Global Greek Yogurt Market

Global Greek Yogurt Market Size, Share, and COVID-19 Impact Analysis, By Flavor (Strawberry, Vanilla, Blueberry, Peach, Others), By Distribution Channel (Supermarkets, Convenience Stores, Online, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Global Greek Yogurt Market Size Summary

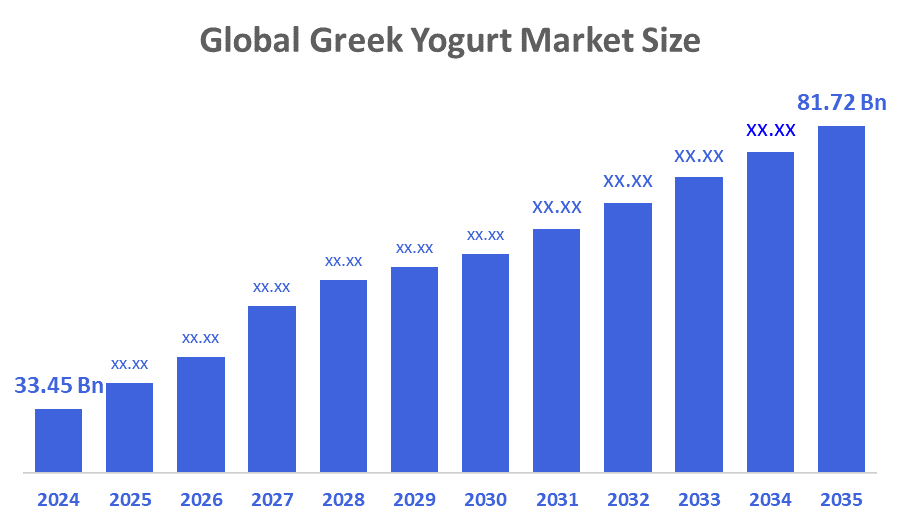

The Global Greek Yogurt Market Size Was Estimated at USD 33.45 Billion in 2024 and is Projected to Reach USD 81.72 Billion by 2035, Growing at a CAGR of 8.46% from 2025 to 2035. Increased demand for high-protein and low-sugar foods, growing knowledge of the advantages of probiotics, and consumers' preference for quick, wholesome snacks among those who lead active, wellness-focused lives are the main factors propelling the Greek yogurt market's expansion.

Key Regional and Segment-Wise Insights

- In 2024, the Greek yogurt market in Europe held the largest revenue share of 29.4% and dominated the market worldwide.

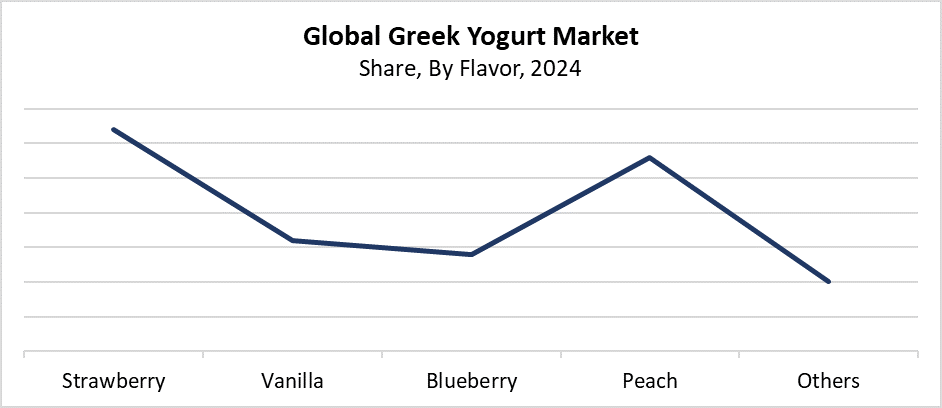

- In 2024, the strawberry segment held the highest revenue share of 32.5% and dominated the global market by flavour.

- With the biggest revenue share in 2024, the supermarket segment led the worldwide market by distribution channel.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 33.45 Billion

- 2035 Projected Market Size: USD 81.72 Billion

- CAGR (2025-2035): 8.46%

- Europe: Largest market in 2024

The Greek yogurt market functions as a distinct division of the dairy industry because it produces yogurt through whey extraction, which results in a product with reduced sugar content and increased protein levels compared to traditional yogurt. People who focus on their health choose this product because it contains specific nutrients that support digestion and promote fullness while building muscle tissue. The market growth stems from three main factors, which include the rising interest in high-protein diets, probiotic foods, and the growing consumer focus on health and wellness. The market growth has been driven by two main factors, which include the rising demand for low-fat and low-sugar foods. The increasing popularity of clean-label natural ingredients. People consume more food because they need convenient meals while their busy schedules continue to grow.

The nutritional profile of Greek yogurt stays intact while technological advancements in dairy processing have enhanced its texture and flavour, and extended its shelf life. Packaging innovations, which include portion-controlled and resealable containers, have made products more convenient to use while making them visually more appealing to customers. The market experiences growth because government programs back healthy eating through their support of dairy product development and their enforcement of food safety standards. The daily consumption of Greek yoghurt as a high-protein food continues to rise because government programs in developing countries promote nutritional improvement.

Flavor Insights

The strawberry segment leads the worldwide Greek yogurt market by holding the largest revenue share of 32.5% in 2024. The growing popularity of Greek yogurt stems from its health benefits and the widespread preference for fruit-flavoured yogurt products. The strawberry-flavoured Greek yogurt appeals to all age groups because it delivers a tasty yet healthy snack option for children and adults who care about their nutrition. People enjoy strawberries because they contain a natural combination of sweetness and tartness, and because they think strawberries provide health advantages. The market manufacturers keep developing new strawberry products, which include low-fat options, organic varieties, and probiotic-enriched products. The worldwide popularity of Strawberry Greek yogurt continues to grow because it comes in different packaging options. It is sold through multiple sales outlets.

The peach segment of the Greek yogurt market is expected to grow at a significant CAGR during the forecast period. The market expansion results from customer demand for fruit-based wellness products, which match their health-focused lifestyle. Peach-flavoured Greek yogurt offers a unique taste experience, which draws consumers who want to try something different from traditional strawberry and vanilla flavours. The product receives positive feedback from health-conscious customers because it combines natural sweetness with digestive health advantages. Manufacturers have started producing new peach-based products. These include organic options and low-fat, and probiotic-enriched versions. It is anticipated that supermarkets, together with speciality shops and online marketplaces, will boost their peach-flavoured Greek yogurt availability, which will drive market expansion through increased consumer demand.

Distribution Channel Insights

The supermarket segment held the highest revenue share and led the worldwide Greek yogurt market during 2024. Supermarkets maintain their position as the most successful retailers because they offer a broad selection of products at convenient locations. Supermarkets offer a broad selection of Greek yogurt products from established brands and new entrants, which include various flavours and packaging options, and nutritional choices such as low-fat, organic, and high-protein options. Dairy purchases depend on the combination of special deals and competitive pricing, along with product placement within dairy sections. People who browse products in physical stores and compare items develop stronger satisfaction with their purchases. This leads to higher customer loyalty. Supermarkets maintain their position as the most common Greek yogurt shopping destination worldwide because of their strong distribution systems and regular customer visits.

The online segment of the Greek yogurt market will experience substantial CAGR growth during the forecast period because of changing consumer shopping patterns and increased e-commerce shopping activities. People now choose digital platforms to purchase their groceries, which include Greek yogurt, because these platforms provide a fast and simple shopping experience. Online stores provide their customers with better convenience through their wide product range, their ability to compare prices easily, their subscription plans, and home delivery options. The combination of cold-chain logistics growth and new packaging solutions enables products to maintain their freshness during transportation. Greek yogurt sales through online channels continue to grow because customers receive promotional discounts and personalised product recommendations. Popular dairy brands gain more exposure on e-commerce platforms.

Regional Insights

Europe leads the worldwide Greek yogurt market with the largest revenue share of 29.4% in 2024. The region's long-standing dairy consumption culture, high level of wellness and health consciousness, and robust demand for foods high in protein and probiotics are the main drivers of this supremacy. Greek yogurt has become more popular as a healthy snack or meal addition in nations like the UK, Germany, and France. The European market shows strong interest in products with reduced sugar content, organic certification, and clean-label attributes, which drives businesses to develop new product offerings. The market has also grown because of the existence of well-known dairy producers, a strong retail network, and government programs encouraging a healthy diet. The market in this region shows growth because more people want to buy plant-based Greek-style yogurts.

North America Greek Yogurt Market Trends

North America held a significant revenue share of the Greek yogurt market during 2024 because people seek protein-rich foods that contain low sugar amounts and probiotics. The United States maintains its position as a major contributor because Greek yogurt remains popular as a healthy snack and meal alternative, while the country maintains a strong health and wellness culture. The market benefits from continuous product development when manufacturers introduce healthy components, plant-based alternatives, and new taste profiles to their offerings. The sales increase because more people want clean-label items, and fitness activities gain popularity while retail stores remain widely available. The market remains successful in the region because Greek yogurt products are available through various online and offline channels, and leading dairy brands operate in the area.

Asia Pacific Greek Yogurt Market Trends

The Asia Pacific Greek yogurt market is expected to grow significantly because people want more high-protein probiotic foods and because they are changing their eating habits and becoming more health aware. The middle-class population growth, together with fast urban development and increasing disposable income levels, drives consumers in China, India, Japan, and Australia to start eating healthier. Greek yogurt continues to grow in popularity as a convenient, nutritious breakfast and snack option which appeals to young health-conscious consumers. The expansion of contemporary retail formats and e-commerce platforms has improved product availability in both urban and semi-urban areas. In order to satisfy different consumer preferences, producers now develop regional flavours and plant-based and lactose-free Greek yogurt options. This drives market growth in the region.

Key Greek Yogurt Companies:

The following are the leading companies in the greek yogurt market. These companies collectively hold the largest market share and dictate industry trends.

- Chobani, LLC

- The Hain Celestial Group

- Nestlé

- Danone

- The Kroger Co.

- General Mills Inc.

- Fage International S.A.

- Horizon Organic Dairy, LLC

- Parmalat S.p.A.

- Stonyfield Farm, Inc.

- Others

Recent Developments

- In October 2024, Chobani announced the introduction of their range of healthy Greek yogurt cups and drinks, Chobani High Protein, which are prepared with natural ingredients and real fruits and don't contain added sugar. The new cups have 20 grams of protein, and the drinks come in 15-, 20-, and 30-gram varieties. They are free of lactose and don't include any protein concentrates, powders, or preservatives. In November, the yogurt cups were distributed to U.S. shops, and in January 2025, the drink options were introduced for sale.

- In September 2024, The Hain Celestial Group launched a new range of fall-themed, healthier snacks and drinks for American consumers. Among other products, they included the Garden Veggie Snacks Apple Straws, Earth's Best Sunny Days Snack Bars, and Greek Gods Honey Yogurt. Major supermarket chains like Walmart, Amazon, and Target, as well as neighbourhood speciality stores, carried the products.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the greek yogurt market based on the below-mentioned segments:

Global Greek Yogurt Market, By Flavor

- Strawberry

- Vanilla

- Blueberry

- Peach

- Others

Global Greek Yogurt Market, By Distribution Channel

- Supermarkets

- Convenience Stores

- Online

- Others

Global Greek Yogurt Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 159 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |