Germany Cyber Insurance Market

Germany Cyber Insurance Market Size, Share, and COVID-19 Impact Analysis, By Insurance Type (Packaged and Stand-alone), By Component (Solution and Services), and Germany Cyber Insurance Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Germany Cyber Insurance Market Size Insights Forecasts to 2035

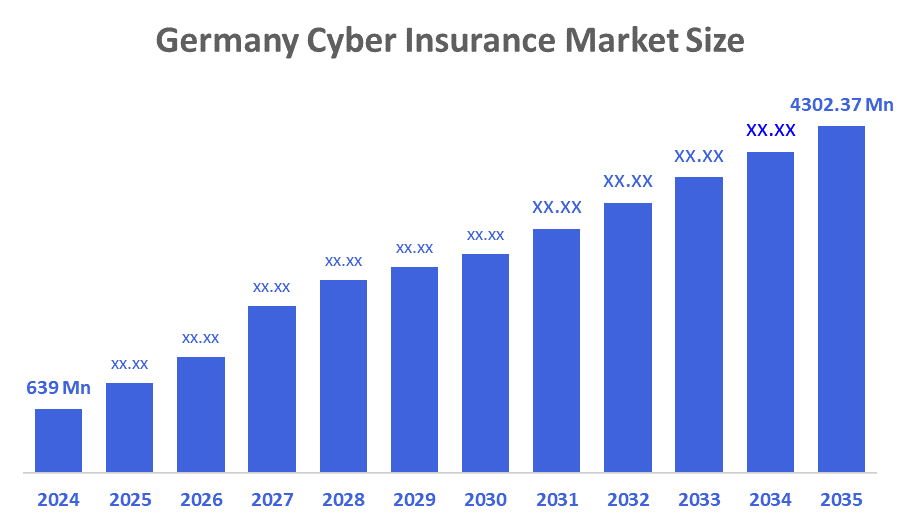

- The Germany Cyber Insurance Market Size was estimated at USD 639.00 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 18.93% from 2025 to 2035

- The Germany Cyber Insurance Market Size is Expected to Reach USD 4302.37 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Germany Cyber Insurance Market Size is anticipated to Reach USD 4302.37 Million by 2035, Growing at a CAGR of 18.93% from 2025 to 2035. The marketplace continues to grow as organizations move to digital operations and experience increasing cyber risk across industries. Growing awareness of data protection and regulatory pressure is creating demand for tailored insurance solutions and increasing the German cyber insurance market share among SMEs and larger enterprises.

Market Overview

The Cyber Insurance Market in Germany pertains to the business of supplying insurance products that assist companies and individuals to avoid financial losses triggered by a cyber event. Cyber events can involve a range of incidents including data breaches, ransomware attacks, network interruptions, identity theft, and other criminal cyber activities. Additionally, the German government has put in place a number of measures to encourage the expansion of the cyber insurance industry. The Cyber Security Strategy for Germany, which attempts to improve cybersecurity measures and resilience across sectors, is one important policy. To further guarantee the security and privacy of personal data, the government has also implemented data protection laws like the General Data Protection Regulation (GDPR). Businesses are now more aware of the value of cyber insurance in reducing the financial risks connected to data breaches and cyberattacks as a result of these regulations.

Report Coverage

This research report categorizes the market for the Germany cyber insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany cyber insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany cyber insurance market.

Driving Factors

The growing regulatory requirements for data protection and businesses' growing awareness of cyber threats make the German cyber insurance market an appealing place to invest. As businesses look for protection against monetary losses and harm to their reputations brought on by cyberattacks, the demand for cyber insurance is growing. The need for comprehensive insurance coverage is growing as a result of the increased potential for cyber risk brought about by the growth of cloud computing, IoT, and digital transformation. As companies prioritize cybersecurity measures and insurers create cutting-edge products to handle changing cyberthreats, investing in the German cyber insurance market may offer growth prospects.

Restraining Factors

The German cyber insurance market faces challenges for insurers and businesses alike. First, many businesses have limited awareness of what cyber risks entail and as a result, do not wish to invest in cyber insurance. Second, the rate at which cyber risks evolve creates challenges for insurers in ensuring accurate assessment and pricing of cyber insurance policies. This also creates challenges for updating policies in relation to emerging risks and coverage needs. In addition, regulations around data protection and cybersecurity create an additional layer of complexity to the market, requiring insurers to manage multiple compliance obligations.

Market Segmentation

The Germany cyber insurance market share is classified into insurance type and component.

- The packaged segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany cyber insurance market is segmented by insurance type into packaged and stand-alone. Among these, the packaged segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Driven by the growing need for integrated risk management solutions that incorporate proactive cybersecurity tools with financial protection. In light of growing cyber threats and regulatory pressures, businesses are favoring bundled offerings that include real-time threat detection, incident response, and vulnerability assessments in addition to traditional coverage. While insurers gain from increased risk visibility and fewer claims, SMEs looking for affordable, all-in-one solutions are also drawn to the packaged model.

- The solution segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany cyber insurance market is segmented by component into solution and services. Among these, the solution segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to the growing need for integrated platforms that provide proactive cybersecurity features in addition to coverage. Businesses, particularly SMEs, are placing a higher priority on automated risk assessments, incident response tools included in insurance packages, and real-time threat detection as cyber threats grow more complex. Both insurers and insureds find solution-based models more appealing as a result of the transition from reactive to preventive models, which improve operational resilience and lower the frequency of claims.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany cyber insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Allianz SE

- Munich Re

- HDI Global SE

- ERGO Group AG

- Cyber Risk Agency GmbH

- AXA Konzern AG

- Others

Recent Developments:

- In May 2025, Coalition had launched Active Cyber Insurance in Denmark and Sweden, backed by Allianz. This innovative offering had combined insurance coverage with cybersecurity tools, helping businesses mitigate digital risks. The move had significantly impacted the Nordic cyber insurance market by enhancing risk management capabilities for companies.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Germany Cyber Insurance Market based on the below-mentioned segments:

FAQ’s

Q: What is the Germany cyber insurance market size?

A: Germany Cyber Insurance Market is expected to grow from USD 639.00 million in 2024 to USD 4302.37 million by 2035, growing at a CAGR of 18.93% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Increased cyber threats, stricter data protection laws, increased industry digitization, growing cyber risk awareness, and the need for customized risk transfer solutions are some of the major factors propelling the German cyber insurance market's expansion.

Q: What factors restrain the Germany cyber insurance market?

A: Limited awareness of cyber risk among SMEs, complicated underwriting, changing threat landscapes, a lack of historical claims data, unclear regulations, and a lack of uniformity in coverage terms among providers are some of the restraining factors.

Q: Who are the key players in the Germany cyber insurance market?

A: Allianz SE, Munich Re, HDI Global SE, ERGO Group AG, Cyber Risk Agency GmbH, AXA Konzern AG, Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 166 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |