Global Handheld X-rays Market

Global Handheld X-rays Market Size, Share, and COVID-19 Impact Analysis, By Application (Dental, Orthopedic, Others), By End-use (Hospitals, Outpatient Facilities, Research & Manufacturing), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Handheld X-rays Market Size Summary

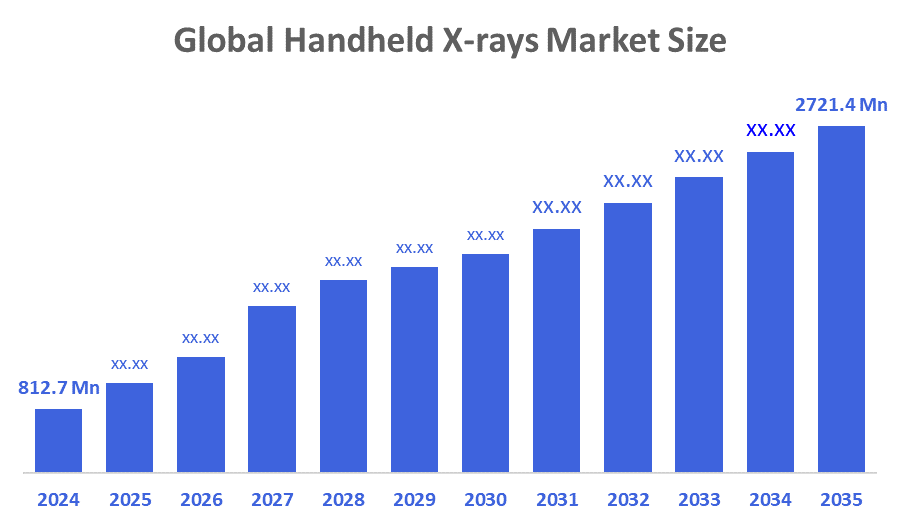

The Global Handheld X-Rays Market Size Was Estimated at USD 812.7 Million in 2024 and is Projected to Reach USD 2721.4 Billion by 2035, Growing at a CAGR of 11.61% from 2025 to 2035. Technological developments such as digital imaging and AI integration, the growing need for portable diagnostics in remote and emergency settings, the preference for mobile solutions because of their affordability and reduced radiation, and the growth of mobile healthcare services are all factors propelling the handheld X-ray market.

Key Regional and Segment-Wise Insights

- In 2024, North America held the largest revenue share of over 33.4% and dominated the market globally.

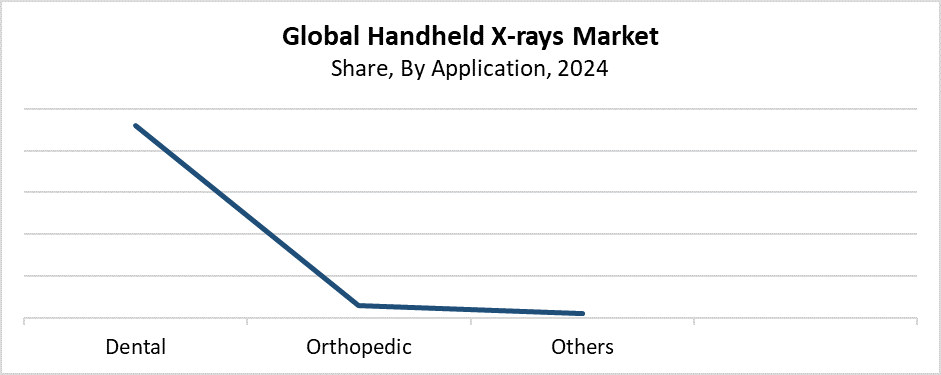

- In 2024, the dental segment had the highest market share by application, accounting for 92.3%.

- In 2024, the hospitals segment had the biggest market share by end use, accounting for 46.3%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 812.7 Million

- 2035 Projected Market Size: USD 2721.4 Billion

- CAGR (2025-2035): 11.61%

- North America: Largest market in 2024

The handheld X-rays market functions as a trading platform for portable medical imaging tools that help doctors conduct diagnostic radiography at treatment sites. Various healthcare settings, such as dental offices and emergency rooms, along with military facilities, sports medicine, and mobile healthcare services, extensively use these compact devices. The market experiences its main growth because of rising requirements for quick and straightforward diagnostic instruments, especially when traditional fixed X-ray scanners prove inconvenient. The worldwide market for handheld X-ray devices grows because of faster medical diagnosis requirements, rising cases of dental and orthopedic diseases, and expanding usage of these devices in home and field medical operations.

The handheld X-ray market experiences substantial changes because of recent technological advancements. Modern handheld X-ray devices improve their performance while remaining safe for operators and user-friendly because of technological progress in digital imaging systems, alongside better battery endurance and lightweight structures, and enhanced image resolution. The system of cloud-based data storage linked with wireless communication allows straightforward sharing and analysis of photographs. Government programs that support diagnostic devices help boost adoption rates, especially in remote and developing areas. The market expands consistently because regulatory bodies approve handheld X-ray machines, which provide safer operation with lower radiation exposure.

Application Insights

The dental segment led the handheld X-rays market with the largest revenue share of 92.3% in 2024. Portable X-ray devices maintain a dominant market position because dental clinics rely on them for their routine diagnostic applications, including implant analysis, cavity detection, and root canal treatment assessments. Dentists prefer handheld X-ray machines because these devices combine portability with user-friendly operation and enable fast, high-quality imaging without requiring patients to move to another room. Point-of-care diagnostics in dentistry clinics, especially small and transportable ones, have driven substantial growth in this segment. Modern dentistry diagnostic protocols now incorporate handheld X-ray technology because technical advancements have reduced radiation levels while maintaining clear image resolution.

The orthopedic segment of the handheld X-rays market is expected to experience significant growth throughout the projected timeframe. The market expansion occurs because of rising requirements for portable imaging devices used in trauma care and sports medicine, as well as emergency services and remote rural areas that lack typical imaging equipment access. The point-of-care diagnostic capabilities of handheld X-ray equipment allow medical professionals to rapidly identify bone fractures alongside joint dislocations and other musculoskeletal issues. As orthopedic care advances toward outpatient and ambulatory models, the medical industry demands diagnostic tools that are compact and straightforward to use. The orthopedic applications of handheld X-ray systems are becoming more suitable because of better image resolution, extended battery life, and radiation safety features that lead to their expanding clinical use.

End-use Insights

The hospital segment leads the handheld X-rays market with the largest revenue share of 46.3% in 2024. Hospitals widely use handheld X-ray equipment because these devices offer portability alongside versatility and immediate diagnostic imaging capabilities at care points. These instruments prove highly useful in operating rooms, critical care units, and emergency rooms where rapid diagnostic imaging supports immediate clinical choices. Hospital settings have experienced increasing demand for bedside diagnostics because they deliver rapid diagnostic capabilities to critical care patients and trauma victims. Digital imaging equipment, together with handheld X-rays, enables hospitals to exchange data faster while streamlining their operational processes. These combined factors drive the segment's leading position in the market.

During the forecast period, the outpatient facilities segment is expected to experience the fastest growth in the handheld X-rays market. The rising need for cost-effective and precise diagnostic tools in ambulatory care settings, which include urgent care facilities, dental clinics, and orthopedic practices, drives this growth. The combination of portability and user-friendliness makes handheld X-ray machines ideal tools for outpatient facilities that often have limited space and resources. The trend toward decentralized healthcare, along with increasing patient volume at outpatient centers and requirements for faster imaging turnaround time, drives accelerated adoption. The segment experiences rapid growth because of wireless connectivity advancements, lightweight designs, and lower radiation exposure make these devices more suitable for outpatient applications.

Regional Insights

In 2024, North America led the handheld X-ray market with the largest revenue share of 33.4%. The sophisticated healthcare system in the region, along with its widespread implementation of advanced medical technology and rising demand for point-of-care diagnostics, helps it maintain its market dominance. Handheld X-ray machine usage in emergency care, orthopedics, and dental practices has caused significant market expansion, mainly in the United States. The high volume of dental and outpatient treatments, combined with favorable reimbursement policies and leading industry players, enables greater device utilization. The FDA, along with other organizations, provides regulatory support and rising mobile healthcare investments, which help drive faster adoption. The combination of these factors establishes North America as the leading market region for handheld X-ray devices.

Europe Handheld X-Rays Market Trends

The European handheld X-ray market held a significant revenue share in 2024 because of a robust healthcare system, rising use of portable medical devices, and increased emphasis on patient-centered treatment. The use of handheld X-ray machines has expanded throughout major European countries because dental offices, outpatient clinics, and emergency care facilities require quick and efficient diagnostic imaging solutions. The industry growth accelerated because governments supported low-dose imaging technologies, and people became more conscious about radiation safety. The increasing elderly population in Europe, alongside rising numbers of dental and musculoskeletal disorders, drives the need for portable diagnostic equipment. Europe's position as a leader in the worldwide handheld X-ray industry strengthens through ongoing developments in digital imaging and data integration.

Asia Pacific Handheld X-Rays Market Trends

The Asia Pacific handheld X-rays market is anticipated to grow at the fastest CAGR during the forecast period. The rapid expansion of healthcare access to remote locations, together with growing needs for mobile diagnostic devices and increased healthcare funding, drives this quick market growth. The increasing number of dental and orthopedic procedures in China, India, and Japan has created a strong need for compact, efficient imaging instruments. The market expands because governments invest in healthcare infrastructure development, and people learn more about detecting diseases at their earliest stages. The Asia Pacific region experiences accelerated handheld X-ray device adoption because these devices cost less and operate easily making them suitable for mobile clinics and rural healthcare settings.

Key Handheld X-rays Companies:

The following are the leading companies in the handheld X-rays market. These companies collectively hold the largest market share and dictate industry trends.

- Dental Imaging Technologies Corporation

- EVIDENT

- MaxRayCocoon.com

- REMEDI Co Ltd

- OXOS Medical

- Genoray

- Digital Doc LLC.

- Carestream Dental LLC

- Others

Recent Developments

- In January 2025, Oxos Medical's MC2 ultraportable x-ray equipment was approved by the FDA. Static imaging, fluoroscopy, and digital radiography are all available with the lightweight, cordless MC2. Its proprietary positioning method facilitates the capturing of images, and its low radiation output and tiny scatter area minimize the requirement for equipment and space.

- In July 2024, Turner Imaging Systems introduced a portable digital X-ray solution called the Enduro DR X-ray system. A wireless flat panel detector, a laptop with software, and a 6-pound scanner are all included. The device is portable and may be used on a tripod or stand, and it is made for a variety of clinical settings.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the handheld X-rays market based on the below-mentioned segments:

Global Handheld X-rays Market, By Application

- Dental

- Orthopedic

- Others

Global Handheld X-rays Market, By End Use

- Hospitals

- Outpatient Facilities

- Research & Manufacturing

Global Handheld X-rays Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 213 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |