Germany Steel Market

Germany Steel Market Size, Share, and COVID-19 Impact Analysis, By Type (Flat Steel and Long Steel), By Product (Structural Steel, Prestressing Steel, Bright Steel, Welding Wire and Rod, Iron Steel Wire, Ropes, and Braids), and Germany Steel Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

Germany Steel Market Insights Forecasts to 2035

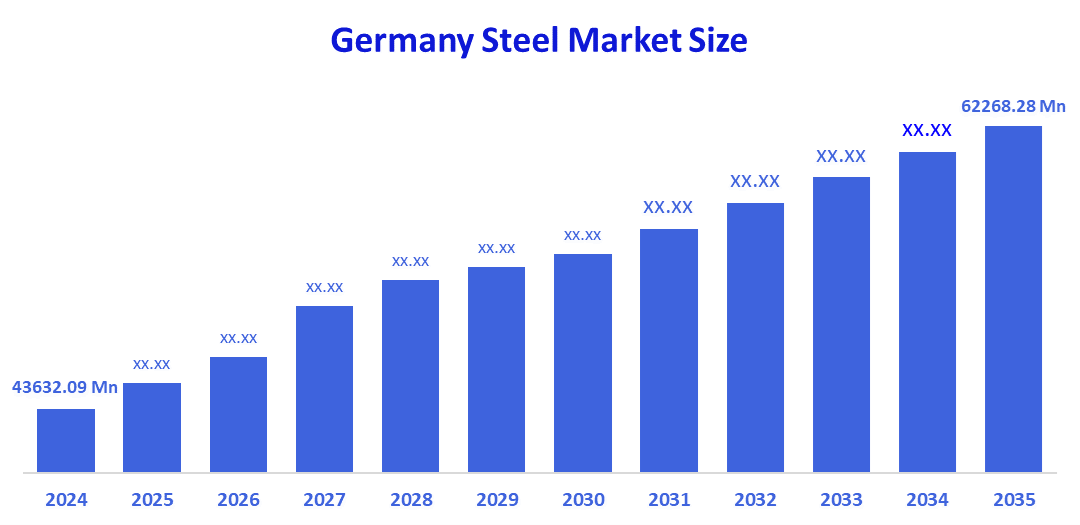

- The Germany Steel Market Size was estimated at USD 43632.09 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.29% from 2025 to 2035

- The Germany Steel Market Size is Expected to Reach USD 62268.28 Million by 2035

According to a research report published by Spherical Insights & Consulting, The Germany Steel Market is anticipated to reach USD 62268.28 million by 2035, growing at a CAGR of 3.29% from 2025 to 2035. A key factor driving the market is the rising use of advanced manufacturing technologies brought on by the rising demand for premium steel.

Market Overview

The steel market in Germany encompasses the domestic production, processing, and consumption of steel across industrial, construction, automotive, and energy sectors, making it an essential element of the nation’s manufacturing economy. Additionally, a new driver for Germany's steel sector is the adoption of digitalization and smart manufacturing technologies. Employing advanced data analytics, automation, and AI-based systems is becoming common in companies, streamlining production processes, reducing material waste, and optimizing energy use. Remote monitoring by intelligent sensors, IoT devices, and predictive maintenance applications enables real-time equipment monitoring, optimizing uptime and output quality. Using digital twin technology to model steel production conditions reduces costs by optimizing process control and resource use. This change encourages, in addition to cost reduction, sustaining agendas through reduced energy use and emissions. As global competition stiffens, digital innovations give German steelmakers an advantage regarding flexibility, customization, and adapted supply chains. Digitalization also mitigates labor shortages by automating material-intensive operations. Government programs such as "Industrie 4.0" programs also promote digital advancements, causing technology to be an important driver of future competitiveness and resilience, thus promoting growth in the German steel market.

Report Coverage

This research report categorizes the market for the Germany steel market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany steel market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany steel market.

Driving Factors

An important trend in the steel market is the growing reliance on scrap and circular economy principles: steel makers are adding more electric arc furnace (EAF) capacity, which uses recycled steel scrap in place of raw iron ore and reduces CO? emissions and energy consumption. For example, Feralpi Stahl pulls scrap from Germany, Poland, and the Czech Republic and checks its purity to ensure quality. The shift responds to EU environmental policy and reduces the amount of raw materials imported (e.g., coking coal or iron ore). In addition, end-users like products made from recycled steel for environmental reasons. On the flip side, the industry faces challenges regarding the reliability of scrap supply and the amount of variation in quality. As such, interest in investing in scrap recovery infrastructure, sorting and logistics will continue to grow. For the next decade, circular economy models will be the name of the game in Germany's steel-making strategy.

Restraining Factors

The consistently high costs of energy and raw materials, which reduce profit margins and discourage investment, are one of the many factors holding back Germany's steel market. The burden of complying with strict EU carbon emission regulations is increased, especially for legacy production facilities. Competitive pressure is further increased by global overcapacity and an increase in imports from lower-cost areas.

Market Segmentation

The Germany steel market share is classified into type and product.

- The flat steel segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany steel market is segmented by type into flat steel, and long steel. Among these, the flat steel segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to strong demand for premium rolled products from the machinery, appliance, and automotive sectors. Growth is further supported by developments in coated and high-strength steel technology as well as rising investments in lightweight and energy-efficient production.

- The structural steel segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany steel market is segmented by product into structural steel, prestressing steel, bright steel, welding wire and rod, iron steel wire, ropes, and braids. Among these, the structural steel segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to a high demand from commercial building, industrial growth, and infrastructure modernization. The use of structural steel in high-rise, tunnel, and bridge construction is further encouraged by government-sponsored green building programs and energy-efficient design guidelines. Furthermore, the segment's upward trajectory is reinforced by the increased use of prefabricated steel components and improvements in fabrication technologies, which speed up and lower the cost of construction.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany steel market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Salzgitter AG

- Kloeckner & Co SE

- Eisen und Hüttenwerke AG

- Others

Recent Developments:

- In June 2025, ArcelorMittal, the world's second-largest steelmaker, had scrapped its plans to convert two German plants to carbon-neutral production, citing high energy costs. The company had also declined government subsidies totaling €1.3 billion ($1.5 billion). This setback had cast doubt on Germany's aspirations for green hydrogen, especially following the loss of Russian gas supply. Meanwhile, rivals Thyssenkrupp and Salzgitter had continued their green steel initiatives. The German ministry had expressed regret over ArcelorMittal's decision.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the Germany Steel Market based on the below-mentioned segments:

Germany Steel Market, By Type

- Flat Steel

- Long Steel

Germany Steel Market, By Product

- Structural Steel

- Prestressing Steel

- Bright Steel

- Welding Wire and Rod

- Iron Steel Wire

- Ropes

- Braids

FAQ’s

Q: What is the Germany steel market size?

A: Germany Steel Market is expected to grow from USD 43632.09 million in 2024 to USD 62268.28 million by 2035, growing at a CAGR of 3.29% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Strong demand from the automotive and construction industries, investments in sustainable and high-strength steel technologies, energy-efficient production, and strategic alignment with EU climate and circular economy goals are the main drivers of Germany's steel market growth.

Q: What factors restrain the Germany steel market?

A: High energy prices, carbon emission rules, global overcapacity, import competition, and the sluggish modernization of legacy infrastructure are some of the factors limiting Germany's steel market and affecting investment momentum and profitability across important segments.

Q: Who are the key players in the Germany steel market?

A: Salzgitter AG, Kloeckner & Co SE, Eisen und Hüttenwerke AG, Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 219 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |