Global Hemorrhagic Stroke Treatment Devices Market

Global Hemorrhagic Stroke Treatment Devices Market Size, Share, and COVID-19 Impact Analysis, By Treatment Type (Aneurysm & Hemorrhagic Stroke Interventions, Cerebral Angioplasty & Vascular Remodeling), By End Use (Hospitals, Specialty Neurosurgery Centers, and Ambulatory Surgical Centers) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Global Hemorrhagic Stroke Treatment Devices Market Size Insights Forecasts to 2035

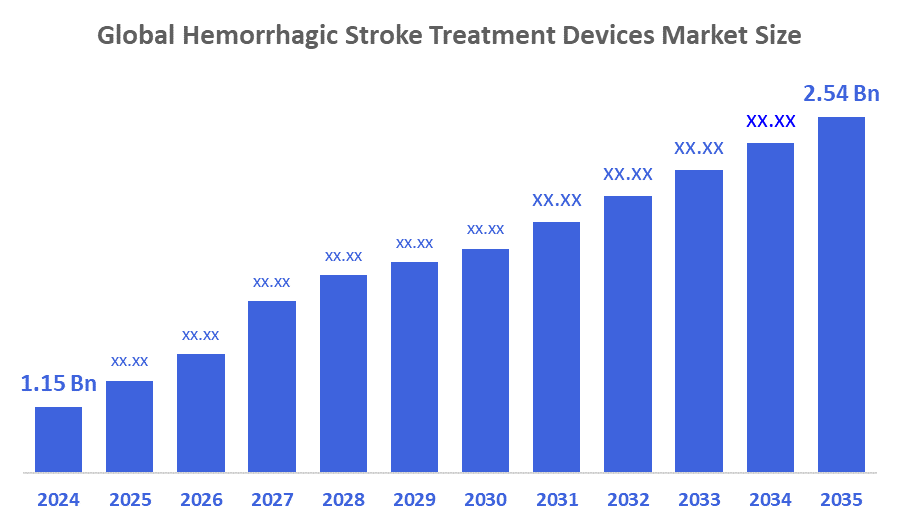

- The Global Hemorrhagic Stroke Treatment Devices Market Size Was valued at USD 1.15 Billion in 2024

- The Global Hemorrhagic Stroke Treatment Devices Market Size is Expected to Grow at a CAGR of around 7.47% from 2025 to 2035

- The Worldwide Hemorrhagic Stroke Treatment Devices Market Size is Expected to Reach USD 2.54 Billion by 2035

- Asia-Pacific is expected to grow the fastest during the forecast period.

According to a research report published by Decisions Advisors and Consulting, The Global Hemorrhagic Stroke Treatment Devices Market Size Was Worth Around USD 1.15 Billion In 2024 And Is Predicted To Grow To Around USD 2.54 Billion By 2035 With A Compound Annual Growth Rate (CAGR) Of 7.47% From 2025 To 2035. Future opportunities in the hemorrhagic stroke treatment devices market extend to emerging economies through advanced minimally invasive devices and AI-guided interventions and improved neuroimaging technologies and increased spending on specialized stroke care facilities.

Market Overview

The global hemorrhagic stroke treatment devices market refers to the worldwide industry focused on medical devices used to diagnose, manage, and treat hemorrhagic strokes caused by intracerebral or subarachnoid bleeding. The medical devices used in this purpose include embolization coils, flow diverters, stents, catheters, and neurovascular access systems. The market experiences growth because stroke cases are increasing and more people are choosing to undergo neurointerventional procedures which use less invasive methods and because technological progress keeps happening. Stroke care receives support from public health programs and enhanced emergency response capabilities and financial backing which developed and developing nations implement to improve hospital infrastructure. The market grows because programs exist to promote early diagnosis and urgent treatment while providing reimbursement support for stroke therapeutics. The regulatory approvals and healthcare investments together create better worldwide access to new hemorrhagic stroke treatment methods.

Report Coverage

This research report categorizes the hemorrhagic stroke treatment devices market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the hemorrhagic stroke treatment devices market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the hemorrhagic stroke treatment devices market.

Driving Factors

The Global Hemorrhagic Stroke Treatment Devices Market exists because more people experience strokes while people seek less invasive neurointervention methods and they learn about how to treat strokes from their initial symptoms. The market expansion receives a boost from technological breakthroughs which include new embolization coils and flow diverters and better neuro-access catheters and AI-powered imaging and advanced material systems which improve safety and accuracy and clinical results.

Restraining Factors

The market for hemorrhagic stroke treatment devices faces multiple obstacles which include high costs of devices and procedures, insufficient neurointerventional specialist training, strict regulations, and limited access to high-level stroke treatment in developing countries.

Market Segmentation

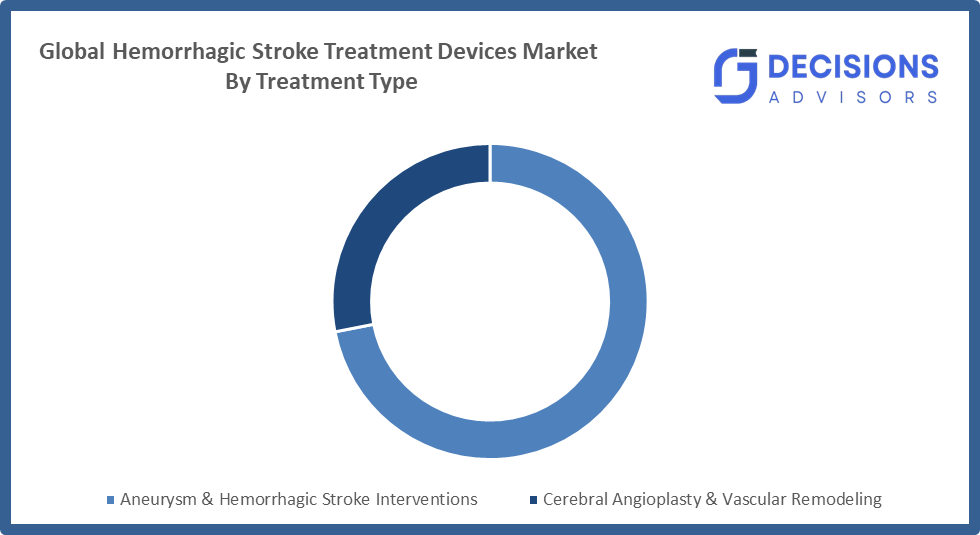

The hemorrhagic stroke treatment devices market share is classified into treatment type and end use

- The aneurysm & hemorrhagic stroke interventions segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the treatment type, the hemorrhagic stroke treatment devices market is divided into aneurysm & hemorrhagic stroke interventions, cerebral angioplasty & vascular remodeling. Among these, the aneurysm & hemorrhagic stroke interventions segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This situation arises because medical professionals treat aneurysm-related hemorrhages as urgent medical emergencies while they prefer to use minimally invasive endovascular treatment methods which include coiling and flow diversion and embolization. The segment experiences growth acceleration because of ongoing technological progress and better clinical results and more neurointerventional centers that provide specialized services.

- The hospitals segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end use, the hemorrhagic stroke treatment devices market is divided into hospitals, specialty neurosurgery centers, and ambulatory surgical centers. Among these, the hospitals segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The concentration of specialized stroke units neurosurgeons and neurointerventional radiologists within hospitals permits medical professionals to deliver immediate diagnosis and essential treatment, which proves vital for treating hemorrhagic stroke patients. Hospitals maintain their dominant market position because their ability to invest capital together with their advantageous reimbursement policies for inpatient treatments and their possession of cutting-edge medical technology give them a competitive edge against other healthcare providers.

Regional Segment Analysis of the Hemorrhagic Stroke Treatment Devices Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the hemorrhagic stroke treatment devices market over the predicted timeframe.

North America is anticipated to hold the largest share of the hemorrhagic stroke treatment devices market over the predicted timeframe. The area experiences high demand for stroke treatment because of its advanced healthcare infrastructure and its widespread use of minimally invasive neurointerventional procedures and its comprehensive reimbursement systems and its early access to breakthrough medical technologies and its numerous stroke cases and its availability of top medical device companies and dedicated stroke treatment facilities.

Asia-Pacific is expected to grow at a rapid CAGR in the hemorrhagic stroke treatment devices market during the forecast period. The healthcare sector is currently experiencing a strong need for new medical technologies which can be used in non-invasive procedures because of the ongoing healthcare improvements and rising funding for neurointerventional procedures. Japan and South Korea and Australia lead in technology adoption while India and Southeast Asia emerge as new markets through their improved training and infrastructure development. Advanced treatment devices now see wider usage in the region because of increased stroke awareness together with better reimbursement systems.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the hemorrhagic stroke treatment devices market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Medtronic

- Terumo Corporation

- Balt

- Scientia Vascular, Inc.

- MicroPort Scientific Corporation

- Johnson & Johnson (MedTech)

- phenox GmbH (Wallaby Medical)

- Acandis GmbH

- B. Braun SE

- Integra LifeSciences

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the hemorrhagic stroke treatment devices market based on the below-mentioned segments:

Global Hemorrhagic Stroke Treatment Devices Market, By Treatment Type

- Aneurysm & Hemorrhagic Stroke Interventions

- Cerebral Angioplasty & Vascular Remodeling

Global Hemorrhagic Stroke Treatment Devices Market, By End Use

- Hospitals

- Specialty Neurosurgery Centers

- Ambulatory Surgical Centers

Global Hemorrhagic Stroke Treatment Devices Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the CAGR of the hemorrhagic stroke treatment devices market over the forecast period?

A: The global hemorrhagic stroke treatment devices market is projected to expand at a CAGR of 7.47% during the forecast period.

- What is the market size of the hemorrhagic stroke treatment devices market?

A: The global hemorrhagic stroke treatment devices market size is estimated to grow from USD 1.15 billion in 2024 to USD 2.54 billion by 2035, at a CAGR of 7.47% during the forecast period 2025-2035.

- Which region holds the largest share of the hemorrhagic stroke treatment devices market?

A: North America is anticipated to hold the largest share of the hemorrhagic stroke treatment devices market over the predicted timeframe.

- Who are the top 10 companies operating in the global hemorrhagic stroke treatment devices market?

A: Medtronic, Terumo Corporation, Balt, Scientia Vascular, Inc., MicroPort Scientific Corporation, Johnson & Johnson (MedTech), phenox GmbH (Wallaby Medical), Acandis GmbH, B. Braun SE, Integra LifeSciences, and Others.

- What are the market trends in the hemorrhagic stroke treatment devices market?

A: The market for hemorrhagic stroke treatment devices is currently experiencing growth because of three main factors which include people adopting less invasive neurointerventional treatments and advances in embolization device technology and rising stroke cases and developing countries building their healthcare systems.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 230 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Feb 2026 |

| Access | Download from this page |