Germany Confectionery Market

Germany Confectionery Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Hard-boiled Sweets, Mints, Gums and Jellies, Chocolate, Caramels and Toffees, Medicated Confectionery, Fine Bakery Wares, and Others), By Price Point (Economy, Mid-range, and Luxury), and Germany Confectionery Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Germany Confectionery Market Insights Forecasts to 2035

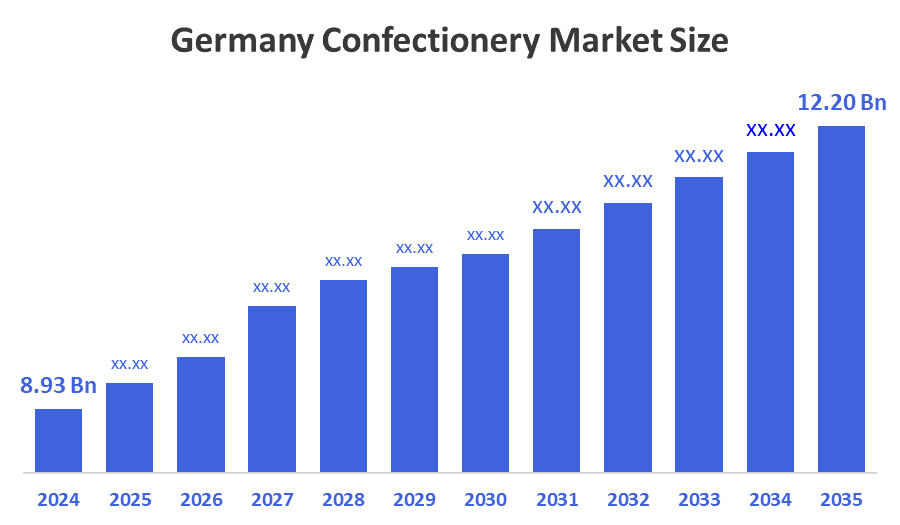

- The Germany Confectionery Market Size was estimated at USD 8.93 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.88% from 2025 to 2035

- The Germany Confectionery Market Size is Expected to Reach USD 12.20 Billion by 2035

According to a research report published by Decision Advisors the Germany confectionery market is anticipated to reach USD 12.20 billion by 2035, growing at a CAGR of 2.88% from 2025 to 2035. The market is driven by premiumization, clean-label demand, and an increase in enthusiasm for functional and plant-based products. Consumers are looking for indulgent experiences that align with their ethical values, health consciousness, and ingredient transparency.

Market Overview

The German confectionery market comprises the manufacturing, distribution, and consumption of sweet food items like confectionery chocolates, candies, gums, and baked goods. Germany is well known for its long history of confectionery manufacturing, reputation for quality, and is one of the largest producers and exporters of confectionery items in Europe. Additionally, the development of plant-based and functional confections that blend indulgence and wellbeing is gaining significant traction in Germany's confectionery market. According to the sources, the German cocoa-free chocolate company ChoViva introduced Peanut Butter Mini Eggs to the UK in February 2025 through Aldi's Dairyfine line, which was created in collaboration with WAWI-Schokolade AG for Easter retail sales.

Report Coverage

This research report categorizes the market for the Germany confectionery market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany confectionery market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany confectionery market.

Driving Factors

As consumer demand for quality, authenticity, and unique taste experiences rises, the German confectionery industry is seeing a growing emphasis on premium and artisanal products. Products that use locally produced specialties, traditional handcrafted production methods, and cocoa sourced sustainably are becoming more popular through specialty and retail channels. Manufacturers are focusing on provenance, craftsmanship, and limited-edition forms as a result of this premiumization trend, which is driven by consumers' desire for indulgence at affordable prices. When Lindt introduced 1,000 limited-edition "Dubai Chocolate" bars in Germany in November 2024, combining pistachio cream and knafeh, it attracted hundreds of customers and highlighted the rising demand for confections with Middle Eastern influences.

Restraining Factors

Growing health concerns about sugar intake are one of the factors holding back the German confectionery market, as consumers shift their preferences from traditional sweets to healthier options. Manufacturers are further challenged by regulatory pressures on sugar content, labeling, and advertising, particularly when it comes to reformulating products to meet changing standards.

Market Segmentation

The Germany confectionery market share is classified into product type and price point.

- The chocolate segment dominated the market in 2024, approximately 58.8% and is projected to grow at a substantial CAGR during the forecast period.

The Germany confectionery market is segmented by product type into hard-boiled sweets, mints, gums and jellies, chocolate, caramels and toffees, medicated confectionery, fine bakery wares, and others. Among these, the chocolate segment dominated the market in 2024, approximately 58.8% and is projected to grow at a substantial CAGR during the forecast period. The segmental growth due to Germany's robust domestic demand, premiumization trends, and export reputation for premium chocolate. Artisanal, organic, and ethically sourced products are becoming more and more popular with consumers, and market appeal is increased by innovations in flavors, formats, and sustainable packaging.

- The mid-range segment dominated the market in 2024, approximately 52% and is projected to grow at a substantial CAGR during the forecast period.

The Germany confectionery market is segmented by price point into economy, mid-range, and luxury. Among these, the mid-range segment dominated the market in 2024, approximately 52% and is projected to grow at a substantial CAGR during the forecast period. The segmental growth due to the strikes the ideal balance between price and quality, making it appealing to Germany's wide range of customers. Strong brand recognition, steady product innovation, and broad availability in supermarkets, specialty shops, and e-commerce platforms are all advantages for this market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany confectionery market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Haribo

- Ritter Sport

- Storck

- Katjes

- Others

Recent Developments:

- In March 2025, Mars Wrigley launched its new frozen snack brand trüfrü in Germany following a successful pilot in summer 2024. trüfrü appeared on shelves at REWE stores nationwide and featured hyper-chilled strawberries, raspberries, and pineapple coated in layers of chocolate. The products were gluten-free and contained no artificial colors, flavors, or preservatives, offering a high-quality frozen treat to German shoppers.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Germany Confectionery Market based on the below-mentioned segments:

Germany Confectionery Market, By Product Type

- Hard-boiled Sweets

- Mints

- Gums and Jellies

- Chocolate

- Caramels and Toffees

- Medicated Confectionery

- Fine Bakery Wares

- Others

Germany Confectionery Market, By Price Point

- Economy

- Mid-range

- Luxury

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |