Germany Mushroom Market

Germany Mushroom Market Size, Share, and COVID-19 Impact Analysis, By Mushroom†Type (Button Mushroom, Shiitake Mushroom, Oyster Mushroom, and Others), By Form (Fresh Mushroom, Canned Mushroom, Dried Mushroom, and Others), and Germany Mushroom Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Germany Mushroom Market Insights Forecasts to 2035

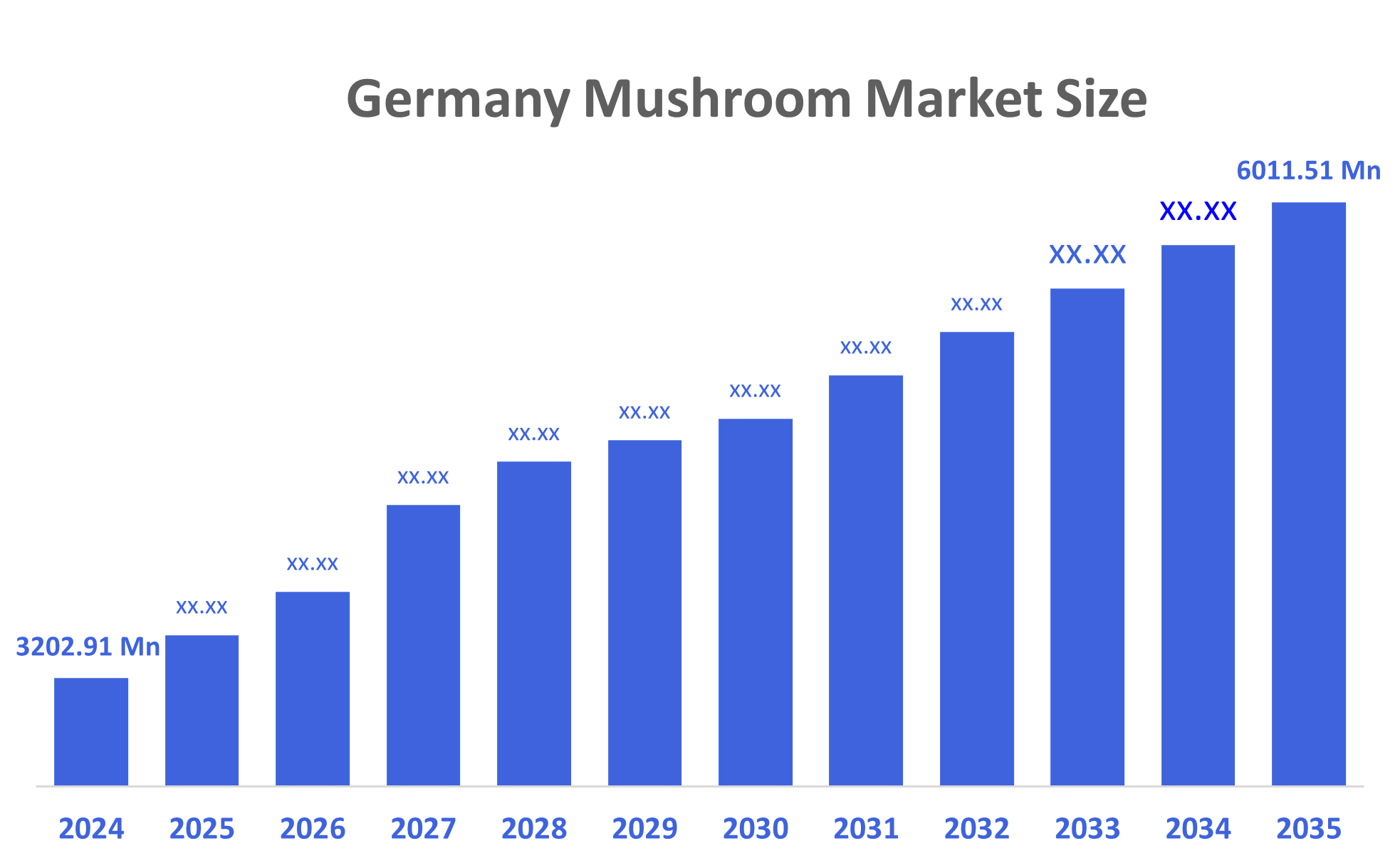

- The Germany Mushroom Market Size was estimated at USD 3202.91 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.89% from 2025 to 2035

- The Germany Mushroom Market Size is Expected to Reach USD 6011.51 Million by 2035

According to a research report published by Decisions Advisors, The Germany Mushroom Market is Anticipated to Reach USD 6011.51 Million by 2035, growing at a CAGR of 5.89% from 2025 to 2035. The growing demand for functional health products and sustainable protein substitutes is driving growth in the German mushroom market. Innovations in wellness-focused mushroom supplements and mycelium-based meat alternatives are changing consumer preferences, production processes, and product offerings, greatly increasing Germany's market share in several important industries.

Market Overview

The German mushroom industry covers the cultivation, importation, distribution, and consumption of edible mushrooms around the country. Both conventional and organic mushrooms are produced for use in foodservice, retail, and industrial purposes. Additionally, regulatory frameworks that are designed to support the development and commercialization of natural health products are providing an enabling environment for innovative products to emerge. For instance, Mushrooms Inc. (OTC: MSRM) launched two health supplements in 2024 LONGEVITY and SPORT+, designed for overall health and recreational athletics in the form of mushroom-derived supplements. The company also launched a collaborative effort with a German research team for next-generation bacterial detection technology, further elevating the position of Germany as a leader in this emerging and in-demand area where fungi can contribute to a biotech infrastructure.

Report Coverage

This research report categorizes the market for the Germany mushroom market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany mushroom market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany mushroom market.

Driving Factors

The demand for options based on fungi is being driven by a shift in consumer values toward ethical and environmentally friendly consumption. In Germany's food industry, this trend is changing supply chains, production techniques, and retail strategies in addition to influencing new product categories. Infinite Roots (formerly Mushlabs), a biotech company based in Hamburg, raised $58 million in a Series B funding round in January 2024 to create meat alternatives based on mushroom mycelium. Supported by investors such as REWE and Haribo's HRH, the company planned to introduce its mushroom-based goods in 2024.

Restraining Factors

High labor costs, perishability, a lack of automation, seasonal production variability, and logistical difficulties in preserving freshness across retail and foodservice supply chains are the main obstacles facing Germany's mushroom market.

Market Segmentation

The Germany mushroom market share is classified into mushroom type and form.

- The button mushroom segment dominated the market in 2024, approximately 58.2% and is projected to grow at a substantial CAGR during the forecast period.

The Germany mushroom market is segmented by mushroom type into button mushroom, shiitake mushroom, oyster mushroom, and others. Among these, the button mushroom segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. Driven by its year-round availability, low cost, and broad culinary acceptance. Its mild flavor and adaptability make it a mainstay in foodservice and domestic applications, which helps to sustain demand. Furthermore, improvements in efficient supply chains and controlled-environment agriculture have improved the quality and scalability of production.

- The fresh mushroom segment dominated the market in 2024, approximately 84% and is projected to grow at a substantial CAGR during the forecast period.

The Germany mushroom market is segmented by form into fresh mushroom, canned mushroom, dried mushroom, and others. Among these, the fresh mushroom segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to consumers are becoming more conscious of the nutritional advantages of mushrooms and prefer natural, minimally processed foods. Consistent demand across retail and foodservice channels is supported by their adaptability in culinary applications, particularly in vegetarian and vegan diets. Additionally, year-round availability and quality have been enhanced by developments in organic farming methods and controlled-environment agriculture

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany mushroom market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pilzland GmbH & Co. KG

- Dohme Pilze GmbH

- Mushlabs GmbH

- Eickmeyer GmbH

- Wiesenhof Pilze GmbH

- Pilzhof Reinshagen GmbH

- Others

Recent Developments:

- In March 2025, Hamburg-based startup The Raging Pig Company had launched a new pea and mushroom-based plant burger patty tailored for the foodservice industry. Designed for use in traditional or smash-burger styles, the product targeted the growing demand for plant-based menu options. This marked the company’s expansion beyond pork alternatives into broader plant-based meat innovation.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Germany Mushroom Market based on the below-mentioned segments:

Germany Mushroom Market, By Mushroom Type

- Button Mushroom

- Shiitake Mushroom

- Oyster Mushroom

- Others

Germany Mushroom Market, By Form

- Fresh Mushroom

- Canned Mushroom

- Dried Mushroom

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 195 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |