Germany Venture Capital Market

Germany Venture Capital Market Size, Share, and COVID-19 Impact Analysis, By Funding Type (First-Time Venturing Funding and Follow-On Venturing Funding), By Sector (Software, Pharma and Biotech, Media and Entertainment, Medical Devices and Equipment, Medical Services and Systems, IT Hardware, IT Services and Telecommunication, Consumer Goods and Recreation, Energy, and Others), and Germany Venture Capital Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Germany Venture Capital Market Insights Forecasts to 2035

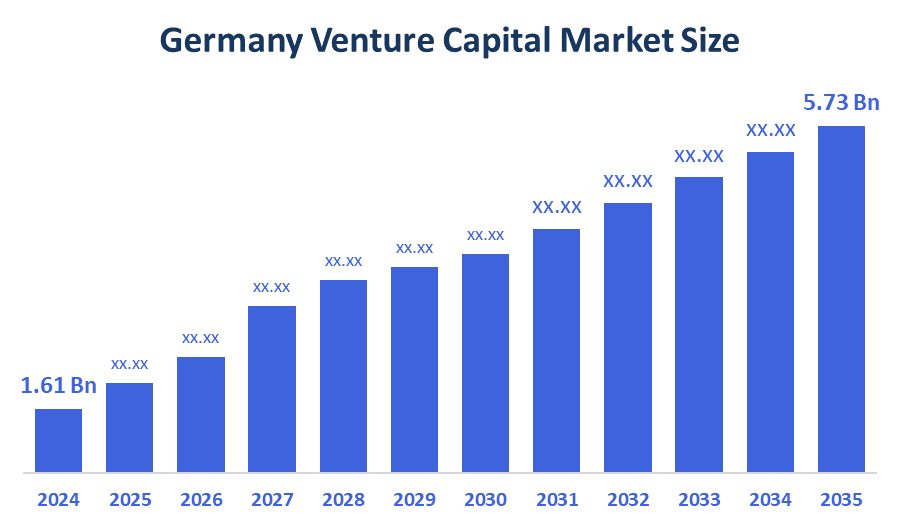

- The Germany Venture Capital Market Size was estimated at USD 1.61 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 12.23% from 2025 to 2035

- The Germany Venture Capital Market Size is Expected to Reach USD 5.73 Billion by 2035

According to a research report published by Spherical Insights & Consulting, The Germany Venture Capital Market is anticipated to reach USD 5.73 billion by 2035, growing at a CAGR of 12.23% from 2025 to 2035. Growing government support, a thriving startup ecosystem, increased interest from foreign investors, a greater emphasis on technology and innovation, and expanding corporate venture capital are the main factors driving Germany's venture capital market share.

Market Overview

The Germany venture capital market consists of the financial system in Germany that involves the financing of startups and early-stage ventures by venture capital firms, private investors, and institutional funds. It involves the flows of investment capital into high-growth, innovation-based enterprises and the structures, regulations, and stakeholders to facilitate those investments. Additionally, Germany boasts one of the most vibrant startup scenes in Europe, with a wide variety of companies in the fintech, e-commerce, healthcare, and technology sectors. The outlook of the German venture capital market is being positively impacted by the nation's expanding standing as a major startup hub, which continues to draw in entrepreneurs and venture capitalists from around the world. This ecosystem is further reinforced by a flourishing network of coworking spaces, incubators, and accelerators that help startups grow quickly. For venture capitalists looking to support the upcoming wave of innovation, these developments have expanded the pool of available investment opportunities. In line with this trend, Berlin-based venture capital firm naturalX Health Ventures established a €100 million fund in February 2025 to assist startups in the consumer health space in Europe. By making investments in consumer-focused, science-driven health solutions, the initiative seeks to close the gap between wellness and medicine.

Report Coverage

This research report categorizes the market for the Germany venture capital market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany venture capital market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany venture capital market.

Driving Factors

The German venture capital ecosystem is being supported by the implementation of various government regulations. The growth of the German venture capital market is being fueled by the introduction of numerous initiatives that promote investments in creative startups. One government-backed seed investor that has been crucial in helping early-stage businesses is the High-Tech Gründerfonds (HTGF). Furthermore, the government has implemented initiatives that offer tax breaks to investors and new businesses, like the "INVEST Grant," which reimburses private investors in creative businesses. These actions lower the risk involved in early-stage investments and foster an environment that is advantageous to investors. Further, the government's initiatives to simplify the laws governing venture capital firms also aid in drawing in both foreign and domestic investors, which supports market expansion.

Restraining Factors

Germany's venture capital market is constrained by a historically conservative investment culture that slows capital deployment and restricts early-stage risk appetite. While fragmented regional funding ecosystems make it difficult to access venture support consistently, regulatory complexity and bureaucratic obstacles make deal execution more difficult. Additionally, investor incentives are diminished by the lack of late-stage capital and slower exit cycles in comparison to international peers.

Market Segmentation

The Germany venture capital market share is classified into funding type and sector.

- The follow-on venturing funding segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany venture capital market is segmented by funding type into first-time venturing funding and follow-on venturing funding. Among these, the follow-on venturing funding segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to the startup ecosystem's growing maturity, which is causing more businesses to move past the seed stage and need bigger funding in order to grow. Investor confidence in later-stage funding has increased as a result of improved exit opportunities through initial public offerings (IPOs) and acquisitions, as well as robust government-backed programs like the Zukunftsfonds.

- The software segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany venture capital market is segmented by sector into software, pharma and biotech, media and entertainment, medical devices and equipment, medical services and systems, IT hardware, IT services and telecommunication, consumer goods and recreation, energy, and others. Among these, the software segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the nation's booming startup scene, especially in Berlin and Munich, where investors are very interested in SaaS, AI, and cybersecurity projects. The segment's appeal is further increased by increased industry-wide digitization, government support for innovation, and scalable business models with high potential returns. Further supporting the software sector's dominant position and anticipated CAGR growth are Germany's strong tech talent pool and growing exit opportunities through IPOs and acquisitions, which boost ongoing venture capital inflows.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany venture capital market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Earlybird Venture Capital

- HV Capital

- Cherry Ventures

- Project A Ventures

- BlueYard Capital

- Atlantic Labs

- Others

Recent Developments:

- In June 2024, Germany-based Vsquared Ventures had announced the closing of a €214 million fund for early-stage deep tech startups. The firm intended to invest in 25 deep tech companies across Europe, allocating between €500,000 and €5 million per startup. Additionally, it had reserved funds for follow-on investments.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Decision Advisiors has segmented the Germany Venture Capital Market based on the below-mentioned segments:

Germany Venture Capital Market, By Funding Type

- First-Time Venturing Funding

- Follow-On Venturing Funding

Germany Venture Capital Market, By Sector

- Software

- Pharma and Biotech

- Media and Entertainment

- Medical Devices and Equipment

- Medical Services and Systems

- IT Hardware

- IT Services and Telecommunication

- Consumer Goods and Recreation

- Energy

- Others

FAQ’s

Q: What is the Germany venture capital market size?

A: Germany Venture Capital Market is expected to grow from USD 1.61 billion in 2024 to USD 5.73 billion by 2035, growing at a CAGR of 12.23% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: The maturing startup ecosystem, growing tech innovation, better exit opportunities, growing investor appetite for scalable, disruptive business models across sectors, and increased government support are some of the major factors propelling the growth of Germany's venture capital market.

Q: What factors restrain the Germany venture capital market?

A: Germany's venture capital market is constrained by a number of factors, such as a culture of risk aversion among investors, dispersed regional funding, complicated regulations, a lack of late-stage capital, and slower exit cycles than those of the US and Asia.

Q: Who are the key players in the Germany venture capital market?

A: Earlybird Venture Capital, HV Capital, Cherry Ventures, Project A Ventures, BlueYard Capital, Atlantic Labs, Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |