. The market is driven by increasing urban population, rising municipal investments in modern cleaning fleets, adoption of energy-efficient low-noise sweepers, smart route optimisation, and government sustainability programs.

Q. What are the major restraining factors in this market?

A. High purchase and maintenance costs, limited awareness of modern cleaning technologies, complex regulatory compliance, and operational training requirements limit market adoption.

Q. Which product type dominates the Germany compact road sweeper market?

A. Mechanical sweepers accounted for the largest revenue market share in 2024 due to durability, low maintenance costs, and suitability for narrow streets and high-traffic urban zones.

Q. Which fuel type holds the largest share in the market?

A. Diesel-powered sweepers dominated in 2024, offering higher power output, longer operational hours, proven reliability, and easier servicing for extensive municipal street cleaning.

Q. Which application segment is leading in the market?

A. The municipal segment accounted for the largest revenue share in 2024, driven by smart city projects, frequent street cleaning needs, and budget allocations for modern compact fleets.

Q. Who are the key players operating in the Germany compact road sweeper market?

A. Bucher Municipal, Aebi Schmidt Group, Kärcher Municipal, FAUN Umwelttechnik, Hako GmbH, Johnston Sweepers, Boschung Group, Dulevo International, and others.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 172 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |