Global Hemophilia B Market

Global Hemophilia B Market Size, Share, and COVID-19 Impact Analysis, By Drugs (Plasma Derived Coagulation Factor Concentrate, Recombinant Coagulation Factor Concentrates, Desmopressin, and Others), By Severity (Mild Hemophilia B, Moderate Hemophilia B, and Severe Hemophilia B), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Global Hemophilia B Market Insights Forecasts to 2035

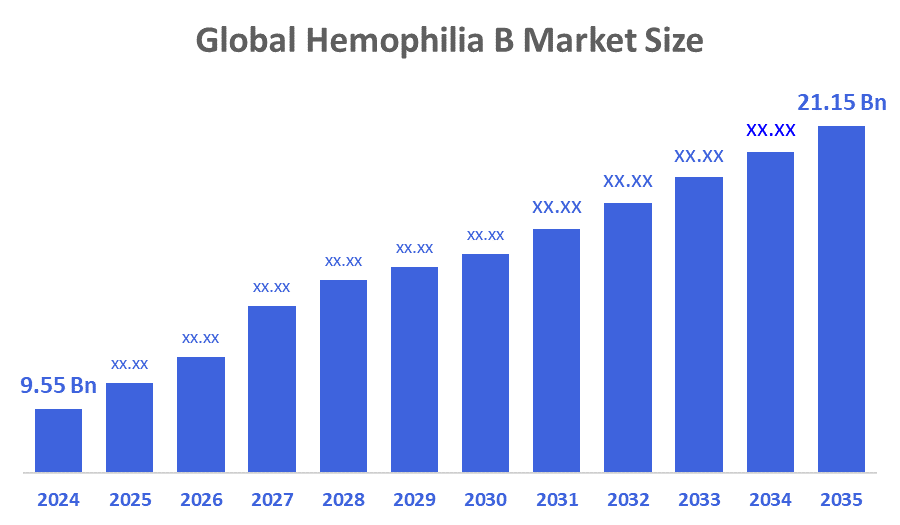

- The Global Hemophilia B Market Size Was Estimated at USD 9.55 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.50% from 2025 to 2035

- The Worldwide Hemophilia B Market Size is Expected to Reach USD 21.15 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global Hemophilia B Market Size was worth around USD 9.55 Billion in 2024 and is predicted to Grow to around USD 21.15 Billion by 2035 with a compound annual growth rate (CAGR) of 7.50 % from 2025 to 2035. The drivers driving this market's growth are emerging markets and the rising global prevalence of uncommon illnesses. Additionally, the existence of reputable healthcare facilities and improvements in treatment options are some of the factors influencing the expansion of the worldwide hemophilia B market.

Market Overview

The Hemophilia B market refers to the global industry focused on the diagnosis, treatment, and management of Hemophilia B, which is a rare genetic bleeding disorder caused by a deficiency of clotting factor IX. It encompasses approved therapies, pipeline drugs, patient services, and the commercial ecosystem supporting care delivery. Hemophilia B is a genetic disorder that affects the blood's ability to clot, making it difficult for the body to stop bleeding. This condition is passed down in an X, X-linked recessive pattern, so males are mainly affected, whereas females are mostly carriers. Patients with hemophilia B have either low levels or a complete lack of a protein called factor IX; thus, their blood takes a long time to clot, and they may bleed excessively, even if they have been injured very slightly, or the bleeding may occur spontaneously.

Some of the symptoms that are often seen in such patients are easy and severe bruising, recurrent nosebleeds, joint pain or swelling, irritability, stiff neck, vomiting, seizures, breathing difficulties, changes in mental status, bleeding that lasts for a long time after cuts or surgery, etc. Diagnosis of the disease is mainly accomplished by taking a detailed medical history and doing a physical examination, and a complete blood count test.

Be Biopharma has raised $82 million to advance its investigational B-cell therapy (BE-101) for hemophilia B into Phase I/II clinical trials. The therapy aims to provide a durable, titratable, and potentially redosable solution by engineering B cells to continuously produce clotting factor IX (FIX).

Report Coverage

This research report categorises the hemophilia B market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the hemophilia B market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the hemophilia B market.

Driving Factors

The rising cases of inherited diseases, which lead to variations in the gene that provides instructions for producing specific proteins in the body, are mainly responsible for the growth of the hemophilia B market. Besides, the increasing use of factor replacement therapy, as a result of its various benefits like preventing severe blood loss and enhancing the quality of life, is also raising the market's positive sentiment. Moreover, the growing popularity of topical fibrin sealants for the treatment of patients, as they can be directly applied to wounds or bleeding sites to facilitate clot formation and bleeding control, is another major factor that is contributing to the market's expansion. In addition, several leading players are heavily investing in R&D activities to introduce non, non-replacement therapies that stimulate the body's natural clotting processes and lessen bleeding episodes, hence, this is also driving the market growth. Furthermore, the increasing adoption of gene therapy, which entails the introduction of a functioning copy of the defective gene into the patient's cells, thus resulting in the production of factor IX in the body, is anticipated to propel the hemophilia B market over the next few years.

Restraining Factors

The market for hemophilia B is constrained by several problems, chief among them being high therapy costs, restricted access in developing nations, dangers associated with inhibitor development, and regulatory obstacles that impede the implementation of innovative medicines.

Market Segmentation

The hemophilia B market share is classified into drugs and severity.

- The recombinant coagulation factor concentrates segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the drugs, the hemophilia B market is segmented into plasma-derived coagulation factor concentrates, recombinant coagulation factor concentrates, desmopressin, and others. Among these, the recombinant coagulation factor concentrates segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Recombinant factor concentrates are genetically engineered to be devoid of human plasma; thus, the risk of transmission of blood-borne pathogens like HIV and hepatitis is reduced significantly. They have higher safety profiles with less concern for immunogenicity compared to plasma-derived products.

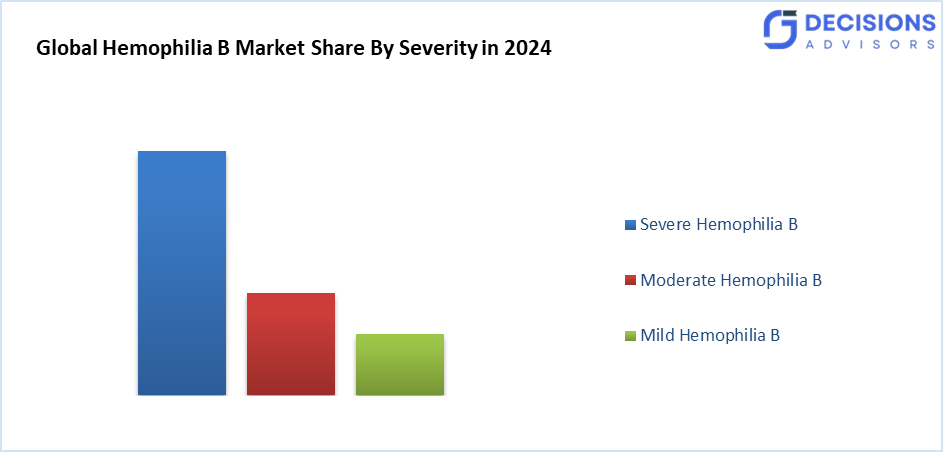

- The severe hemophilia B segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the severity, the hemophilia B market is divided into mild hemophilia B, moderate hemophilia B, and severe hemophilia B. Among these, the severe hemophilia B segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Severe haemophiliacs are most of the time in need of a preventive infusion of Factor IX to avoid spontaneous bleeding and its complications. The higher the treatment frequency in such severe cases, the higher the demand for its replacement therapies stays high and dominant. Moderate or mild hemophilia cases might only require on-demand treatment of bleeding episodes, which would consequently imply lower volumes of overall treatments than those of severe cases.

Regional Segment Analysis of the Hemophilia B Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Europe is anticipated to hold the largest share of the Hemophilia B market over the predicted timeframe.

Europe is anticipated to hold the largest share of the Hemophilia B market over the predicted timeframe. Europe ranks highly because it provides a great drive for breakthrough treatments and strong care networks; Germany and the UK are two of the most developed countries in this regard. However, the best quality of research and development, as well as access to expensive treatments, belongs to that region.

A landmark 13-year follow-up study by St. Jude Children’s Research Hospital and University College London confirms that gene therapy for hemophilia B remains safe, effective, and durable, with patients continuing to benefit more than a decade after treatment.

North America is expected to grow at a rapid CAGR in the Hemophilia B market during the forecast period. The North American region already has a well-established healthcare system, cutting-edge treatments, and a high rate of gene therapy and recombinant factor IX product acceptance. In addition, the region's proactive approach to rare illness management, high health care costs, and patient access to cutting-edge medicines keep North America at the top of the worldwide market.

The FDA approved Alhemo (concizumab-mtci) as a once-daily prophylactic treatment for adults and children (≥12 years) with hemophilia A or B without inhibitors. Clinical trial data showed up to an 86% reduction in annualised bleeding rates, marking a major advancement in non-factor therapy options.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the hemophilia B market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aspen Holdings

- Baxter

- Bayer AG

- Bristol Myers Squibb Company

- Emcure Pharmaceuticals

- EMERGENT

- F. Hoffmann-La Roche Ltd

- Fresenius Kabi AG

- Gilead Sciences, Inc.

- Grifols S.A.

- GSK Plc.

- Hikma Pharmaceuticals PLC

- Mylan N.V.

- Teva Pharmaceutical Industries Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2025, HYMPAVZI® (marstacimab) is highly relevant to the Hemophilia A and B markets, especially for patients with inhibitors, which are one of the biggest restraining factors in both markets. HYMPAVZI is administered once a week at a dose of 150 mg after a 300 mg subcutaneous loading dose.

- In August 2025, BE-101 indeed received Orphan Drug and Fast Track Designations from the U.S. Food and Drug Administration (FDA). These designations are strategically important because they accelerate development and regulatory review for therapies addressing serious or rare conditions.

- In January 2025, UC San Diego Health will become one of the first centres on the U.S. West Coast to offer a newly FDA-approved gene therapy for Hemophilia B. This therapy provides long-term bleeding control with a single infusion, replacing a lifetime of regular factor IX infusions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the hemophilia B market based on the below-mentioned segments:

Global Hemophilia B Market, By Drugs

- Plasma Derived Coagulation Factor Concentrate

- Recombinant Coagulation Factor Concentrates

- Desmopressin

- Others

Global Hemophilia B Market, By Severity

- Mild Hemophilia B

- Moderate Hemophilia B

- Severe Hemophilia B

Global Hemophilia B Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the projected size of the Global Hemophilia B Market by 2035?

The market is expected to grow from USD 9.55 billion in 2024 to USD 21.15 billion by 2035.

- What is the CAGR for the Hemophilia B Market from 2025 to 2035?

The market is forecasted to grow at a CAGR of 7.50% during this period.

- What are the main market segments by drugs?

Segments include plasma-derived coagulation factor concentrates, recombinant coagulation factor concentrates, desmopressin, and others. Recombinant concentrates held the largest share in 2024.

- Which severity segment dominates the market?

Severe hemophilia B accounted for the highest revenue in 2024 and is expected to grow at a significant CAGR due to frequent treatment needs.

- Which region will hold the largest market share?

Europe is anticipated to hold the largest share, driven by advanced treatments and strong healthcare networks in countries like Germany and the UK.

- What are the key drivers of market growth?

Rising prevalence of genetic disorders, factor replacement therapies, gene therapies, and investments in non-replacement options fuel expansion.

- What are some recent developments in treatments?

FDA approvals like Alhemo (concizumab) for prophylaxis, BE-101's Orphan Drug status, and gene therapies offering long-term control with single infusions.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Treatment

- Market Attractiveness Analysis By Therapy

- Market Attractiveness Analysis By Region

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Treatment paradigm to more durable, patient-friendly and effective solutions

- Restraints

- Restricted accessibility in low-income areas, the possibility of inhibitor development

- Opportunities

- Awareness about hemophilia, the widespread adoption of prophylactic treatment

- Challenges

- High treatment costs, and reliance on plasma-derived products

- Global Hemophilia A Market Analysis and Projection, By Treatment

- Segment Overview

- On-Demand

- Cure

- Prophylaxis

- Global Hemophilia A Market Analysis and Projection, By Therapy

- Segment Overview

- Factor Replacement Therapy

- Desmopressin & Fibrin Sealants

- Gene Therapy & Monoclonal Antibodies

- Global Hemophilia A Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Hemophilia A Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Hemophilia A Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Coverage Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Aptevo Therapeutics

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Bayer AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- BioMarin Pharmaceutical Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- CSL Behring

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- F. Hoffmann-La Roche Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Grifols S.A.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Novo Nordisk A/S

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Octapharma AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Pfizer Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Sangamo Therapeutics

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Sanofi

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Spark Therapeutics

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Takeda Pharmaceutical Company Limited

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- uniQure N.V.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Others

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Aptevo Therapeutics

List of Table

- Global Hemophilia A Market, By Treatment, 2024-2035(USD Billion)

- Global On-Demand, Hemophilia A Market, By Region, 2024-2035(USD Billion)

- Global Cure, Hemophilia A Market, By Region, 2024-2035(USD Billion)

- Global Prophylaxis, Hemophilia A Market, By Region, 2024-2035(USD Billion)

- Global Hemophilia A Market, By Therapy, 2024-2035(USD Billion)

- Global Factor Replacement Therapy, Hemophilia A Market, By Region, 2024-2035(USD Billion)

- Global Desmopressin & Fibrin Sealants, Hemophilia A Market, By Region, 2024-2035(USD Billion)

- Global Gene Therapy & Monoclonal Antibodies, Hemophilia A Market, By Region, 2024-2035(USD Billion)

- North America Hemophilia A Market, By Treatment, 2024-2035(USD Billion)

- North America Hemophilia A Market, By Therapy, 2024-2035(USD Billion)

- U.S. Hemophilia A Market, By Treatment, 2024-2035(USD Billion)

- U.S. Hemophilia A Market, By Therapy, 2024-2035(USD Billion)

- Canada Hemophilia A Market, By Treatment, 2024-2035(USD Billion)

- Canada Hemophilia A Market, By Therapy, 2024-2035(USD Billion)

- Mexico Hemophilia A Market, By Treatment, 2024-2035(USD Billion)

- Mexico Hemophilia A Market, By Therapy, 2024-2035(USD Billion)

- Europe Hemophilia A Market, By Treatment, 2024-2035(USD Billion)

- Europe Hemophilia A Market, By Therapy, 2024-2035(USD Billion)

- Germany Hemophilia A Market, By Treatment, 2024-2035(USD Billion)

- Germany Hemophilia A Market, By Therapy, 2024-2035(USD Billion)

- France Hemophilia A Market, By Treatment, 2024-2035(USD Billion)

- France Hemophilia A Market, By Therapy, 2024-2035(USD Billion)

- U.K. Hemophilia A Market, By Treatment, 2024-2035(USD Billion)

- U.K. Hemophilia A Market, By Therapy, 2024-2035(USD Billion)

- Italy Hemophilia A Market, By Treatment, 2024-2035(USD Billion)

- Italy Hemophilia A Market, By Therapy, 2024-2035(USD Billion)

- Spain Hemophilia A Market, By Treatment, 2024-2035(USD Billion)

- Spain Hemophilia A Market, By Therapy, 2024-2035(USD Billion)

- Asia Pacific Hemophilia A Market, By Treatment, 2024-2035(USD Billion)

- Asia Pacific Hemophilia A Market, By Therapy, 2024-2035(USD Billion)

- Japan Hemophilia A Market, By Treatment, 2024-2035(USD Billion)

- Japan Hemophilia A Market, By Therapy, 2024-2035(USD Billion)

- China Hemophilia A Market, By Treatment, 2024-2035(USD Billion)

- China Hemophilia A Market, By Therapy, 2024-2035(USD Billion)

- India Hemophilia A Market, By Treatment, 2024-2035(USD Billion)

- India Hemophilia A Market, By Therapy, 2024-2035(USD Billion)

- South America Hemophilia A Market, By Treatment, 2024-2035(USD Billion)

- South America Hemophilia A Market, By Therapy, 2024-2035(USD Billion)

- Brazil Hemophilia A Market, By Treatment, 2024-2035(USD Billion)

- Brazil Hemophilia A Market, By Therapy, 2024-2035(USD Billion)

- The Middle East and Africa Hemophilia A Market, By Treatment, 2024-2035(USD Billion)

- The Middle East and Africa Hemophilia A Market, By Therapy, 2024-2035(USD Billion)

- UAE Hemophilia A Market, By Treatment, 2024-2035(USD Billion)

- UAE Hemophilia A Market, By Therapy, 2024-2035(USD Billion)

- South Africa Hemophilia A Market, By Treatment, 2024-2035(USD Billion)

- South Africa Hemophilia A Market, By Therapy, 2024-2035(USD Billion)

List of Figures

- Global Hemophilia A Market Segmentation

- Hemophilia A Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top investment pocket in the Hemophilia A Market

- Top Winning Strategies, 2024-2035

- Top Winning Strategies, By Development, 2024-2035(%)

- Top Winning Strategies, By Company, 2024-2035

- Moderate Bargaining power of Buyers

- Moderate Bargaining power of Suppliers

- Moderate Bargaining power of New Entrants

- Low threat of Substitution

- High Competitive Rivalry

- Top Player Positioning, 2024

- Market Share Analysis, 2024

- Restraint and Drivers: Hemophilia A Market

- Hemophilia A Market Segmentation, By Treatment

- Hemophilia A Market For On-Demand, By Region, 2024-2035 ($ Billion)

- Hemophilia A Market For Cure, By Region, 2024-2035 ($ Billion)

- Hemophilia A Market For Prophylaxis, By Region, 2024-2035 ($ Billion)

- Hemophilia A Market Segmentation, By Therapy

- Hemophilia A Market For Factor Replacement Therapy, By Region, 2024-2035 ($ Billion)

- Hemophilia A Market For Desmopressin & Fibrin Sealants, By Region, 2024-2035 ($ Billion)

- Hemophilia A Market For Gene Therapy & Monoclonal Antibodies, By Region, 2024-2035 ($ Billion)

- Aptevo Therapeutics: Net Sales, 2024-2035 ($ Billion)

- Aptevo Therapeutics: Revenue Share, By Segment, 2024 (%)

- Aptevo Therapeutics: Revenue Share, By Region, 2024 (%)

- Bayer AG: Net Sales, 2024-2035 ($ Billion)

- Bayer AG: Revenue Share, By Segment, 2024 (%)

- Bayer AG: Revenue Share, By Region, 2024 (%)

- BioMarin Pharmaceutical Inc.: Net Sales, 2024-2035 ($ Billion)

- BioMarin Pharmaceutical Inc.: Revenue Share, By Segment, 2024 (%)

- BioMarin Pharmaceutical Inc.: Revenue Share, By Region, 2024 (%)

- CSL Behring: Net Sales, 2024-2035 ($ Billion)

- CSL Behring: Revenue Share, By Segment, 2024 (%)

- CSL Behring: Revenue Share, By Region, 2024 (%)

- F. Hoffmann-La Roche Ltd.: Net Sales, 2024-2035 ($ Billion)

- F. Hoffmann-La Roche Ltd.: Revenue Share, By Segment, 2024 (%)

- F. Hoffmann-La Roche Ltd.: Revenue Share, By Region, 2024 (%)

- Grifols S.A.: Net Sales, 2024-2035 ($ Billion)

- Grifols S.A.: Revenue Share, By Segment, 2024 (%)

- Grifols S.A.: Revenue Share, By Region, 2024 (%)

- Novo Nordisk A/S: Net Sales, 2024-2035 ($ Billion)

- Novo Nordisk A/S: Revenue Share, By Segment, 2024 (%)

- Novo Nordisk A/S: Revenue Share, By Region, 2024 (%)

- Octapharma AG: Net Sales, 2024-2035 ($ Billion)

- Octapharma AG: Revenue Share, By Segment, 2024 (%)

- Octapharma AG: Revenue Share, By Region, 2024 (%)

- Pfizer Inc: Net Sales, 2024-2035 ($ Billion)

- Pfizer Inc: Revenue Share, By Segment, 2024 (%)

- Pfizer Inc: Revenue Share, By Region, 2024 (%)

- Sangamo Therapeutics: Net Sales, 2024-2035 ($ Billion)

- Sangamo Therapeutics: Revenue Share, By Segment, 2024 (%)

- Sangamo Therapeutics: Revenue Share, By Region, 2024 (%)

- Sanofi: Net Sales, 2024-2035 ($ Billion)

- Sanofi: Revenue Share, By Segment, 2024 (%)

- Sanofi: Revenue Share, By Region, 2024 (%)

- Spark Therapeutics: Net Sales, 2024-2035 ($ Billion)

- Spark Therapeutics: Revenue Share, By Segment, 2024 (%)

- Spark Therapeutics: Revenue Share, By Region, 2024 (%)

- Takeda Pharmaceutical Company Limited: Net Sales, 2024-2035 ($ Billion)

- Takeda Pharmaceutical Company Limited: Revenue Share, By Segment, 2024 (%)

- Takeda Pharmaceutical Company Limited: Revenue Share, By Region, 2024 (%)

- uniQure N.V.: Net Sales, 2024-2035 ($ Billion)

- uniQure N.V.: Revenue Share, By Segment, 2024 (%)

- uniQure N.V.: Revenue Share, By Region, 2024 (%)

- Others: Net Sales, 2024-2035 ($ Billion)

- Others: Revenue Share, By Segment, 2024 (%)

- Others: Revenue Share, By Region, 2024 (%)

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 291 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |