Global Hemophilia A Market

Global Hemophilia A Market Size, Share, and COVID-19 Impact Analysis, By Treatment (On-Demand, Cure, and Prophylaxis), By Therapy (Factor Replacement Therapy, Desmopressin & Fibrin Sealants, and Gene Therapy & Monoclonal Antibodies), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Global Hemophilia A Market Insights Forecasts to 2035

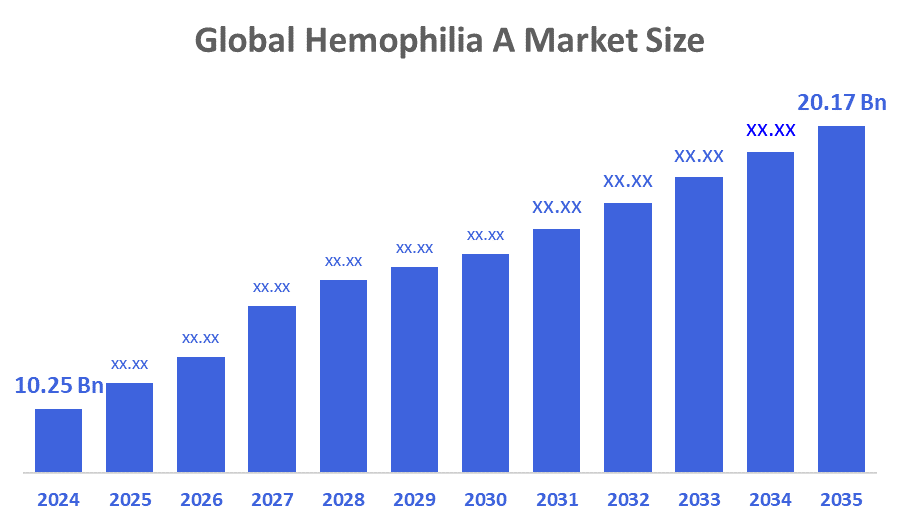

- The Global Hemophilia A Market Size Was Estimated at USD 10.25 billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.35% from 2025 to 2035

- The Worldwide Hemophilia A Market Size is Expected to Reach USD 20.17 billion by 2035

- North America is expected to grow the fastest during the forecast period.

According to a research report published by Decisions Advisors and Consulting, the global hemophilia A market size was worth around USD 10.25 billion in 2024 and is predicted to grow to around USD 20.17 billion by 2035 with a compound annual growth rate (CAGR) of 6.35 % from 2025 to 2035. The hemophilia A treatment market is primarily driven by several key factors such as the increased awareness about hemophilia, the widespread adoption of prophylactic treatment regimens, and the ongoing advancements in gene therapy research. Furthermore, the market landscape is being influenced by the substantial investments made toward a variety of innovative therapies that include non-factor replacement products and gene editing technologies.

Market Overview

The worldwide sector devoted to developing, and distributing treatments for hemophilia A and it is a hereditary bleeding condition brought on by a lack or malfunction of clotting factor VIII to as a treatment. The symptoms of the disease include prolonged bleeding after injuries, surgeries, or dental procedures; nosebleeds; easy bruising; spontaneous bleeding in joints or muscles; and, in severe cases, bleeding inside the body, which can be fatal. People with hemophilia A may also suffer from excessive bleeding caused by minor cuts or trauma and bleeding from the gums or digestive tract that lasts for a long time. For diagnosis, a doctor will take the patient's medical records and family history into account and look for symptoms of abnormal bleeding. Blood tests will be done to check factor VIII levels in the blood. A very low level of FVIII is the confirmation of hemophilia A. If necessary, genetic testing can be done to determine specific mutations in the F8 gene.

Hemab Therapeutics has raised $157 million in a Series C round to advance its pipeline of next-generation treatments for rare and underserved bleeding disorders. The company positions itself as the “ultimate clotting company,” aiming to transform care for patients with limited therapeutic options.

Report Coverage

This research report categorises the hemophilia A market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the hemophilia A market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the hemophilia A market.

Driving Factors

The market for hemophilia A therapies is being powered by numerous revolutionary factors that are not only reshaping patient care but also driving industry growth. Gene therapy advancement is undoubtedly the most important factor that could offer, potentially, a one-time permanent solution to the genetic defect. Several clinical trials have shown sustained factor VIII expression with fewer bleeding episodes, and thus, very few infusions are necessary. At the same time, the use of extended half-life (EHL) factor VIII products such as Eloctate and Adynovate is making patient compliance easier, because fewer infusions are necessary, and therefore, the quality of life and treatment adherence are improving. The biggest and most important reason for the rise of non-factor replacement therapies is the case of inhibitor patients in hemophilia. In particular, Emicizumab provides comfortable subcutaneous administration and has exhibited excellent effectiveness in bleeding rate reduction, especially in patients with inhibitors. These innovations alone are shifting the treatment paradigm to more durable, patient-friendly and effective solutions, thereby contributing to market expansion and positioning hemophilia A care as a path to curative outcomes.

Restraining Factors

The main factors impeding market expansion are high treatment costs, restricted accessibility in low-income areas, the possibility of inhibitor development, and reliance on plasma-derived products.

Market Segmentation

The hemophilia A market share is classified into treatment, and therapy.

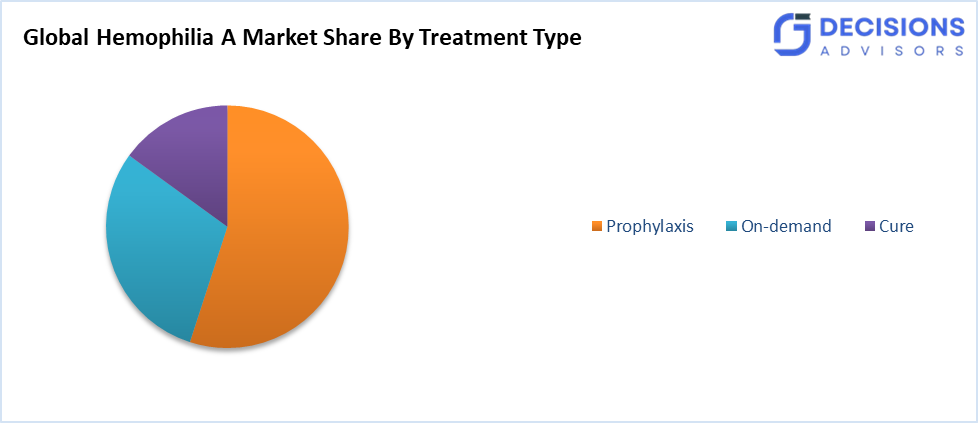

- The prophylaxis segment accounted for the largest share in 2024 and is projected to grow at a significant CAGR during the forecast period.

Based on the treatment, the hemophilia A market is divided into on-demand, cure, and prophylaxis. Among these, the prophylaxis segment accounted for the largest share in 2024 and is projected to grow at a significant CAGR during the forecast period. This segmented growth is driven by the effectiveness of these agents in the prevention of bleeding episodes and the maintenance of a good quality of life. These therapies, mostly through factor VIII replacement products or non-factor replacement therapies like emicizumab, are progressively preferred because of their confirmed success in lowering the annualised bleeding rates. The knowledge of healthcare providers and patients about the advantages of prophylaxis in the long run is also a factor that enhances the prevalence of this segment.

- The factor replacement therapy segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the therapy, the hemophilia A market is divided into factor replacement therapy, desmopressin & fibrin sealants, and gene therapy & monoclonal antibodies. Among these, the factor replacement therapy segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is largely explained by its long-standing role as the go-to treatment for hemophilia A. So far, both recombinant and plasma-derived factor VIII products have been extensively used due to their effectiveness in bleeding episode management and in prophylaxis. The segment, thus, has been more visible than ever with the rising use of extended half-life factor VIII products, which offer patients greater convenience and less frequent infusion.

Regional Segment Analysis of the Hemophilia A Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the hemophilia A market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the hemophilia A market over the predicted timeframe. The Asia Pacific region is a fast, expanding market for hemophilia A treatment. This growth is mainly due to increased healthcare expenditures and a higher incidence of hemophilia in populous countries such as China and India. The availability of healthcare analytical testing services and the awareness of hemophilia management have positively impacted the adoption of advanced treatments. Various governments and non-profit organisations are instrumental in facilitating diagnostic initiatives and providing subsidies for therapies, especially in emerging economies. The expansion of the regional market is also attributed to clinical trials and local production aimed at making novel therapies more accessible and affordable.

India has successfully conducted its first in-human gene therapy trial for hemophilia A, supported by the Department of Biotechnology. The therapy, developed at the Centre for Stem Cell Research (CSCR), CMC Vellore, uses a lentiviral vector and achieved zero annualised bleeding rates in all five enrolled patients, marking a historic milestone in genetic medicine.

North America is expected to grow at a rapid CAGR in the hemophilia A market during the forecast period. This is largely due to its robust healthcare infrastructure, rapid uptake of cutting-edge therapies, and hefty investments in research and development. The area enjoys good reimbursement policies and is home to a large number of biopharmaceutical companies that are actively engaged in the development of innovative treatments such as gene therapy and monoclonal antibodies. In addition, the region's market growth is supported by the increasing number of awareness campaigns, for example, by the National Hemophilia Foundation, and by the thriving clinical trial activity.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the hemophilia A market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aptevo Therapeutics

- Bayer AG

- BioMarin Pharmaceutical Inc.

- CSL Behring

- F. Hoffmann-La Roche Ltd.

- Grifols S.A.

- Novo Nordisk A/S

- Octapharma AG

- Pfizer Inc.

- Sangamo Therapeutics

- Sanofi

- Spark Therapeutics

- Takeda Pharmaceutical Company Limited

- uniQure N.V.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, The FRONTIER clinical trials provided the evidence base for Novo Nordisk’s Biologics License Application (BLA) to the FDA for Mim8 (denecimig), an investigational bispecific antibody therapy for hemophilia A. Mim8 is designed as a next-generation Factor VIIIa mimetic, showing strong efficacy and safety in reducing bleeding episodes in patients with or without inhibitors.

- In June 2025, Pfizer announced positive topline Phase 3 results for HYMPAVZI (marstacimab) in patients with hemophilia A or B with inhibitors. The therapy demonstrated a statistically significant and clinically meaningful reduction in annualised bleeding rates compared to on-demand treatment, with a favourable safety profile.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the hemophilia A market based on the below-mentioned segments:

Global Hemophilia A Market, By Treatment

- On-Demand

- Cure

- Prophylaxis

Global Hemophilia A Market, By Application

- Factor Replacement Therapy

- Desmopressin & Fibrin Sealants

- Gene Therapy & Monoclonal Antibodies

Global Hemophilia A Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

1. What is the current size of the market?

The market was valued at USD 10.25 billion in 2024.

2. What is the projected market size by 2035?

It is expected to reach USD 20.17 billion by 2035.

3. What is the forecasted CAGR for the market?

The compound annual growth rate (CAGR) is 6.35% from 2025 to 2035.

4. Which treatment segment leads the market?

Prophylaxis holds the largest share in 2024 and is projected to grow at a significant CAGR, due to its effectiveness in preventing bleeding episodes.

5. Which therapy segment generates the highest revenue?

Factor replacement therapy accounted for the highest revenue in 2024 and is expected to grow at a significant CAGR, driven by recombinant and extended half-life products.

6. Which region will dominate the market share?

Asia Pacific is anticipated to hold the largest share over the forecast period, fueled by rising healthcare spending in countries like China and India.

7. Which region is expected to grow the fastest?

North America is projected to grow at the fastest CAGR, supported by advanced healthcare infrastructure and R&D investments.

8. What are the main drivers of market growth?

Key drivers include increased awareness, adoption of prophylactic treatments, advancements in gene therapy, and innovations like extended half-life products and non-factor therapies such as Emicizumab.

1. Introduction

2. Objectives of the Study

3. Market Definition

4. Research Scope

5. Research Methodology and Assumptions

6. Executive Summary

7. Premium Insights

8. Porter’s Five Forces Analysis

9. Value Chain Analysis

10. Top Investment Pockets

11. Market Attractiveness Analysis

11.1 Market Attractiveness Analysis by Treatment

11.2 Market Attractiveness Analysis by Therapy

11.3 Market Attractiveness Analysis by Region

12. Industry Trends

13. Market Dynamics

14. Market Evaluation

14.1 Drivers

14.1.1 Treatment paradigm shifting toward more durable, patient-friendly, and effective solutions

14.2 Restraints

14.2.1 Restricted accessibility in low-income areas

14.2.2 Possibility of inhibitor development

14.3 Opportunities

14.3.1 Awareness about hemophilia

14.3.2 Widespread adoption of prophylactic treatment

14.4 Challenges

14.4.1 High treatment costs

14.4.2 Reliance on plasma-derived products

15. Global Hemophilia A Market Analysis and Projection, by Treatment

15.1 Segment Overview

15.1.1 On-Demand

15.1.2 Cure

15.1.3 Prophylaxis

16. Global Hemophilia A Market Analysis and Projection, by Therapy

16.1 Segment Overview

16.1.1 Factor Replacement Therapy

16.1.2 Desmopressin & Fibrin Sealants

16.1.3 Gene Therapy & Monoclonal Antibodies

17. Global Hemophilia A Market Analysis and Projection, by Region

17.1 North America

17.1.1 U.S.

17.1.2 Canada

17.1.3 Mexico

17.2 Europe

17.2.1 Germany

17.2.2 France

17.2.3 U.K.

17.2.4 Italy

17.2.5 Spain

17.3 Asia-Pacific

17.3.1 Japan

17.3.2 China

17.3.3 India

17.4 South America

17.4.1 Brazil

17.5 Middle East and Africa

17.5.1 UAE

17.5.2 South Africa

18. Global Hemophilia A Market – Competitive Landscape

18.1 Overview

18.2 Market Share of Key Players

18.2.1 Global Company Market Share

18.2.2 North America Company Market Share

18.2.3 Europe Company Market Share

18.2.4 APAC Company Market Share

18.3 Competitive Situations and Trends

18.3.1 Coverage Launches and Developments

18.3.2 Partnerships, Collaborations, and Agreements

18.3.3 Mergers and Acquisitions

18.3.4 Expansions

19. Company Profiles

19.1 Aptevo Therapeutics

19.2 Bayer AG

19.3 BioMarin Pharmaceutical Inc.

19.4 CSL Behring

19.5 F. Hoffmann-La Roche Ltd.

19.6 Grifols S.A.

19.7 Novo Nordisk A/S

19.8 Octapharma AG

19.9 Pfizer Inc.

19.10 Sangamo Therapeutics

19.11 Sanofi

19.12 Spark Therapeutics

19.13 Takeda Pharmaceutical Company Limited

19.14 uniQure N.V.

19.15 Others

20. List of Tables

20.1 Global Hemophilia A Market, by Treatment, 2024–2035 (USD Billion)

20.2 Global On-Demand Hemophilia A Market, by Region, 2024–2035

20.3 Global Cure Hemophilia A Market, by Region, 2024–2035

20.4 Global Prophylaxis Hemophilia A Market, by Region, 2024–2035

20.5 Global Hemophilia A Market, by Therapy, 2024–2035

20.6 Regional and Country-Level Market Tables

21. List of Figures

21.1 Global Hemophilia A Market Segmentation

21.2 Research Methodology

21.3 Market Size Estimation (Top-down and Bottom-up)

21.4 Data Triangulation

21.5 Porter’s Five Forces Analysis

21.6 Value Chain Analysis

21.7 Top Investment Pockets

21.8 Market Share Analysis

21.9 Drivers and Restraints

21.10 Company-wise Revenue and Regional Share Analysis

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 269 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |