Germany Health and Wellness Market

Germany Health and Wellness Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Functional Foods and Beverages, Beauty and Personal Care Products, Preventive and Personalized Medicinal Products, and Others), By Functionality (Nutrition & Weight Management, Heart & Gut Health, Immunity, Bone Health, Skin Health, and Others), and Germany Health and Wellness Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Germany Health and Wellness Market Insights Forecasts to 2035

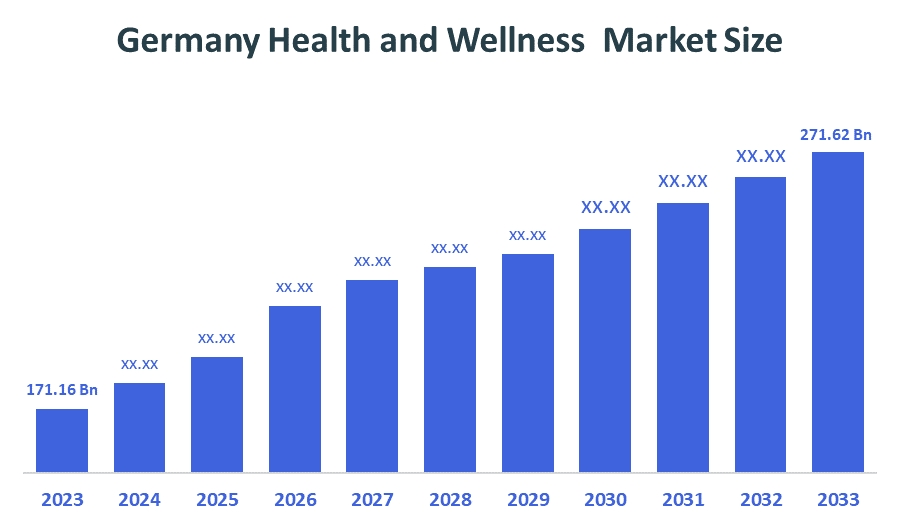

- The Germany Health and Wellness Market Size was estimated at USD 171.16 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.29% from 2025 to 2035

- The Germany Cryptocurrency Market Size is Expected to Reach USD 271.62 Billion by 2035

According to a Research Report Published by Decision Advisiors & Consulting, the Germany Health and Wellness Market is anticipated to reach USD 271.62 billion by 2035, growing at a CAGR of 4.29% from 2025 to 2035. The market is dominated by growing interest in organic, plant-based products, a strong ethos of natural and holistic healing, and growing consumer awareness of preventive care.

Market Overview

The industry that focuses on goods, services, and innovations that support mental, emotional, and physical well-being is known as the Germany health and wellness market. Additionally, the German government has put in place a number of initiatives to support the nation's health and well-being. All citizens have access to comprehensive coverage and healthcare services due to the statutory health insurance system. The government has also launched programs to encourage healthy living, including campaigns to increase awareness of the value of exercise and a balanced diet and subsidies for preventive health measures. Government agencies enforce stringent standards to guarantee the quality and safety of health products and services available in the market. In general, the goals of German government policies are to lower healthcare costs, improve public health outcomes, and improve population well-being.

Report Coverage

This research report categorizes the market for the Germany health and wellness market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany cryptocurrency market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany cryptocurrency market.

Driving Factors

The German health and wellness industry is growing rapidly and offers a variety of investment options. With more emphasis on preventive health and wellness, consumers have begun to demand better, more innovative products and services in places like Fitness, Nutrition, Mental Health, and Holistic Wellness. Opportunities exist to invest in businesses that provide: Digital Health Solutions, Personalized Nutrition Services, Health Technology Devices, and Wellness Retreats. Given the increasing elderly population in Germany, there are also growing markets for: Services for Care of the Elderly, Medical Devices and Facilities. Working with local wellness and health-related businesses, providing investments to support the ongoing research and development within the industry, and using technology to create a better delivery model for health services has many opportunities within the ever-changing German health and wellness market.

Restraining Factors

A growing rivalry among wellness service providers, shifting consumer preferences toward more individualized and comprehensive approaches, and regulatory obstacles pertaining to health claims and certifications are some of the major challenges facing the German health and wellness market. Concerns about data security and privacy are also becoming more prevalent, particularly as wearable technology and digital health solutions gain popularity. Additionally, the market is having trouble meeting the demands of an aging population and encouraging younger generations to lead healthy lifestyles.

Market Segmentation

The Germany health and wellness market share is classified into product type and functionality

- The functional foods and beverages segment dominated the market in 2024, approximately 33% and is projected to grow at a substantial CAGR during the forecast period.

The Germany health and wellness market is segmented by product type into functional foods and beverages, beauty and personal care products, preventive and personalized medicinal products, and others. Among these, the functional foods and beverages segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to growing consumer demand for organic, plant-based, and fortified products, growing awareness of preventive nutrition, and growing preferences for healthier diets. Adoption is further accelerated by growing innovation in probiotics, dietary supplements, and functional beverages, as well as by Germany's regulatory emphasis on food safety and wellness.

- The nutrition and weight management segment dominated the market in 2024, approximately 64.5% and is projected to grow at a substantial CAGR during the forecast period.

The Germany health and wellness market is segmented by functionality into nutrition and weight management, heart & gut health, immunity, bone health, skin health, and others. Among these, the nutrition and weight management segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. This is driven by the growing prevalence of obesity, consumers' growing emphasis on leading healthier lives, and the robust demand for low-calorie, functional foods, and dietary supplements. Adoption is being aided by government programs that encourage balanced diets and rising public awareness of preventive healthcare. Additionally, consumers are being encouraged to invest in weight management products by the growth of fitness culture, urbanization, and the availability of creative, plant-based, and customized nutrition solutions, all of which are supporting strong market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany health and wellness market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nosh.bio GmbH

- Health & Wise GmbH

- Boehringer Ingelheim

- BASF SE (Nutrition & Health Division)

- Adidas Runtastic GmbH

- Siemens Healthineers

- Others

Recent Developments:

- In November 2024, The German legislature enacted a law that restructured the healthcare system, reduced the number of hospitals, enhanced clinics, and modernized administrative processes.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Decision Advisiors has segmented the Germany Health and Wellness Market based on the below-mentioned segments:

Germany Health and Wellness Market, By Product Type

- Functional Foods and Beverages

- Beauty and Personal Care Products

- Preventive and Personalized Medicinal Products

- Others

Germany Health and Wellness Market, By Functionality

- Nutrition & Weight Management

- Heart & Gut Health

- Immunity

- Bone Health

- Skin Health

- Others

FAQ’s

Q: What is the Germany health and wellness market size?

A: Germany Health and Wellness Market is expected to grow from USD 171.16 billion in 2024 to USD 271.62 billion by 2035, growing at a CAGR of 4.29% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: An aging population, rising obesity rates, a focus on preventive healthcare, consumer preferences for healthier lifestyles, and rising demand for organic, natural, and functional products are the main factors driving the German health and wellness market.

Q: What factors restrain the Germany health and wellness market?

A: The high product costs, complicated regulations, low consumer awareness in rural areas, dispersed distribution channels, and difficulties scaling creative solutions across a range of demographics are all barriers to the German health and wellness market.

Q: Who are the key players in the Germany health and wellness market?

A: Nosh.bio GmbH, Health & Wise GmbH, Boehringer Ingelheim, BASF SE (Nutrition & Health Division), Adidas Runtastic GmbH, Siemens Healthineers, Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 170 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |