Germany Packaging Market

Germany Packaging Market Size, Share & Industry Analysis, By Material (Plastic, Paper & Paperboard, Metal, Glass, Wood, and Others), By Product Type (Rigid Packaging and Flexible Packaging), By Packaging Type (Primary Packaging, Secondary Packaging, and Tertiary Packaging), and Germany Packaging Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Germany Packaging Market Insights Forecasts to 2035

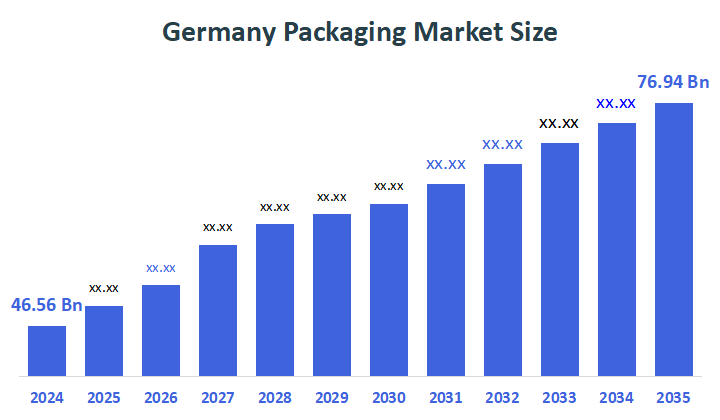

- The Germany Packaging Market Size Was Estimated at USD 46.56 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.67% from 2025 to 2035

- The Germany Packaging Market Size is Expected to Reach USD 76.94 Billion by 2035

According to a Research Report Published by Decisions Advisors, the Germany Packaging Market is anticipated to reach USD 76.94 billion by 2035, growing at a CAGR of 4.67% from 2025 to 2035. The market growth is driven by a strong push for sustainability & eco-friendly materials, fuelled by regulations like the VerpackG (Packaging Act), alongside booming e-commerce, demand for convenience/ready-to-eat foods, growth in pharma/cosmetics, and innovation in lightweight/smart packaging, all converging to create a high-tech, environmentally conscious, and efficient sector.

Market Overview

Germany packaging market is defined as the design, manufacture, and distribution of containers (plastic, paper, glass, metal) for protecting and presenting goods, which are pushed by e-commerce, convenience foods, and tight sustainability regulations such as the VerpackG.

Key trends include flexible packaging expansion, need for recyclable mono-materials, and innovation for the food, beverage, pharmaceutical, and cosmetics industries, making it a prominent global player focused on circular economy concepts. The German Packaging Act (VerpackG), which took effect on January 1, 2019, regulates all enterprises that sell packaged goods in Germany. It requires LUCID registration and establishes high recycling standards, including 90% for paper and more than 60% for plastics.

Germany provides significant development potential for post-consumer recycled (PCR) material, particularly food-grade rPET, as regulations tighten under the Single-Use Plastics Fund Act (effective 2024) and EU directives. Rising recycled-content targets, brand sustainability promises, and limited local rPET supply drive demand for advanced recycling, food-grade decontamination technologies, closed-loop systems, and PCR imports, cementing Germany's position as a premium market for high-quality recycled packaging materials.

Report Coverage

This research report categorises the market for the Germany packaging market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany packaging market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany packaging market.

Driving Factors

Driven by its energiewende initiative, Germany is leading Europe’s sustainability transition by prioritizing carbon emission reduction and rapid expansion of renewable energy sources. This long-term commitment has positioned the country as a key innovation hub, significantly boosting demand for solar, wind, hydrogen, and sustainable packaging solutions. The food, healthcare, and consumer goods industries are moving more quickly toward recyclable, lightweight, and bio-based packaging due to strict environmental regulations, such as recycling mandates, recycled-content requirements, and extended producer responsibility, as well as consumer preferences and the ecofriendly products which are comfortable to the customers. Additionally, Germany's emphasis on industrial competitiveness, healthcare modernization, and climate action is pushing businesses to embrace low-carbon materials, digitalized production, and circular economy models. The packaging value chain is being further strengthened by public-private investments in food-grade rPET, chemical recycling, and recycling infrastructure.

Restraining Factors

The restraining factors are stringent environmental restrictions, high operational costs (energy and raw materials), and difficulty in recycling infrastructure are the key barriers to growth in the German packaging sector.

The market is under pressure from volatile raw materials (resin) and high domestic electricity prices, which are reducing manufacturers' profit margins. For instance, a planned EUR 0.80/kg plastics tax is expected to have a short-term negative impact on the market's compound annual growth rate.

Market Segmentation

The Germany packaging market share is classified into material, product type, and packaging type.

- The plastic segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Germany packaging market is divided by material into plastic, paper & paperboard, metal, glass, wood, and others. Among these, the plastic segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Plastic packaging has several benefits for Germany, including protection against waste and contaminants, economic efficiency, light weight for transportation, and adaptability to a variety of products.

- The rigid packaging segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The Germany packaging market is segmented by product type into rigid packaging and flexible packaging. Among these, the rigid packaging segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. In Germany, the need for rigid packaging is primarily impacted by sustainability, which is fuelled by strict EU and German rules such as the VerpackG. Notable trends include a shift toward ecologically friendly materials such as recyclable and bio-based plastics, increased incorporation of post-consumer recycled content (PCR), and the creation of lightweight products to minimize material usage and reduce carbon emissions.

- The secondary packaging segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The Germany packaging market is segmented by packaging type into primary packaging, secondary packaging, and tertiary packaging. Among these, the secondary packaging segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. A major trend in secondary packaging in the country is a greater emphasis on sustainability, which is impacted by regulations and customer preferences for recycled, biodegradable, and recyclable materials, particularly paper and paperboard.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Germany packaging market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amcor plc

- Mondi plc

- Sealed Air Corp

- Constantia Flexibles

- Huhtamaki Oyj

- Berry Global

- Others

Recent Developments:

- In August 2025, Germany introduced updated recyclability standards that assess packaging based on real-world sorting and recycling infrastructure. These rules push companies to redesign packaging for compatibility with existing systems, accelerating practical circular economy adoption across the German packaging market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Germany packaging market based on the below-mentioned segments:

Germany Packaging Market, By Material

- Plastic

- Paper & Paperboard

- Metal

- Glass

- Wood

- Others

Germany Packaging Market, By Product Type

- Rigid Packaging

- Flexible Packaging

Germany Packaging Market, By Packaging Type

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

FAQ

Q: What are the Germany Packaging Market size?

A: Germany packaging market size is expected to grow from USD 46.56 billion in 2024 to USD 76.94 billion by 2035, growing at a CAGR of 4.67% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by driven by a strong push for sustainability & eco-friendly materials, fuelled by regulations like the VerpackG (Packaging Act), alongside booming e-commerce, demand for convenience/ready-to-eat foods, growth in pharma/cosmetics, and innovation in lightweight/smart packaging, all converging to create a high-tech, environmentally conscious, and efficient sector.

Q: What factors restrain the Germany Packaging Market?

A: Constraints include stringent environmental restrictions, high operational costs (energy and raw materials), and difficulty in recycling infrastructure are the key barriers to growth in the German packaging sector.

Q: How is the market segmented by material?

A: The market is segmented into plastic, paper & paperboard, metal, glass, wood, and others

Q: Who are the key players in the Germany Packaging Market?

A: Key companies include Amcor plc, Mondi plc, Sealed Air Corp, Constantia Flexibles, Huhtamaki Oyj, Berry Global, Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 160 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |