Germany Generic Drugs Market

Germany Generic Drugs Market Size, Share, and COVID-19 Impact Analysis, By Therapy Area (Central Nervous System, Cardiovascular, Dermatology, Genitourinary/Hormonal, Respiratory, Rheumatology, Diabetes, Oncology, and Others), By Drug Delivery (Oral, Injectables, Dermal/Topical, and Inhalers), and Germany Generic Drugs Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Germany Generic Drugs Market Insights Forecasts to 2035

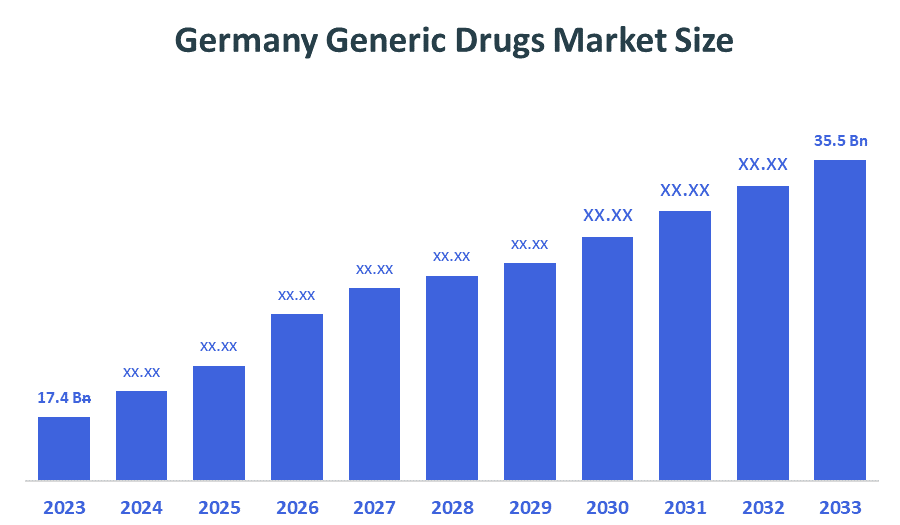

- The Germany Generic Drugs Market Size was estimated at USD 17.4 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.7% from 2025 to 2035

- The Germany Generic Drugs Market Size is Expected to Reach USD 35.5 Billion by 2035

According to a Research Report Published by Decision Advisior & Consulting, the Germany Generic Drugs Market is anticipated to reach USD 35.5 billion by 2035, growing at a CAGR of 6.7% from 2025 to 2035. The market is driven by a number of factors such as the increasing healthcare costs, expiration of patents of well-known drugs, favorable government policies, rise in the number of chronic diseases, emphasis on economical treatments, and the increase in the elderly population.

Market Overview

The market for generic drugs in Germany is the sector of the pharmaceutical industry that is dedicated to the manufacture, distribution, and use of off-patent medicines, which are cheaper substitutes for the branded drugs as well. Additionally, the escalating incidence of chronic illnesses, like diabetes, heart diseases, and cancer, demands long-term medication which is a significant growth factor for the market. Generics make it easier and cheaper to cope with these conditions which drives the market upwards. The U.S. National Institute of Health (NIH) states that diabetes is becoming a global issue. Germany's current diabetes population is estimated at 6.2 million (around 10% of the total population) and is projected to be over 10 million by 2040. Eurostat data indicates that there were 37,200 heart bypasses performed in Germany in 2021, more than twice the number in any other EU country (17,400 done in France). In 2020, the ZfKD estimated that Germany witnessed around 493,200 new cancer patients. Of these, roughly 261,800 were males and 231,400 were females. Almost half of the cases were in the breast (71,300), prostate (65,800), colon (54,800), or lungs (56,700).

Report Coverage

This research report categorizes the market for the Germany generic drugs market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany generic drugs market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany generic drugs market.

Driving Factors

The escalating prices of medical care are encouraging the use of cheaper treatments that are more effective and thus have a major impact on the growth of the market. People who are consumers and healthcare providers look for solutions that are affordable, which is why they turn to generic drugs. These medicines are less expensive than the branded ones but provide the same therapeutic advantage, hence they are favored by the price-sensitive patients and systems. The generic drugs' market share is getting larger as patents on the high-cost branded drugs are expiring making it all more competitive with lower prices and more access for the people thus the market is growing. The Germany Trade and Invest reports that in 2021, health care expenditures in Germany were more than EUR 457 billion, excluding costs for wellness and fitness. The market has experienced a 5.4% annual growth over the past five years. Health care is one of the major economic sectors in Germany with 7.7 million employees and exports worth over EUR 158 billion.

Restraining Factors

In the case of Germany's generic pharmaceuticals industry, the restraining factors comprise the very slow reimbursement approvals, and the complex tendering processes which are inevitable due to patient awareness of the cheap drugs being very limited, and in addition, the procurement systems being fragmented, the manufacturing costs being very high, and the active pharmaceutical ingredients shortages, and the long-term supply reliability being very difficult to sustain.

Market Segmentation

The Germany generic drugs market share is classified into therapy area and drug delivery.

- The cardiovascular segment dominated the market in 2024, approximately 28% and is projected to grow at a substantial CAGR during the forecast period.

The Germany generic drugs market is segmented by therapy area into central nervous system, cardiovascular, dermatology, genitourinary/hormonal, respiratory, rheumatology, diabetes, oncology, and others. Among these, the cardiovascular segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. The German market for cardiovascular medicines is expected to grow tremendously because of the country’s high rate of cardiovascular diseases, the aging population that needs longer treatment, and the rising demand for low-cost alternatives to branded drugs. The growth is also guaranteed by the expiration of patents for the leading cardiovascular drugs, the hard government policies that are in favor of the substitution of generics, and the wide acceptance of generics by doctors.

- The oral segment dominated the market in 2024, approximately 70% and is projected to grow at a substantial CAGR during the forecast period.

The Germany generic drugs market is segmented by drug delivery into oral, injectables, dermal/topical, and inhalers. Among these, the oral segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the market for oral drugs in Germany is mainly attributed to its ease of administration, high patient compliance, and wide therapeutic applicability in the areas of cardiovascular, central nervous system, and diabetes treatments. The affordability of oral generics, the preference of doctors for prescribing them widely, and the strong demand for cheaper alternatives to branded drugs all contribute to growth. Moreover, the expiration of patents for major oral formulations and government measures that facilitate the use of generics have a positive impact on the segment's growth. Thus, oral delivery becomes the backbone of Germany's generic drugs market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany generic drugs market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- STADA Arzneimittel AG

- Hexal AG

- Ratiopharm GmbH

- Aliud Pharma GmbH

- 1A Pharma GmbH

- Boehringer Ingelheim Generics Division

- Others

Recent Developments:

- In November 2023, STADA Arzneimittel AG, headquartered in Bad Vilbel, Germany, had announced an expansion and enhancement of its distribution and promotion of cough and cold brands in China through a partnership with leading locally listed pharmaceuticals company CR Sanjiu. This cooperation was formalized during a signing ceremony in Shenzhen on November 22.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035 Decision Advisior has segmented the Germany Generic Drugs Market based on the below-mentioned segments:

Germany Generic Drugs Market, By Therapy Area

- Central Nervous System

- Cardiovascular

- Dermatology

- Genitourinary/Hormonal

- Respiratory

- Rheumatology

- Diabetes

- Oncology

- Others

Germany Generic Drugs Market, By Drug Delivery

- Oral

- Injectables

- Dermal/Topical

- Inhalers

FAQ’s

Q: What is the Germany generic drugs market size?

A: Germany Generic Drugs Market is expected to grow from USD 17.4 billion in 2024 to USD 35.5 billion by 2035, growing at a CAGR of 6.7% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: The main factors for the growth of the generic drug market in Germany are the demand for cost-effective healthcare, the expiration of patents, the government policies that are favorable, the increase in the prevalence of chronic diseases, and the acceptance of low-cost generic drugs as substitutes for branded ones.

Q: What factors restrain the Germany generic drugs market?

A: The restraining factors affecting Germany's generic drugs market are pretty much the same everywhere: very strict rules and regulations, cuts in prices, intense competition, doctors' choice of brands, weak points in the distribution network, not enough incentives for innovation, and tough times in guaranteeing the same high-quality standards all the time.

Q: Who are the key players in the Germany generic drugs market?

A: STADA Arzneimittel AG, Hexal AG, Ratiopharm GmbH, Aliud Pharma GmbH, 1A Pharma GmbH, Boehringer Ingelheim Generics Division, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 158 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |