Germany Reverse Factoring Market

Germany Reverse Factoring Market Size, Share, and COVID-19 Impact Analysis, By Category (Domestic and International), By Financial Institution (Banks and Non-banking Financial Institutions), and Germany Reverse Factoring Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Germany Reverse Factoring Market Insights Forecasts to 2035

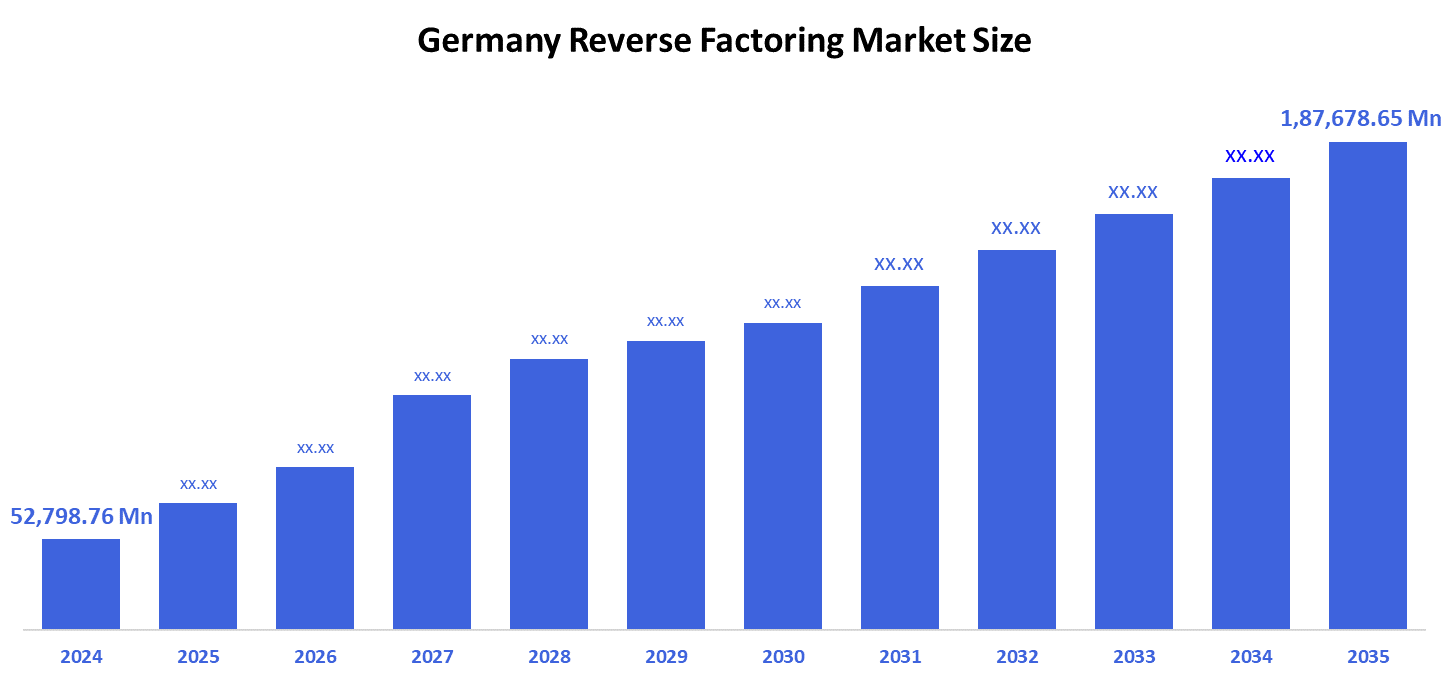

- The Germany Reverse Factoring Market Size Was Estimated at USD 52,798.76 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 12.22% from 2025 to 2035

- The Germany Reverse Factoring Market Size is Expected to Reach USD 1,87,678.65 Million by 2035

According to a Research Report Published by Spherical Insights & Consulting, the Germany Reverse Factoring Market Size is Anticipated to reach USD 1,87,678.65 Million by 2035, Growing at a CAGR of 12.22% from 2025 to 2035. The damaging market integrity, losing investor confidence, and insider business pressure on financial institutions to aggressively invest in supply chain finance solutions and services are driving the growth of the reverse factoring or supply chain finance (SCF) market.

Market Overview

The reverse factoring market entails a financing mechanism, whereby suppliers are paid earlier for invoices by a third-party financier, usually a bank, based on the buyer’s creditworthiness. This allows suppliers to improve cash flow and minimize payment delays and offers the buyer extended payment terms. The benefits of reverse factoring for companies include enhanced liquidity, enhanced supplier relationships, and optimized working capital management. The market also has an opportunity in the increasing demand from small and medium enterprises (SMEs) for flexible financing solutions in response to current supply chain financing risk, and by leveraging enhancements in digital platforms offering financing options. Governments are focused on enabling reverse factoring through introducing supporting government strategies and programs that promote supplier credits and supply chain financing solutions, especially for small and medium enterprises (SMEs).

Report Coverage

This research report categorizes the market for Germany reverse factoring market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany reverse factoring market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment Germany reverse factoring market.

Driving Factors

The growing demand for efficient working capital management, as well as improved cash flow by companies, primarily small and medium-sized enterprises (SMEs). Providing supply chain financing solutions to SMEs and other companies that mitigate payment latency while improving supplier relationships will drive forward growth in reverse factoring in Canada. Technological development of digital supply chain platforms that enhance transaction processing and transparency will also support the growth of reverse factoring in Germany.

Restraining Factors

A lack of knowledge and comprehension of reverse factoring by small businesses has limited their adopting reverse factoring. Some other concerns revolve around the cost, including fees charged by financial institutions that could discourage suppliers and buyers from participating in reverse factoring. Security and privacy issues related to digitally integrated platforms may also cause concerns.

Market Segmentation

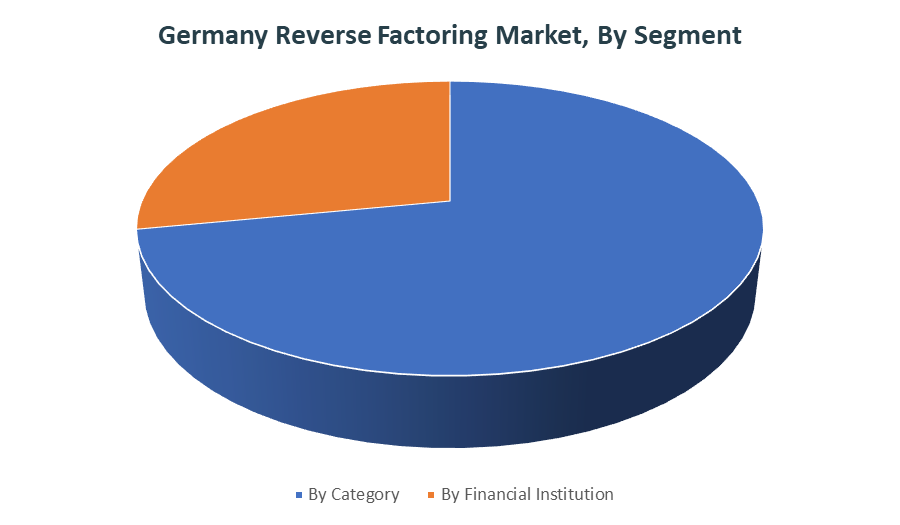

The Germany reverse factoring market share is classified into category and financial institution.

- The domestic segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany reverse factoring market is segmented by category into domestic and international. Among these, the domestic segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. The strong presence of SMEs relying on efficient cash flow solutions. Companies prefer domestic reverse factoring for its lower risk, faster processing, and alignment with local legal and regulatory frameworks. Strong relationships between local buyers, suppliers, and financial institutions further support adoption. With increasing digitalization and demand for flexible financing.

- The banks segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany reverse factoring market is segmented by financial institution into banks and non-banking financial institutions. Among these, the banks segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Businesses prefer banks for their reliability, lower interest rates, and integration with existing financial services. Banks also offer advanced digital platforms and customized solutions, making reverse factoring more accessible to SMEs and large corporations alike. As demand for secure and efficient supply chain financing grows.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany reverse factoring market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Herlitz

- ProfiOffice

- Dokumental

- Rotring

- Pelikan

- Schwan?Stabilo

- stilform

- Gmund

- Onlineprinters

- Novus Dahle

- Faber?Castell

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Germany reverse factoring market based on the below-mentioned segments:

Germany Reverse Factoring Market, By Category

- Domestic

- International

Germany Reverse Factoring Market, By Financial Institution

- Banks

- Non-banking Financial Institutions

Frequently Asked Questions

Q.1: What is the market size of the Germany Reverse Factoring Market in 2024?

A: The Germany Reverse Factoring Market size was estimated USD 52,798.76 Million in 2024.

Q.2: What is the forecasted CAGR of the Germany Reverse Factoring Market from 2024 to 2035?

A: The market is expected to grow at a CAGR of around 12.22% during the period 2024–2030.

Q.3: Who are the top 10 companies operating in the Germany Reverse Factoring Market?

A: Key players include Herlitz, ProfiOffice, Dokumental, Rotring, Pelikan, Schwan?Stabilo, stilform , Gmund, Onlineprinters, Novus Dahle, Faber?Castell, Others

Q.4: What are the main drivers of growth in the Germany Reverse Factoring Market?

A: The growing demand for efficient working capital management, as well as improved cash flow by companies, primarily small and medium-sized enterprises (SMEs).

Q.5: What are the main restraining of growth in the Germany Reverse Factoring Market?

A: A lack of knowledge and comprehension of reverse factoring by small businesses has limited their adopting reverse factoring.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |