Germany Sustainable Packaging Market

Germany Sustainable Packaging Market Size, Share, and COVID-19 Impact Analysis, By Type (Rigid and Flexible), By Material (Plastics, Paper and Paperboard, Glass, and Metal), and Germany Sustainable Packaging Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Germany Sustainable Packaging Market Insights Forecasts to 2035

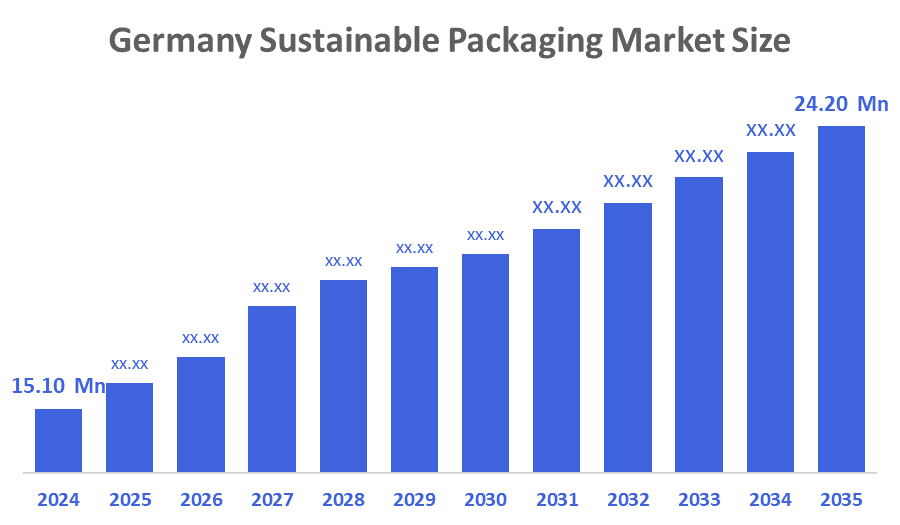

- The Germany Sustainable Packaging Market Size was estimated at USD 15.10 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.38% from 2025 to 2035

- The Germany Sustainable Packaging Market Size is Expected to Reach USD 24.20 Billion by 2035

According to a research report published by Decision Advisior & Consulting, the Germany Sustainable Packaging Market is anticipated to reach USD 24.20 billion by 2035, growing at a CAGR of 4.38% from 2025 to 2035. The market's growth is stable and it is being mainly supported by the following: tough environmental regulations, a rise in customer preference for ecofriendly goods, and innovations in packaging materials technology.

Market Overview

The market for sustainable packaging in Germany pertains to the sector that is entirely dedicated to inventing, manufacturing, and marketing packing alternatives that through their recyclability, biodegradability, and use of renewable resources would not harm the environment and also would fulfill the very strict EU and national sustainability laws. Additionally, Germany's sustainable packaging market is going through a remarkable transformation mainly due to technology developments. The industry is putting emphasis on eco-sustainable and economically viable solutions for new packaging materials. The primary focus of research is on the new biodegradable polymers, e.g. polylactic acid (PLA), which is derived from corn and is thus bio-based polyethylene (PE), leading to the phasing out of traditional plastics. To give an instance, in August 2024 Alpla entered into a partnership with the German start-up Sea Me to market inclusive of the zero packaging system the reusable PET bottles for cosmetics. By a deposit return scheme, these 300ml bottles will be initially distributed in Germany and Austria. This move is designed to make cosmetic packaging less harmful to the environment and at the same time, be a part of the circular economy.

Report Coverage

This research report categorizes the market for the Germany sustainable packaging market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany sustainable packaging market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany sustainable packaging market.

Driving Factors

In Germany, consumer preferences are markedly changing in the direction of sustainability, which has been mainly caused by the increased consciousness around the environmental problems of plastic pollution and carbon emissions, among others. As a result, stores are selling products with little or no environmental impact, and in turn, companies are being forced to switch to eco-friendly packing and adoption of sustainable packaging. Companies that offer eco-friendly packaging are reaping the benefits of consumer trust and loyalty thus obtaining a competitive advantage over others. An example of such a brand is Gerresheimer, which in February 2024 declared its collaboration with the German startup 4peoplewhocare to come up with an eco-friendly pack for a new deodorant cream. The product constitutes a Gx Amsterdam glass jar and a bio-based forewood closure.

Restraining Factors

The restraining factor in Germany's sustainable packaging market is the supply chain which is highly fragmented, limited standardization along eco-friendly materials, adoption taking place slowly in small-sized companies, and inefficiencies in logistics working together to reduce scalability, hinder spread of innovations, and postpone universal market penetration.

Market Segmentation

The Germany sustainable packaging market share is classified into type and material.

- The rigid segment dominated the market in 2024, approximately 55% and is projected to grow at a substantial CAGR during the forecast period.

The Germany sustainable packaging market is segmented by type into rigid and flexible. Among these, the rigid segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. The expansion of the German rigid plastic packaging market is primarily propelled by strong demand from the food, beverage, and pharmaceutical industries, which value durability, product safety, and compliance with strict EU packaging regulations above all. The rise in consumer preference for premium and eco-friendly rigid formats, along with the development of recyclable and biodegradable materials, is another factor that contributes to the market's growth.

- The paper and paperboard segment dominated the market in 2024, approximately 42% and is projected to grow at a substantial CAGR during the forecast period.

The Germany sustainable packaging market is segmented by material into plastics, paper and paperboard, glass and metal. Among these, the paper and paperboard segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. Germany's strong recycling infrastructure, eco-friendly packaging consumer preference, and government support for fiber-based solutions have been the main forces driving the market. In addition, the food, beverage, and e-commerce sectors' increasing demand for sustainable, lightweight, and biodegradable materials is another factor that speeds up the adoption of these materials.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany sustainable packaging market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Winfried Wirth

- Mondi Group

- Smurfit Kappa

- DS Smith

- Stora Enso

- Constantia Flexibles

- Others

Recent Developments:

- In December 2024, LEEF, a Berlin-based palm leaf packaging specialist announced the acquisition of sustainable packaging startup Wisefood, known for its edible straws and cups. The merger aimed to enhance retail and e-commerce channels and developed new eco-friendly solutions, boosting LEEF's revenue and growth, with plans for full integration by 2025.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035.Decision Advisior has segmented the Germany Sustainable Packaging Market based on the below-mentioned segments:

Germany Sustainable Packaging Market, By Type

- Rigid

- Flexible

Germany Sustainable Packaging Market, By Material

- Plastics

- Paper and Paperboard

- Glass

- Metal

FAQ’s

Q: What is the Germany sustainable packaging market size?

A: Germany Sustainable Packaging Market is expected to grow from USD 15.10 billion in 2024 to USD 24.20 billion by 2035, growing at a CAGR of 4.38% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Germany's green packaging sector is growing primarily due to the strict environmental rules, more consumers becoming environmentally aware, and innovations in materials technology, along with the sustainability efforts of corporations and the preference for packaging solutions that can be recycled, composted, or are otherwise friendly to the environment.

Q: What factors restrain the Germany sustainable packaging market?

A: Germany's eco-friendly packaging market is held back by a myriad of factors including high production costs, limited source materials, technological problems, consumers being price-sensitive, and complicated regulatory compliance which altogether hinder the adoption and scalability of such products.

Q: Who are the key players in the Germany sustainable packaging market?

A: Winfried Wirth, Mondi Group, Smurfit Kappa, DS Smith, Stora Enso, Constantia Flexibles, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 196 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |