Germany Private Equity Market

Germany Private Equity Market Size, Share, and COVID-19 Impact Analysis, By Fund Type (Buyout, Venture Capital (VCs), Real Estate, Infrastructure, and Others), By Enterprise Size (Mid-Cap Enterprises, Small Enterprises, and Large Enterprises), and Germany Private Equity Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Germany Private Equity Market Insights Forecasts to 2035

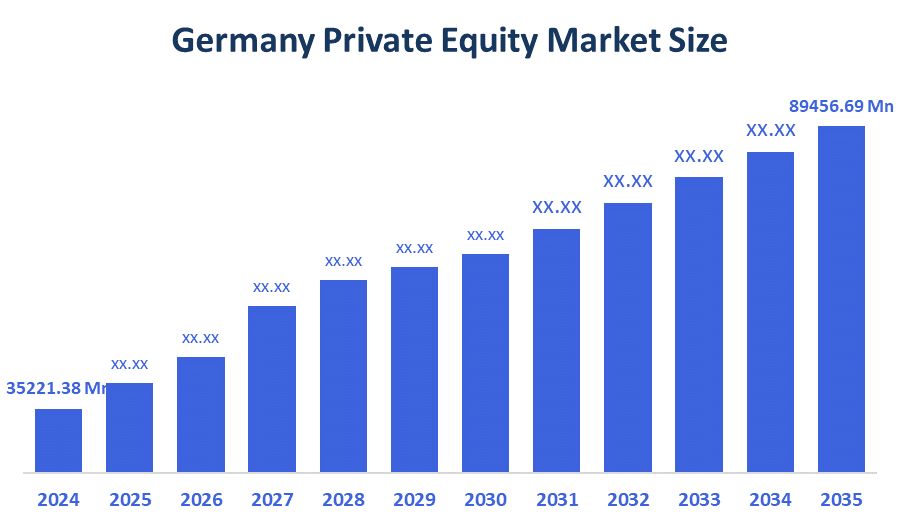

- The Germany Private Equity Market Size was estimated at USD 35221.38 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.84% from 2025 to 2035

- The Germany Private Equity Market Size is Expected to Reach USD 89456.69 Million by 2035

According to a research report published by Spherical Insights & Consulting, the Germany Private Equity Market is anticipated to reach USD 89456.69 million by 2035, growing at a CAGR of 8.84% from 2025 to 2035. The market is being driven by strong economic fundamentals, a strong industrial base, and growing institutional investor interest.

Market Overview

The German private equity market is the ecosystem of investment activities that involves the deployment of funds into privately held companies at all stages of growth. The market is characterized by flows of institutional capital, strategic acquisitions, and value creation through improving operations, restructuring governance, and encouraging innovation. Additionally, the German private equity market provides a number of alluring investment options in a number of industries, including consumer goods, manufacturing, healthcare, and technology. Germany is an attractive location for private equity investors looking for growth potential and diversification because of its robust and stable economy and significant position in the European market. Opportunities are present in startups and high-growth companies seeking capital for innovation and market expansion, as well as in established businesses seeking to restructure or expand. The country's investment climate is further improved by the German government's efforts to encourage innovation and entrepreneurship.

Report Coverage

This research report categorizes the market for the Germany private equity market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany private equity market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany private equity market.

Driving Factors

The private equity market in Germany is facing a number of significant trends. To begin, there is a rising interest in tech and digital product investments, with major capital flowing into software, e-commerce, and fintech. Secondly, sustainability and ESG (Environmental, Social and Governance) factors are increasingly factor for investor portfolios, which has led to a rise in impact investments and sustainable finance. Finally, the market is seeing a trend towards larger deal sizes (and buyouts) as a result of a strong economic environment and available capital.

Restraining Factors

The fierce competition for appealing investment opportunities, high valuations that make it hard to find deals at affordable prices, and German investors' comparatively cautious attitude toward riskier investments are some of the major obstacles facing the Germany private equity market. Deal-making activities can also be impacted by political unpredictability and regulatory barriers. International investors and German companies may have different communication and business practices, which can make it difficult to establish rapport and carry out profitable transactions.

Market Segmentation

The Germany private equity market share is classified into fund type and enterprise size.

- The buyout segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany private equity market is segmented by fund type into buyout, venture capital (VCs), real estate, infrastructure, and others. Among these, the buyout segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to a high demand for technology and industrial mid-cap companies with scalable operations and steady cash flows. Deal activity has been further accelerated by favorable financing conditions, post-Brexit capital reallocation, and succession planning among family-owned businesses. Because of their risk-adjusted returns, buyout strategies are still preferred by institutional investors, and Germany's strong legal and regulatory environment fosters investor confidence and transaction transparency.

- The mid-cap enterprises segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany private equity market is segmented by enterprise size into Enterprise Size mid-cap enterprises, small enterprises, large enterprises. Among these, the mid-cap enterprises segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to their ability to strategically balance stability and scalability, which makes them desirable targets for growth equity and buyout funds. These businesses frequently look for funding for international expansion, digital transformation, and succession planning in order to meet investor demands for value creation and operational enhancement. Deal flow is further improved by Germany's robust industrial base and hospitable financing climate, and sustained investment momentum is driven by mid-cap valuations that are still more accessible than their large-cap counterparts.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany private equity market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Triton Partners

- Deutsche Beteiligungs AG

- AdAstra

- Afinum Management GmbH

- Capiton AG

- Others

Recent Developments

- In June 2025, Deutsche Private Equity (DPE) acquired a majority stake in CPM Partners, a Geneva-based consulting and technology firm specializing in Corporate Performance Management (CPM).The partnership aimed to accelerate growth and expand CPM’s capabilities in complex transformation projects. DPE saw strong potential in building an end-to-end platform serving CFOs. This move aligned with DPE’s strategy to back high-growth mid-sized companies in the DACH region.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Decision Advisiors has segmented the Germany Private Equity Market based on the below-mentioned segments:

FAQ’s

Q: What is the Germany private equity market size?

A: Germany Private Equity Market is expected to grow from USD 35221.38 million in 2024 to USD 89456.69 million by 2035, growing at a CAGR of 8.84% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: A transparent regulatory framework that encourages investor confidence and deal activity, post-Brexit capital inflows, rising tech and sustainability investments, mid-cap succession trends, Germany's industrial resilience, and favorable financing conditions are some of the major growth drivers.

Q: What factors restrain the Germany private equity market?

A: Restraining factors that impede deal flow, fundraising momentum, and wider market expansion in Germany include high valuation pressures, regulatory complexity, geopolitical uncertainties, limited exit opportunities, and cautious investor sentiment.

Q: Who are the key players in the Germany private equity market?

A: Triton Partners, Deutsche Beteiligungs AG, AdAstra, Afinum Management GmbH, Capiton AG, Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 169 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |