Global Healthy Fruit and Vegetable Chips Market

Global Healthy Fruit and Vegetable Chips Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Fruit Chips, Vegetable Chips, Combination Chips (Fruit and Vegetable)), By Ingredient (Dried Fruit, Dried Vegetables, Mixed Ingredients (Fruit and Vegetable)), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Global Healthy Fruit and Vegetable Chips Market Size Insights Forecasts to 2035

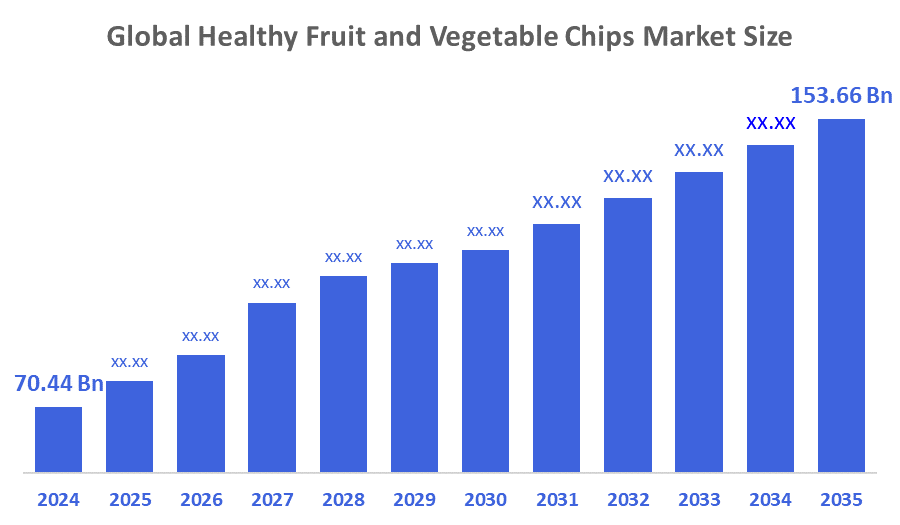

- The Global Healthy Fruit and Vegetable Chips Market Size Was Estimated at USD 70.44 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.35% from 2025 to 2035

- The Worldwide Healthy Fruit and Vegetable Chips Market Size is Expected to Reach USD 153.66 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global Healthy Fruit and Vegetable Chips Market Size was worth around USD 70.44 Billion in 2024 and is predicted to Grow to around USD 153.66 Billion by 2035 with a compound annual growth rate (CAGR) of 7.35% from 2025 to 2035. Consumers' rising preference for functional, convenient, and flavored ready, to, eat snacks is the main driver of the market demand. Additionally, there is an opportunity to develop vegetable chips that are not only functional but also enriched with added nutrients, such as fibre, protein, or probiotics, essentially turning snacks into products that support health.

Market Overview

The healthy fruit and vegetable chips market describes a segment within the packaged food industry that focuses on the production and sale of chips made of fruits and vegetables, which are presented as healthier substitutes for traditional potato chips. Generally, these products are promoted as low-fat, nutrient, rich, plant, plant-based snacks that attract health-conscious consumers, fitness enthusiasts, and individuals with dietary restrictions. Fruit and vegetable chips are snacks made by drying, frying, or baking fresh fruits and vegetables while still retaining their natural flavours and nutrients. They provide a healthier alternative to conventional potato chips by supplying dietary fibre, vitamins, and antioxidants. The most common products are chips made of apple, banana, beetroot, carrot, sweet potato, and mixed vegetables. These snacks are designed to appeal to health-conscious consumers who are looking for convenient, tasty, and shelf-stable solutions and are thus becoming popular in both retail and e-commerce channels worldwide.

In July 2025, Kerala-based banana chips brand Beyond Snack raised $3.5 million in a pre-Series A funding round led by NABVENTURES, the agri-food focused venture capital fund backed by NABARD. The capital will be used to expand distribution, strengthen supply chains, and invest in R&D.

The USDA announced on October 18, 2024, that it is investing over $46 million to strengthen food and nutrition security in underserved communities, focusing on expanding access to fruits and vegetables and supporting healthier diets. The funding will be distributed through two major programs: the Community Food Projects Competitive Grants Program (CFPCGP) and the Gus Schumacher Nutrition Incentive Program (GusNIP).

Report Coverage

This research report categorises the healthy fruit and vegetable chips market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the healthy fruit and vegetable chips market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the healthy fruit and vegetable chips market.

Driving Factors

The market growth can be attributed to various factors, such as consumer awareness of plant-based nutrition and functional snacks, the demand for gluten-free and preservative-free, free products, and the adoption trend among cafes, restaurants, and corporate snacking segments. On top of that, there are chances to take sustainable packaging to the next level, focus on the markets with a rise in disposable incomes, and create chips with added nutrients or protein to satisfy the customers' dietary preferences, thus making these snacks not only healthy but also compatible with modern lifestyles. The demand for unique and healthy snacks is the main reason behind the global fruits and vegetable chips market being flooded with innovative flavours and exotic combinations. Producers are turning to tropical fruits, root vegetables, and mixed blends not only to improve the taste and the look but also to satisfy the dietary preferences that are changing.

Restraining Factors

The high production cost is one of the main factors that hinder the growth of vegetable chips over traditional snacks. Moreover, limited shelf life and storage problems, especially for chips made without preservatives, can also create difficulties in the supply chain for manufacturers and retailers.

Market Segmentation

The healthy fruit and vegetable chips market share is classified into product type, and ingredient.

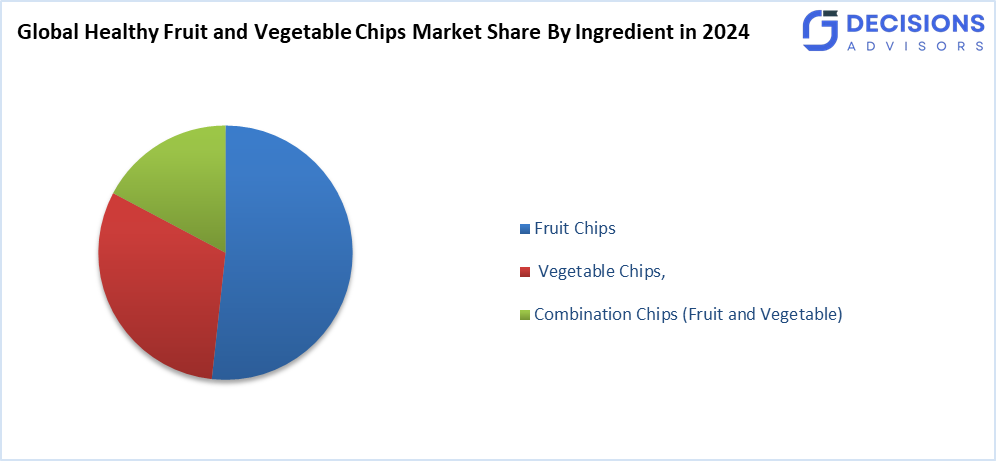

- The fruit chips segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product type, the healthy fruit and vegetable chips market is divided into fruit chips, vegetable chips, and combination chips (fruit and vegetable). Among these, the fruit chips segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Fruit chips are gaining popularity as they attract health-conscious consumers who seek nutritious alternatives to traditional snacks and also provide natural sweetness and a wide range of flavours. These chips, which are at the forefront of the healthy snacking sector, are attractive to a broad demographic, e. g. children and adults, because of their bright colours and attractive taste.

- The dried fruit segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the ingredient, the healthy fruit and vegetable chips market is segmented into dried fruit, dried vegetables, and mixed ingredients (fruit and vegetable). Among these, the dried fruit segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Dried fruit dominates the healthy fruit and vegetable chip market as the primary component. This is mainly due to its broad appeal and the existing consumer base that prefers sweet, naturally flavoured snacks. Its multi-use nature and the generally accepted notion of its health benefits are what keep it at the forefront of the market.

Regional Segment Analysis of the Healthy Fruit and Vegetable Chips Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the healthy fruit and vegetable chips market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the healthy fruit and vegetable chips market over the predicted timeframe. The expansion is fueled by the continuous urbanisation, increased disposable incomes, and the rising awareness of health and wellness. Regulations in countries such as Japan and Australia are also progressively endorsing healthier food choices, thus impelling manufacturers to innovate and broaden their product offerings. Major companies in this region comprise both local brands and international corporations, which are primarily active in countries such as Japan, Australia, and China. The competition landscape is changing, as a blend of traditional snacks and healthier alternatives is becoming more popular. The consumption of organic and non-GMO products is likewise escalating, thus mirroring the shift in consumer preference towards a healthy lifestyle.

India’s government is intensifying its push for corporate investment in the food processing sector, with major initiatives like World Food India 2025 securing over ?1.02 lakh crore in commitments from 26 global and domestic firms. Policies such as Agro-Processing Clusters (APCs) and the PMFME scheme are designed to scale infrastructure, support micro-enterprises, and position India as a global hub for food processing.

North America is expected to grow at a rapid CAGR in the healthy fruit and vegetable chips market during the forecast period. The demand for natural and organic convenience food products has been increasing in the U. S. and Canada. Hence, manufacturers have been focusing on offering naturally flavoured vegetable chips such as tomato, cucumber, carrot, and others to attract health-conscious consumers. Kettle Chips introduced a line of chips with flavours such as Sweet Potato, Beetroot, and Apple. Besides, the spread of supermarkets in this region is the primary factor resulting in the dominance of this region. Community Food Centres Canada's Market Greens initiative, which aims to make fresh fruits and vegetables affordable for low-income Canadians through local markets, has received funding support from the Government of Canada. A $1 5 million federal government contribution was made to Community Food Centres Canada.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the healthy fruit and vegetable chips market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bare Snacks

- Brothers All Natural

- Calbee

- Crispy Green, Inc.

- General Mills, Inc.

- Hain Celestial Group, Inc.

- Kellanova

- Luke's Organic

- PepsiCo, Inc.

- Rhythm Superfoods

- Seneca Foods Corporation

- The Better Chip

- Tropical Foods

- Wise Foods

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2025, Healthy snacking brand To Be Honest (TBH), part of Ghodawat Consumer Limited (GCL), launched Mix Veggie Chips in India. Made from five vacuum-cooked vegetables: golden sweet potato, purple sweet potato, jackfruit, beetroot, and okra—the chips retain over 90% of nutrients, contain 40% less fat, and are palm-oil free.

- In October 2025, Frito-Lay, the snack division of PepsiCo, invested in developing veggie and fruit chips to appeal to health-conscious consumers. This move expands their portfolio beyond indulgent snacks like Doritos and Cheetos, aligning with the rising demand for better-for-you options.

- In April 2025, Singapore-based healthy snack brand Hey! Chips launched Hey! Fruit Bites, the country’s first clean-label freeze-dried fruit snack. Designed for all ages, the innovation emphasises natural ingredients, nutrient retention, and transparency, with no artificial additives.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the healthy fruit and vegetable chips market based on the below-mentioned segments:

Global Healthy Fruit and Vegetable Chips Market, By Product Type

- Fruit Chips

- Vegetable Chips

- Combination Chips (Fruit and Vegetable)

Global Healthy Fruit and Vegetable Chips Market, By Ingredient

- Dried Fruit

- Dried Vegetables

- Mixed Ingredients (Fruit and Vegetable)

Global Healthy Fruit and Vegetable Chips Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the current size of the global healthy fruit and vegetable chips market?

The market was valued at USD 70.44 billion in 2024.

- What is the projected market size by 2035?

It is expected to reach USD 153.66 billion by 2035.

- What is the CAGR for the forecast period?

The market is projected to grow at a CAGR of 7.35% from 2025 to 2035.

- Which product segment leads the market?

Fruit chips held the largest share in 2024 and are expected to grow significantly.

- Which ingredient segment dominates?

Dried fruit accounted for the highest revenue in 2024 and is anticipated to continue growing.

- Which region will hold the largest market share?

Asia-Pacific is expected to dominate due to urbanisation, rising incomes, and health awareness.

- What drives growth in this market?

Rising demand for convenient, nutrient-rich, plant-based snacks and functional foods fuels expansion.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Product Type

- Market Attractiveness Analysis By Ingredient

- Market Attractiveness Analysis By Region

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Consumers' rising preference for convenient, flavoured, ready-to-eat snacks

- Restraints

- Difficulties in the supply chain for manufacturers and retailers

- Opportunities

- Rise in disposable incomes, and the addition of nutrients

- Challenges

- High production cost, limited shelf life and storage problems

- Global Healthy Fruit and Vegetable Chips Market Analysis and Projection, By Product Type

- Segment Overview

- Fruit Chips

- Vegetable Chips

- Combination Chips (Fruit and Vegetable)

- Global Healthy Fruit and Vegetable Chips Market Analysis and Projection, By Ingredient

- Segment Overview

- Dried Fruit

- Dried Vegetables

- Mixed Ingredients (Fruit and Vegetable)

- Global Healthy Fruit and Vegetable Chips Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Healthy Fruit and Vegetable Chips Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Healthy Fruit and Vegetable Chips Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Coverage Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Bare Snacks

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Brothers All Natural

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Calbee

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Crispy Green, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- General Mills, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Hain Celestial Group, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Kellanova

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Luke’s Organic

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- PepsiCo, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Rhythm Superfoods

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Seneca Foods Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- The Better Chip

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Tropical Foods

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Wise Foods

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Others

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Bare Snacks

List of Table

- Global Healthy Fruit and Vegetable Chips Market, By Product Type, 2024-2035(USD Billion)

- Global Fruit Chips, Healthy Fruit and Vegetable Chips Market, By Region, 2024-2035(USD Billion)

- Global Vegetable Chips, Healthy Fruit and Vegetable Chips Market, By Region, 2024-2035(USD Billion)

- Global Combination Chips (Fruit and Vegetable), Healthy Fruit and Vegetable Chips Market, By Region, 2024-2035(USD Billion)

- Global Healthy Fruit and Vegetable Chips Market, By Ingredient, 2024-2035(USD Billion)

- Global Dried Fruit, Healthy Fruit and Vegetable Chips Market, By Region, 2024-2035(USD Billion)

- Global Dried Vegetables, Healthy Fruit and Vegetable Chips Market, By Region, 2024-2035(USD Billion)

- Global Mixed Ingredients (Fruit and Vegetable), Healthy Fruit and Vegetable Chips Market, By Region, 2024-2035(USD Billion)

- North America Healthy Fruit and Vegetable Chips Market, By Product Type, 2024-2035(USD Billion)

- North America Healthy Fruit and Vegetable Chips Market, By Ingredient, 2024-2035(USD Billion)

- U.S. Healthy Fruit and Vegetable Chips Market, By Product Type, 2024-2035(USD Billion)

- U.S. Healthy Fruit and Vegetable Chips Market, By Ingredient, 2024-2035(USD Billion)

- Canada Healthy Fruit and Vegetable Chips Market, By Product Type, 2024-2035(USD Billion)

- Canada Healthy Fruit and Vegetable Chips Market, By Ingredient, 2024-2035(USD Billion)

- Mexico Healthy Fruit and Vegetable Chips Market, By Product Type, 2024-2035(USD Billion)

- Mexico Healthy Fruit and Vegetable Chips Market, By Ingredient, 2024-2035(USD Billion)

- Europe Healthy Fruit and Vegetable Chips Market, By Product Type, 2024-2035(USD Billion)

- Europe Healthy Fruit and Vegetable Chips Market, By Ingredient, 2024-2035(USD Billion)

- Germany Healthy Fruit and Vegetable Chips Market, By Product Type, 2024-2035(USD Billion)

- Germany Healthy Fruit and Vegetable Chips Market, By Ingredient, 2024-2035(USD Billion)

- France Healthy Fruit and Vegetable Chips Market, By Product Type, 2024-2035(USD Billion)

- France Healthy Fruit and Vegetable Chips Market, By Ingredient, 2024-2035(USD Billion)

- U.K. Healthy Fruit and Vegetable Chips Market, By Product Type, 2024-2035(USD Billion)

- U.K. Healthy Fruit and Vegetable Chips Market, By Ingredient, 2024-2035(USD Billion)

- Italy Healthy Fruit and Vegetable Chips Market, By Product Type, 2024-2035(USD Billion)

- Italy Healthy Fruit and Vegetable Chips Market, By Ingredient, 2024-2035(USD Billion)

- Spain Healthy Fruit and Vegetable Chips Market, By Product Type, 2024-2035(USD Billion)

- Spain Healthy Fruit and Vegetable Chips Market, By Ingredient, 2024-2035(USD Billion)

- Asia Pacific Healthy Fruit and Vegetable Chips Market, By Product Type, 2024-2035(USD Billion)

- Asia Pacific Healthy Fruit and Vegetable Chips Market, By Ingredient, 2024-2035(USD Billion)

- Japan Healthy Fruit and Vegetable Chips Market, By Product Type, 2024-2035(USD Billion)

- Japan Healthy Fruit and Vegetable Chips Market, By Ingredient, 2024-2035(USD Billion)

- China Healthy Fruit and Vegetable Chips Market, By Product Type, 2024-2035(USD Billion)

- China Healthy Fruit and Vegetable Chips Market, By Ingredient, 2024-2035(USD Billion)

- India Healthy Fruit and Vegetable Chips Market, By Product Type, 2024-2035(USD Billion)

- India Healthy Fruit and Vegetable Chips Market, By Ingredient, 2024-2035(USD Billion)

- South America Healthy Fruit and Vegetable Chips Market, By Product Type, 2024-2035(USD Billion)

- South America Healthy Fruit and Vegetable Chips Market, By Ingredient, 2024-2035(USD Billion)

- Brazil Healthy Fruit and Vegetable Chips Market, By Product Type, 2024-2035(USD Billion)

- Brazil Healthy Fruit and Vegetable Chips Market, By Ingredient, 2024-2035(USD Billion)

- The Middle East and Africa Healthy Fruit and Vegetable Chips Market, By Product Type, 2024-2035(USD Billion)

- The Middle East and Africa Healthy Fruit and Vegetable Chips Market, By Ingredient, 2024-2035(USD Billion)

- UAE Healthy Fruit and Vegetable Chips Market, By Product Type, 2024-2035(USD Billion)

- UAE Healthy Fruit and Vegetable Chips Market, By Ingredient, 2024-2035(USD Billion)

- South Africa Healthy Fruit and Vegetable Chips Market, By Product Type, 2024-2035(USD Billion)

- South Africa Healthy Fruit and Vegetable Chips Market, By Ingredient, 2024-2035(USD Billion)

List of Figures

- Global Healthy Fruit and Vegetable Chips Market Segmentation

- Healthy Fruit and Vegetable Chips Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top investment pocket in the Healthy Fruit and Vegetable Chips Market

- Top Winning Strategies, 2024-2035

- Top Winning Strategies, By Development, 2024-2035(%)

- Top Winning Strategies, By Company, 2024-2035

- Moderate Bargaining power of Buyers

- Moderate Bargaining power of Suppliers

- Moderate Bargaining power of New Entrants

- Low threat of Substitution

- High Competitive Rivalry

- Top Player Positioning, 2024

- Market Share Analysis, 2024

- Restraint and Drivers: Healthy Fruit and Vegetable Chips Market

- Healthy Fruit and Vegetable Chips Market Segmentation, By Product Type

- Healthy Fruit and Vegetable Chips Market For Fruit Chips, By Region, 2024-2035 ($ Billion)

- Healthy Fruit and Vegetable Chips Market For Vegetable Chips, By Region, 2024-2035 ($ Billion)

- Healthy Fruit and Vegetable Chips Market For Combination Chips (Fruit and Vegetable), By Region, 2024-2035 ($ Billion)

- Healthy Fruit and Vegetable Chips Market Segmentation, By Ingredient

- Healthy Fruit and Vegetable Chips Market For Dried Fruit, By Region, 2024-2035 ($ Billion)

- Healthy Fruit and Vegetable Chips Market For Dried Vegetables, By Region, 2024-2035 ($ Billion)

- Healthy Fruit and Vegetable Chips Market For Mixed Ingredients (Fruit and Vegetable), By Region, 2024-2035 ($ Billion)

- Bare Snacks: Net Sales, 2024-2035 ($ Billion)

- Bare Snacks: Revenue Share, By Segment, 2024 (%)

- Bare Snacks: Revenue Share, By Region, 2024 (%)

- Brothers All Natural: Net Sales, 2024-2035 ($ Billion)

- Brothers All Natural: Revenue Share, By Segment, 2024 (%)

- Brothers All Natural: Revenue Share, By Region, 2024 (%)

- Calbee: Net Sales, 2024-2035 ($ Billion)

- Calbee: Revenue Share, By Segment, 2024 (%)

- Calbee: Revenue Share, By Region, 2024 (%)

- Crispy Green, Inc.: Net Sales, 2024-2035 ($ Billion)

- Crispy Green, Inc.: Revenue Share, By Segment, 2024 (%)

- Crispy Green, Inc.: Revenue Share, By Region, 2024 (%)

- General Mills, Inc.: Net Sales, 2024-2035 ($ Billion)

- General Mills, Inc.: Revenue Share, By Segment, 2024 (%)

- General Mills, Inc.: Revenue Share, By Region, 2024 (%)

- Hain Celestial Group, Inc.: Net Sales, 2024-2035 ($ Billion)

- Hain Celestial Group, Inc.: Revenue Share, By Segment, 2024 (%)

- Hain Celestial Group, Inc.: Revenue Share, By Region, 2024 (%)

- Kellanova: Net Sales, 2024-2035 ($ Billion)

- Kellanova: Revenue Share, By Segment, 2024 (%)

- Kellanova: Revenue Share, By Region, 2024 (%)

- Luke’s Organic: Net Sales, 2024-2035 ($ Billion)

- Luke’s Organic: Revenue Share, By Segment, 2024 (%)

- Luke’s Organic: Revenue Share, By Region, 2024 (%)

- PepsiCo, Inc: Net Sales, 2024-2035 ($ Billion)

- PepsiCo, Inc: Revenue Share, By Segment, 2024 (%)

- PepsiCo, Inc: Revenue Share, By Region, 2024 (%)

- Rhythm Superfoods: Net Sales, 2024-2035 ($ Billion)

- Rhythm Superfoods: Revenue Share, By Segment, 2024 (%)

- Rhythm Superfoods: Revenue Share, By Region, 2024 (%)

- Seneca Foods Corporation: Net Sales, 2024-2035 ($ Billion)

- Seneca Foods Corporation: Revenue Share, By Segment, 2024 (%)

- Seneca Foods Corporation: Revenue Share, By Region, 2024 (%)

- The Better Chip: Net Sales, 2024-2035 ($ Billion)

- The Better Chip: Revenue Share, By Segment, 2024 (%)

- The Better Chip: Revenue Share, By Region, 2024 (%)

- Tropical Foods: Net Sales, 2024-2035 ($ Billion)

- Tropical Foods: Revenue Share, By Segment, 2024 (%)

- Tropical Foods: Revenue Share, By Region, 2024 (%)

- Wise Foods: Net Sales, 2024-2035 ($ Billion)

- Wise Foods: Revenue Share, By Segment, 2024 (%)

- Wise Foods: Revenue Share, By Region, 2024 (%)

- Others: Net Sales, 2024-2035 ($ Billion)

- Others: Revenue Share, By Segment, 2024 (%)

- Others: Revenue Share, By Region, 2024 (%)

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 199 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |