Germany Foreign Exchange Market

Germany Foreign Exchange Market Size, Share, and COVID-19 Impact Analysis, By Type (Currency Swap, Outright Forward and FX Swaps, and FX Options), By Counterparty Insights (Reporting Dealers, Other Financial Institutions, and Non-financial Customers), and Germany Foreign Exchange Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Germany Foreign Exchange Market Insights Forecasts to 2035

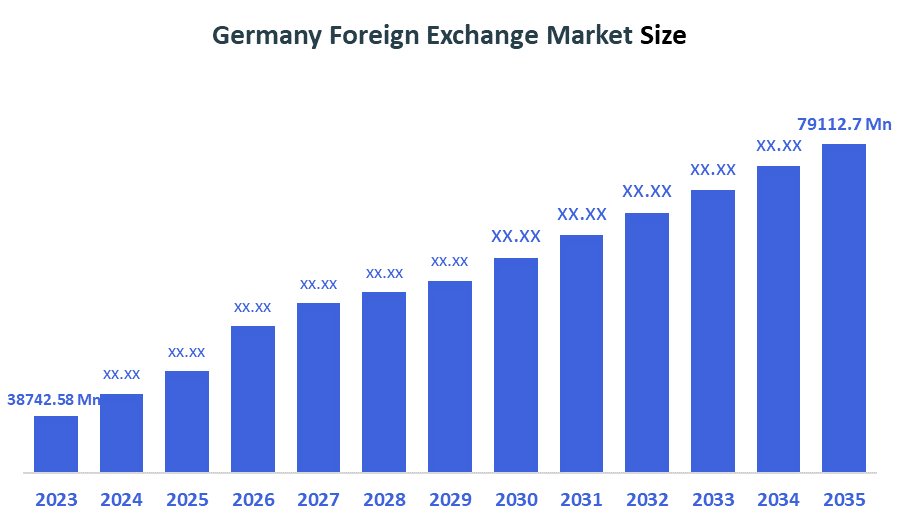

- The Germany Foreign Exchange Market Size was estimated at USD 38742.58 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.71% from 2025 to 2035

- The Germany Foreign Exchange Market Size is Expected to Reach USD 79112.7 Million by 2035

According to a research report published by Decision Advisor, the Germany Foreign Exchange Market is anticipated to reach USD 79112.7 million by 2035, growing at a CAGR of 6.71% from 2025 to 2035. The country's stability and high trade volumes, which result in steady demand for foreign exchange business, drive the market.

Market Overview

The German foreign exchange market is the organized setting for trading currencies inside and outside of Germany, including spot trades, derivatives, and cross-border settlements. The market is characterized by Germany's export-oriented economy, central role in the eurozone, and importance as a financial centre for institutional and corporate FX business. Additionally, Recent developments in the geopolitical landscape and changes in global trading dynamics have resulted in greater market volatility. Germany, as the largest exporter in Europe and an essential member of the eurozone, is particularly vulnerable to external trade disruptions, sanctions, and changes in global supply chains. Recent tensions with major trading partners, such as China, as well as the ongoing impacts of the Russia-Ukraine conflict, have resulted in abrupt changes in currency valuations and shifts in investor sentiment. These geopolitical developments are frequently exacerbated by speculative flows and aversion to risk from institutional investors that often enhance movements in the euro exchange rate. The market also reacts quickly to announcements on tariffs, energy security actions, and cross-border capital controls. The uncertainty associated with EU (level) fiscal policy-making, and Germany's pivotal role in shaping such policies, has added an additional level of complexity. In this context, FX derivatives markets (i.e., options, forwards) are experiencing heightened demand as participants hedge against macroeconomic uncertainty and currency risk attributable to Germany's reliance on global trade.

Report Coverage

This research report categorizes the market for the Germany foreign exchange market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany foreign exchange market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany foreign exchange market.

Driving Factors

The growth of the German foreign exchange market is being positively impacted by the financial sector's overall shift towards sustainability and environmental, social, and governance (ESG). Although ESG metrics have historically been outside the core scope of currency markets, they are now influencing capital flows and investment choices that have a direct impact on the supply and demand for foreign exchange. Furthermore, international investors' portfolio allocations have changed as a result of the German government's issuance of green bonds and an increase in ESG-aligned sovereign debt, which has affected currency volatility and euro inflows. FX adjustments are also being driven by the European Central Bank's (ECB) and the Deutsche Bundesbank's sustainable finance policies. Interest rate differentials and inflation expectations, two important factors influencing exchange rates, are indirectly impacted by central banks' decisions to incorporate green assets into quantitative easing programs.

Restraining Factors

The restrictive factors that affect the German foreign exchange market include tight regulatory frameworks that make cross-border transactions more difficult, geopolitical tensions, and monetary instability in the eurozone. Increased competition among trading platforms and low participation from retail investors further limit market growth. Further hindering wider adoption and innovation in FX trading are operational risks associated with technological disruptions and compliance requirements, which present difficulties for smaller financial institutions.

Market Segmentation

The Germany foreign exchange market share is classified into type and counterparty insights.

- The FX swaps segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period

The Germany foreign exchange market is segmented by type into currency swap, outright forward and FX swaps, and FX options. Among these, The FX swaps segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Germany is driven by its crucial role in helping financial institutions manage short-term liquidity and reduce currency risk. In order to manage funding mismatches and maximize cross-border transactions, banks and corporations are depending more and more on FX swaps as the monetary dynamics of the eurozone change. High trade volumes, Germany's strong financial system, and the growing need for adaptable hedging tools all help the segment.

- The reporting dealers segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany foreign exchange market is segmented by counterparty insights into reporting dealers, other financial institutions, and non-financial customers. Among these, the reporting dealers segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to their central function in liquidity provision, trading between dealers, regulatory compliance, and the like. Reporting dealers, primarily large banks and authorized market makers, have benefits of direct access to networks globally and advanced trading infrastructure because of the desire for execution and transparency on the part of financial institutions. This has been further augmented by Germany's position as a post-Brexit financial centre and the increasing demand for complex instruments (i.e., FX swaps and options) which reinforces the preeminence of reporting dealers in high volume, cross-border transactions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany foreign exchange market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 360T

- Deutsche Bank AG

- Deutsche Börse AG

- Commerzbank AG

- DZ Bank AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the Germany Foreign Exchange Market based on the below-mentioned segments:

FAQ’s

Q: What is the Germany foreign exchange market size?

A: Germany Foreign Exchange Market is expected to grow from USD 38742.58 million in 2024 to USD 79112.7 million by 2035, growing at a CAGR of 6.71% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: The stable German economy, high trade volumes, euro volatility, accommodative monetary policies, and rising institutional and corporate demand for currency derivatives like swaps and options are major growth drivers.

Q: What factors restrain the Germany foreign exchange market?

A: Restraining factors that collectively impede broader market expansion and operational efficiency in Germany include geopolitical uncertainties, regulatory complexity, limited retail investor participation, monetary fluctuations in the eurozone, and intense competition among trading platforms.

Q: Who are the key players in the Germany foreign exchange market?

A: 360T, Deutsche Bank AG, Deutsche Börse AG, Commerzbank AG, DZ Bank AG, Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |