Germany Paper Packaging Market

Germany Paper Packaging Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Corrugated Boxes, Folding Boxes and Cases, Liquid Paperboard Cartons, Paper Bags and Sacks, and Others), By Grade (Solid Bleached, Coated Recycled, Uncoated Recycled, and Others), and Germany Cryptocurrency Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Germany Paper Packaging Market Insights Forecasts to 2035

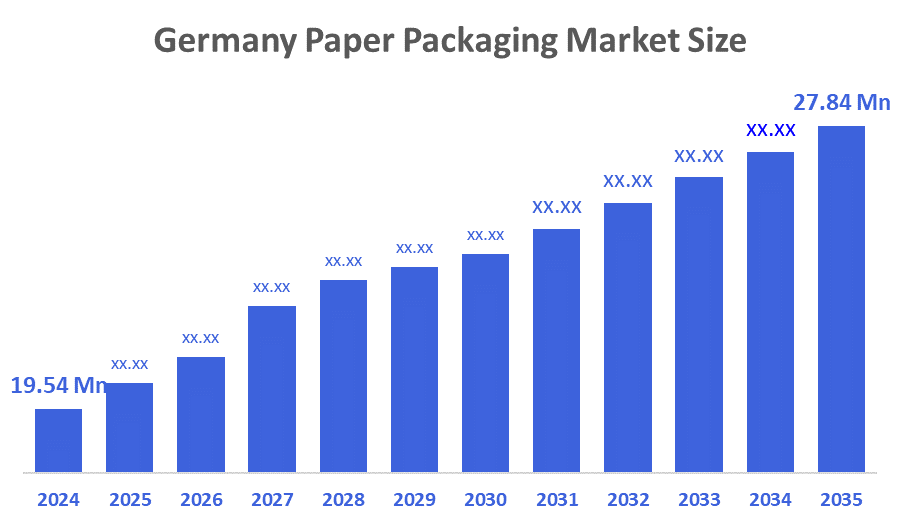

- The Germany Paper Packaging Market Size was estimated at USD 19.54 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.27% from 2025 to 2035

- The Germany Paper Packaging Market Size is Expected to Reach USD 27.84 Billion by 2035

According to a research report published by Decision Advisor & Consulting, The Germany Paper Packaging Market Size is anticipated to reach USD 27.84 Billion by 2035, Growing at a CAGR of 3.27% from 2025 to 2035. The market has an impact from a significant shift towards sustainability which is supported by strict environmental laws and the existing recycling habit that pushes the change from plastics to eco-friendly paper-based solutions.

Market Overview

The Germany Paper Packaging Market Size is the industry that covers every aspect of paper-based materials for the packaging applications in the different sectors like food & beverages, healthcare, personal care, e-commerce, and industrial goods that is to say production, distribution, and also utilization. Technological advancement along with creative packaging design is making the major impact on the trends of the paper packaging market in Germany. The manufacturers are experimenting with the development of new grades of paperboard, coatings, and structural designs which would not only provide strength or durability but also give better barrier properties and visual appeal to the paper packaging. Paper packaging is thus being considered as a possible substitute for plastic in a variety of applications such as food, beverages, and personal care items. Further, brands are more and more considering packaging as an essential marketing tool, employing the application of innovative paper solutions for high-quality printing, customization and premium aesthetics.

Report Coverage

This research report categorizes the market for the Germany paper packaging market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany paper packaging market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany paper packaging market.

Driving Factors

The development of online shopping in Germany has brought about the necessity of durable, lightweight, and cheap paper packaging to a greater extent. Retailers that sell over the internet need protective and fresh materials that are suitable for storage, transport, and delivery options, thus making paper-based materials the most viable and most desired. People using paper packaging for their brands are likely to gain consumer approval because they are perceived to comply with the earth-friendly mantra. The rise of DTC (Direct-to-Consumer) models and subscription services has created a greater need for unique paper formats that will not only tell the brand story but also offer a fantastic unboxing experience. In 2023, the dual-system packaging collection from households in Germany recovered more than 5.5?million tonnes of packaging waste, with nearly 5.2?million tonnes recycled, thus meeting or exceeding the legal recycling targets for paper, paperboard, and cardboard. It shows how paper packaging is in tune with the changing consumer tastes as regards convenience and lesser environmental impact, thereby prompting the manufacturers to come up with new ideas and increase their range of products.

Restraining Factors

The German paper packaging market is facing several restraining factors such as increasing energy costs, the shortage of skilled labor, the slow development in advanced coatings, the disjointed supplier networks, and the changing consumer preferences, which together limit the overall efficiency, affect the competitiveness negatively, and prevent the market from consistent long-term growth.

Market Segmentation

The Germany paper packaging market share is classified into product type and grade.

- The corrugated boxes segment dominated the market in 2024, approximately 38% and is projected to grow at a substantial CAGR during the forecast period.

The Germany paper packaging market is segmented by product type into corrugated boxes, folding boxes and cases, liquid paperboard cartons, paper bags and sacks, and others. Among these, the corrugated boxes segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. The growing penetration of e-commerce and the resulting demand for strong and inexpensive shipping solutions have made the industry take notice. Besides, the heavy usage in automotive, electronics, and manufacture sectors has directly contributed to the acceptance of the new trend. Strict sustainability regulations and customer inclination for recyclable packaging are the other two factors that are benefitting the industry, as corrugated boxes fit in quite well with the recycling habits in Germany.

- The coated recycled segment dominated the market in 2024, approximately 25% and is projected to grow at a substantial CAGR during the forecast period.

The Germany paper packaging market is segmented by grade into solid bleached, coated recycled, uncoated recycled, and others. Among these, the coated recycled segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. Germany's impressive recycling system, the strict European Union directives on packaging waste, and the customers' growing inclination towards environmentally friendly alternatives are the reasons for the trend. The food and beverage and e-commerce industries, which need the coated recycled grades, are the main consumers supporting the trend. In addition, reduced prices compared to virgin pulp, supported by government-backed sustainability programs and businesses' pledges to circular economy practices, are pushing the changes in all sectors toward coated recycled paper packaging.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany paper packaging market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Winfried Wirth GmbH

- Smurfit Kappa Deutschland GmbH

- DS Smith Packaging Deutschland Stiftung & Co. KG

- Mayr-Melnhof Karton AG

- Segezha Group Germany

- Others

Recent Developments:

- In June 2025, Evonik had removed the plastic film layer from their MetAMINO (DL-methionine) product and had replaced it with a sustainable 25-kg paper bag in order to adhere to the EU's Packaging & Packaging Waste Regulation. The new fully recyclable two-layer paper bag (PAP 22) reduced the packaging’s CO? footprint by 20% and saved 32 tons of polyethylene annually at the Antwerp site. Product quality and its 36-month shelf life remained unchanged, with rollouts planned for Singapore and Mobile (US) production sites.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the Germany Paper Packaging Market based on the below-mentioned segments:

Germany Paper Packaging Market, By Product Type

- Corrugated Boxes

- Folding Boxes and Cases

- Liquid Paperboard Cartons

- Paper Bags and Sacks

- Others

Germany Paper Packaging Market, By Grade

- Solid Bleached

- Coated Recycled

- Uncoated Recycled

- Others

FAQ’s

Q: What is the Germany paper packaging market size?

A: Germany Paper Packaging Market is expected to grow from USD 19.54 billion in 2024 to USD 27.84 billion by 2035, growing at a CAGR of 3.27% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: The main factors that will drive the growth of the paper packaging market in Germany are the demands for sustainability, stricter environmental regulations, the recycling culture of the country, new technology, the choice of consumers for eco-friendly solutions, and the increasing use of paper packaging for food, electronics, and personal care products.

Q: What factors restrain the Germany paper packaging market?

A: The German paper packaging market is facing a number of restraining factors, such as the high cost of production, strict regulations, supply chain problems, and ups and downs in raw material prices. Additionally, there are difficulties related to digitization and competition from other packaging solutions. All these factors together are limiting the market's sustainable growth.

Q: Who are the key players in the Germany paper packaging market?

A: Winfried Wirth GmbH, Smurfit Kappa Deutschland GmbH, DS Smith Packaging Deutschland Stiftung & Co. KG, Mayr-Melnhof Karton AG, Segezha Group Germany, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |