Germany Cryptocurrency Market

Germany Cryptocurrency Market Size, Share, and COVID-19 Impact Analysis, By Type (Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Dashcoin, and Others), By Component (Hardware and Software), and Germany Cryptocurrency Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Germany Cryptocurrency Market Insights Forecasts to 2035

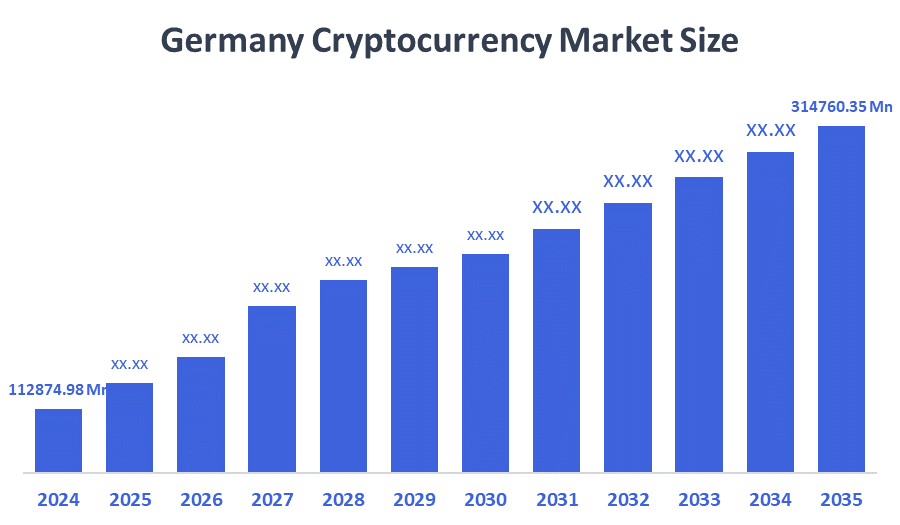

- The Germany Cryptocurrency Market Size was estimated at USD 112874.98 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.77% from 2025 to 2035

- The Germany Cryptocurrency Market Size is Expected to Reach USD 314760.35 Million by 2035

According to a research report published by Spherical Insights & Consulting, The Germany Cryptocurrency Market is anticipated to reach USD 314760.35 million by 2035, growing at a CAGR of 9.77% from 2025 to 2035. Fintech businesses are incorporating cryptocurrency into wallets, user-friendly apps, and hybrid financial products.

Market Overview

The Germany cryptocurrency market denotes the total environment and activity pertaining to the use, trading, investing, and regulating of digital currencies in Germany. It includes the infrastructure, players, and institutions involved in the buying, selling, mining, and exchanging of cryptocurrencies including Bitcoin, Ethereum, and others. Additionally, to make it simpler for consumers and businesses to interact with cryptocurrencies, German fintech startups are creating crypto-friendly platforms like trading apps, digital wallets, and decentralized finance (DeFi) services. These developments help normalize the use of cryptocurrencies by lowering the barriers to purchasing, selling, and storing digital assets. Furthermore, partnerships between fintech companies and conventional financial institutions are producing hybrid services that appeal to mainstream investors, such as investment products and loans backed by cryptocurrency. A key component of cryptocurrency adoption, trust is increased by fintech's focus on user experience and compliance.

Report Coverage

This research report categorizes the market for the Germany cryptocurrency market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany cryptocurrency market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany cryptocurrency market.

Driving Factors

Germany's market is expanding due to increased retail participation. Entry barriers are quickly falling as more people have access to digital financial tools, such as easy-to-use cryptocurrency trading apps and wallets. Cryptocurrencies are being viewed by younger generations, especially millennials and Gen Z, as an alternative investment and a hedge against inflation and low interest rates in conventional savings products. Long-term demand in the retail sector is being driven by this generational shift as well as rising financial literacy and awareness of digital assets.

Restraining Factors

The regulatory ambiguity surrounding the classification and taxation of digital assets, the lack of institutional participation owing to compliance risks, and ongoing worries about fraud and cybersecurity are some of the factors that are holding back Germany's cryptocurrency market. Further limiting market expansion are conservative banking practices, the slow integration of blockchain infrastructure across legacy financial systems, and high energy costs and environmental scrutiny that impede domestic cryptocurrency mining.

Market Segmentation

The Germany cryptocurrency market share is classified into type and component.

- The bitcoin segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany cryptocurrency market is segmented by type into bitcoin, ethereum, bitcoin cash, ripple, litecoin, dashcoin, and others. Among these, the bitcoin segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to growing institutional interest, more transparent regulations regarding the custody of digital assets, and growing integration with popular financial platforms like Sparkassen's app through DekaBank. Adoption is further supported by the growing demand for decentralized investment options in the face of inflationary pressures, as well as by improved retail accessibility via fintech apps and integrated banking services.

- The software segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany cryptocurrency market is segmented by component into hardware and software. Among these, the software segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to the growing use of trading platforms, digital wallets, and blockchain-based financial services in institutional and retail channels. Accessibility and trust are increased by regulatory support for crypto custody and tokenization as well as fintech integration into banking apps like Sparkasse's. Furthermore, software solutions' scalability, affordability, and energy neutrality when compared to hardware mining infrastructure position this market for long-term growth over the course of the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany cryptocurrency market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Solaris SE

- Finoa GmbH

- Krypto News Deutschland

- Tangany GmbH

- Bitwala

- Upvest GmbH

- Others

Recent Developments:

- In July 2025, Germany’s Sparkassen group had lifted its three-year ban on cryptocurrency, announcing intentions to offer Bitcoin and crypto trading via DekaBank by summer 2026. The service was planned to be integrated directly into the Sparkasse app within a regulated framework, signifying a major strategic shift for Germany's largest savings bank network. With approximately 50 million clients, Sparkassen’s entry into crypto was expected to serve as a substantial catalyst for cryptocurrency adoption across Germany.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Decision Advisiors has segmented the Germany Cryptocurrency Market based on the below-mentioned segments:

Germany Cryptocurrency Market, By Type

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dashcoin

- Others

Germany Cryptocurrency Market, By Component

- Hardware

- Software

FAQ’s

Q: What is the Germany cryptocurrency market size?

A: Germany Cryptocurrency Market is expected to grow from USD 112874.98 million in 2024 to USD 314760.35 million by 2035, growing at a CAGR of 9.77% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Rising fintech integration, youth-led retail adoption, demand to hedge against inflation, advantageous tax incentives, and growing e-commerce acceptance of digital assets and blockchain technologies are some of the major factors propelling the growth of the German cryptocurrency market.

Q: What factors restrain the Germany cryptocurrency market?

A: The German cryptocurrency market is being restrained by a number of factors, such as unclear regulations, a lack of institutional adoption, cybersecurity issues, fluctuating asset values, energy-intensive mining methods, and cautious banking sector use of digital currencies.

Q: Who are the key players in the Germany cryptocurrency market?

A: Solaris SE, Finoa GmbH, Krypto News Deutschland, Tangany GmbH, Bitwala, Upvest GmbH, Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |