Germany Family Offices Market

Germany Family Offices Market Size, Share, and COVID-19 Impact Analysis, By Type (Single Family Office, Multi-Family Office, and Virtual Family Office), By Office Type (Founder?s Office, Multi-Generational Office, Investment Office, Trustee Office, Compliance Office, Philanthropy Office, Shareholder?s Office, and Others), and Germany Family Offices Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

Germany Family Offices Market Insights Forecasts to 2035

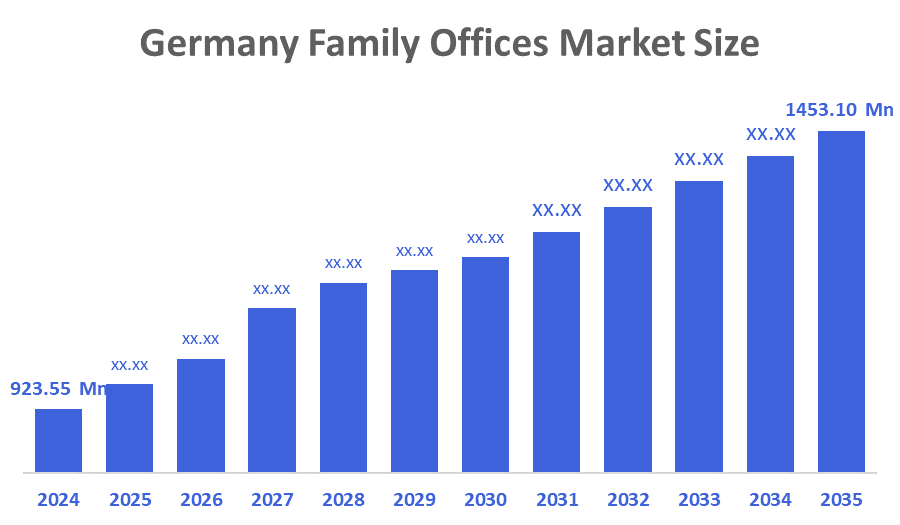

- The Germany Family Offices Market Size was estimated at USD 923.55 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.21% from 2025 to 2035

- The Germany Family Offices Market Size is Expected to Reach USD 1453.10 Million by 2035

According to a research report published by Decision Advisior & Consulting, the Germany Family Offices Market is anticipated to reach USD 1453.10 million by 2035, growing at a CAGR of 4.21% from 2025 to 2035. The market is significantly growing and this is mainly through diversified investment plans, global portfolios integration and ESG adoption. Besides, the higher investments in alternative assets, international partnerships and eco-friendly activities are not only making the portfolios more resilient but also fitting in with the changing priorities of investors.

Market Overview

The term Germany family offices market denotes a grouping of affluent families organized into professional structures that manage, protect, and increase their financial resources through the implementation of corporate governance, investment strategies, and inheritance planning. These offices function as independent organizations that administer the various areas of wealth management, estate planning, charity, and legal compliance, thus making sure the family wealth lasts for a long time. Additionally, ESG integration and sustainability are becoming the new normal for the German family office investment processes, reflecting the trend of wealth responsible stewardship. Huge amounts of capital are flowing into renewable energy projects, green real estate, fair trade businesses, and eco-friendly companies. Often, these investments are analysed through the lens of ESG frameworks, which enable one to measure the impact on the environment, society, and governance with accuracy. The younger generation in leadership positions is one of the factors that make this transition happen at a faster pace, since more attention is given by the younger decision-makers to the importance of the investment values that consider ethics and sustainability first.

Report Coverage

This research report categorizes the market for the Germany family offices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany family offices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany family offices market.

Driving Factors

The major reason behind the growth of Germany's family offices market is the transfer of wealth between generations, which compels the need for governance models, professional advisory services, and planning for successors to be properly structured. Furthermore, the aforementioned factors alongside the growing interest on the part of the wealthy families in charitable donations, social responsible investments, and eco-friendly legacy-building projects, increase the importance of family offices. More regulatory clarity, better investment opportunities worldwide, and the need for specialized skills are the factors that also contribute to the family offices' growth and their strategic relevance in the long run.

Restraining Factors

The limitations affecting Germany’s family offices market are the low-level digital transformation, investing trends leaning towards conservatism, and slow adaption of modern wealth management practices. Together, these factors make it harder for family offices in Germany to be Agile, and modern, and to position themselves competitively in the global financial ecosystems.

Market Segmentation

The Germany family offices market share is classified into type and office type.

- The single family office segment dominated the market in 2024, approximately 85% and is projected to grow at a substantial CAGR during the forecast period.

The Germany family offices market is segmented by type into single family office, multi-family office, and virtual family office. Among these, the single family office segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. Germany's wealth and the focus on privacy as well as strong direct control over assets, along with the need for specialized governance structures for complicated succession planning were the main drivers behind that issue. Single family offices are further strengthened by the increasing share going to alternative investments, integration of ESG and cross-border diversification.

- The multi-generational office segment dominated the market in 2024, approximately 65% and is projected to grow at a substantial CAGR during the forecast period.

The Germany family offices market is segmented by office type into founder’s office, multi-generational office, investment office, trustee office, compliance office, philanthropy office, shareholder’s office, and others. Among these, the multi-generational office segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. This trend is mainly caused by the fact that Germany is home to a number of very rich industrial families, and that there is a growing demand for planned and organized successions. Families are now more than ever focusing on the continuity of governance, the long-term preservation of wealth, and the planning of intergenerational transfers as means to protect their assets through several generations. The increasing interest in the areas of ESG integration, philanthropy, and investing in diversified global markets is also a factor that makes multi-generational offices stronger.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany family Offices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- THI Investments

- Family Trust Investor FTI

- Liberta Partners

- FORUM Family Office

- CSSP Holding

- ATHOS

- Others

Recent Developments:

- In August 2025, The Porsche-Piëch family's investment holding company, Porsche SE, stated that it was involving German family offices in co-investments in the defence industry. The company allocated as much as €2 billion for this purpose, demonstrating a strategic diversification beyond automotive assets and in line with rising European defence spending.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Decision Advisior has segmented the Germany Family Offices Market based on the below-mentioned segments:

Germany Family Offices Market, By Type

- Single Family Office

- Multi-Family Office

- Virtual Family Office

Germany Family Offices Market, By Office Type

- Founder’s Office

- Multi-Generational Office

- Investment Office

- Trustee Office

- Compliance Office

- Philanthropy Office

- Shareholder’s Office

- Others

FAQ’s

Q: What is the Germany family offices market size?

A: Germany Family Offices Market is expected to grow from USD 923.55 million in 2024 to USD 1453.10 million by 2035, growing at a CAGR of 4.21% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: The remarkable growth of Germany's family offices market is largely attributed to the adoption of diversified investment approaches, integration of ESG, increases in allocation towards alternative investments, forming alliances across borders, new technology, and changes in wealth management practices that are making portfolios more resilient to market fluctuations and therefore more sustainable in the long term.

Q: What factors restrain the Germany family offices market?

A: The market of family offices in Germany is encumbered with regulatory complications, succession issues, lack of proficient manpower, escalating operating expenses, cybersecurity problems, and disintegrated governance frameworks, which together slow down the process of efficiency, scaling, and building up strategic growth for the long term.

Q: Who are the key players in the Germany family offices market?

A: THI Investments, Family Trust Investor FTI, Liberta Partners, FORUM Family Office, CSSP Holding, ATHOS, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 201 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |