Global Healthcare Cold Chain Logistics Market

Global Healthcare Cold Chain Logistics Market Size, Share, and COVID-19 Impact Analysis, By Product (Vaccines, Biopharmaceuticals, Clinical trial materials, and Others), By Service (Transportation, Storage, Packaging, and Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Global Healthcare Cold Chain Logistics Market Size Insights Forecasts to 2035

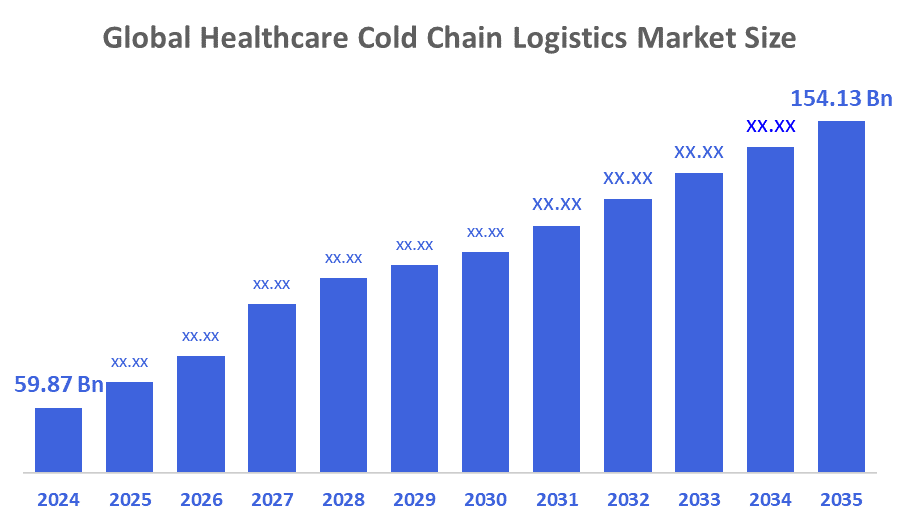

- The Global Healthcare Cold Chain Logistics Market Size Was valued at USD 59.87 Billion in 2024

- The Global Healthcare Cold Chain Logistics Market Size is Expected to Grow at a CAGR of around 8.98% from 2025 to 2035

- The Worldwide Healthcare Cold Chain Logistics Market Size is Expected to Reach USD 154.13 Billion by 2035

- Asia-Pacific is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global Healthcare Cold Chain Logistics Market Size was worth around USD 59.87 Billion in 2024 and is predicted to Grow to around USD 154.13 Billion by 2035 with a compound annual growth rate (CAGR) of 8.98% from 2025 to 2035. The market for healthcare cold chain logistics is expanding primarily because of its significant role in healthcare for the transportation of vaccines, pharmaceuticals, biologics, blood and blood products, medical devices, and laboratory specimens. It offers a lot of advantages like reduction in waste, better quality of products, higher efficiency, safer environment, and savings in cost.

Market Overview

The global healthcare cold chain logistics market designates the international sector that handles the entire process of transporting, storing, and distributing perishable items with temperature control, such as food, drugs, and chemicals, while maintaining their quality, safety, and regulatory compliance. Additionally, the healthcare cold chain logistics market is gaining significant opportunities due to the global growth of clinical trials. The drug manufacturers are performing studies in several countries which require the careful handling of biological samples, investigational drugs, and treatments tailored to specific patients. Logistics companies can win over the customers by providing customized services that combine adherence to regulations, paperwork, and temperature control across borders. They are working with contract research organizations and drug manufacturers to make the distribution of trial-related products quicker and easier. Cold chain operators who can prove their accuracy in handling product quality during transportation through complicated routes will be the ones who will get the flowers from trial sponsors as they want very exact control over sample preservation and drug delivery.

Report Coverage

This research report categorizes the healthcare cold chain logistics market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the healthcare cold chain logistics market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the healthcare cold chain logistics market.

Driving Factors

The clinical trial supply chain is progressively incorporating modern logistics solutions for the purpose of improving efficiency and reliability. Innovations like real-time tracking, automated inventory management and temperature-controlled shipping are being combined in a way that they help to deliver trial materials on time and securely. These developments are very important to hold up the integrity of clinical trials and to meet the requirements of regulatory standards. An example of this is the opening of the Life Science Center (LSC) in India by FedEx Express in February 2024. This center is designed to meet the storage and logistics demands of the healthcare sector and hence serves the clinical trial market by allowing both local usage and international shipping to India.

Restraining Factors

Conventional methods generally did not provide complete traceability and therefore could not supply detailed information on the journey of the product through the cold chain. This drawback made it difficult to pinpoint the exact reasons for fluctuations in temperature or cases of spoilage, thus limiting the healthcare cold chain logistics market.

Market Segmentation

The healthcare cold chain logistics market share is classified into product and service.

- The vaccines segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product, the healthcare cold chain logistics Market is divided into vaccines, biopharmaceuticals, clinical trial materials, and others. Among these, the vaccines segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The leadership in this area is related to the strict temperature requirements of the vaccines, which dictate the need for exact and uninterrupted cold chain logistics to keep the vaccines potent and in adherence to health regulations. Temperature-controlled logistics services are always in demand because of global vaccination programs, which include childhood immunization, seasonal flu, and various infectious diseases.

- The transportation segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the service, the healthcare cold chain logistics market is divided into transportation, storage, packaging, and others. Among these, the transportation segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The transportation industry is made quite visible through its function of securing the delivery of biopharma goods, both in time and through the right temperature. The healthcare supply chains are becoming more intricate and that is the reason for higher demand for multimodal, real-time monitored, and validated transportation services.

Regional Segment Analysis of the Healthcare Cold Chain Logistics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the healthcare cold chain logistics market over the predicted timeframe.

North America anticipated to hold the largest share of the healthcare cold chain logistics market over the predicted timeframe. North America is rigorously upgrading cold chain infrastructure through digitalization and automation. Along with that, the use of AI-powered temperature monitoring and automated storage systems for increasing efficiency and compliance is a common practice among the companies. The modernization not only aims to meet the growing demand for temperature-sensitive products but also to make the distribution process smoother across the area.

Asia-Pacific is expected to grow at a rapid CAGR in the healthcare cold chain logistics market during the forecast period. Government-funded production hubs and rapidly expanding healthcare access are the main reasons behind this situation. The use of robots in Chinese warehouses at below-freezing temperatures is a clear sign of improved operational efficiency brought about by technology. With its state-of-the-art technology and convenient location, Singapore's DHL Pharma Hub not only connects the region better but also highlights the increasing importance of cold chain logistics in Southeast Asia’s healthcare market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the healthcare cold chain logistics market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DHL International GmbH

- FedEx Corporation

- United Parcel Service, Inc.

- Kuehne + Nagel International AG

- DB Schenker

- CEVA Logistics

- DSV

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2024, DP World had launched over 100 new freight forwarding offices globally, marking a significant expansion in its logistics capabilities. This expansion covered various sectors, with a particular emphasis on healthcare logistics, ensuring the safe and efficient transportation of medical supplies and equipment.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the healthcare cold chain logistics market based on the below-mentioned segments:

Global Healthcare Cold Chain Logistics Market, By Product

- Vaccines

- Biopharmaceuticals

- Clinical trial materials

- Others

Global Healthcare Cold Chain Logistics Market, By Service

- Transportation

- Storage

- Packaging

- Others

Global Healthcare Cold Chain Logistics Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the CAGR of the healthcare cold chain logistics market over the forecast period?

A: The global healthcare cold chain logistics market is projected to expand at a CAGR of 8.98% during the forecast period.

- What is the market size of the healthcare cold chain logistics market?

A: the global healthcare cold chain logistics market Size is estimated to grow from USD 59.87 billion in 2024 to USD 154.13 billion by 2035, at a CAGR of 8.98% during the forecast period 2025-2035.

- Which region holds the largest share of the healthcare cold chain logistics market?

A: North America is anticipated to hold the largest share of the healthcare cold chain logistics market over the predicted timeframe.

- Who are the top 10 companies operating in the global healthcare cold chain logistics market?

A: DHL International GmbH, FedEx Corporation, United Parcel Service, Inc., Kuehne + Nagel International AG, DB Schenker, CEVA Logistics, DSV, and Others.

- What are the market trends in the healthcare cold chain logistics market?

A: The healthcare cold chain logistics market is witnessing major trends such as increased requirement for temperature-sensitive medicines, IoT monitoring adoption, rise in biologics and vaccines, cold storage infrastructure development, and more emphasis on compliance with regulations and tracking.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 276 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |