Germany Haying & Forage Machinery Market

Germany Haying & Forage Machinery Market Size, Share, And COVID-19 Impact Analysis, By Product Type (Mowers, Balers, Tedders & Rakes, Forage Harvesters), By Application (Livestock Farms, Commercial Farming), By Distribution Channel (Dealers, Online Platforms), By Technology (Conventional, Advanced/Smart Systems) And Germany Haying & Forage Machinery Market Insights, Industry Trend, Forecast To 2035.

Report Overview

Table of Contents

Germany Haying & Forage Machinery Market Insights Forecasts to 2035

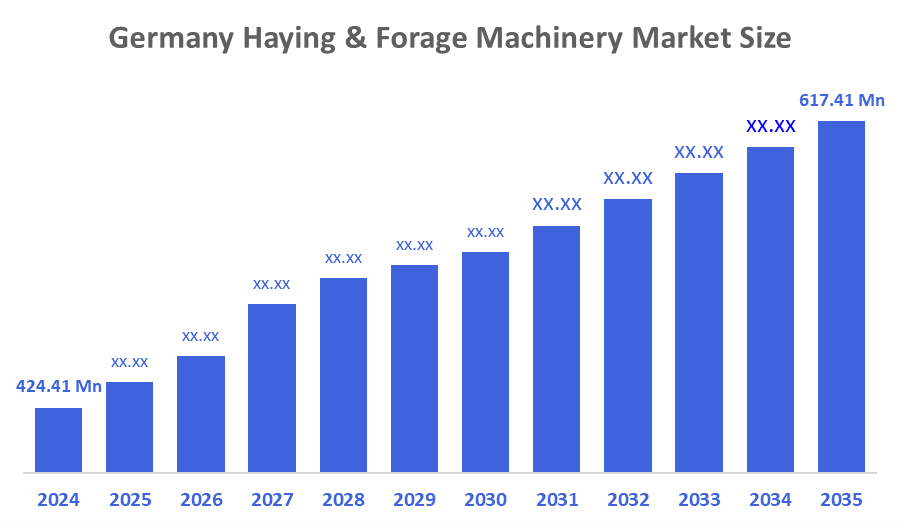

- Germany Haying & Forage Machinery Market Size Was Estimated at USD 424.41 Million in 2024.

- The Market Size is Expected to Grow at a CAGR of Around 3.47% from 2025 to 2035.

- Germany Haying & Forage Machinery Market Size is Expected to Reach USD 617.41 Million by 2035.

According to a research report published by Decision Advisors & Consulting, The Germany Haying & Forage Machinery Market size is Anticipated to reach USD 617.41 Million by 2035, growing at a CAGR of 3.47% from 2025 to 2035. The Germany haying & forage machinery market is driven by increasing mechanisation of livestock farms, rising demand for high-quality fodder, technological advancements in forage harvesters and balers, and growing investment in modern agricultural equipment.

Market Overview

Germany’s haying & forage?machinery market includes machines for mowing, harvesting, chopping, baling, and storing forage crops like grass and silage for livestock and dairy farms. These machines help farmers produce high-quality fodder efficiently, reduce labor dependency, and boost overall farm productivity. Market growth is driven by expanding livestock farms, labor shortages, and rising mechanization. Innovations such as self-propelled forage harvesters, efficient balers, and GPS-enabled smart harvesters enhance precision, minimize crop loss, and improve operational efficiency. Government support under the Common Agricultural Policy (CAP) 2023-2027 allocates ~€6.2?billion annually for sustainable farming, modernization, and mechanization, encouraging farmers to adopt advanced equipment. Adoption of digital farming is high, with ~85.5% of farms using technology for planning and precision harvesting. Domestic production of agricultural machinery reached ~€4.8?billion in 2024. Rising labor costs, environmental regulations, and CAP-driven subsidies are accelerating mechanization. Combined with manufacturer investments and smart-farming innovations, these factors position Germany’s haying & forage?machinery market for sustained growth and modernization in the coming years.

Report Coverage

This research report categorizes the market for the Germany haying & forage machinery market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany haying & forage machinery market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany haying & forage machinery market.

Driving Factors

The Germany haying & forage machinery markets in Germany are driven by increasing mechanisation across livestock farms, rising demand for high-quality fodder, technological advancements in forage harvesters and balers, strong OEM presence, and growing need to improve operational efficiency while reducing labour dependency.

Restraining Factors

The high cost of advanced machinery, seasonal demand fluctuations, limited affordability for smaller farms, and high maintenance and repair costs restrain the Germany haying & forage machinery market in Germany.

Market Segmentation

The Germany haying & forage machinery market share is categorized by product type, application, distribution channel, and technology.

- The mowers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany haying & forage machinery market is segmented by product type into mowers, balers, tedders & rakes, and forage harvesters. Among these, the mowers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by increasing demand for efficient grass-cutting operations, widespread adoption of disc mowers among dairy farms, and rising preference for faster field operations and reduced crop loss.

- The livestock farms segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Germany haying & forage machinery market is segmented by application into livestock farms and commercial farming. Among these, the livestock farms segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The dominance is due to Germany’s strong dairy and beef sectors, high demand for quality silage, and increased use of forage harvesters and balers in large-scale fodder production. Livestock farms are expected to remain the primary end-users driving demand.

- The dealers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany haying & forage machinery market is segmented by distribution channel into dealers and online platforms. Among these, the dealers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is driven by established OEM dealer networks, availability of financing, after-sales services, and customer preference for in-person inspections and demonstrations. Online platforms are growing, but dealers remain dominant.

- The advanced/smart systems segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Germany haying & forage machinery market is segmented by technology into conventional and advanced/smart systems. Among these, the advanced/smart systems segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Growth is supported by increasing adoption of precision farming solutions, ISOBUS-enabled balers, telematics in harvesters, and automation to boost productivity and improve forage quality.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany haying & forage machinery market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current developments of the companies, including product innovation, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for comprehensive evaluation of the overall competition within the market.

List of Key Companies

- CLAAS KGaA mbH

- Krone Agriculture SE (Krone)

- Fendt (AGCO Corporation)

- AMAZONE

- Pöttinger

- John Deere

- AGCO Corporation

- KUHN Group

- Others

Key Target Audience

-

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firms

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2025, CLAAS showcased the fully autonomous electric wheel loader TORION Autonomy Connect at Agritechnica 2025. The system uses AI-based navigation and automation to perform repetitive tasks such as silage loading, feed pushing, and material handling in dairy farms and biogas plants. This helps farmers reduce labour dependency, maintain consistent daily operations, and improve efficiency in forage and biomass management.

- In September 2024, Fendt introduced the fully electric Fendt e100 Vario tractor, developed for low-noise and zero-emission farm operations. The machine is designed for daily tasks such as loader work, grassland maintenance, and transport activities on livestock farms and vegetable farms. Its 100kWh battery enables farmers to use on-farm renewable energy, reduce fuel costs, and operate efficiently in areas where noise and emissions must be kept low, such as barns, greenhouses, and enclosed farm buildings.

Market Segment

This study forecasts revenue at the Germany, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Germany Haying & Forage Machinery Market based on the below-mentioned segments:

Germany Haying & Forage Machinery Market, By Product Type

- Mowers

- Balers

- Tedders & Rakes

- Forage Harvesters

- Others

Germany Haying & Forage Machinery Market, By Application

- Livestock Farms

- Commercial Farming

Germany Haying & Forage Machinery Market, By Distribution Channel

- Dealers

- Online Platforms

Germany Haying & Forage Machinery Market, By Technology

- Conventional

- Advanced/Smart Systems

FAQ’s

Q. What is the projected market size & growth rate of the Germany haying & forage machinery market?

A. The Germany haying & forage machinery market was valued at USD 424.41 million in 2024 and is projected to reach USD 617.41 million by 2035, growing at a CAGR of 3.47% from 2025 to 2035.

Q. What are the key driving factors for the growth of the Germany haying & forage machinery market?

A. The Germany haying & forage machinery market is driven by increasing mechanisation, rising demand for high-quality fodder, advancements in forage harvesters and balers, strong OEM presence, and the need to reduce labour dependency while improving operational efficiency.

Q. What are the top players operating in the Germany haying & forage machinery market?

A. CLAAS KGaA mbH, Krone Agriculture SE, Fendt (AGCO Corporation), AMAZONE, Pöttinger, John Deere, AGCO Corporation, KUHN Group, Others.

Q. What segments are covered in the Germany haying & forage machinery market report?

A. The Germany haying & forage machinery market is segmented based on Product Type, Application, Distribution Channel, and Technology.

Q. Which product type held the largest market share in 2024?

A. The mowers segment held the largest share in 2024 due to high adoption of efficient grass-cutting equipment and strong demand from dairy farms for faster field operations and reduced crop loss.

Q. Which application segment dominates the Germany haying & forage machinery market?

A. Livestock farms dominate the market because of Germany’s strong dairy and beef sectors and the rising use of forage harvesters and balers for large-scale silage production.

Q. Which technology segment is expected to grow the fastest?

A. The advanced/smart systems segment is expected to grow the fastest owing to increasing adoption of telematics, automation, GPS-guided mowing, ISOBUS-enabled systems, and precision forage management technologies

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 176 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |