Global Hemostasis and Tissue Sealing Agents Market

Global Hemostasis and Tissue Sealing Agents Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Product Type (Topical Hemostats and Adhesives & Tissue Sealants), By Material (Collagen-Based, Gelatin-Based, Oxidized Regenerated Cellulose, and Polysaccharide-Based), and By Region (Asia Pacific, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Hemostasis and Tissue Sealing Agents Market Summary, Size & Emerging Trends

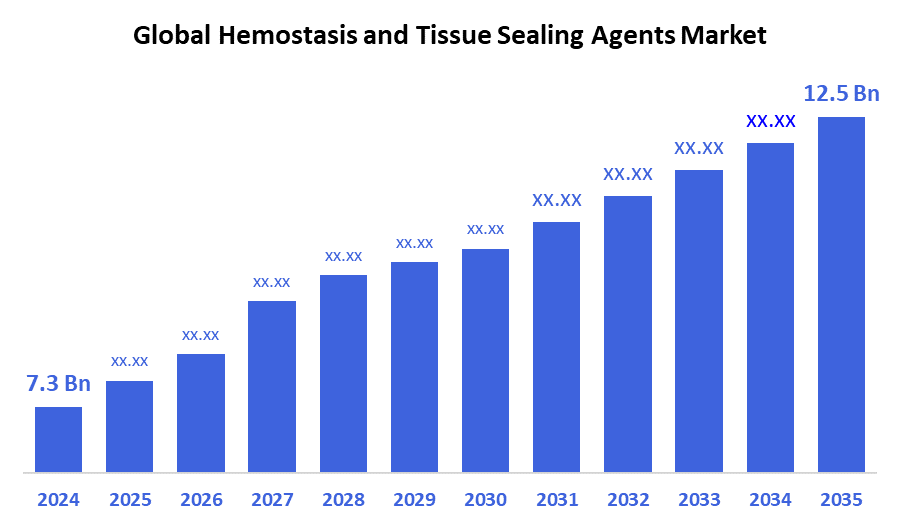

According to Decision Advisors, The Global Hemostasis and Tissue Sealing Agents Market Size is expected to grow from USD 7.3 Billion in 2024 to USD 12.5 Billion by 2035, at a CAGR of 5.9% during the forecast period 2025-2035. The market is driven by an increase in surgical procedures worldwide, advancements in minimally invasive surgery, and the need for effective blood loss control. Enhanced focus on patient safety, faster recovery, and improved hemostatic technologies are shaping the market dynamics.

Key Market Insights

- North America is expected to hold the largest share of the hemostasis and tissue sealing agents market in 2024 due to higher surgical volumes and adoption of advanced hemostatic agents.

- Asia Pacific is the fastest-growing region, with a CAGR projected above 8%, driven by expanding healthcare infrastructure, medical tourism, and awareness of surgical care advancements.

- Topical Hemostats lead the product segment, while collagen-based materials are the most preferred due to their biocompatibility and effectiveness.

- General Surgery remains the leading application segment with over 30% market share due to broad clinical use across hospital settings.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 7.3 Billion

- 2035 Projected Market Size: USD 12.5 Billion

- CAGR (2025-2035): 5.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Hemostasis and Tissue Sealing Agents Market

The hemostasis and tissue sealing agents market encompasses a range of products designed to control bleeding and enhance wound closure during surgical procedures. These agents, including topical hemostats, fibrin sealants, and adhesive-based sealers, are vital in minimizing intraoperative and postoperative blood loss, improving patient outcomes, and reducing surgical complications. The market is witnessing robust growth due to rising surgical volumes globally, especially in cardiovascular, orthopedic, and trauma-related surgeries. Governments and health organizations are promoting advanced surgical care by supporting innovations in biomaterials and offering favorable reimbursement policies for hemostatic products. For instance, the U.S. FDA and European Medicines Agency (EMA) have streamlined regulatory pathways for high-performance hemostats, encouraging R&D investments. Moreover, healthcare systems are emphasizing minimally invasive surgeries, further boosting demand for efficient sealing and bleeding control products. The market is also driven by aging populations and the increasing burden of chronic diseases requiring surgical intervention.

Hemostasis and Tissue Sealing Agents Market Trends

- Increased adoption of minimally invasive surgeries is boosting demand for faster-acting hemostatic agents.

- Surge in orthopedic and trauma procedures post-COVID due to backlog recovery.

- Development of biodegradable and synthetic sealants is enhancing patient safety.

- Hospitals are shifting toward bundle procurement from key suppliers to streamline surgical toolkits.

Hemostasis and Tissue Sealing Agents Market Dynamics

Driving Factors: The market is primarily driven by the rising volume of surgical procedures worldwide

The market is primarily driven by the rising volume of surgical procedures worldwide, particularly due to an aging population and increasing chronic disease burden. There’s growing emphasis on minimizing intraoperative and postoperative complications, which has accelerated the adoption of effective hemostats and sealing agents. Technological advancements, including the development of faster-acting, absorbable, and minimally invasive products, have enhanced surgical outcomes and efficiency. Hospitals and surgical centers are prioritizing solutions that improve wound management and reduce recovery times. Greater awareness of the importance of bleeding control in complex surgeries further fuels global demand for advanced hemostasis products.

Restrain Factors: The high cost of advanced sealing agents poses a barrier

Despite strong demand, the high cost of advanced sealing agents poses a barrier, particularly in cost-sensitive or underfunded healthcare systems. Variability in insurance coverage and reimbursement policies across regions limits consistent adoption. In developing markets, lack of skilled surgical professionals affects the optimal use of these products. Additionally, certain patients may experience allergic reactions to animal- or biologic-based ingredients, raising safety concerns. Stringent regulatory requirements for novel biomaterials can delay product approvals, while clinical efficacy across multiple surgical scenarios is still under investigation, affecting confidence in widespread application.

Opportunities: Emerging economies are increasingly investing in surgical infrastructure

Emerging economies are increasingly investing in surgical infrastructure, creating opportunities for market penetration. Growth of outpatient and same-day surgery centers in both developed and developing regions expands the need for fast, effective hemostatic solutions. The trend toward personalized and procedure-specific agents is driving R&D into bioadhesives and synthetic sealants that deliver targeted performance. Additionally, the shift toward absorbable, eco-friendly, and biocompatible materials is opening up new commercial avenues. Partnerships between medical device companies and hospital networks for tailored product development and training programs also create long-term growth potential in underserved regions.

Challenges: Scalability remains difficult due to the lack of standardized benchmarks for product performance across different surgical procedures

Scalability remains difficult due to the lack of standardized benchmarks for product performance across different surgical procedures. Biologic-based agents face supply chain vulnerabilities, especially in the sourcing and preservation of raw materials. Regulatory pathways for novel sealing technologies are complex, time-consuming, and vary by country, slowing down market entry. In lower-resource settings, maintaining product sterility and consistent storage conditions is a significant challenge, especially for temperature-sensitive biomaterials. Shelf life limitations, coupled with high operational costs for clinical validation, pose further hurdles for manufacturers aiming to serve both premium and mid-tier healthcare segments.

Global Hemostasis and Tissue Sealing Agents Market Ecosystem Analysis

The global hemostasis and tissue sealing agents market ecosystem includes raw material suppliers (e.g., collagen, gelatin), manufacturers of hemostats and sealants, regulatory bodies (like FDA, EMA), healthcare providers (hospitals, ASCs), distributors, and reimbursement systems. Academic institutions contribute clinical validation, while innovators and startups drive technological advancements. Payers and patient safety advocates influence adoption. The ecosystem thrives on biomaterial innovation, regulatory support, and demand for efficient surgical outcomes, particularly in minimally invasive and outpatient procedures, fostering rapid product adoption and global market expansion.

Global Hemostasis and Tissue Sealing Agents Market, By Product Type

Topical hemostats hold the largest share of the global hemostasis and tissue sealing agents market, accounting for over 50% of the total revenue. Their dominance is attributed to broad usage across multiple surgical disciplines, including general, orthopedic, dental, and trauma procedures. These products such as collagen sponges, oxidized cellulose, and gelatin-based pads, are preferred for their ease of use, immediate action, and effectiveness in controlling minor to moderate bleeding. Their affordability and compatibility with various surgical techniques further support widespread adoption in both developed and emerging healthcare systems.

Adhesive & tissue sealants, while currently holding a smaller market share, are witnessing rapid growth, particularly in high-stakes specialties like cardiovascular, neurosurgery, and thoracic procedures. Their role in precise bleeding control and wound closure, especially where sutures or staples are inadequate, is critical. As surgical technologies evolve, this segment is projected to grow at a CAGR of approximately 7% through 2033, driven by demand for minimally invasive, biocompatible, and absorbable sealing solutions.

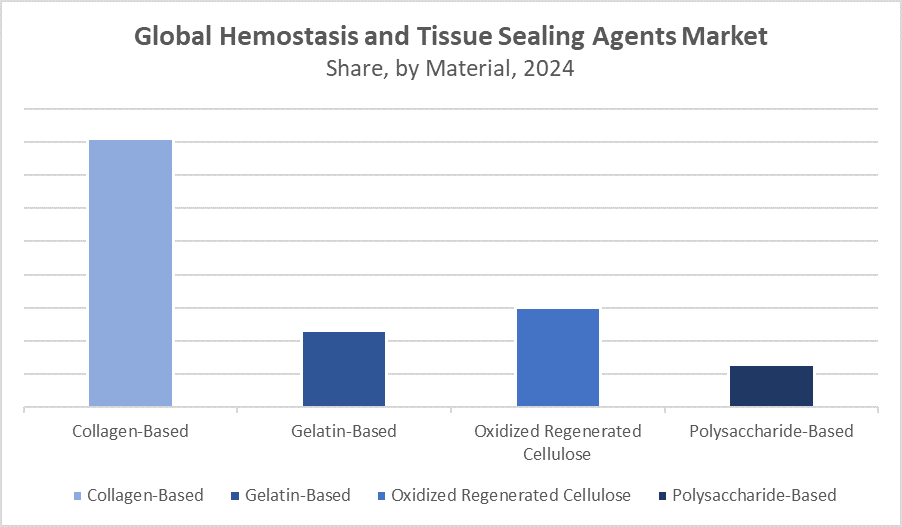

Global Hemostasis and Tissue Sealing Agents Market, By Material

Collagen-based hemostats represent the highest revenue-generating segment among material types in the hemostasis and tissue sealing agents market. These products are widely used due to their excellent biocompatibility, rapid clotting properties, and ease of absorption within the body. Their effectiveness across general, orthopedic, cardiovascular, and dental surgeries makes them the top choice in hospitals and surgical centers. The ability of collagen-based agents to promote platelet aggregation and support natural clot formation drives their dominant position in the market.

Oxidized regenerated cellulose (ORC) is a significant and fast-growing segment, particularly in minimally invasive and laparoscopic procedures. ORC-based products offer broad antimicrobial properties and are easy to apply on irregular bleeding surfaces, which enhances their appeal in complex surgeries. Their expanding use in neurosurgery and trauma cases, along with favorable clinical outcomes, contributes to their increasing market share. While not the largest, this material category is expected to see steady growth over the next decade.

North America holds the largest share of the global hemostasis and tissue sealing agents market, accounting for approximately 40%.

This dominance is driven by its advanced healthcare infrastructure, a high number of surgical procedures, and well-established reimbursement systems that encourage the use of advanced hemostatic agents. The United States leads within the region, supported by widespread adoption of innovative surgical products, presence of major industry players, and strong focus on reducing postoperative complications through effective bleeding control technologies.

Asia Pacific is the fastest-growing region, expected to expand at a CAGR of 8% through the forecast period.

Growth is fueled by rising healthcare expenditure, improved access to surgical care, and rapid adoption of modern medical technologies in countries like China, India, and Southeast Asia. Additionally, government initiatives aimed at reducing surgical mortality and enhancing hospital infrastructure are creating a conducive environment for the increased use of hemostatic and tissue sealing agents across the region.

WORLDWIDE TOP KEY PLAYERS IN THE HEMOSTASIS AND TISSUE SEALING AGENTS MARKET INCLUDE

- Baxter International Inc.

- Johnson & Johnson (Ethicon Inc.)

- B. Braun Melsungen AG

- BD (Becton, Dickinson and Company)

- Medtronic plc

- CryoLife Inc.

- Pfizer Inc.

- Takeda Pharmaceutical Company

- Integra LifeSciences

- CSL Behring

- Others

Product Launches in Hemostasis and Tissue Sealing Agents Market

- In March 2024, Baxter introduced a next-generation flowable hemostatic matrix, specifically engineered for rapid and precise application during minimally invasive surgeries. This advanced product is designed to control bleeding quickly in complex surgical environments where access is limited and traditional methods may be less effective. The innovation enhances surgical efficiency by reducing application time and improving adaptability to irregular wound surfaces.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the hemostasis and tissue sealing agents market based on the below-mentioned segments:

Global Hemostasis and Tissue Sealing Agents Market, By Product Type

- Topical Hemostats

- Adhesives & Tissue Sealants

Global Hemostasis and Tissue Sealing Agents Market, By Material

- Collagen-Based

- Gelatin-Based

- Oxidized Regenerated Cellulose (ORC)

- Polysaccharide-Based

Global Hemostasis and Tissue Sealing Agents Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: What is driving the growth of the hemostasis and tissue sealing agents market?

A: Rising surgical procedures, aging populations, and demand for minimally invasive bleeding control solutions.

Q: Which product type dominates the market?

A: Topical hemostats lead the market due to wide use across surgical specialties.

Q: Why is collagen-based material widely used?

A: It offers excellent biocompatibility, fast clotting, and ease of absorption.

Q: What challenges does the market face?

A: High product costs, regulatory hurdles, and limited adoption in low-resource settings.

Q: Which region is expected to grow the fastest?

A: Asia Pacific, driven by healthcare infrastructure improvements and rising surgical volumes.

Q: What opportunities exist for manufacturers?

A: Demand in outpatient surgery centers and innovation in biodegradable and bioadhesive sealants.

Q: Who are the key players in this market?

A: Baxter, Johnson & Johnson, Medtronic, BD, B. Braun, and CryoLife are major players.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |