Germany Frozen Food Market

Germany Frozen Food Market Size, Share, and COVID-19 Impact Analysis, By Product (Frozen Meals and Ready-to-Eat Dishes, Frozen Snacks, Frozen Meat and Poultry, Frozen Seafood, Frozen Vegetables and Fruits, Frozen Bakery Products, and Others), By Distribution Channel (Offline and Online), and Germany Frozen Food Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Germany Frozen Food Market Insights Forecasts to 2035

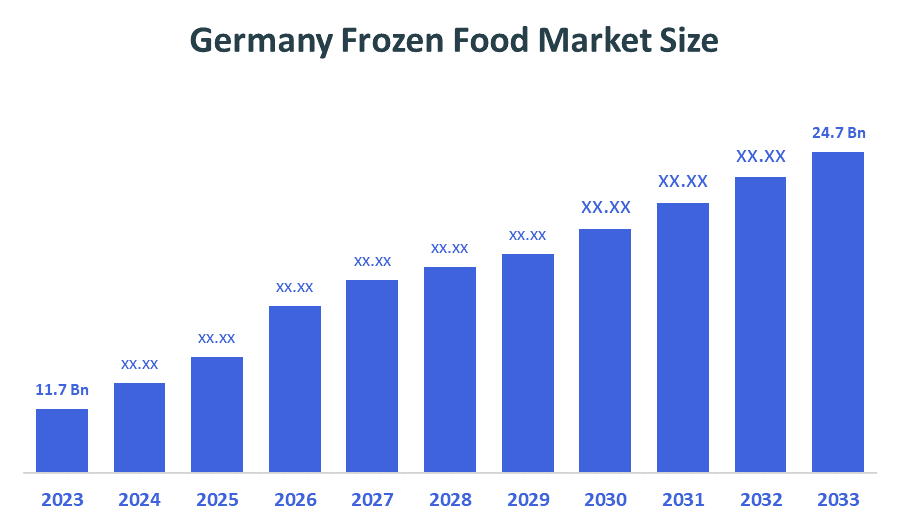

- The Germany Frozen Food Market Size was estimated at USD 11.7 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.03% from 2025 to 2035

- The Germany Frozen Food Market Size is Expected to Reach USD 24.7 Billion by 2035

According to a Research Report Published by Decision Advisiors & Consulting, the Germany Frozen Food Market is anticipated to reach USD 24.7 Billion by 2035, Growing at a CAGR of 7.03% from 2025 to 2035. Growing consumer demand for convenience, the popularity of ready-to-eat (RTE) meals, advantageous developments in freezing technology, a growing inclination for longer shelf-life products, and the growing range of frozen food options meeting a variety of dietary preferences are the main drivers of the German frozen food market.

Market Overview

In the German market, frozen food includes foods produced, stored, and consumed using freezing technology to assure that the products have a consistent and extended shelf life, to maintain their quality, and to assure their availability throughout all seasons or months of the year. Additionally, the market for frozen food in Germany is extensive and expanding, driven by consumers seeking convenient and high-quality meal solutions. The frozen food industry is expanding as a result of the younger generation's lack of time for meal preparation due to their increased involvement in daily activities. DTI reports that household consumption increased by 4.1 kg to 96.4 kg in 2022, while per capita consumption increased to 47.7 kg. In 2022, total frozen food sales increased by 3.6% to 3.909 million tons, breaking the previous record set in 2019 by 2%. These products are becoming more and more popular among consumers because of their long shelf life, ease of preparation, and preserved nutritional value.

Report Coverage

This research report categorizes the market for the Germany frozen food market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany frozen food market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany frozen food market.

Driving Factors

Growing consumer demand for ready-to-eat options and convenience, bolstered by busy urban lifestyles and dual-income households, is driving the frozen food market in Germany. Technological developments in freezing techniques improve the nutrition, taste, and quality of products, increasing consumer confidence. Widespread accessibility is ensured by growing retail networks and the robust penetration of supermarkets, hypermarkets, and discount chains; online platforms, on the other hand, accelerate growth through home delivery services.

Restraining Factors

The Germany frozen food market faces restraining factors such as strong consumer preference for fresh and organic alternatives, growing health concerns regarding preservatives and additives, and sustainability issues linked to packaging and energy-intensive cold-chain logistics. Rising electricity costs for storage and transportation further challenge profitability, while competition from chilled and ready-to-cook food segments limits growth potential.

Market Segmentation

The Germany frozen food market share is classified into product and distribution channel.

- The frozen meals and ready-to-eat dishes segment dominated the market in 2024, approximately 27.29% and is projected to grow at a substantial CAGR during the forecast period.

The Germany frozen food market is segmented by product into frozen meals and ready-to-eat dishes, frozen snacks, frozen meat and poultry, frozen seafood, frozen vegetables and fruits, frozen bakery products, and others. Among these, the frozen meals and ready-to-eat dishes segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to the growing demand for time-saving food solutions, busy urban lifestyles, and consumer preferences for convenience. Innovations in product variety, healthier formulations, and premium offerings that accommodate changing dietary preferences all contribute to growth. Improved freezing technologies that maintain nutrition and taste, along with the expansion of retail and online distribution channels, further boost adoption. Additionally, during the forecast period, the segment will continue to grow due to the influence of younger demographics and working professionals looking for quick yet high-quality meal options.

- The offline segment dominated the market in 2024, approximately 73% and is projected to grow at a substantial CAGR during the forecast period.

The Germany frozen food market is segmented by distribution channel into offline and online. Among these, the offline segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to consumers' heavy reliance on convenience stores, supermarkets, and hypermarkets that offer quick access to products and well-established cold-chain infrastructure. Growth is further supported by the presence of large retail chains like Aldi, Lidl, Rewe, and Edeka, which guarantee broad product availability and competitive pricing. Additionally, even as online channels grow, offline dominance is maintained by consumer trust in physical stores, preference for in-person product inspection, and promotional tactics like discounts and bundled offers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany frozen food market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Frozen Fish International GmbH

- FRoSTA AG

- Apetito AG

- Iglo GmbH (Nomad Foods subsidiary)

- Bofrost Dienstleistungs GmbH & Co. KG

- Eismann Tiefkühl-Heimservice GmbH

- Others

Recent Developments:

- In May 2024, The Cannes Lions International Festival of Creativity announced Unilever as the 2024 Creative Marketer of the Year. The honorary accolade was presented to a marketer that had amassed a body of iconic, Lion?winning work over a sustained period of time, with Unilever having established a reputation for producing brave, creative, and innovative marketing solutions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Decision Advisiors has segmented the Germany Frozen Food Market based on the below-mentioned segments:

Germany Frozen Food Market, By Product

- Frozen Meals and Ready-to-Eat Dishes

- Frozen Snacks

- Frozen Meat and Poultry

- Frozen Seafood

- Frozen Vegetables and Fruits

- Frozen Bakery Products

- Others

Germany Frozen Food Market, By Distribution Channel

- Offline

- Online

FAQ’s

Q: What is the Germany frozen food market size?

A: Germany Frozen Food Market is expected to grow from USD 11.7 billion in 2024 to USD 24.7 billion by 2035, growing at a CAGR of 7.03% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: As a result of Germany's increasing need for convenience, ready meals, advances in freezing technology, long shelf life products, and greater retail & online distribution channels.

Q: What factors restrain the Germany frozen food market?

A: Several factors, such as the consumer's preference for fresh foods, health concerns regarding frozen products containing preservatives, sustainability concerns, and increased energy prices have restricted Germany's frozen food industry. Competition from the Chill sector and the Ready to Cook segment also poses a large amount of competition to this industry.

Q: Who are the key players in the Germany frozen food market?

A: Frozen Fish International GmbH, FRoSTA AG, Apetito AG, Iglo GmbH (Nomad Foods subsidiary), Bofrost Dienstleistungs GmbH & Co. KG, Eismann Tiefkühl-Heimservice GmbH, Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 160 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |